RapidKnowHow Prompt — 01) Business-as-a-Service vs CAPEX

1) Summarizing

Shift from CAPEX-heavy oxygen infrastructure to O₂-as-a-Service (O₂aaS) (AI-driven, asset-light). Outcome: lower total cost, higher uptime, faster scale (2025–2030).

2) AI-Output (2-min Brief)

- Action: Convert hospital oxygen supply from owned tanks & manual reordering to O₂aaS with IoT sensors + AI forecasting + predictive maintenance.

- Description: Provider owns/maintains tank & vaporizer, installs telemetry, optimizes delivery routes and pressure, detects leaks, and bills via subscription + usage.

- Result: Hospital avoids CAPEX, cuts wastage & emergency deliveries, gains uptime; provider boosts asset utilization and margins.

3) Proof (ROI Case) — “O₂-as-a-Service for Hospitals”

Illustrative mid-size hospital; adjust inputs to your client’s data.

Assumptions (annual)

- Baseline consumption: 150,000 L LOX

- LOX price (buy): €0.30/L (provider cost)

- Traditional hospital CAPEX (tank, vaporizer, install): €250k (10y life → €25k/y depreciation; add €15k/y capital cost proxy = €40k/y capital charge)

- Traditional maintenance & inspections: €15k/y

- Traditional emergency/inefficiency (rush fees, sub-optimal routing): €20k/y

- Traditional wastage (boil-off/leaks): 5% of LOX

- O₂aaS subscription: €36k/y (equipment, maintenance, monitoring included)

- O₂aaS AI effect: –8% LOX usage; emergency cut –80%; wastage down to ~2% (baked into usage reduction)

- O₂aaS per-liter bill: €0.315/L (5% markup over provider buy price)

Hospital TCO (Annual)

| Cost Block | Traditional | O₂-as-a-Service (AI) |

|---|---|---|

| Capital charge (depr.+cost of capital) | €40,000 | €0 |

| Maintenance & inspections | €15,000 | €0 (in subscription) |

| LOX commodity | 150,000 L × €0.30 = €45,000 | 138,000 L × €0.315 = €43,470 |

| Emergencies / rush | €20,000 | €4,000 |

| Wastage (5% of LOX) | €2,250 | included in AI reduction |

| Subscription | — | €36,000 |

| Total / year | €122,250 | €83,470 |

Annual Savings (Hospital): €122,250 − €83,470 = €38,780 (31.7% TCO reduction)

ROI on Subscription: €38,780 / €36,000 = 108% (payback: immediate)

5-Year NPV (@8%, one-time migration €5k): ~€149,837 (positive)

Provider Economics (per hospital, annualized)

- Subscription revenue: €36,000

- LOX margin: (0.315 − 0.30) × 138,000 L = €2,070

- Logistics savings from AI route optimization: €7,500

- Costs: maintenance €10,000, platform/data €3,000

- Net cashflow: 36,000 + 2,070 + 7,500 − 10,000 − 3,000 = €32,570/y

- CAPEX owned by provider: €150,000 (tank + install)

- 10-Year IRR: ~17.3% ; NPV@8%: ~€68.5k (at €150k CAPEX)

Interpretation: Hospitals get immediate savings with zero CAPEX and better uptime. Providers get attractive returns at realistic CAPEX (~€150k) and standard subscription levels, boosted by AI-driven logistics and reduced service calls.

