The RapidKnowHow Partner Commercialisation Process (V1.0, 2026)

Learn → Lead → License → Scale → Compounding → Orchestrator Leadership

Structured so ANY partner can immediately start generating sales, licenses, and recurring value in their markets.

1. THE MODEL AT A GLANCE

LEARN → LEAD → LICENSE → SCALE → COMPOUND → ORCHESTRATOR LEADER

Each stage has one clear monetization mechanism and one clear asset:

| LEARN | Attract interest | PowerPosts | Free → Low-ticket |

| LEAD | Convert interest | PowerBook / Action Guide | €19–€97 |

| LICENSE | Deliver Impact | 30-Day Sprint + System License | €9,500 → €25,000 |

| SCALE | Multiply Clients | Multi-Sprint Packs | High-Ticket |

| COMPOUND | Recurring Value | Annual System Licenses | €4,900–€25,000 / year |

| ORCHESTRATOR LEADER | Own Market Position | Partner Ecosystem + M&A + Thought Leadership | Multi-year recurring + equity opportunities |

THIS is the commercial flywheel.

2. STAGE 1 — LEARN: POWER POSTS (Free → Low Ticket)

Partners generate attraction with:

Power Posts

- 1–2 pages

- Rapid Insight + Action

- Sector pain point → ROI promise

- Clear CTA to PowerBook (LEAD stage)

Examples for Industrial Gas Market:

- “5 Pricing Errors Cutting Your ROCE in Half — and the AI Fix.”

- “Unlock 20% ROICE in 30 Days — Scenario Playbook.”

Objective

- Build trust

- Capture emails

- Demonstrate expertise

- Funnel toward LEAD products

Partner Monetization

- Free → €9.90 → €19 mini-products

- Lead magnet for Sprint sales

3. STAGE 2 — LEAD: POWERBOOK / ACTION GUIDE (€19–€97)

Partners use the PowerBook to create strong early revenue and position themselves as credible transformation providers.

PowerBook Structure

- Problem

- Insight

- Model

- 3–5 Actions

- Case Example

- Scenario

- CTA to 30-Day Sprint (LICENSE stage)

Action Guide

A structured “how-to implement in 7–30 days” manual.

Objective

- Convert readers from interest to action

- Move them into the high-ticket Sprint

- Show rapid value within 1–2 hours of reading

Partner Monetization

- €19 → €97 per sale

- Bundles for €147–€197

- 10–30% conversion to Sprints

4. STAGE 3 — LICENSE: SCALE RAPIDKNOWHOW SOLUTIONS (High-Ticket)

This is the core revenue layer.

Partners deliver:

A) 30-Day Strategic Sprint

Based on the Standard Blueprint V1.0.

Example:

Industrial Gas 20% ROICE Sprint (€9,500–€18,500)

Healthcare Preventive CEO Sprint (€7,500–€15,000)

GeoPower Flashpoint Sprint (€9,500)

AI-MBA 30-Day Sprint (€4,900)

B) The Annual System License

To keep the model alive:

- Tools, simulators, dashboards

- Updates

- Quarterly Advisory Clinics

- Branding: “Powered by RapidKnowHow”

Annual Fee: €4,900–€25,000 (depending on sector, geography, exclusivity)

Objective

→ Partners deliver strategic outcome + embed a recurring licensing model.

Partner Monetization

- Sprint fees

- License fees

- Add-on consulting

- Co-execution fees

- Expansion across BU, regions, plants, customer portfolios

5. STAGE 4 — SCALE: MULTIPLICATION OF CLIENTS

Once partners deliver 1–2 Sprints, scaling becomes straightforward.

Partners now offer:

- Multi-Sprint Packages (3, 5, or 10) for corporate groups

- Annual Transformation Packages (Quarterly Sprints)

- Regional Rollout Packages (Country by Country)

Price Levels

- €25,000 → €150,000+ depending scope

- ROICE uplift and cash-flow gains justify price

Strategic Result

Partners start owning segments:

- Industrial Gas Pricing Excellence

- ESG for Manufacturing

- Preventive Health CEO Standard

- AI-MBA Leadership Transformation

This leads to dominant market presence.

6. STAGE 5 — COMPOUND: RECURRING VALUE & CASH-FLOW

This stage transforms RapidKnowHow from a “program” to a compounding business system.

Partners sell:

A) Annual System Licenses

Recurring €4,900–€25,000 per client.

B) Platform Access

- Tools + dashboards

- Annual strategy updates

- AI-powered simulators

- ROICE calculators

- Executive briefings

C) Additional Assets Annually

- PowerCase bundles

- Sector updates

- Regional adaptations

- Scenario modules

- New Sprints

- KPIs & dashboards

Objective

Every year revenues grow WITHOUT additional acquisition costs.

