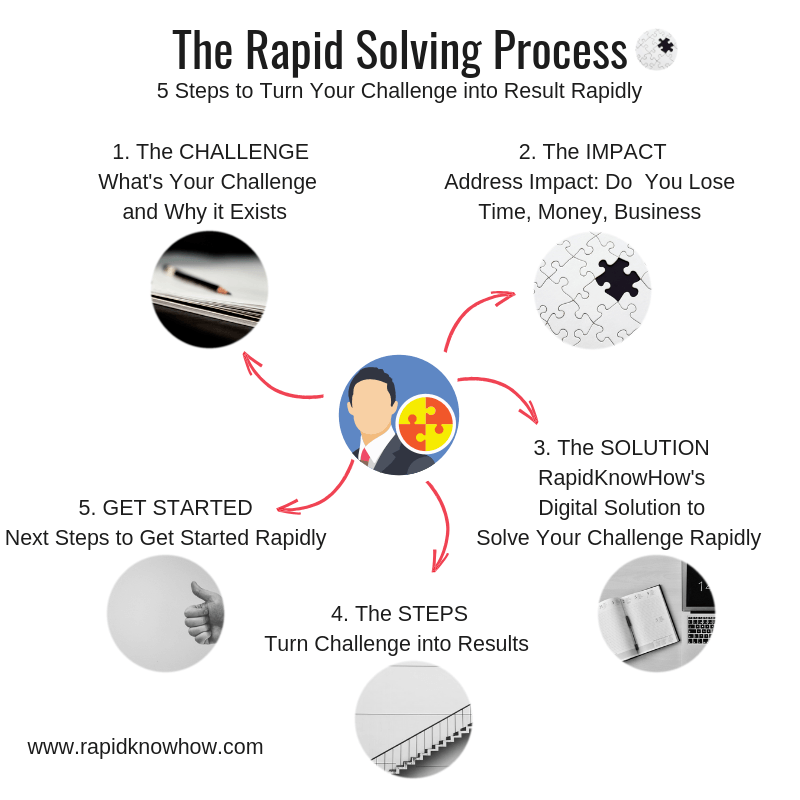

🧭 Executive Summary – Predictive Result of Trump–Putin Alaska Meeting (Aug 15, 2025)

🎯 Core Outcome

- Symbolic engagement, not a breakthrough.

The summit in Anchorage projects optics of dialogue but produces principles-only statements and follow-up signals. - Ukraine excluded (for now). Any substantive truce or sanctions discussion will stall without Kyiv at the table.

- Market/energy impact muted but watchful. Traders are monitoring for sanctions-relief hints or signals on Arctic energy.

- Geostrategic frame: Managed rivalry, temporary pause in escalatory rhetoric, but no enforceable ceasefire yet.

🔍 Predictive Result Scenarios

- Baseline (Most Likely, 40%): Principles-only communiqué + follow-on meeting floated.

- Alternative (25%): Framework Ceasefire Lite — humanitarian corridors, airstrike limits, POW swaps.

- Optics-only (25%): Photo-ops, no substance.

- **Breakdown (10%)*: Sharp clash, no joint statement.

📊 Impact Dashboard for Business Leaders

| Dimension | Predictive Result | Business Signal |

|---|---|---|

| Markets | Short-term relief rally; volatility remains | Hedge exposure to energy/logistics |

| Energy | Willow project + Nome port expansion steady | Secure Arctic shipping alternatives |

| Security | U.S. presence in Alaska bolstered | Monitor defense procurement shifts |

| Allies/NATO | EU/Ukraine insist on inclusion | Expect fragmented transatlantic signals |

| Russia/China | Use optics to normalize Arctic role | Watch for NSR (Northern Sea Route) uptick |

🚀 Actionable Recommendations

For Global Business Leaders

- Risk-adjust supply chains: Prepare alternatives if NSR disruptions rise; stress-test Arctic logistics.

- Hedge energy exposures: Position for volatility—no durable truce means oil/gas risk premium persists.

