Powered by People, Enabled by AI

Positioning RapidKnowHow as the Leading AI-Orchestrator for a Compounded Growth Network (2026–2030)

A) Executive Summary – The Strategic Shift

The Industrial Gas Sector stands at a decisive turning point in 2026.

Global leaders such as Linde plc, Air Liquide, and Air Products and Chemicals have demonstrated that scale, pricing power, and disciplined capital allocation generate superior Free Cash Flow (FCF) and strong market multiples.

However, the next growth wave (2026–2030) will not be won by expanding fixed assets alone.

It will be won by:

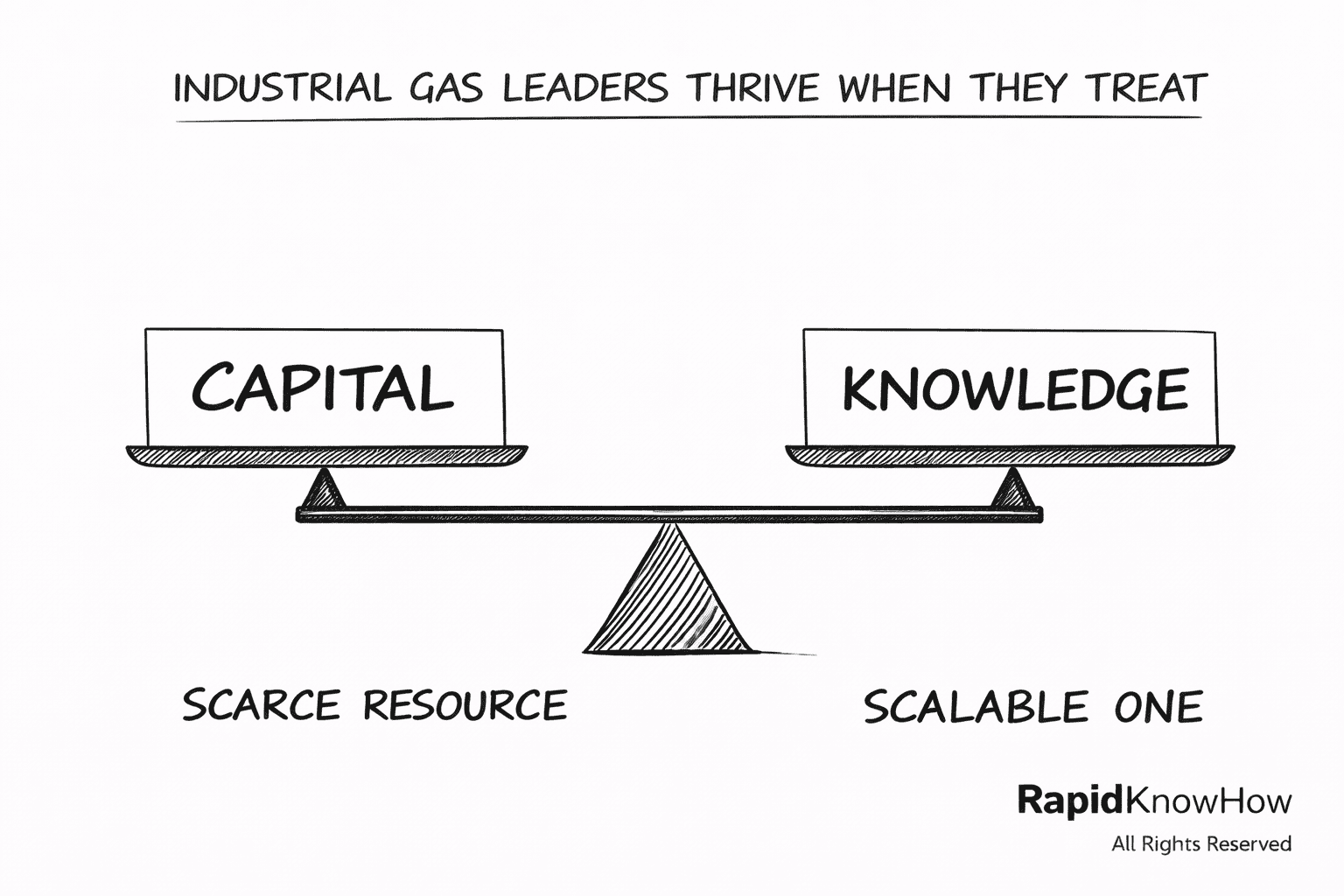

- Leveraging people knowledge as scalable capital

- Deploying AI as orchestration intelligence

- Treating financial capital as scarce and strategic

- Designing network-based compounding growth models

RapidKnowHow positions itself as the AI-Orchestrator Leadership System that transforms Industrial Gas from an asset-heavy industry into a knowledge-leveraged, free-cash-flow-optimized ecosystem.

The core thesis:

Free Cash Flow is not the result of size.

Free Cash Flow is the result of orchestrated intelligence.

B) The Structural Reality of Industrial Gas 2026

1. Capital Intensity vs. Capital Scarcity

Industrial gas remains:

- Capex-intensive (ASUs, pipelines, hydrogen hubs)

- Energy-price sensitive

- Long-cycle contract driven

- Increasingly exposed to decarbonization pressure

At the same time:

- Interest rates remain structurally higher than in 2015–2021

- ESG capital demands transparency

- Governments push for local resilience

- Customers demand flexibility

Capital is no longer “cheap abundance.”

It is a scarce strategic lever.

The companies that win will:

- Convert operational intelligence into FCF

- Reduce working capital cycles

- Increase asset turns

- Protect pricing via AI-enabled transparency

C) The Free Cash Flow Driven Growth™ Formula

1. Traditional Model (2020 Logic)

Growth =

More plants → More volume → More revenue → Margin discipline → FCF

Limitation:

