🗞️ RapidNews – Today’s Briefing

📅 Date: 23 August 2025 | 🧠 Created by: Josef David | ⚡ Powered by: ChatGPT

1) 🇺🇸 U.S. takes ~10% stake in Intel, jolting industrial policy 😐

EN: The U.S. will acquire ~10% stake in Intel (valued around $8.9–11B) via CHIPS Act funding. It’s seen as a bold strategic tech investment—or a risky market intervention, depending on the viewpoint.

DE: Die US-Regierung erwirbt rund 10 % von Intel (geschätzt auf $8,9–11 Mrd.) durch Fördermittel des CHIPS-Gesetzes. Einschätzungen reichen von „strategisch sinnvoll“ bis „staatlicher Eingriff in Märkte“.

🔗 Sources:

2) 📉 Powell hints at rate cuts ahead as risks “more balanced” 🙂

EN: Fed Chair Powell (Jackson Hole) suggested rate cuts could arrive “in coming months” if labor markets soften. Inflation from tariffs remains a concern.

DE: Powell signalisierte in Jackson Hole mögliche Zinssenkungen, falls der Arbeitsmarkt schwächer wird – mit Blick auf inflationsfördernde Zölle.

🔗 Sources:

3) 🇺🇦 EU disburses over €4bn to Ukraine before Independence Day 🙂

EN: The EU allocated €4.05B to Ukraine: €3.05B via the Ukraine Facility, €1B through emergency macro-financial assistance.

DE: Die EU stellte vor dem Unabhängigkeitstag der Ukraine €4,05 Mrd. bereit – teils als Soforthilfe, teils über den Ukraine-Fonds.

🔗 Sources:

4) 🇺🇸 FBI searches John Bolton’s home in classified-docs probe 😟

EN: The FBI searched the home/office of former NSA John Bolton as part of a classified documents investigation.

DE: Das FBI durchsuchte das Haus von Ex-Sicherheitsberater John Bolton wegen mutmaßlicher Geheimdokumente.

🔗 Sources:

5) 🚀 Space Day: Blue Origin NS-35 & SpaceX X-37B lift off 🙂

EN: Blue Origin’s New Shepard NS-35 launches today (research payloads only). SpaceX already launched the X-37B for U.S. Space Force experiments.

DE: Blue Origin startet heute NS-35 mit Forschungsladung; SpaceX brachte zuvor das Militär-Raumschiff X-37B ins All.

🔗 Sources:

6) 🌍 WHO confirms famine in Gaza; Europe heatwave alerts 😢

EN: WHO declared a famine in Gaza and issued global heat-stress guidance as extreme heat and wildfires hit Southern Europe.

DE: WHO bestätigt Hungersnot in Gaza und gibt Leitfaden gegen Hitzestress heraus – angesichts massiver Hitzewellen und Brände in Südeuropa.

🔗 Sources:

7) ⚽ Culture & Sport: Chelsea 5–1 West Ham; TWICE wins in Macau 🙂

EN: Chelsea crushed West Ham 5–1; big EPL matches today. Edinburgh festivals receive rave reviews. K-pop group TWICE wins TMElive international award.

DE: Chelsea deklassiert West Ham 5:1; Edinburgh begeistert mit Kultur, TWICE gewinnt Musikpreis in Macau.

🔗 Sources:

🗺️ GeoScenario Heatmap (Regional Impacts)

| Status | Region | Impact Highlights |

|---|---|---|

| 🔴 Severe | Gaza / Ukraine front | Famine + war financing; security & aid corridors strained |

| 🟠 Elevated | USA, Southern EU | Intel state stake; monetary policy pivot; climate wildfires |

| 🟢 Calm | Australasia, N. Europe | Stable; positive tourism + space tech developments |

😄 Overall Daily Outlook: Positive Tilt

- Monetary policy easing sentiment boosts markets.

- Humanitarian crisis in Gaza worsens.

- Geo-political risks persist in Ukraine.

- Space tech and cultural activity bring optimism.

Here’s a Q4 2025 Outlook broken into three strategic scenarios, each with an assessment, rationale, and a geopolitical/economic risk overlay. This approach balances macroeconomic signals, conflict dynamics, energy and technology policy, and climate extremes.

