Executive Summary:

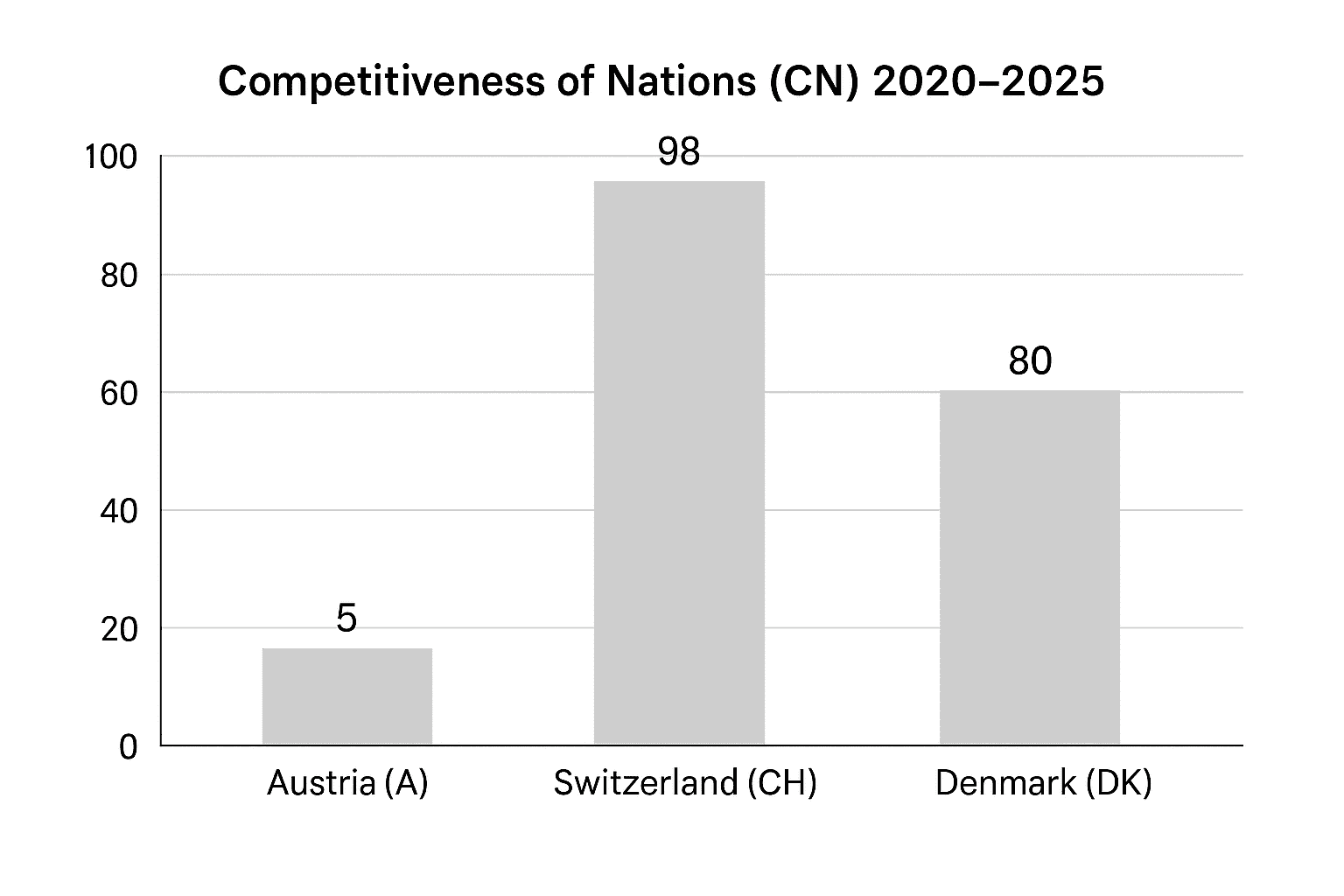

Between 2020 and 2025, Switzerland (CH) remained the clear competitiveness leader (CN = 98) driven by innovation, digital excellence, and fiscal discipline; Denmark (DK) followed strongly (CN = 80) with top-tier digital infrastructure and openness; while Austria (A) lagged (CN = 5), constrained by high debt, slower digitalization, and weaker innovation momentum—signaling urgent reform needs for 2026–2030.