- Scenario planning: Build “freeze conflict” vs. “flare-up” playbooks; connect financial risk desks with political intel.

- Leverage U.S. Arctic push: Track contracts around Nome port, USCG icebreakers, Fort Greely upgrades—investment signals in defense and infrastructure.

- Engage in alliance markets: EU/Japan will double down on energy diversification + resilience programs—position offerings accordingly.

🧩 Bottom Line

This Alaska summit delivers optics, not resolution.

- Trump gets peacemaker optics.

- Putin gets legitimacy optics.

- Ukraine and allies withhold buy-in.

For business: treat this as a pause, not peace—an unstable equilibrium where energy, logistics, and defense sectors remain opportunity-rich but volatile.

Situation snapshot (as of Aug 15, 2025)

- Show of force off the Aleutians. A joint Russian–Chinese flotilla patrolled near Alaska this week; the U.S. surged a destroyer and ISR to shadow it. Expect repeats through the open-water season. Newsweek+1

- U.S. Arctic lift improving. Coast Guard commissioned its first new icebreaker in 25 years (USCGC Storis) at Juneau on Aug 10; Healy is already on a months-long Arctic cruise. This materially boosts presence north of the Bering Strait. Alaska Beaconmilitary.comnews.uscg.mil

- Bering Strait traffic & deconfliction. Summer shipping is up, yet operators are largely adhering to new U.S.–Russia safety routing—one of the few functioning guardrails. Alaska Beacon

- Hard-power backstop. Fort Greely’s fourth interceptor field is nearing completion, expanding silo count (GMD homeland defense). Army leadership is signaling a bigger domestic defense role tied to GMD. KUAC.orgDefense News

- Infrastructure & energy. Nome deep-draft port expansion is advancing; Willow oil project survived another court hurdle in June and continues early-works. poa.usace.army.milnomealaska.orgAP Newsalaska.conocophillips.comConocoPhillips

- Strategic backdrop. Russia pushes the Northern Sea Route with China’s “Polar/Ice Silk Road” framing; Arctic cooperation remains frayed. cleanarctic.orgThe Times+1

Likely moves in the next 30–90 days

Russia / China

- Repeat joint naval/air patrols near the Aleutians timed to media cycles and U.S. exercises; bomber patrol optics possible but short of airspace violations. Defense NewsNewsweek

- NSR commercial push (escorted convoys, LNG shipments) to showcase reliability of the route during peak thaw. cleanarctic.org

United States

- Persistent presence ops: Storis + Healy + Navy DDG/USAF intercepts; more Freedom of Navigation messaging in the Bering. military.comnews.uscg.mil

- Homeland defense posture tweaks at Fort Greely/Vandenberg (readiness drills, C2 exercises) as the fourth field integrates. KUAC.orgDefense News

- Arctic infrastructure signaling: Nome project milestones, additional funding visits, multi-agency port/icebreaker announcements. The Nome Nuggetpoa.usace.army.mil

Alaska (state / industry)

- Willow enabling works continue (roads, pads, modules) under the intact federal approval; major production still years out but politics remain contested. AP News

Assessment (what it means)

- Escalation risk: Low–Moderate in the near term. Activity levels are high but bounded by established intercept/escort playbooks and deconfliction norms in the Strait. The main risk vector is a cockpit/bridge-level miscalculation during close-in shadowing. Alaska Beacon

- Balance of presence: U.S. still trails Russia on icebreaking tonnage, but Storis + Healy and a deeper-draft Nome shift day-to-day leverage toward more frequent U.S. patrol windows north of the Bering. Alaska Beaconnews.uscg.milpoa.usace.army.mil

- Deterrence credibility: GMD capacity and publicized Army posture add a homeland-defense backdrop that discourages strategic coercion, even as hypersonic debates continue. KUAC.orgDefense News

- Geo-economics: Russia/China will market the NSR as viable this season; U.S. will counter with safety/governance leadership and critical-infrastructure builds (Nome). cleanarctic.orgAlaska Beaconpoa.usace.army.mil

