M&A or Organic Growth in the Industrial Gas Sector

Focus: Key Geographic Regions Worldwide

This is a classic high-stakes, irreversible decision with long cash-flow tails, regulatory traps, and geopolitical exposure.

Below is a Decision Governance–driven answer, not a generic strategy opinion.

1️⃣ Decision Definition (Governance First)

Decision Question

Should we pursue growth in Industrial Gases via M&A or Organic Expansion—by region?

Decision Type

- Strategic, capital-intensive, partly irreversible

- 10–25 year asset & relationship lock-in

Decision Owner

- Group CEO / Board Investment Committee

Primary Objective

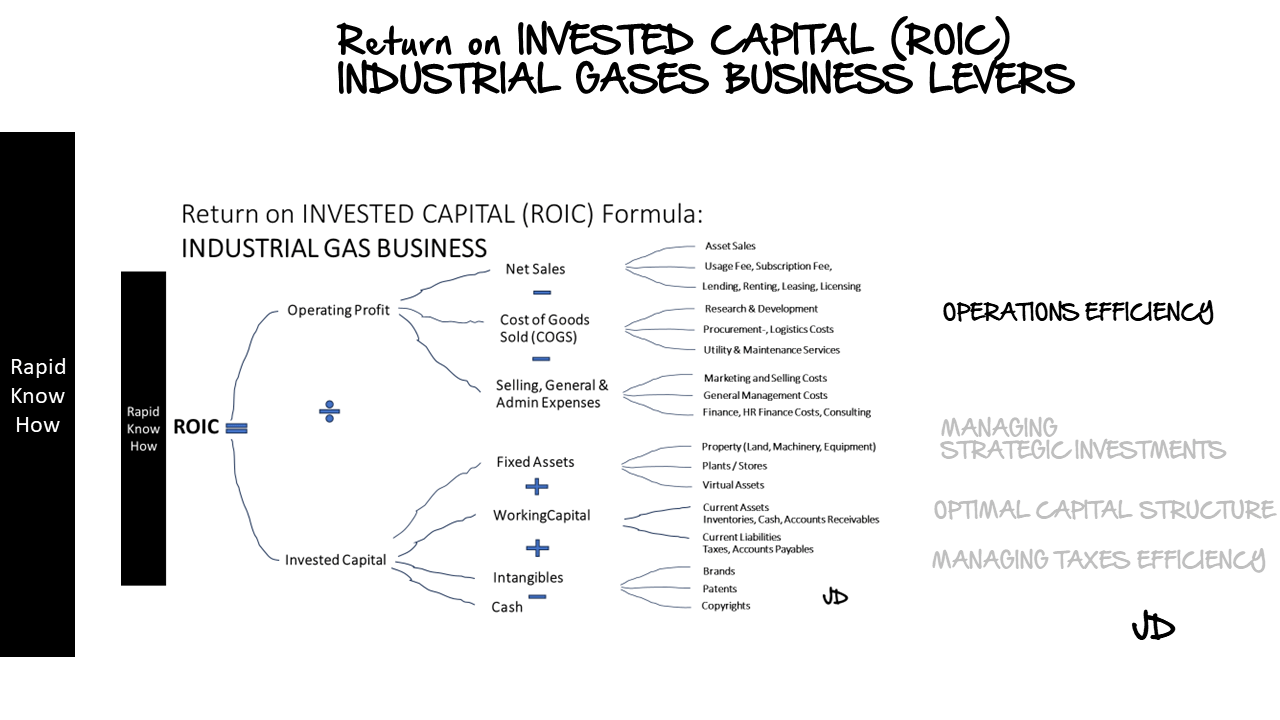

- Sustainable cash-flow

- ROCE resilience

- Strategic optionality under geopolitical stress

2️⃣ Facts vs Assumptions Firewall

Hard Facts (Sector Reality)

- Industrial gases = local, regulated, asset-heavy

- Cash-flow stability depends on:

- Long-term offtake contracts

- Energy prices

- Regulation & permitting

- Logistics density

- M&A premiums are highest where assets already exist

Common False Assumption

“M&A is always faster and safer than organic growth.”