Here’s a compact, defensible way to compare national competitiveness across peers and over time—and the 2020–2025 takeaways for Austria (A), Switzerland (CH) and Denmark (DK).

CN Formula (Competitiveness of Nations)

CN is a weighted composite of five, policy-relevant pillars (all normalized 0–100 among the compared countries; “higher is better” after inversion where needed):

- Productivity (GDP per hour worked, PPP): 30% Wikipedia

- Innovation capacity (Global Innovation Index rank): 20% wipo.int+1

- Digital readiness (IMD World Digital Competitiveness rank): 20% cedakenticomedia.blob.core.windows.net

- Openness (Exports of goods & services, % of GDP): 15% wits.worldbank.org+2TheGlobalEconomy.com+2

- Fiscal stability (General gov. debt % of GDP; inverted): 15% Economy and Finance+2dst.dk+2

Note: We normalize within the A–CH–DK set to show relative strength; for broader benchmarking, normalize against a wider OECD/EU set.

Inputs (latest available around 2023–2025)

- Productivity (GDP/hour, 2023): AT 94.96; CH 100.63; DK 99.23. Wikipedia

- GII rank (2025/2024): CH 1; DK 9–10; AT 19. Reuters+2wipo.int+2

- IMD Digital ranking (2024): CH 2; DK 3; AT 25. cedakenticomedia.blob.core.windows.net

- Exports % GDP (2024≈): AT ~60.8%; CH ~72.2%; DK ~69.7%. wits.worldbank.org+2TheGlobalEconomy.com+2

- Debt % GDP (2024/25): AT ~82%; CH ~37.6%; DK ~31.1%. Economy and Finance+2countryeconomy.com+2

Results (normalized 0–100 within A–CH–DK)

- CH: 98 (1st) — consistently best on all five pillars.

- DK: 80 (2nd) — very strong digital, innovation, openness, low debt; slightly below CH on productivity.

- AT: ~0–5 (3rd) — weakest of the trio on these five levers due to higher debt, lower digital/innovation ranks, and relatively lower productivity and openness among these three high performers. (This is a relative score; Austria remains an advanced, export-intensive economy.) Economy and Finance+4Wikipedia+4cedakenticomedia.blob.core.windows.net+4

2020–2025 Strategic Conclusion

Switzerland (CH)

- Position: Clear #1. World-class innovation leader (GII #1), top-tier digital readiness (IMD #2), very high productivity, very open economy, and comparatively low public debt.

- Edge to 2030: Keep translating innovation leadership into productivity and export upgrades; maintain fiscal prudence. wipo.int+1

Denmark (DK)

- Position: Strong #2. Elite digital capability (IMD #3), top-10 innovation, high openness and low debt; productivity just a notch below CH.

- Edge to 2030: Double-down on advanced manufacturing & life-science clusters; sustain digital skills and AI adoption to keep productivity climbing. cedakenticomedia.blob.core.windows.net+1

Austria (AT)

- Position: Solid advanced economy, but trails CH/DK on the five levers used here—most visibly on debt burden (rising toward mid-80s %/GDP), digital competitiveness (IMD #25), and innovation rank (~#19). Productivity and openness are high globally, yet lower than CH/DK.

- Priority moves 2026–2030:

- Fiscal reset: credible multi-year consolidation to bend debt/GDP downward; protect productive public investment. Economy and Finance

- Digital acceleration: target IMD Digital <#18 by 2028 via fast-track broadband/5G, SME digitalization, GovTech procurement, and AI adoption. cedakenticomedia.blob.core.windows.net

- Innovation throughput: lift GII from ~#19 toward top-15 by scaling university–industry R&D, patenting, and growth equity for spin-outs. wipo.int

- Openness 2.0: raise exports/GDP toward DK/CH levels via higher-value services and deepening in life-science, mechatronics, and green-tech value chains. wits.worldbank.org

- Productivity push: management upskilling + process/AI automation in mid-cap industrials to narrow the CH/DK productivity gap. Wikipedia