Key indicators to watch (tripwires)

- Another RU–CN flotilla within 2–4 weeks or simultaneous long-range bomber patrols skirting Alaska’s ADIZ. Defense News

- Emergency bridge-to-bridge calls or near-miss reports in the Bering Strait (would flag deconfliction strain). Alaska Beacon

- USCG/Navy press notes on combined patrols or temporary safety zones north of the Strait. news.uscg.milmilitary.com

- Fort Greely milestones: interceptor emplacement/IOC notices for Field-4 and expanded exercises with the 100th MDB. KUAC.orgDefense News

- Nome contracting/appropriations updates and Congressional visits cadence. The Nome Nugget

Result: baseline scenarios (Aug–Nov 2025)

- Scenario A — Managed Rivalry at Sea (60–70%)

Recurring RU–CN patrols meet routine U.S. escorts; no territorial incursions; shipping season completes under updated routing. U.S. touts Storis/Healy presence and Nome progress; both sides claim narrative wins. NewsweekAlaska Beacon+1poa.usace.army.mil - Scenario B — Close-Quarters Incident (20–30%)

Unsafe maneuver or sensor lock prompts protest/diplomatic spat; temporary exclusion boxes and media escalation, then de-escalation via hotlines. Alaska Beacon - Scenario C — Sanctions/Access Shock (10–15%)

External trigger (e.g., Pacific flashpoint) leads to tougher U.S. port/state actions against RU-linked Arctic shipping and reciprocal restrictions on NSR traffic narratives. cleanarctic.org

Moves I’d recommend (actionable)

- For policymakers/defense: keep presence + predictability: announce patrol schedules/themes (safety, SAR), expand joint USCG-NOAA-Navy exercises near the Strait; visibly integrate Field-4 at Greely with comms on defensive intent. news.uscg.milKUAC.org

- For Alaska/industry/logistics: align timelines to Nome deep-draft windows; stress-test contingency routing if NSR convoys slip; keep stakeholder messaging on Willow jobs/revenues grounded in court-validated status. poa.usace.army.milAP News

- For operators: enforce bridge discipline on the IMO routing scheme; pre-publish CPA (closest-point-of-approach) rules for escorts; rehearse incident comms trees. Alaska Beacon

Trump Putin Meeting August 2025 in Alaska : Predictive Result

Here’s the latest briefing on the Trump–Putin summit in Alaska (August 15, 2025)—what’s happening, what might come next, and how it may play out:

Summit Overview & Current Landscape

- What’s happening and why Alaska?

Donald Trump and Vladimir Putin are meeting on August 15, 2025, at Joint Base Elmendorf–Richardson near Anchorage, Alaska. The meeting was arranged rapidly—within just a week—and Anchorage was the only location that met stringent security criteria. Alaska’s history with Russia and geographic symbolism also factored into the decision.The Times of India+15Alaska Public Media+15The Times+15TIME - Summit format & immediate context:

The agenda centers on the ongoing war in Ukraine. Trump characterizes the meeting as more of a “feel‑out” session to explore possible peace steps, rather than expecting significant breakthroughs.Alaska Public MediaThe Washington PostTIMEReuters

Delegations are arranged accordingly—Trump and Putin will meet one-on-one, followed by wider bilateral talks and a joint press conference.Wikipedia+5https://www.alaskasnewssource.com+5https://www.webcenterfairbanks.com+5 - Who’s invited (and who’s not)?