This is Operational Compounding — the holy grail of strategy consulting.

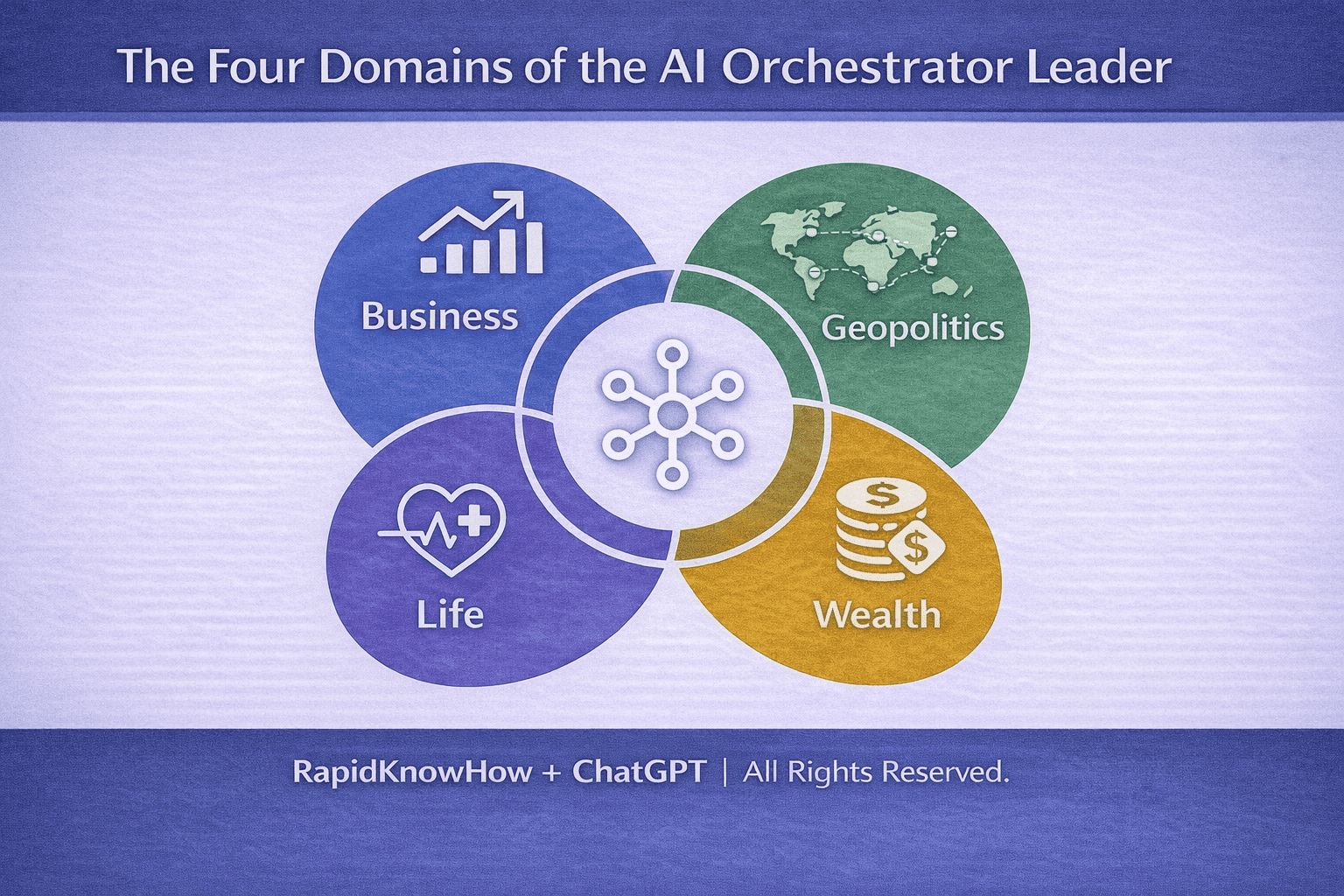

7. STAGE 6 — ORCHESTRATOR LEADER (Ultimate Positioning)

This is the top-level partner stage.

Partners become:

- Dominant sector authorities

- Regional ecosystems builders

- Licensing multipliers

- Channel orchestrators

- M&A connectors

- Policy & regulation influencers

- Strategic thought leaders with their own “PowerHub”

What they gain:

- Equity-like recurring revenues

- Long-term clients

- Strategic trust access

- Upsell rights

- Co-branding with RapidKnowHow

- Leadership status in their region/sector

What RapidKnowHow gains:

- Network expansion

- Standard adoption

- Licensing growth

- Sector credibility

- Recurring global footprint

This is where RapidKnowHow creates the global AI-powered leadership ecosystem.

