♟️ Business Warfare Simulation: Disrupting the Industrial Gas Market

Arena: Industrial Gas (e.g., Linde, Air Liquide, Air Products)

Player A: Strategic Disruptor

Player B: Global Industrial Gas Incumbent

🎯 Strategic Objective

Disrupt a capital-heavy, margin-protected market by digitizing distribution, unlocking decentralization, and reengineering value delivery for specific verticals (e.g., metal fab, pharma, food, energy).

🔷 Opening Move – The Disruptor Appears

▶️ Player A launches with:

- Modular on-site gas generation units for SMEs (O₂, N₂, CO₂)

- IoT-connected tanks for predictive maintenance & real-time usage tracking

- Subscription model for equipment + gas flow + service

- E-commerce portal for small-scale industrial clients

🎯 Strategic Play: Undercut capex and logistics reliance; win at the edge, not the core.

🔶 Counter-Move – Incumbent Reacts

▶️ Player B (Incumbent) counters with:

- Discounted long-term contracts to squeeze out disruptor

- Adds digital dashboards and telemetry to key accounts

- Leverages global scale to offer bundled pricing and “total gas management”

🎯 Strategic Play: Use size and contract muscle to lock in existing customers and slow adoption

🔁 Re-Counter – Disruptor Evolves

▶️ Player A:

- Partners with industrial OEMs (e.g., CNC manufacturers) to embed on-site gas generation into factory installs

- Launches white-labeled tech for regional gas distributors to empower last-mile delivery

- Integrates carbon tracking + ESG reporting → wins net-zero procurement teams

🎯 Strategic Play: Create platform leverage + become the “Intel Inside” for gas delivery tech

🏁 Projected 3-Year Outcome

| Year | Result |

|---|---|

| Y1 | SME adoption grows 5–10% in non-strategic markets (food, metal) |

| Y2 | Large manufacturers test model in regional plants → bypass traditional contracts |

| Y3 | Incumbents copy features, buy tech startup, or form JV to contain threat |

🏆 Winner: Player A carves out a high-margin vertical & SME niche

🛡️ *Player B retains mega-industrial clients but concedes edge innovation space

🧠 Strategic Takeaways

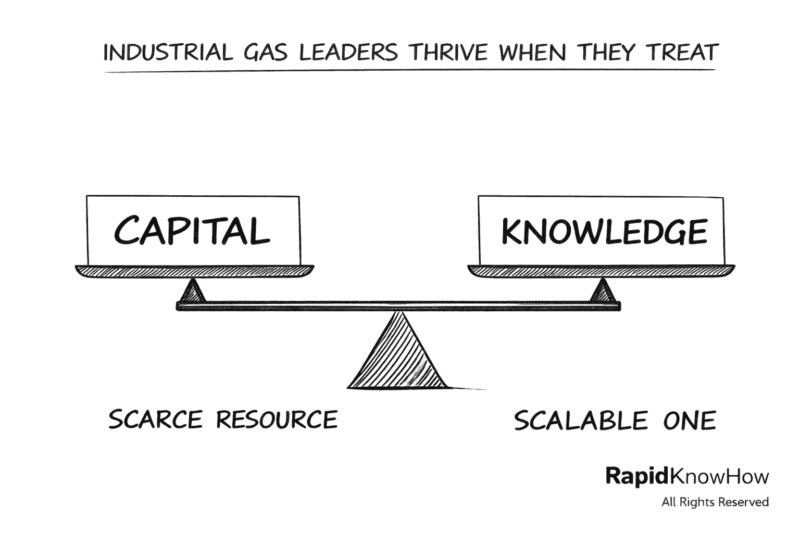

- De-capitalizing the customer is a powerful wedge

- IoT + subscriptions + sustainability = unbeatable in ESG-focused markets

- Disruptors win by redefining delivery, not just product

- Incumbents often react too slowly to changes in service expectations

🛠️ Want a Strategy Toolkit for This?