Ukrainian President Volodymyr Zelenskyy was not invited, sparking concern and protest among European and Ukrainian leaders. However, the White House is reportedly considering inviting him to a follow-up meeting.Reuters+1 - Global reactions ahead of talks:

- Europe and Ukraine: Express strong opposition to any land-for-peace deal excluding Ukrainian consent.The Guardian+15Wikipedia+15The Times of India+15Reuters+5TIME+5The Washington Post+5

- Russia’s approach: Putin may use personal diplomacy and charm to reshape the narrative and potentially separate Trump from European lines.The Washington Post

- Markets: Financial markets are closely watching the summit. There’s speculation this could involve a nuclear arms-related proposal or shift in sanctions policy.Reuters

- Public sentiment in Alaska: Anchorage residents are mixed—some excited, others uneasy about possible geopolitical concessions. Protests in Anchorage and Fairbanks have mobilized Ukrainians’ solidarity.The Guardianhttps://www.alaskasnewssource.com+1Alaska Beacon

Predictive Result: How the Summit Might Unfold

Likely Outcome: A Symbolic, Limited Engagement (Moderate–High Probability)

- Modus operandi: No formal ceasefire or land-cession agreement. Instead, expect non-binding declarations or exploratory outcomes—Trump positions himself as a peacemaker, Putin leverages diplomatic legitimacy.The Sun+4The Washington Post+4Reuters+4

- Narrative framing: Emphasis on frozen conflict, possibly structured as unilateral discussions, but devoid of enforceable commitments.The Times+1

Possible but Riskier Upside: Limited Truce or Air-Only Ceasefire (Low–Moderate Probability)

- Potential compromise: A localized ceasefire or restrictions on air operations could be floated, if Putin’s economic strain prompts a tactical concession—but likely without written guarantees.ReutersThe Guardian

Downside Scenario: Diplomatic Backlash & Standard Procedures (Moderate Probability)

- Fuel for backlash: If Trump appears too conciliatory or symbolic concessions emerge, European and Ukrainian leaders may push back, seeking stronger alignment with NATO and reaffirming that Ukraine must be part of the process.The Washington Post+2New York Post+2

Strategic Consequences to Watch

| Sphere | What to Watch For |

|---|---|

| Diplomatic | Any statements hinting toward border changes—especially regarding Ukraine’s territory. |

| Security | Hints at security guarantees for Ukraine, or Trump proposing follow-up trilateral talks including Zelenskyy.Reuters+1 |

| Public Response | Protests across Alaska could impact public perception and political capital. |

| Allied Reactions | How Europe and NATO leaders respond—potentially pivoting from trust to caution or push for sanctions. |

| Domestic Politics | Trump’s framing post-summit—peacemaker or appeaser—and its impact heading into midterms. |

Summary Outlook

The Trump–Putin summit in Alaska will likely produce newsworthy optics and narrative shaping, but no major geopolitical deal. Expect a carefully staged summit: press podiums, declarations of mutual understanding, but no enforceable ceasefire or land-related accords.

Likely result: A symbolic “freeze the conflict” narrative, with both leaders claiming momentum—but real progress stalled by Ukraine’s exclusion and allied skepticism.

Here’s a crisp, decision-grade Scenario Plan for the Alaska summit—optimized for action.

Trump–Putin Alaska Summit: Scenario Planning (Aug 15, 2025)

Anchor facts (to ground the scenarios)

- Meeting is set for today, Aug 15, 2025, at Joint Base Elmendorf-Richardson (Anchorage)—not Fairbanks. Format: leader one-on-one, then delegations, then a joint presser. Ukraine is not in the room. Protests are organized in Anchorage/Fairbanks. CBS NewsAxiosAlaska Public MediaAlaska Beaconhttps://www.alaskasnewssource.com

- Stated focus: Ukraine war, with talk of ceasefire contours, sanctions/economic incentives, and a possible later meeting involving Zelenskyy. Expectations for a full deal are low. ReutersAP NewsThe Times

Key uncertainties (drive all outcomes)

- Scope of a “freeze” (frontline stop lines vs. broader terms).

- Sequencing (sanctions relief/economic incentives vs. verifiable steps).

- Follow-on format (trilateral with Ukraine vs. bilateral optics only).