8. COMMERCIAL FLOW SUMMARY (FOR PARTNERS)

Step 1 — Publish PowerPosts

Step 2 — Sell PowerBooks & Action Guides

Step 3 — Run 30-Day Sprints

Step 4 — Sell Annual Licenses

Step 5 — Roll Out Multi-Sprint Programs

Step 6 — Build Sector Hub

Step 7 — Become the Orchestrator Leader

Each step feeds the next, creating a self-reinforcing commercial flywheel.

9. WHAT PARTNERS NEED TO START (Minimum Requirements)

✔ 1. Certification (8–12 hours)

Understanding:

- ROICE model

- 30-Day Sprint

- Simulation tools

- Roadmap & business case templates

✔ 2. Content Startup Pack

- PowerPosts

- PowerBook templates

- Landing pages

- Email sequences

- Sales scripts

✔ 3. Sector Selection

Partners must choose:

- Geography

- Sector

- Level of exclusivity

✔ 4. Minimum Deal Target

- 3 Sprints in first 90 days

- OR €25,000 licensing sales

10. PARTNER REVENUE POTENTIAL (PER YEAR)

If one partner follows the system:

| Component | Price | Deals/Year | Revenue |

|---|---|---|---|

| PowerBooks | €47 | 300 | €14,100 |

| Sprints | €9,500 | 8 | €76,000 |

| Sprints (Enterprise) | €18,500 | 3 | €55,500 |

| Annual Licenses | €7,500 | 5 | €37,500 |

| Add-on Consulting | €3,000 | 10 | €30,000 |

| Workshops | €2,000 | 10 | €20,000 |

Partner Annual Potential: ~€233,000

Fairly achievable for a good partner.

Great partners will hit €350k–€500k+.

11. BENEFITS FOR RAPIDKNOWHOW

RapidKnowHow gains:

✔ Global scaling without direct delivery

✔ Sector authority positioning

✔ Recurring licensing revenue

✔ Standardisation of ecosystem

✔ Network effects across markets

✔ Compounding market dominance

This is how RapidKnowHow becomes the AI-Orchestrated B2B & Geopolitical Leadership Platform globally.

RAPIDKNOWHOW — LICENSING SPECIFICATION FOR PARTNER MARKETS

Document Type: Licensing & Commercial Specification

Version: V1.0 (2026)

Applies to: All Partners, Distributors, System Integrators, and Sector Specialists licensing RapidKnowHow Sprint Systems and Toolkits.

1. PRODUCT SCOPE COVERED BY THE LICENSE

The License grants the Partner the rights to deliver, localize, market, and monetize the following RapidKnowHow Assets in their territory:

✔ 30-Day Strategic Sprints (LEAD stage)

✔ Simulation & Scenario Models

✔ Financial & Business Case Models

✔ Roadmap Templates

✔ Executive Decision Brief Templates

✔ Sector Adaptation Frameworks

✔ Licensing-Ready Toolkits (updates included per tier)

The License does not grant ownership of any IP or rights to alter branding unless explicitly permitted (see Section 7 & 9).

2. LICENSE RIGHTS GRANTED

Depending on Tier (Section 5), Partners receive:

2.1 Delivery Rights

Partner may deliver 30-Day Sprints to end-customers in the approved territory & sector(s).

2.2 Monetization Rights

Partner may sell Sprints and Sprint Bundles at freely chosen prices, respecting minimum quality & scope requirements defined in Section 3.

2.3 System Access Rights

Partner receives access to:

- Core Tools (Calculators, Simulations, Models)

- Master Templates (Roadmaps, Briefs, Playbooks)

- Annual Updates (Financial, Regulatory, Sector)

- Digital Assets (If included in Tier)

2.4 Multi-Client Rights

Partner may serve multiple clients without per-client royalties unless Revenue-Share model is activated (Section 6.2).

2.5 Brand Alignment Rights

Partner may use branding as:

“Powered by RapidKnowHow”

or

“RapidKnowHow Licensed Partner — [Territory / Sector]”

Brand misuse voids the license (Section 9).