Outlook Q4 2025 – Scenario Matrix

📅 Forecast Period: October–December 2025

🔎 Focus: Global Economy, Geopolitics, Markets, Energy, Climate, Tech

🧠 Created by: Josef David | ⚡ Powered by: ChatGPT

🔵 Scenario 1: “Soft Landing & Stabilization”

🟢 Probability: Moderate (~45%)

🙂 Assessment: Cautiously Positive

💡 Rationale:

- Fed & ECB begin light rate cuts (~25bps) as labor & inflation cool without collapse

- US–China tension remains cold but stable; no new sanctions or tech flashpoints

- Ukraine war enters winter stalemate; EU support continues, no major escalation

- Global markets regain confidence; tech & green sectors rebound

- Energy supply stable, mild winter reduces gas volatility in EU

- Climate risks remain but are better managed with preemptive responses

🌐 Implications:

- EM capital inflows return

- Eurozone avoids recession

- Nasdaq and S&P500 end the year near ATH

- Commodity prices remain stable

🧭 GeoPressure: 🟡 Moderate – YELLOW ZONE

😄 Global Sentiment: Resilient optimism

🟠 Scenario 2: “Fragmentation & Friction”

🟡 Probability: Moderate (~35%)

😐 Assessment: Choppy & Uneven

💡 Rationale:

- Fed delays cuts due to sticky core inflation or renewed tariff pressures

- Gaza famine worsens, drawing broader regional criticism and NGO breakdowns

- China–Taiwan tensions flare through naval posturing or export restrictions (e.g. rare earths)

- Intel/U.S. industrial policy backlash causes G7 tech realignment

- Wildfires & floods persist in Southern Hemisphere summer (AU/BR/ZA)

- Political instability in at least one key democracy (e.g. Argentina, France, or U.S. impeachment ripple)

🌐 Implications:

- Supply chains face new stressors

- Investor confidence fractured; asset rotation into commodities and defense

- FX volatility increases (USD/BRL, EUR/JPY)

- EMs feel squeeze on debt and capital flows

🧭 GeoPressure: 🔴 Elevated – ORANGE ZONE

😐 Global Sentiment: Anxious adaptability

🔴 Scenario 3: “Systemic Disruption”

🔴 Probability: Low (~20%)

😣 Assessment: Crisis-Facing

💡 Rationale:

- Major military escalation in Ukraine, e.g., Belarus or Polish border incident

- Cyberattack or blackout on U.S./EU infrastructure from state actor

- Oil supply shock due to Houthi strikes in Red Sea or Persian Gulf unrest

- U.S. impeachment or constitutional crisis leads to shutdown/governance gridlock

- Global food shortages intensify due to climate-linked crop failures (India, Sub-Saharan Africa)

- Winter energy demand surge meets LNG transport bottlenecks

🌐 Implications:

- Recession risk returns for EU, Japan

- U.S. yields spike, gold surges, crypto volatility explodes

- Humanitarian systems overloaded

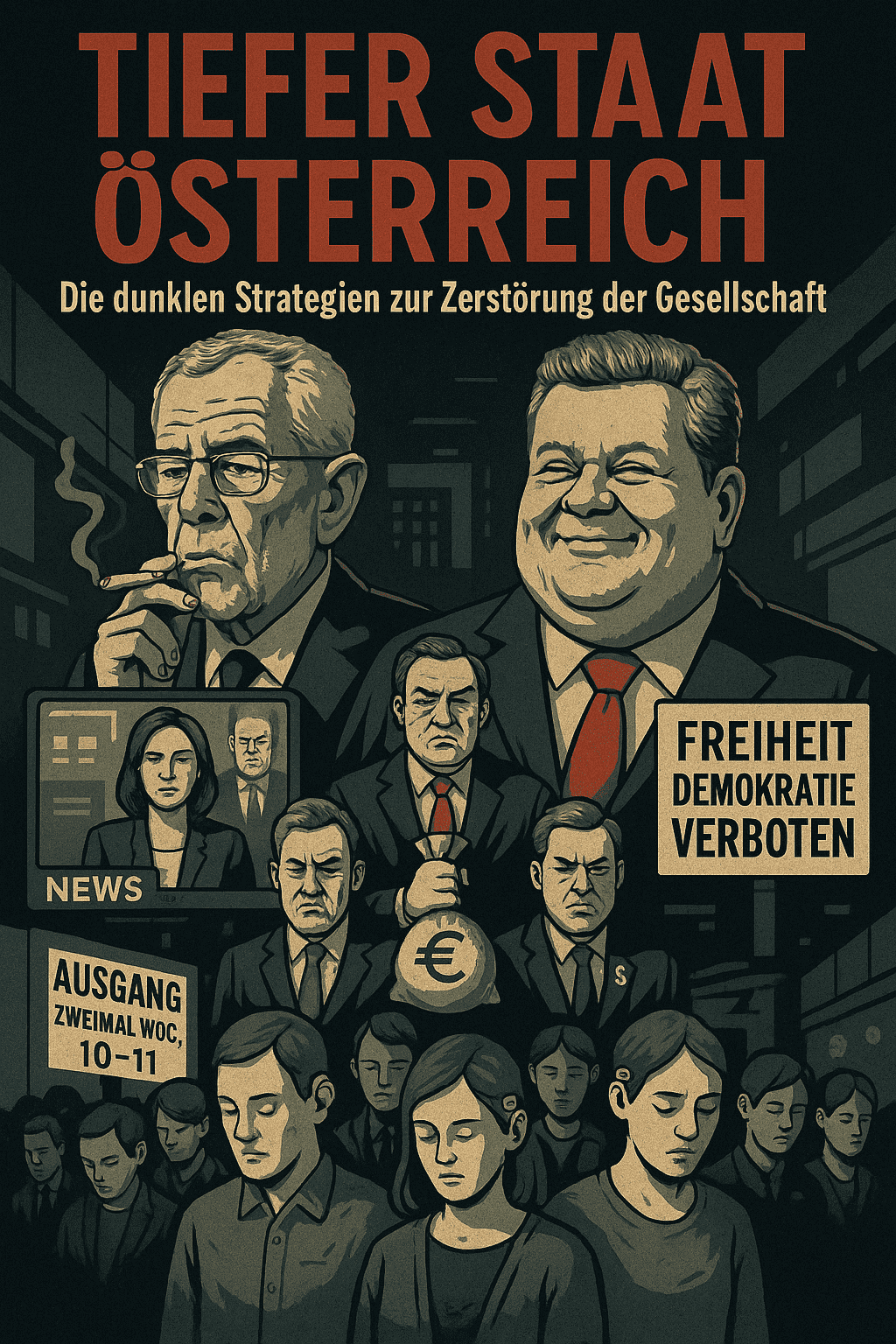

- Public trust in institutions further declines

🧭 GeoPressure: 🔴 Critical – RED ZONE

😣 Global Sentiment: Defensive & fragmented

🎯 Summary Table

| Scenario | Probability | Assessment | GeoPressure | Global Sentiment |

|---|---|---|---|---|

| 🟦 Soft Landing | 45% | Cautiously Positive | 🟡 Yellow | Resilient Optimism |

| 🟧 Fragmentation & Friction | 35% | Uneven Risks | 🔴 Orange | Anxious Adaptability |

| 🟥 Systemic Disruption | 20% | Crisis Facing | 🔴 Red | Defensive & Fragmented |

Here’s a comprehensive Conclusion + Action Recommendations section tailored for Businesses, Governments, and Citizens, derived from the three-scenario outlook for Q4 2025.

✅ Conclusion & Action Recommendations

📅 Q4 2025 | Global Geopolitical & Economic Outlook

🔎 Source: Josef David | Powered by: ChatGPT

🧠 Conclusion

The final quarter of 2025 presents a volatile but navigable global environment. While signs point toward economic stabilization, the geopolitical, environmental, and technological fault lines remain tense and increasingly intertwined.

Three scenarios – Soft Landing, Fragmentation, and Systemic Disruption – frame the landscape, where resilience, agility, and scenario-preparation will differentiate successful actors from exposed ones.

Bottom Line:

🌍 Hope is on the table, but fragility is the undercurrent.

🏢 Recommendations for Businesses

✅ Key Priorities:

- Scenario-Based Planning:

- Update Q4 playbooks using the three-scenario matrix.

- Run simulations for inflation resurgence, energy supply shocks, or cyberattacks.

- Strengthen Supply Chains:

- Diversify sourcing away from single-vendor/region dependencies (esp. China, Taiwan, Middle East).

- Invest in local/regional warehousing and digital tracking.

- Cyber Resilience & Data Sovereignty:

- Review data residency rules in light of geopolitical fragmentation.

- Harden systems against infrastructure-level attacks.

- Climate Response Strategy:

- Monitor agricultural/energy supply stress zones for operational risks.

- Consider adaptive pricing and logistics to reflect extreme weather scenarios.

- Financial Strategy:

- Hedge against currency volatility, especially USD and EM FX pairs.

- Increase cash buffers in preparation for rate and demand swings.

🏛️ Recommendations for Governments

✅ Key Priorities:

- Crisis Preparedness:

- Reinforce food and energy stockpiles.

- Prepare rapid response mechanisms for internal and external climate emergencies.

- Global Coordination:

- Double down on diplomatic backchannels to mitigate escalation in Gaza, Ukraine, Taiwan.

- Stabilize global aid pipelines (e.g. for famine relief, LNG redistribution).

- Industrial Policy with Guardrails:

- Align subsidy programs (e.g., CHIPS, energy transition) with transparency and private sector partnership to avoid crowding out innovation.

- Public Trust & Transparency:

- Improve real-time communication regarding national security, inflation, and energy planning.

- Combat disinformation aggressively, especially during politically sensitive periods (elections, investigations).

