How Leaders Use Deep Opportunity Insight & Strategic Data Management to Outperform Markets

A) Executive Strategic Snapshot (15-Second Read)

The Core Truth 2026+:

Markets are no longer won by better execution, but by earlier, calmer, structurally advantaged decisions.

Most organizations:

- Optimize inside visible markets

- React to signals after they are priced in

- Use AI to analyze, not to capture

Winners use:

- Deep Opportunity Insight (DOI)

- Strategic Data Management (SDM)

- Prompt-driven value capture systems

B) Why Traditional Strategy Fails After 2025

1️⃣ The Strategy Timing Collapse

- Annual strategy cycles are obsolete

- Quarterly steering is already late

- Decisions now decay in value within weeks

Insight: Strategy is no longer what you decide — but when you decide.

2️⃣ The Data Illusion

Organizations drown in:

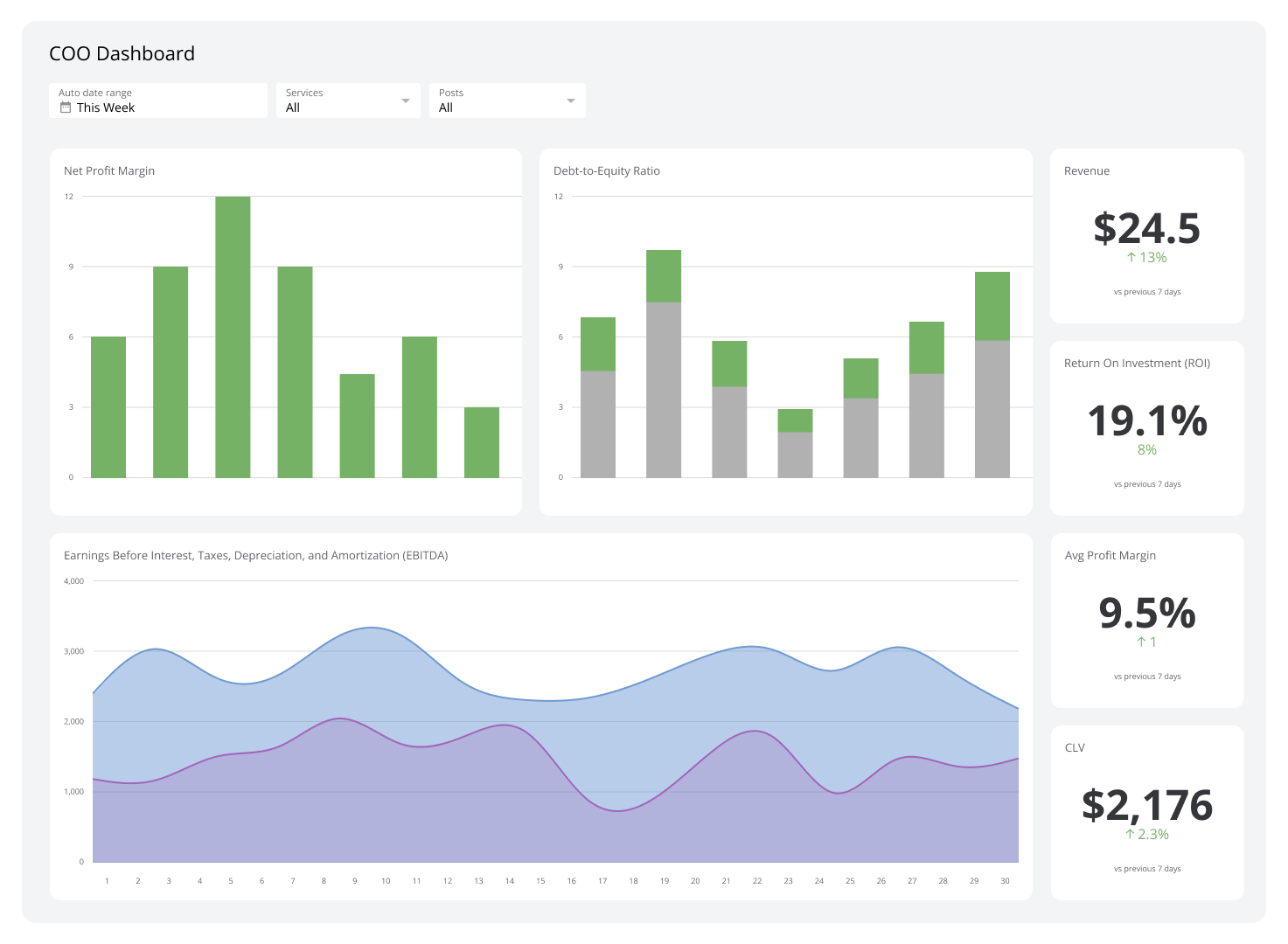

- Dashboards without decisions

- KPIs without consequence

- Reports without authority

Strategic Data ≠ Big Data

Strategic data must:

- Change a decision

- Shift a priority

- Reallocate cash-flow

If it doesn’t → delete it.

