1. Vision & Strategic Goal

Vision:

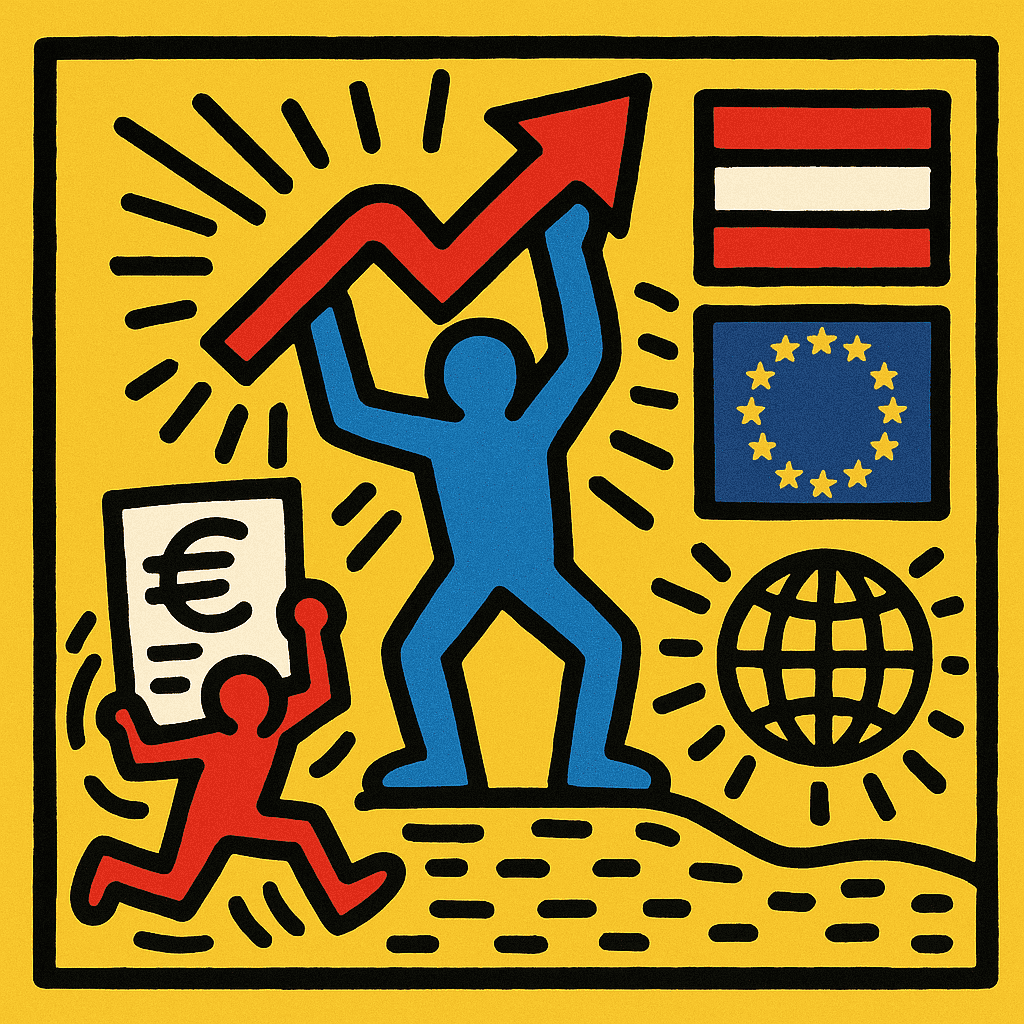

To establish a resilient, AI-powered industrial gas leadership ecosystem across Central and Eastern Europe (CEE) that drives sustainable growth, energy security, operational excellence, and competitive advantage by 2030.

Strategic Goal 2026:

Achieve top-tier industrial gas market position in key CEE economies (PL, CZ, SK, HU, RO, BG, AT, SI) through coordinated AI-driven operations, demand forecasting, network optimization, and partner ecosystem orchestration.

2. Strategic Pillars

Pillar A — AI-Driven Operational Excellence

Objective: Digitalize and automate core production, distribution, and maintenance operations.

Core Initiatives:

- Predictive Maintenance: Deploy machine learning models on compression systems, cryogenic units, & turbine health to reduce downtime by >30%.

- Real-Time Process Optimization: Use reinforcement learning for combustion control, energy balancing, and storage management.

- Digital Twin Implementation: Virtual replicas of plants and pipelines for simulation, risk testing, and scenario planning.

KPIs:

- OEE (Overall Equipment Efficiency) +15%

- Unplanned downtime −30%

- Energy intensity −12%

Pillar B — AI in Demand & Supply Synchronization

Objective: Use advanced forecasting to sync production, storage, and delivery with volatile demand patterns.