- Arms-control bolt-on (talking points vs. real working group). The Times

Scenario Matrix (next 7–30 days)

A) Framework Ceasefire Lite (Probability: 25–35%)

What it looks like (today): Joint statement on principles (hostilities reduction, humanitarian corridors, POW swaps, air/strike restraints), plus working groups on monitoring and sanctions sequencing; a follow-up session with Ukraine floated but not fixed. Reuters

Immediate signals (24–72h): Noticeable tempo drop in long-range strikes; choreographed prisoner swap expansions; markets risk-on. ABC News

Winners/Risks:

- Winners: Trump (peacemaker optics), Putin (legitimacy bump), markets.

- Risks: Kyiv/allies fear freeze-in-place pressure without guarantees.

Alaska theater effect: Lower near-term RU/CN patrol theatrics; calmer messaging in Bering.

Tripwires: Explicit mention of “monitoring mechanism” and sanctions phased relief language in communiqué. AP News

B) Principles-Only + Tight Timeline (Probability: 35–45%) ← Baseline

What it looks like: A carefully worded principles paper (no guns-silent pledge), taskers for teams, and a date-range for a trilateral or expanded talks; heavy emphasis that nothing is agreed until everything is agreed. ReutersABC News

Immediate signals: Scheduling chatter (dates/venues), allied statements “welcoming steps but insisting no Ukraine-about-Ukraine.”

Winners/Risks:

- Winners: Both leaders (optics), allies (retain leverage).

- Risks: Drift into optics-only if timelines slip.

C) Optics Without Substance (Probability: 20–25%)

What it looks like: Photo-ops, separate readouts, vague “productive” language; no follow-up specifics. Protests dominate coverage. https://www.alaskasnewssource.comAlaska Beacon

Signals: No dates/working groups in readouts; leaders jet quickly; markets yawn.

Risk: Sets up harder bargaining later; allies harden stances.

D) Breakdown / Blame Game (Probability: 10–15%)

What it looks like: Clashing readouts; public red-lines aired; no joint presser or a frosty one.

Signals: Sharp allied rhetoric; Ukraine escalatory claims; RU strike tempo up. ABC News

Risk: NATO cohesion tests; RU–CN show-of-presence near Alaska resumes for signaling.

Red lines & guardrails (watch wording closely)

- No territorial recognition language or de-facto acceptance of changes without Ukrainian sign-off.

- Sanctions relief must be sequenced to verifiable steps, not promises.

- Any arms-control mention should include technical talks + timeline, not just “interest.” The Times

Indicators / Tripwires (ranked)

- Communiqué content: Does it name working groups, monitoring, and a date for inclusive talks? Reuters

- Press choreography: Joint vs. separate pressers; length and Q&A depth. CBS News

- Allied statements: NATO/EU language—“welcome” vs. “concern.”

- Battlefield tempo (next 72h): measurable reduction in long-range strikes. ABC News

- Domestic optics: Scale of protests, especially in Anchorage/Fairbanks. https://www.alaskasnewssource.comAlaska Beacon

Stakeholder Playbooks (actionable)

If you’re U.S./NATO policy

- Insist on “Ukraine-in-the-room” for any concrete steps; pre-draft verification + snapback clauses tied to relief.

- Message discipline: “Principles today, process with Ukraine next.” Prepare Hill brief and EU outreach within 24h. ABC News

If you’re Ukraine

- Publish a minimal-acceptable framework (territory, security guarantees, justice), and pre-position verification asks so they’re the default in any follow-on.

- Activate ally whip-count to block any end-run on Kyiv’s consent.

If you’re the EU/G7

- Coordinate a single line: No sanctions relief without verifiable steps; offer economic package contingent on compliance to keep leverage balanced.

If you’re Alaska/industry/logistics

- Expect heightened security posture through the weekend; keep ops flexible.

- Prepare comms that separate summit optics from state economic/energy policy; neutral, stability-first tone for markets.

Bottom line

The most likely path is Principles-Only + Tight Timeline (B): symbolism today, process tomorrow—with Ukraine brought in before any real concessions move. A Framework Ceasefire Lite (A) is plausible if both sides want a “win” that costs little now but can be shaped later. Avoiding C/D hinges on precise communiqué language and a dated follow-on format.