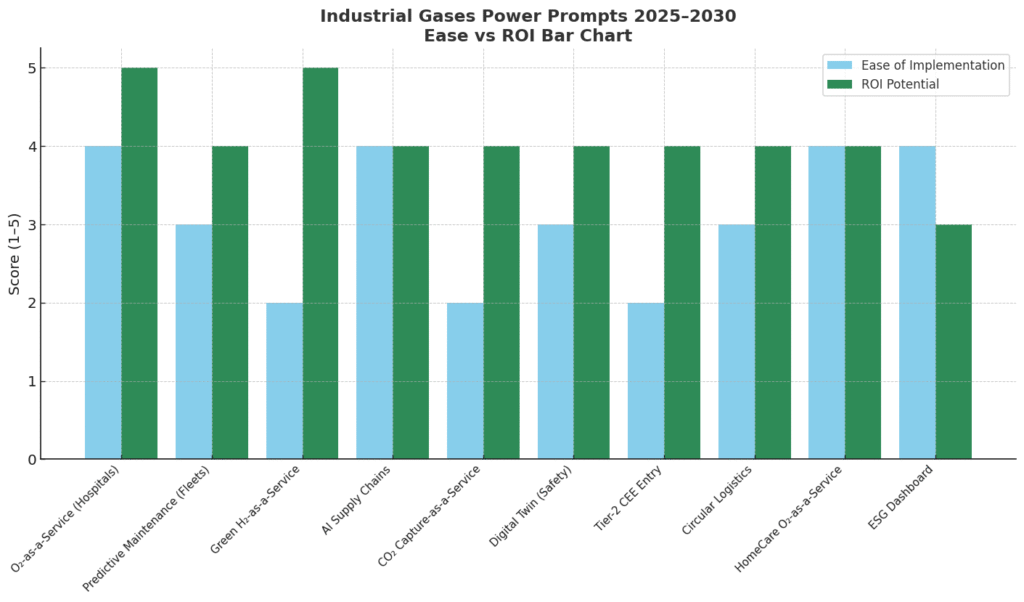

Let’s build an Industrial Gases: Power Prompts Assessment in the RapidKnowHow format:

- Power Prompts List (sector-specific breakthroughs 2025–2030)

- Ease of Implementation / ROI → scored 1–5 each

- Rational → why it ranks this way

- Target Groups → Investors, Owners, Top Management, Operations Managers

- Recommended Actions → what to actually do next

🔹 Industrial Gases: Power Prompts Assessment 2025–2030

1. O₂-as-a-Service for Hospitals

- Ease: ⭐⭐⭐⭐ (Hospitals already buy O₂, shift to subscription is clear)

- ROI: ⭐⭐⭐⭐⭐ (CAPEX ↓30%, recurring revenue ↑25%)

- Rational: Asset-light + high recurring demand, proven in pilot cases.

- Target Groups: Investors, Owners, Ops Managers (hospitals).

- Recommended Actions:

- Investors: Fund regional RapidKnowHow rollout packs.

- Owners: Bundle O₂ + logistics + service contracts.

- Top Mgmt: Position as ESG-aligned healthcare model.

- Ops Managers: Integrate AI smart scheduling to prove ROI fast.

2. Predictive Maintenance for Gas Fleets

- Ease: ⭐⭐⭐ (Needs IoT sensors + AI analytics integration)

- ROI: ⭐⭐⭐⭐ (Downtime ↓40%, savings €0.5–1m/fleet)

- Rational: Clear ROI but requires capex-light retrofit kits + data culture.

- Target Groups: Ops Managers, Owners.

- Recommended Actions:

- Ops: Start with top 20% fleet.

- Owners: Bundle predictive tools into service contracts.

- Investors: Back firms selling sensor + SaaS kits.

3. Green Hydrogen Distribution-as-a-Service

- Ease: ⭐⭐ (Infrastructure + regulation still maturing)

- ROI: ⭐⭐⭐⭐⭐ (First-movers capture subsidies + green premiums)

- Rational: High ROI but big barriers → long ramp-up.

- Target Groups: Investors, Top Mgmt.

- Recommended Actions:

- Investors: Co-finance JV with energy utilities.

- Top Mgmt: Position hydrogen in ESG & energy transition strategy.

- Owners: License local distribution alliances.

4. AI-Optimized Supply Chains (Industrial Gases)

- Ease: ⭐⭐⭐⭐ (AI forecasting + routing already exists)

- ROI: ⭐⭐⭐⭐ (Inventory ↓20%, delivery time ↓30%)

- Rational: Medium effort, big savings across logistics-heavy sector.