Core Initiatives:

- Demand Forecasting Models: Seasonal, economic, and weather-driven predictive models for industrial & utility demand.

- Dynamic Supply Allocation: AI-based allocation engine across hubs (Wien, Katowice, Bratislava, Budapest, Bucharest).

- Market & Trade Optimization: Algorithmic optimization for spot vs contract pricing, balancing inventories across borders.

KPIs:

- Forecast accuracy > 92%

- Inventory carrying cost −20%

- On-time delivery >98%

Pillar C — Regional Network Orchestration & Partnerships

Objective: Build a collaborative industrial ecosystem involving producers, distributors, power plants, refineries, and major industrial consumers.

Core Initiatives:

- CEE Gas Consortium (AI-Orchestrator Network): Shared forecasting, infra-sharing, real-time data exchange.

- Public-Private Strategic Alliances: Governments + infrastructure operators for seasonal resilience and emergency response (e.g., cold snaps, supply shocks).

- Cross-Border Digital Corridors: Real-time pipeline flow data, optimization across TEN-T corridors.

KPIs:

- Consortium adoption (members) ≥ 50 corporate & national partners

- Cross-border transit reliability ≥ 99.5%

- Shared optimization savings ≥ €50M annually

Pillar D — Sustainability & Decarbonization

Objective: Integrate AI to reduce carbon intensity and advance green gas solutions.

Core Initiatives:

- Emission Analytics & Reduction Models: AI monitors CO₂, NOx, methane slip across plants and pipelines.

- Green Hydrogen & E-Gas Planning: AI scenario planning for hybrid networks (natural gas + H₂ injection + bio-gases).

- Energy Source Optimization: Renewables + gas turbine dispatch optimized for lowest carbon marginal cost.

KPIs:

- CO₂ intensity −22%

- Green gas share (H₂/bio) >10% in new contracts

- Methane loss <0.1%

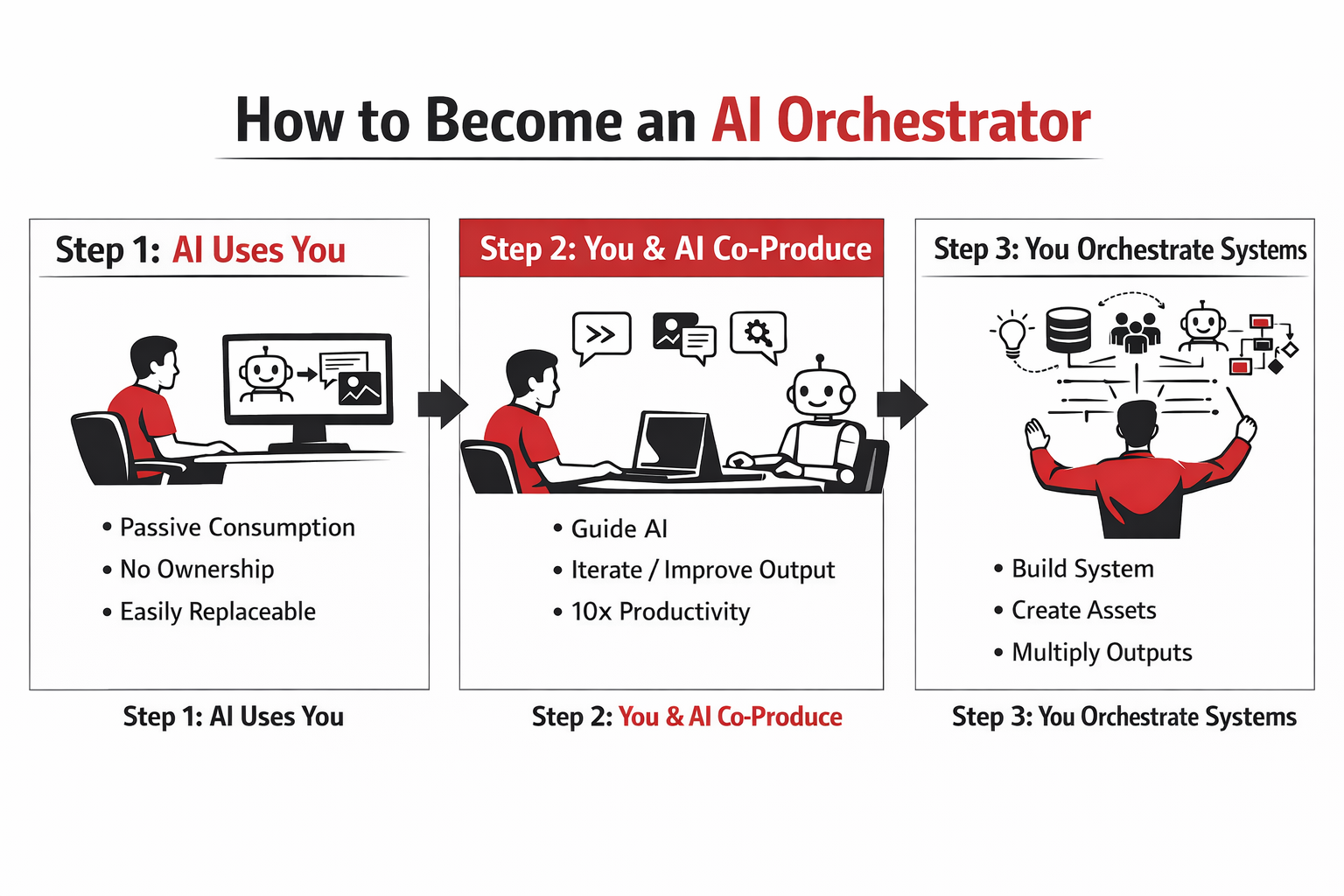

3. AI Orchestration Architecture

Core Technology Stack

- Edge AI Agents — real-time sensors & controllers

- Cloud AI Engines — forecasting, optimization, simulation

- Data Lake & Knowledge Graphs — unified industrial gas dataset across CEE

- Security & Compliance Layer — ISO 27001, GDPR, energy sector standards

4. Implementation Roadmap 2026

| Quarter | Focus |

|---|---|

| Q1 | AI strategy kickoff, data infrastructure build, partner outreach |

| Q2 | Pilot predictive maintenance + dynamic forecasting models |

| Q3 | Regional hub orchestration platform MVP; consortium launch |

| Q4 | Full deployment across core facilities; sustainability integrations |

5. Organizational & Capability Build

AI-Orchestrator Org Structure

- CEO / Strategy Lead

- CTO — AI & Digital Platforms

- Operations Lead — Production & Maintenance

- Network Orchestration Lead

- Sustainability & Green Gas Lead

- Data Governance & Security Lead

Talent & Skills

- AI/ML engineers (forecasting, optimization)

- Industrial domain specialists (gas & utilities)

- Digital transformation architects

- Cybersecurity & compliance experts

6. Risk & Mitigation Matrix

| Risk | Mitigation |

|---|---|

| Data silos | Central data governance, APIs |

| Regulatory fragmentation | Policy task force across CEE |

| Cyber threats | Tier-1 security standards, simulations |

| Market volatility | Adaptive algorithms; hedging strategies |

7. Value & Impact Summary

Economic:

Lower operating costs, higher throughput, optimized pricing, stronger regional competitiveness.

Operational:

Predictive insights, automated orchestration, greater reliability.

Strategic:

Regional leadership, stronger supply resilience, optimized cross-border operations.

ESG:

Reduced emissions, improved environmental reporting, green gas integration.

Applying The Indirect Strategy for Establishing the AI – Orchestrator Industrial Gas Leadership in CEE

Now we apply The Indirect Strategy (Sir Basil Liddell Hart) for establishing the AI-Orchestrator Leadership for Industrial Gas in CEE

Objective: Establish AI-Orchestrator Industrial Gas Leadership in CEE in 2026

Method: Using Indirect Strategy instead of head-to-head confrontation.

✅ 1. Understanding the Indirect Strategy (Compressed)

Liddell Hart’s Indirect Approach rests on five principles:

- Dislocate rather than destroy

→ Undermine existing strengths without direct clash. - Approach on the line of least expectation

→ Advance where incumbents are not defending. - Exploit systemic vulnerabilities

→ Hit the soft spots—coordination, time delays, fragmentation. - Avoid attrition and frontal battles

→ Don’t fight where incumbents are strong (capex, plants, trucks). - Turn small advantages into strategic leverage

→ Use speed, information, partnerships, not scale.

For Industrial Gases, this approach is extremely effective.

🎯 2. The Situation in CEE Industrial Gases (2026 Reality Check)

CEE region characteristics:

- Highly fragmented industrial customer base (PL, CZ, SK, HU, RO, BG)

- Incumbents with strong physical assets but weak AI orchestration

- Distribution & supply chains inefficient / manual

- Governments hungry for resilience + ESG compliance

- Local alternatives exist but lack system coordination

Conclusion:

The battlefield is NOT the plant — it is the orchestration layer.

That’s where the indirect strategy wins.