C) The RapidKnowHow Deep Opportunity Insight (DOI) System

The DOI Operating Loop

DOI Loop:

- Detect underpriced change

- Translate into decision advantage

- Rank by value capture potential

- Act before consensus forms

- Lock in structural advantage

This is pre-market strategy.

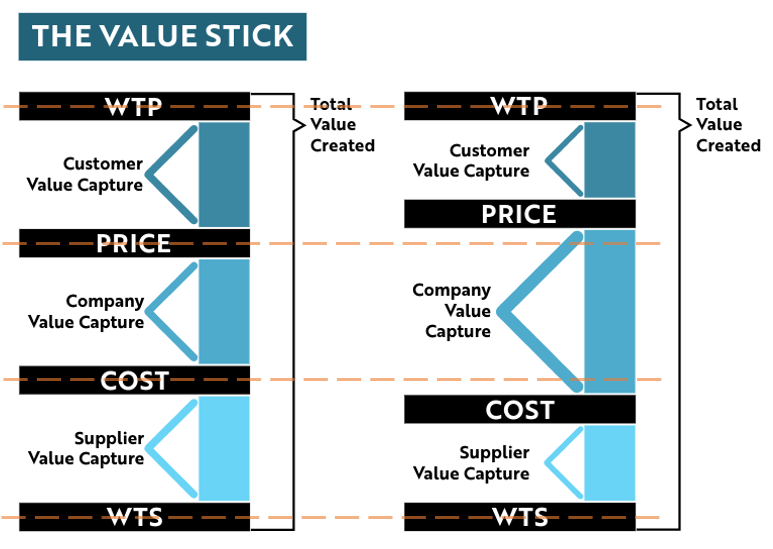

D) Strategic Data Management (SDM): The Filter That Matters

Only data answering one of these four questions is allowed:

| Strategic Question | Value Impact |

|---|---|

| What is accelerating unnoticed? | Timing advantage |

| Where is friction becoming leverage? | Margin capture |

| Which delay destroys cash-flow? | Speed arbitrage |

| Who controls the bottleneck? | Power position |

Everything else is operational noise.

E) The ROICE-X Opportunity Ranking Model

Board-Grade Formula

ROICE-X = (Δ Cash-Flow × Speed Advantage × Control Factor) ÷ Complexity

Interpretation:

- Δ Cash-Flow → measurable impact within 12–24 months

- Speed Advantage → weeks/months gained vs competitors

- Control Factor → ownership of constraint, not volume

- Complexity → execution drag (kills value fast)

If Complexity > Control, reject.

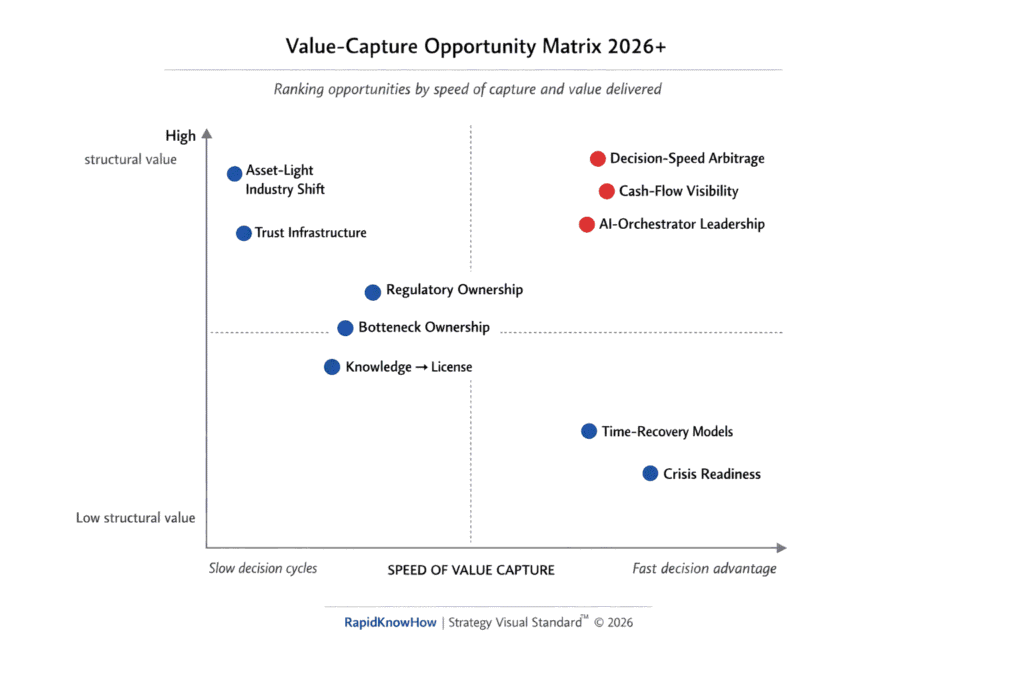

F) The Top 10 Asymmetric Value Opportunities (2026+)