3. MINIMUM STANDARD OF SERVICE (MoS)

To protect brand integrity and customer outcomes, Partners MUST deliver the Sprint according to:

3.1 Method Standard

All Sprints must deliver the 5 mandatory outputs:

- Baseline Report

- Scenario Simulations

- Business Case Model

- 12-Month Roadmap

- Executive Decision Brief

3.2 Delivery Standard

Delivery must include at minimum:

- 4 Workshops (90–120 min)

- 1 Executive Clinic (optional in Basic, mandatory in Pro+)

- Online support channel (email or Slack/Teams)

3.3 Documentation Standard

Deliverables must be provided in:

- PDF (Decision Brief)

- XLS/Sheets (Financial Model)

- PPT/PDF (Roadmap)

- XLS/HTML (Simulations or DI Tools)

3.4 Certification of Compliance

RapidKnowHow reserves the right to conduct:

- Random audits

- Review anonymized outputs

- Interview customers

- Collect NPS/CSAT scores

4. GEOGRAPHY, SECTOR, AND EXCLUSIVITY

Licenses specify three scope dimensions:

4.1 Geography

- Country

- Region

- Cross-Region (optional)

4.2 Sector

Examples:

- Industrial Gases

- Logistics

- Healthcare

- Sustainability

- Strategy Consulting

- Education

4.3 Exclusivity Type

| Type | Description |

|---|---|

| Non-Exclusive | Many Partners per territory |

| Selective | Limited partners per sector/territory |

| Exclusive | Single partner per territory & sector |

Exclusivity fees & performance criteria apply (Section 8).

5. LICENSE TIERS

RapidKnowHow recommends 3 Standard Tiers:

| Tier | Rights & Assets | Annual Fee |

|---|---|---|

| BASIC | Delivery rights + core tools + templates | €4,900 / year |

| PRO | BASIC + sector frameworks + updates + clinics | €9,500 / year |

| ENTERPRISE | PRO + exclusivity + dashboards + co-execution + brand playbooks | €12,500–€25,000 / year |

Discounts available for multi-country or multi-sector licenses.

6. COMMERCIAL MODELS

Partners can choose Fixed Licensing or Hybrid Licensing:

6.1 Fixed Licensing (No Revenue Share)

Partner charges the client directly.

RapidKnowHow earns annual license revenue only.

Used by mature B2B integrators.

—

6.2 Hybrid Licensing (Revenue Share)

Partner keeps most of the sprint revenue and pays RapidKnowHow a 5–15% revenue share on:

- Sprint Fees

- Recurring License Resales

- System Deployment Projects

Used by partners in growth markets or capital-light geographies.

—

6.3 Minimum Pricing Guidance

To protect brand value:

- Standard Sprint should not be priced < €7,500

- Enterprise Sprint should not be < €15,000

This prevents market dumping.

7. BRANDING & IP RULES

Partner must follow:

✔ Use approved brand: “Powered by RapidKnowHow”

✔ Do not remove or alter trademarks

✔ Do not republish IP without permission

✔ Do not sell the toolkit standalone without sprint

✔ Do not modify simulation logic without review

RapidKnowHow retains full IP ownership.

8. PERFORMANCE REQUIREMENTS (if Exclusive)

Exclusive Partners must meet both metrics:

(A) Activity Metric

≥ 8 Sprints / 12 months OR ≥ €150,000 sales pipeline

(B) Quality Metric

CSAT/NPS ≥ 8/10

Non-compliance → License reverts to Selective at renewal.

9. TRAINING & CERTIFICATION

To protect quality, Partners must:

✔ Complete Partner Certification (8–12h)

✔ Submit 1 dummy roadmap + business case

✔ Pass method compliance check

Certifications renew annually with update modules.

10. SUPPORT & ENABLEMENT

RapidKnowHow provides:

- Quarterly update calls

- Annual sector update pack

- Go-To-Market guidance (playbooks, messaging)

- Optional co-execution on first 2–3 deals (extra fee)

- Optional deal qualification support

11. TERMINATION & RENEWAL

11.1 Term

Standard Term: 12 months

11.2 Renewal

Automatic renewal unless:

- Partner opts out

- Partner fails exclusivity performance criteria

- IP misuse occurs

- Payment delays exceed 60 days

11.3 Exit Rights

Upon exit:

- All tools must be deleted

- No new sales permitted

- Existing contracts may be served to completion

12. RECOMMENDED PARTNER PROFILES

Ideal Partners:

✔ B2B Consulting Firms (Strategy, Transformation, ESG)

✔ System Integrators (Digital, AI, Data)

✔ Sector Specialists (Industrial Gas, Health, Logistics)

✔ Business Schools / Executive Programs (Academic Licensing)

✔ Investors & Holdings (for value capture & M&A)

13. MARKET ROLL-OUT OPTIONS

Partners may license the Standard for:

- Direct Service Delivery

- Resale to Consulting Teams

- Embedding into Executive Education

- Private Equity / Holding Deployment

- Government / NGO Programs

Each with different monetization dynamics.

CONCLUSION

This Licensing Specification:

✔ Protects the brand

✔ Enables scaling

✔ Ensures quality

✔ Ensures partner profitability

✔ Supports cross-sector multiplication