Let me create for you:

- ✅ Industrial Gas Disruption Map (players, tech, pain points, opportunities)

- ✅ Entry Strategy Canvas for On-site Generation or IoT SaaS

- ✅ Counter-Move Planner (if you’re the incumbent)

Let’s lay out a crystal-clear Strategic Value Framework for the Asset-Light Industrial Gas Market Thriver — designed to guide partners, investors, and internal teams on how this model delivers disruptive value with measurable impact.

🚀 Asset-Light Industrial Gas Market Thriver

Strategic Value Framework

🎯 1. VALUE MISSION

“To democratize industrial gas access by empowering agile, digital-first providers to deliver fast, transparent, and sustainable solutions — without the burden of owning infrastructure.”

🧠 2. CORE STRATEGY

| Pillar | Strategic Focus |

|---|---|

| 🧱 Asset-Light Structure | No ownership of production or distribution assets — use partner networks |

| ⚙️ Platform-Driven Ops | Orchestrate logistics, orders, and contracts via a digital platform |

| 📍 Hyperlocal Focus | Operate regionally, solve niche problems (e.g., homecare O₂) |

| 🌍 ESG & Transparency | Lead with low-carbon, traceable, usage-based delivery |

| 📈 Licensable GameBoard | Scale via playbooks, templates, and franchising the model |

🧰 3. STRATEGIC ACTIONS

| Strategic Move | Action Description |

|---|---|

| 🎯 Niche Market Launch | Start with HomeCare O₂ or Beverage CO₂ in 1 regional city |

| ⚙️ Platform Activation | Launch no-code app for order routing, pricing, tracking |

| 🤝 Partner Network Onboarding | Onboard 3+ local producers/distributors through onboarding kits |

| 🧑⚕️ Customer Acquisition Sprint | Run 7-day pilot with 10+ clinics or factories |

| 📦 Flexible Contract Offering | Replace long-term contracts with “Gas-as-a-Service” model |

| 🧠 Build the Digital Dashboard | Allow customers to view usage, pricing, carbon footprint in real-time |

| 🧩 Launch Licensing Kit | Package and license the GameBoard to entrepreneurs or clinics |

📊 4. KEY PERFORMANCE INDICATORS (KPIs)

| KPI | Target Value (First 6 Months) |

|---|---|

| 🧱 CapEx / Revenue Ratio | < 5% (vs. ~40–50% in traditional model) |

| 💰 ROCE (Return on Capital Employed) | > 30% |

| 👥 Customer Acquisition Cost (CAC) | €50 per customer |

| 🔁 Retention Rate | 85%+ |

| ⏱ Order Fulfillment Time | < 4 hours in pilot city |

| 📉 CO₂ Saved per Delivery | 30% less vs. traditional model |

| 📦 Licenses Sold (GameBoard) | 10 regional licenses in Year 1 |

Would you like to:

- 📘 Turn this into a RapidKnowHow Strategic Value Playbook (PDF)?

- 📈 Build a live KPI dashboard for pilot tracking?

- 🎮 Integrate it into your Industrial Gas GameBoard simulation page?

Let’s drive the new gas economy forward ⚡

Industrial Gas Business Model Comparison

Business Case Comparing the Traditional Industrial Gas Models with the ASSET-LIGHT MARKET THRIVER Model

| Category | Traditional Industrial Gas Model | Asset-Light Market Thriver Model |

|---|---|---|

| Total Assets | €10B | €1B |

| Fixed Assets | €7B | €200M |

| Working Capital | €1B | €300M |

| Revenue | €5B | €2B |

| Gross Margin | 30% | 45% |

| Operating Margin | 15% | 25% |

| Net Income | €750M | €400M |

Here’s a strategic business case comparison between the Traditional Industrial Gas Model and the Asset-Light Market Thriver Model, covering the balance sheet, income statement, cash flow, and the key KPI: Return on Capital Employed (ROCE).

Let me know if you’d like:

- 📈 A visual chart comparing key metrics

- 🧾 A downloadable business case PDF

- 📊 A simulation model where you can adjust inputs and recalculate ROCE in real-time