🧩 3. Direct vs Indirect Strategy Comparison for 2026

| Strategy Type | Method | Result |

|---|---|---|

| Direct (Wrong Game) | Build plants, fleets, capex battles with Linde/Air Liquide | Lose (too slow, too expensive) |

| Indirect (Winning Game) | Control orchestration layer: data, AI, logistics, forecasting, compliance | Win fast, low capex, scalable |

Incumbents defend plants.

Nobody is defending orchestration.

🏹 4. The Indirect Strategy in Practice (Step-by-Step)

Step 1 — Target the Vulnerability: Coordination

CEE incumbents weaknesses:

- Manual dispatch

- Siloed forecasting

- Weak maintenance prediction

- Fragmented ESG reporting

- Poor cross-border synergy

These are AI solvable, not capex solvable.

Step 2 — Attack through the Line of Least Expectation

Areas incumbents ignore:

- AI-based demand forecasting

- Digital twins for plants & fleets

- Predictive maintenance

- Cross-border optimization hubs

- ESG compliance reporting for governments

- Industrial gas knowledge graph

Create value where no one is looking.

Step 3 — Build the Winning Position BEFORE the Battle

The AI-Orchestrator wins by:

- Controlling knowledge (data)

- Controlling coordination (dispatch)

- Controlling compliance (ESG)

- Controlling risk dashboards (resilience)

- Controlling procurement (digital marketplace)

This turns the orchestrator into the strategic center of gravity.

Step 4 — Gain Allies Before Confronting Incumbents

Liddell Hart emphasizes alliances.

In CEE, ideal allies:

- Large industrial buyers (steel, automotive, chemicals)

- Hospitals & homecare oxygen

- Governments (energy resilience)

- Logistics operators

- H₂/biogas pilot projects

- Local distributors

This builds a coalition that pulls the incumbents, not pushes them.

Step 5 — Force Incumbents Into Your Frame

Once orchestration becomes valuable:

- Incumbents will join the ecosystem

- Not because they want to

- But because their customers demand it

This is indirect dislocation: control the rules → force competitors to play.

🧠 5. The Strategic Center of Gravity Shift

Today (2025):

Power = Physical Assets (plants, fleets)

After Orchestration (2026+):

Power = AI Coordination + Resilience + Data Ecosystem

The shift mirrors:

- Uber vs taxi fleets

- AWS vs on-prem servers

- Tesla vs ICE incumbents

- Booking vs hotel chains

Industrial gases will follow the same pattern.

🧬 6. The AI-Orchestrator Playbook for CEE (2026)

Below is the Indirect Strategy Operational Sequence:

Phase 1 — Intelligence & Positioning (Q1 2026)

- Map cross-border demand & nodes

- Build CEE gas demand forecasting models

- Identify fleet inefficiencies

- Build ESG regulatory map (EU taxonomy, CBAM, ETS)

Outcome: Knowledge advantage

Phase 2 — Coalition Building (Q2 2026)

Recruit allies:

- Industrial clusters

- Hospitals

- Logistics fleets

- H₂ ecosystem players

- Ministries of Energy & Economy

Outcome: Network advantage

Phase 3 — Create AI Platforms (Q3 2026)

Deliver 4 orchestrator platforms:

- Predictive Maintenance Platform

- Dynamic Dispatch Platform

- Digital Twin Simulation Platform

- ESG & Resilience Compliance Platform

Outcome: Systems advantage

Phase 4 — Market Pull & Indirect Pressure (Q4 2026)

Industrial customers start demanding:

- ESG reporting

- Lower CO₂ delivery footprint

- Surge capacity resilience

- Energy security analytics

Incumbents cannot deliver alone → they must join the orchestrator.

Outcome: Demand-side power shift

📈 7. Value Capture (Non-Capex Based)

Indirect strategy creates value without building plants:

- Data-as-a-Service

- Optimization-as-a-Service

- ESG Compliance-as-a-Service

- Hydrogen Transition Consulting

- Cross-border risk dashboards

- Resilience scorecards

- Digital twin simulations

This drives high-margin, asset-light profit pools.

⚖️ 8. Final Indirect Strategy Evaluation

| Test | Status |

|---|---|

| Avoiding incumbent strengths | ✔️ No capex race |

| Exploiting vulnerabilities | ✔️ Coordination, ESG, resilience |

| Using line of least expectation | ✔️ AI + orchestration |

| Achieving systemic dislocation | ✔️ Shift from assets → coordination |

| Creating allies before battle | ✔️ Industry clusters + governments |

| Forcing enemy to join your frame | ✔️ Market-pull via compliance + resilience |

🏁 9. One-Sentence Essence

You don’t defeat Linde or Air Liquide by building plants.

You defeat them by making the entire CEE ecosystem dependent on your AI orchestration layer