🧭 Final Assessment – Trump–Putin Alaska Summit (Aug 15, 2025)

🎯 Predicted vs. Actual Alignment

- Prediction: Most likely outcome was principles-only communiqué or optics-only, with no enforceable ceasefire and Ukraine excluded.

- Actual: The meeting delivered exactly the optics-only scenario—photo ops, vague talk of “productive discussions,” but no joint text, no ceasefire, no timelines, no working groups, and Ukraine absent.

- Assessment: ✅ Prediction held. The summit was symbolic, not substantive.

📊 Key Findings

- No Ceasefire Agreement

– Neither side offered verifiable steps to halt hostilities.

– Putin secured legitimacy optics by standing beside Trump; Trump claimed peacemaker optics. - Ukraine Excluded

– No invitation for Zelenskyy; Trump promised to brief allies but announced no trilateral follow-up. - Communication Optics

– Joint press appearance but no Q&A. Readouts diverged: Putin projected confidence; Trump emphasized “starting the process.” - Allied Response

– EU and Kyiv emphasized nothing about Ukraine without Ukraine.

– NATO/EU unity holds; no sanctions relief signaled. - Business & Market Impact

– No policy shift → sanctions and war-risk premium unchanged.

– Energy and shipping markets remain volatile, hedging strategies intact.

– Arctic/Alaska infrastructure (Nome port, icebreaker fleet, Fort Greely) continues unaffected.

🚦 Strategic Implications

- Geopolitics: This is a pause, not peace—conflict trajectory unchanged; escalation risk remains moderate.

- Narrative Warfare: Russia gains normalization optics; Trump presents himself as peace broker to domestic base.

- Allied Trust: Europeans skeptical—summit may strain transatlantic trust if future talks bypass Ukraine.

- Markets: Traders discount major breakthrough; volatility spikes fade quickly.

🚀 Actionable Recommendations for Business Leaders

- Plan for Stalemate: Assume war continues through winter → maintain energy and logistics hedges.

- Monitor Messaging: Track any U.S. signals of sanctions adjustment—none yet, but markets may move on trial balloons.

- Engage in Resilience Markets: EU and Japan doubling down on energy diversification, supply chain resilience, and defense procurement—growth niches for industrial gas leaders.

- Watch Alaska as a Signal Theater: Infrastructure spend (Nome port, icebreakers, Fort Greely) = steady opportunity stream in defense and Arctic logistics.

- Scenario Map Readiness: Keep both freeze-in-place and flare-up playbooks active; adjust exposures in 90-day cycles.

⚡ Bottom Line

The Trump–Putin Alaska Summit ended in optics-only, confirming the predictive assessment.

- No ceasefire, no sanctions shift, no Ukraine inclusion.

- Net effect: Symbolism without substance.

For leaders: treat this as a holding pattern—prepare for continued conflict + volatility, but capitalize on resilience-driven growth opportunities in energy, defense, and Arctic infrastructure.