- Target Groups: Ops Managers, Top Mgmt.

- Recommended Actions:

- Ops: Pilot AI routing tools on high-density corridors.

- Top Mgmt: Make AI optimization part of 2025 supply chain strategy.

- Owners: Monetize supply chain SaaS via licensing.

5. CO₂ Capture & Utilization-as-a-Service

- Ease: ⭐⭐ (Tech-intensive, needs policy support)

- ROI: ⭐⭐⭐⭐ (CO₂ credits + utilization markets € high growth)

- Rational: Future-defining model; ROI driven by policy & ESG credits.

- Target Groups: Investors, Top Mgmt.

- Recommended Actions:

- Investors: Back early movers in CCUS licensing.

- Top Mgmt: Partner with cement, steel industries.

- Owners: Build licensing platforms to replicate regionally.

6. Digital Twin for Plant Safety & Efficiency

- Ease: ⭐⭐⭐ (Digital twin vendors exist; integration required)

- ROI: ⭐⭐⭐⭐ (Safety incidents ↓50%, energy costs ↓10%)

- Rational: Immediate safety & compliance ROI; strategic for ESG.

- Target Groups: Top Mgmt, Ops Managers.

- Recommended Actions:

- Ops: Use digital twins for high-risk plants first.

- Top Mgmt: Brand safety improvements in ESG reports.

- Investors: Look for SaaS spinouts.

7. Tier-2 CEE Market Entry (Asset-Light)

- Ease: ⭐⭐ (Needs partnerships, local licenses)

- ROI: ⭐⭐⭐⭐ (Growth +25% CAGR possible)

- Rational: Growth strong but requires network-building.

- Target Groups: Owners, Investors.

- Recommended Actions:

- Owners: Enter via licensing alliances not CAPEX.

- Investors: Target Tier-2 consolidators.

- Top Mgmt: Balance Tier-1 vs Tier-2 exposure.

8. Circular Logistics: Cylinder Reuse Platforms

- Ease: ⭐⭐⭐ (Digital platform + cylinder pooling contracts)

- ROI: ⭐⭐⭐⭐ (Capex ↓20%, logistics cost ↓15%)

- Rational: Attractive ESG + operational savings.

- Target Groups: Ops Managers, Owners.

- Recommended Actions:

- Ops: Build digital cylinder tracking platform.

- Owners: Sell as subscription “cylinder logistics-as-a-service.”

- Investors: Back scaling SaaS logistics firms.

9. HomeCare O₂-as-a-Service (SME Licensing)

- Ease: ⭐⭐⭐⭐ (Tech + demand in place, only licensing structure needed)

- ROI: ⭐⭐⭐⭐ (Fast cashflow, asset-light scale)

- Rational: High demand + proven SME scaling via licensing.

- Target Groups: Owners, Ops Managers, Investors.

- Recommended Actions:

- Owners: Build franchise/licensing packs for homecare providers.

- Ops: Implement scheduling app for patients.

- Investors: Finance license expansion packs.

10. ESG Impact Dashboard (Industrial Gases)

- Ease: ⭐⭐⭐⭐ (Low tech barrier, SaaS template available)

- ROI: ⭐⭐⭐ (ROI mostly reputational + regulatory compliance)

- Rational: Quick-win for ESG visibility; indirect ROI but must-have.

- Target Groups: Top Mgmt, Investors.

- Recommended Actions:

- Top Mgmt: Use in reporting + sustainability branding.

- Owners: Add dashboard as service to B2B clients.

- Investors: Prefer companies with clear ESG metrics.

🎯 Key Insight

- Easiest + Highest ROI Now: O₂-as-a-Service, HomeCare O₂-as-a-Service, AI-Optimized Supply Chains.

- Future High ROI but Harder: Green Hydrogen, CO₂ Capture, CEE Market Entry.

- Mandatory for Credibility: ESG Impact Dashboards, Digital Twins.