➡ False in regions with:

- Political risk

- Energy volatility

- Regulatory capture

- Overpriced incumbents

3️⃣ Option Architecture (Global)

Option A — M&A-Led Expansion

- Buy plants, contracts, people

- Faster market share

- High capital + integration risk

Option B — Organic / Asset-Light Growth

- New plants, on-site, VMI, partnerships

- Slower but controllable

- Better long-term ROCE

Option C — Hybrid (Staged Governance)

- Organic entry → selective bolt-on M&A

- Highest optionality

- Governance-intensive (best leaders win here)

4️⃣ Regional Decision Governance Matrix

🌍 NORTH AMERICA (USA, Canada)

Reality

- Mature market

- High concentration

- High M&A multiples

- Stable regulation

Governance Decision

✅ Selective M&A + On-Site Organic

Why

- Greenfield is slow (permits)

- M&A works only if:

- Contracts are long-term

- Energy exposure is hedged

- Organic works for:

- On-site hydrogen, specialty gases

Decision Rule

Risk-adjusted ROCE beats speed.

🌍 EUROPE (EU, UK, Nordics)

Reality

- Overregulated

- Energy cost volatility

- Political intervention risk

- Aging assets

Governance Decision

⚠️ Organic / Asset-Light FIRST

❌ Avoid large M&A

Why

- M&A inherits:

- Old plants

- Labor rigidity

- Political risk

- Organic allows:

- New tech

- Modular plants

- Contract-driven cash-flow

Decision Rule

Survival & optionality before scale.

🌍 CHINA

Reality

- State influence

- JV necessity

- IP risk

- Scale advantages

Governance Decision

⚠️ Controlled Partnerships, NOT full M&A

Why

- M&A = limited control

- Organic alone = blocked

- Best path:

- JV

- Technology + services

- Exit optionality

Decision Rule

Control risk > growth ambition.

🌍 INDIA

Reality

- Fast industrial growth

- Infrastructure gaps

- Fragmented market

Governance Decision

✅ Organic Growth Dominant

Why

- Greenfield cheaper

- Less legacy burden

- Long runway for demand

Decision Rule

Build early, compound patiently.

🌍 MIDDLE EAST

Reality

- Energy advantage

- Mega-projects

- State customers

Governance Decision

🔁 Hybrid (Anchor Projects + Partnerships)

Why

- Organic via mega on-site plants

- M&A mostly irrelevant

- Political alignment critical

Decision Rule

Relationship governance > capital.

🌍 LATAM

Reality

- Volatility

- Currency risk

- Uneven regulation

Governance Decision

⚠️ Organic + small bolt-ons only

Why

- Large M&A = fragile

- Organic allows exit flexibility

Decision Rule

Flexibility beats footprint.

🌍 AFRICA

Reality

- Early-stage

- Infrastructure deficit

- Political instability

Governance Decision

✅ Pure Organic / Asset-Light

Why

- M&A adds no value

- Modular, mobile solutions win

Decision Rule

Minimum irreversible capital.

🌍 SOUTH-EAST ASIA

Reality

- Manufacturing shift

- Mixed regulation

- Growth + volatility

Governance Decision

🔁 Hybrid with strong exit clauses

Why

- Organic entry

- Tactical acquisitions later

Decision Rule

Optionality first, scale second.

5️⃣ Bias & Power Check

Typical Board Biases

- “Everyone else is buying—so should we”

- Overconfidence in integration capability

- Underestimating regulatory friction

Governance Countermove

- Region-by-region decision

- No global “one size fits all” rule

6️⃣ Final Governance Recommendation (Board-Grade)

Global Rule

Default to ORGANIC.

Use M&A only where regulation, density, and energy stability justify it.

Strategic Pattern

- Europe → Organic / Asset-Light

- India / Africa / SEA → Organic early

- North America → Selective M&A

- China / Middle East → Partnership-led

7️⃣ 30-Second Executive Summary

In Industrial Gases, M&A buys yesterday’s assets.

Organic growth builds tomorrow’s cash-flow.

Decision Governance means choosing region-specific rules, not ideology.- Josef David