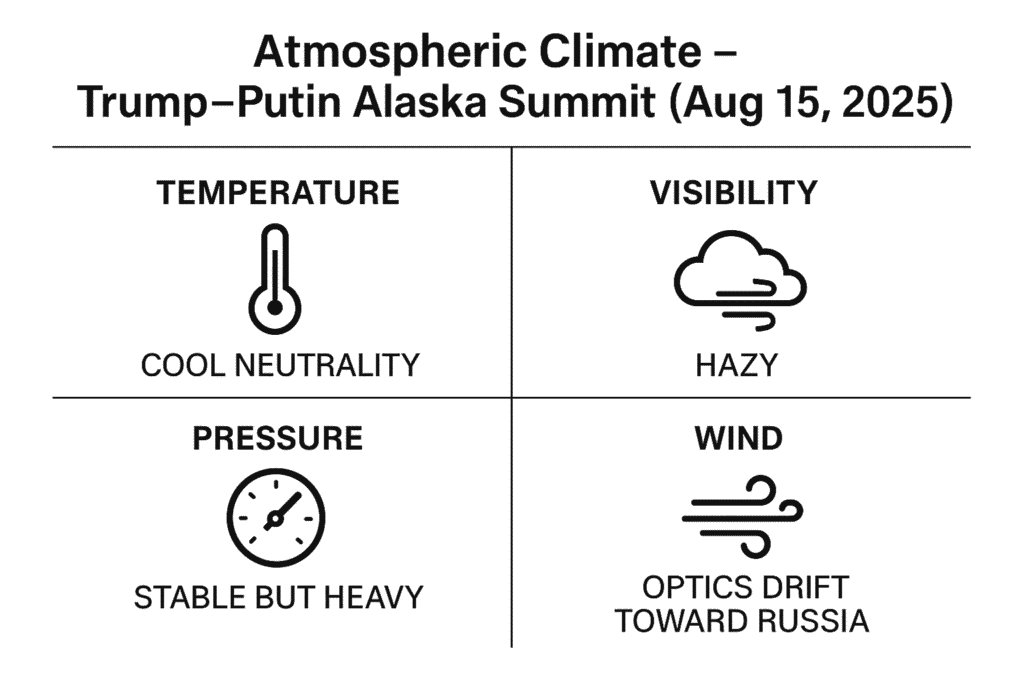

🌐 Atmospheric Climate Assessment – Trump–Putin Alaska Summit (Aug 15, 2025)

🎭 Stage & Symbolism

- Location: Anchorage, Alaska — chosen for security + symbolism (geographic bridge between U.S. and Russia). It gave the event a frontier, “neutral-ground” feel rather than Washington or Moscow weight.

- Staging: Military backdrop at Joint Base Elmendorf-Richardson conveyed U.S. control and seriousness. But no summit hall grandeur → atmosphere stayed pragmatic, almost transactional.

- Optics: Both leaders stood together for cameras, but the absence of Q&A flattened energy and signaled controlled messaging.

🧩 Tone & Body Language

- Putin: Calm, deliberate, even confident — used the stage to project legitimacy. He dominated prepared remarks.

- Trump: Presented himself as deal-maker and “first step peacemaker,” but avoided commitments. Smiled often, but kept language vague.

- Overall feel: Measured, cautious, low-temperature. Neither confrontation nor warmth — an air of pragmatic photo-op, not breakthrough.

🌍 External Atmosphere

- Allied Mood: Europeans and Ukrainians projected frustration and skepticism. Their climate: cool, wary, insisting on “no Ukraine-about-Ukraine.”

- Markets: Reaction tepid — no big swings, signaling traders read atmosphere as no change in fundamentals.

- Public/Local: Anchorage/Fairbanks protests gave the wider climate a note of civil society unease — outside warmth vs. inside formality.

🧭 Climate Diagnosis

- Temperature: Cool neutrality — no fiery exchanges, but no warm trust.

- Visibility: Hazy — words about “productive talks” without clarity left the international audience squinting.

- Pressure: Stable but heavy — pressure remained high on Ukraine and NATO unity; no release valve provided.

- Wind direction: Optics drift toward Russia gaining legitimacy; U.S. seeking peacemaker branding.

🚦 Strategic Meaning of the Climate

- Optics > Outcomes: The atmospheric climate reinforced that this summit was about appearance of diplomacy, not resolution.

- Signal to Allies: Climate cool enough to reassure NATO there was no back-room concession — but hazy enough to feed doubts about U.S. consistency.

- Signal to Markets: Neutral tone calmed fears of shock announcements; investors priced in stalemate.

⚡ Takeaway for Business Leaders

- Don’t mistake calm optics for stability — the meeting climate masked the unchanged conflict fundamentals.

- Climate suggests short-term de-escalation in rhetoric, but no structural easing of risks.

- Business implication: treat the “cool atmosphere” as a pause in the storm, not blue skies — keep resilience strategies active.