- Linear

- Slow

- Asset-heavy

- Vulnerable to energy shocks

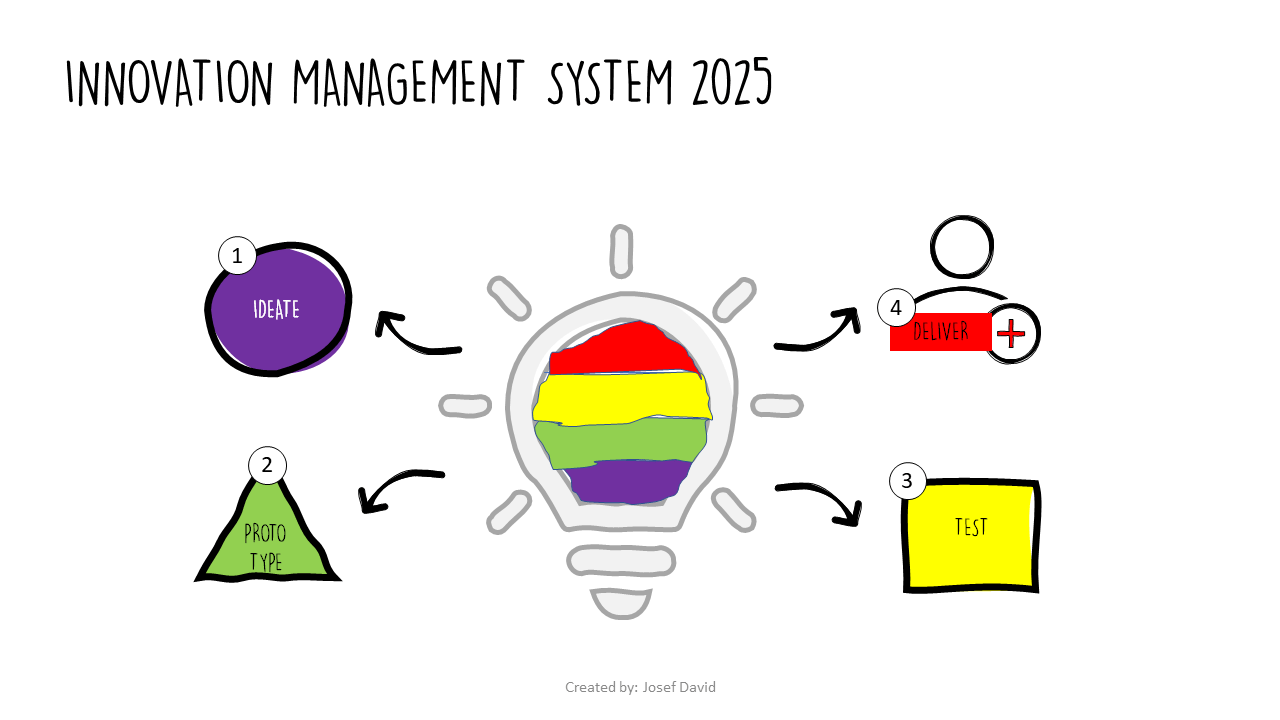

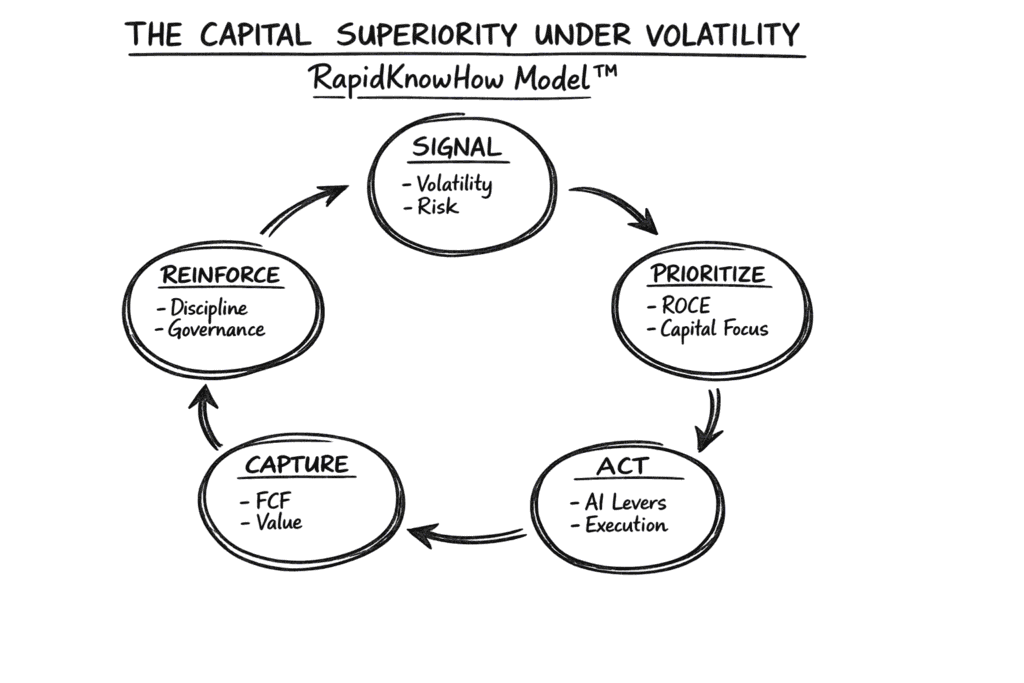

2. RapidKnowHow AI-Orchestrated Model (2026 Logic)

Growth =

Signal → Prioritize → Act → Capture → Reinforce

Where:

Signal

Real-time AI detection of:

- Customer margin leakage

- Pass-through misalignment

- Energy inefficiencies

- Contract underpricing

- Idle asset pockets

Prioritize

Focus on:

- Highest FCF sensitivity levers

- ROCE uplift impact

- Speed-to-cash improvements

Act

Deploy:

- AI pricing engines

- Smart renegotiation systems

- Capex deferral strategies

- Network rebalancing

Capture

Turn improvements into:

- Immediate FCF uplift

- Working capital release

- Cash acceleration

Reinforce

Reinvest in:

- High-return growth nodes

- Asset-light services

- Data intelligence loops

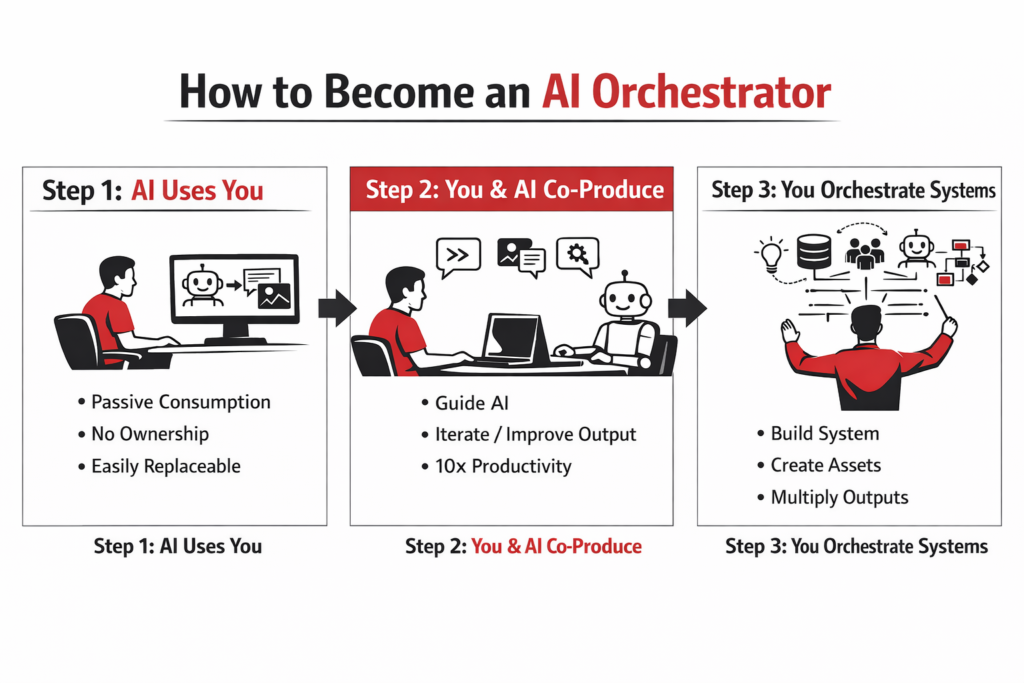

D) Powered by People – Enabled by AI

The biggest hidden asset in industrial gas is not the plant.

It is the people.

- Sales engineers with contract intuition

- Plant managers with yield optimization insights

- Key account leaders with negotiation power

- Financial controllers with FCF visibility

But traditionally, this knowledge:

- Remains siloed

- Is not scaled

- Is not systemized

- Leaves when people leave

The Shift:

AI does not replace people.

AI scales their intelligence.

RapidKnowHow positions the AI-Orchestrator as:

- The system that captures human expertise

- Turns tacit knowledge into structured leverage

- Multiplies decision speed

- Connects operations to finance in real-time

People Knowledge → AI Structuring → Network Intelligence → FCF Compounding

E) From Single Company to Compounded Growth Network (2026–2030)

The next strategic leap is ecosystem-based.

Instead of:

Company vs. Company

The model becomes:

Network vs. Network

The Compounded Growth Network includes:

- Industrial Gas Core Operators

- Energy Providers

- Hydrogen Mobility Players

- OEM Equipment Suppliers

- Smart Infrastructure Platforms

- Financing Institutions

- Regional Public Partners

The AI-Orchestrator integrates:

- Energy volatility data

- Customer demand shifts

- Capex timing

- Regulatory triggers

- Cross-border optimization

This creates:

- Faster decision cycles

- Better capital allocation

- Shared intelligence advantage

- FCF resilience

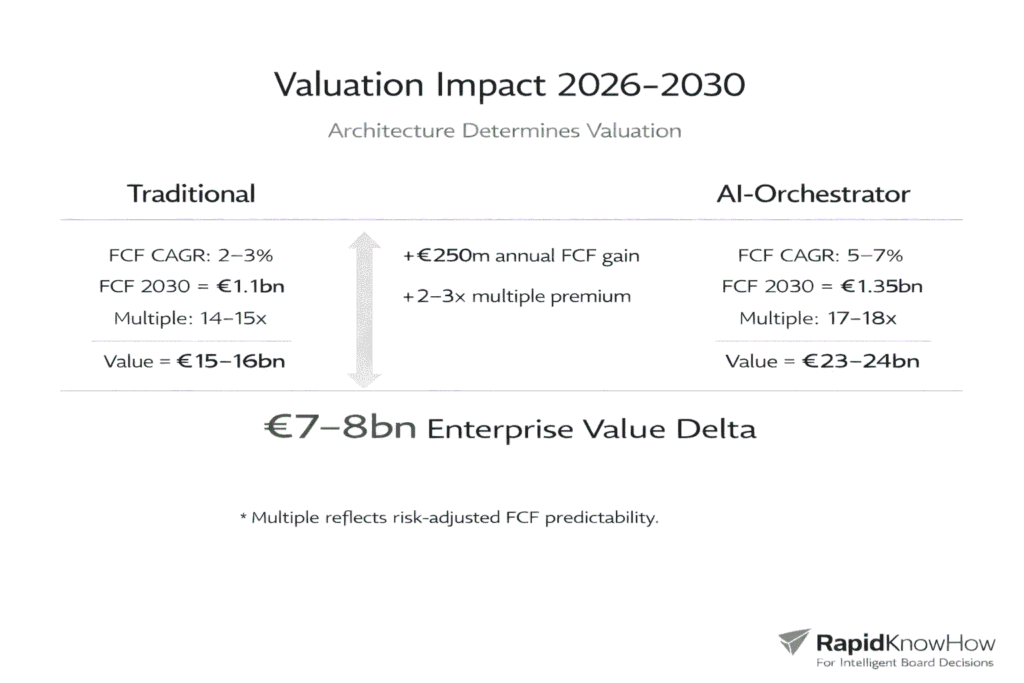

F) The Financial Engine: FCF → ROCE → Multiple → Market Value

The strategic cascade is clear:

- AI improves margin capture

- Margin capture improves Free Cash Flow

- FCF reduces capital pressure

- ROCE improves

- Market assigns higher multiple

- Market value compounds

Boards understand this chain.

Investors reward it.

But execution requires orchestration.

G) 2026–2030 Strategic Action Blueprint

Phase 1 (2026): Free Cash Flow Acceleration

- AI pricing optimization

- Energy pass-through automation

- Working capital compression

- Contract repricing analytics

Target:

+8–12% FCF uplift without major capex

Phase 2 (2027–2028): Asset-Light Growth Nodes

- Gas-as-a-Service

- Data-driven optimization contracts

- Modular hydrogen clusters

- Service-layer monetization

Target:

Increase ROCE while limiting fixed asset growth

Phase 3 (2029–2030): Network Intelligence Advantage

- Cross-company data orchestration

- Predictive energy hedging

- Integrated supply resilience

- AI-based capital planning

Target:

Structural multiple expansion

H) Why RapidKnowHow Is Uniquely Positioned

RapidKnowHow is not:

- A consultancy selling slides

- A software vendor selling tools

- A financial advisor selling valuation theory

It is positioned as:

The AI-Orchestrator Leadership System for Industrial Gas

Core strengths:

- FCF-centric logic

- Capital allocation discipline

- System-thinking architecture

- People-first leverage philosophy

- Compounded value design

It bridges:

Operations ↔ Finance ↔ Strategy ↔ AI

This is the missing integration layer in the industry.

I) The 2026 Leadership Call

Industrial Gas 2026 requires a new type of leader:

Not a plant optimizer.

Not only a deal negotiator.

Not only a capital allocator.

But:

An AI-Orchestrator Leader.

One who understands:

- Decision speed as advantage

- FCF as oxygen

- Capital as scarce

- People knowledge as scalable gold

Final Strategic Positioning Statement

Industrial Gas 2026 – Free Cash Flow Driven Growth™

Powered by People. Enabled by AI.

Orchestrated by RapidKnowHow.

The companies that master this shift will not just grow.

They will compound.

From 2026 to 2030, the winners will be those who:

- Treat knowledge as capital

- Treat AI as multiplier

- Treat Free Cash Flow as strategic oxygen

- Treat networks as the new moat

RapidKnowHow positions itself not as a commentator of this shift. But as the orchestrator of it. – Josef David