🥇 1. Decision-Speed Arbitrage

Capture: Faster strategic calls under uncertainty

Why it wins: Delay is now the biggest cost

Models: Board games, simulations, decision retainer

🥈 2. Cash-Flow Visibility Before Commitment

Capture: Seeing cash impact before action

Why: Accounting is backward-looking

Models: CFO dashboards, scenario alerts

🥉 3. AI-Orchestrator Leadership Systems

Capture: Leaders who direct AI, not delegate to it

Why: Tools are commoditized, orchestration is scarce

Models: Licensing, certification, ecosystems

4️⃣ Regulation as Competitive Moat

Capture: Turning compliance into growth leverage

Why: Fear freezes competitors

Models: Compliance-as-Strategy platforms

5️⃣ Asset-Light Industry Rewrites

Capture: Removing CapEx drag from legacy sectors

Why: Balance sheets suffocate agility

Models: BaaS, long-term service contracts

6️⃣ Bottleneck Ownership

Capture: Control of the slowest, most painful step

Why: Power always sits at constraints

Models: Platform control, toll gates

7️⃣ Crisis Readiness Monetization

Capture: Selling preparedness, not firefighting

Why: Crises are permanent

Models: Retainers, readiness audits

8️⃣ Knowledge → License → Ecosystem

Capture: Turning expertise into systems

Why: Consulting doesn’t compound

Models: Royalties, partner markets

9️⃣ Trust Infrastructure

Capture: Decision-grade truth in noisy environments

Why: Misinformation destroys confidence

Models: Premium intelligence subscriptions

🔟 Time-Recovery Models

Capture: Selling time saved, not features

Why: Time is the scarcest resource

Models: Outcome-based pricing

G) The One Question Every Board Must Answer

“Which decision, if made 30 days earlier than competitors, would permanently improve our cash-flow trajectory — and why haven’t we made it yet?”

If the answer is unclear:

- Strategy is missing

- Leadership is reactive

- Value will leak

H) How This Becomes a Competitive Weapon

Organizations that win in 2026+:

- Rank opportunities monthly, not annually

- Use prompts as strategic instruments

- Treat insight as a monetizable asset

- Lock in advantage before markets agree

Those who don’t:

- Optimize declining models

- Argue with lagging indicators

- Discover too late that value moved elsewhere

How to measure how quickly new market opportunities are identified

this goes straight to decision advantage, not vanity KPIs.

Here’s a clean, board-usable way to measure how quickly new market opportunities are identified — not “analyzed”, identified early enough to matter.

A) The Core Principle

Opportunity speed is not time-to-report — it is time-to-decision-readiness.

An opportunity is identified only when:

- It is decision-relevant

- It is ranked

- It can trigger action or rejection

Anything earlier is just signal noise.

B) The 4 Metrics That Actually Measure Opportunity-Speed

4

1️⃣ Signal-to-Insight Time (SIT)

What it measures:

How long it takes to turn a weak signal into a strategic insight

Formula:

SIT = Date of decision-grade insight – Date of first detectable signal

Benchmark:

- ❌ > 90 days → reactive organization

- ⚠️ 30–90 days → average

- ✅ < 30 days → early mover

- 🟢 < 14 days → asymmetric advantage

Board question:

“When did we first see this — and when did we understand it?”

2️⃣ Insight-to-Ranking Time (IRT)

What it measures:

Speed from insight to formal prioritization

Formula:

IRT = Date ranked in Top-X portfolio – Date insight was formulated

Why it matters:

Most organizations see opportunities but never rank them → value dies in ambiguity.

Benchmark:

- ❌ > 45 days → strategy paralysis

- ✅ < 14 days → decision discipline

- 🟢 < 7 days → decision culture

3️⃣ Opportunity Half-Life (OHL)

What it measures:

How fast an opportunity loses value if not acted upon

Definition:

Time until 50% of potential value is gone due to:

- Competitor moves

- Regulation

- Cost inflation

- Narrative lock-in

Key insight:

If OHL < your decision cycle, you structurally lose.

Board rule:

“If the half-life is shorter than our governance cycle — we don’t have a strategy.”

4️⃣ Decision Latency Index (DLI)

What it measures:

Organizational delay after opportunity is already clear

Formula:

DLI = Decision date – Date opportunity was decision-ready

Interpretation:

- DLI caused by analysis → acceptable

- DLI caused by politics, fear, unclear authority → value destruction

Healthy organizations:

DLI < OHL

C) The Opportunity-Speed Score (OSS) — One Number for the Board

You can combine all four into a single board KPI:

OSS = (OHL – (SIT + IRT + DLI)) ÷ OHL

Meaning:

- 🟢 OSS > 0.4 → opportunity captured early

- 🟡 OSS 0–0.4 → marginal advantage

- 🔴 OSS < 0 → opportunity identified too late

This turns speed into a measurable strategic asset.

D) What High-Performing Organizations Do Differently

4

They:

- Track first signal dates explicitly

- Force ranking within days, not weeks

- Assign decision owners, not committees

- Kill 70–80% of opportunities fast (this increases speed)

They do not:

- Wait for certainty

- Confuse dashboards with decisions

- Treat speed as an operational issue

E) The One Diagnostic Question to Use Immediately

Ask this in your next leadership meeting:

“Which opportunity did we see early but act on late — and what exactly slowed us down?”

If the answer is unclear:

- Opportunity speed is low

- Value leakage is structural

- AI won’t fix it — governance will