- Digital Defense & Infrastructure:

- Boost national cyber capacity; simulate cyber-blackout drills.

- Secure satellite & communications infrastructure, especially for emergency services.

👥 Recommendations for People / Citizens

✅ Key Priorities:

- Stay Informed – Filter Noise:

- Rely on diverse, verified sources; avoid echo chambers.

- Follow official weather, energy, and safety advisories, especially in high-risk zones.

- Emergency Readiness:

- Have basic supplies ready (food, water, cash, power bank) for extreme weather or digital disruptions.

- Consider winter-proofing homes amid energy uncertainty.

- Financial Caution & Flexibility:

- Avoid over-leveraging; variable-rate loans may become volatile.

- Build up 3–6 months of essential liquidity if possible.

- Digital Awareness:

- Enable 2FA and cyber hygiene across devices.

- Be alert to phishing and election-related disinformation.

- Mental Resilience:

- Recognize crisis fatigue; reduce doomscrolling.

- Prioritize physical well-being and human connection during uncertain times.

💸 3-Month Plan to Build 3–6 Months of Emergency Liquidity

Building up 3–6 months of essential liquidity (aka an emergency fund) within just 3 months is aggressive but achievable with strategy and discipline — especially if you prioritize ruthlessly, leverage temporary income boosts, and cut non-essentials. Here’s a concrete, actionable roadmap:

🎯 Target: Cover essential expenses only (rent, food, utilities, insurance, transport, debt minimums).

💡 Example: If your essential monthly costs = €1,800 →

Goal = €5,400 to €10,800 saved in 3 months.

🗓️ Month-by-Month Strategy

✅ Month 1: Audit, Cut, and Redirect

Goal: Free up max liquidity from existing cash flow.

- 📊 Full Expense Audit (1 day)

- Categorize: Must-have vs. Nice-to-have

- Cut all subscriptions, dining out, premium services, luxury items

- 🧾 Slash 30–50% of Variable Spending

- Cook at home only

- Pause entertainment spend

- Use public transport or carpool

- Negotiate utility bills & mobile plans

- 🎯 Reallocate savings immediately

- Open a separate emergency fund account (online bank or high-yield savings)

- Automate daily or weekly transfers, even small (e.g., €20/day = €600/month)

- 🧼 Sell unused items

- Use eBay, Vinted, Facebook Marketplace

- Furniture, old electronics, clothes, tools, etc.

🎯 Target Savings by Month-End: €1,500–€3,000

✅ Month 2: Boost Income

Goal: Bring in extra cash fast.

- 🧳 Monetize skills (freelance/side jobs)

- Writing, design, tutoring, tech support, online courses

- Use platforms like Upwork, Fiverr, TaskRabbit, or local job boards

- 🛍️ Temporary Gig Work

- Courier/delivery (UberEats, Glovo)

- Part-time weekend shifts (retail, hospitality, events)

- 📦 Rent out space/assets

- Sublet room, rent storage space, parking spot

- Rent camera/gear/equipment on peer platforms

🎯 Target Earnings: €1,500+ from side income this month

Combined with continued cuts: €2,000–€4,000 in total liquidity

✅ Month 3: Lock It In + Test the System

Goal: Stabilize, maintain liquidity mindset.

- 🏦 Treat liquidity like a bill

- Automate the rest of the goal to your emergency fund

- Build psychological “non-negotiability” around saving

- 🧪 Run a “low-spend challenge” for 30 days

- Only spend on true essentials

- No cards for optional purchases — use cash envelopes if needed

- 📈 Review & refine

- Adjust savings if income changes

- Consider placing part in a high-yield account or money market fund (not locked, but earning)

🎯 Final Savings: Reach €5,400–€10,800 target

Bonus: You’ve now restructured habits for long-term resilience

🚦 Priority Ranking: If You Can’t Do All

| Priority Level | Action | Reason |

|---|---|---|

| 🔴 Critical | Cut spending & automate saving | Fastest way to build liquidity |

| 🟠 High | Sell unused assets | Immediate cash |

| 🟡 Medium | Side gigs / freelance | May take 1–2 weeks to ramp |

| 🟢 Bonus | Invest returns in cash-like assets | Optional after fund is built |

🛡️ Tools & Apps That Help:

- YNAB / Mint / N26 Spaces / Revolut Vaults – budgeting & savings

- eBay / Vinted / Etsy / Upwork / Fiverr – selling and side gigs

- Monese / bunq / Wise – high-interest savings (EU options)

📣 Final Thought

“Liquidity isn’t just survival money — it’s freedom fuel.”

If you build this cushion now, you’re protected from job loss, inflation spikes, or regional crises — while also giving yourself psychological room to plan long-term. – Josef David

📊 Strategic Takeaway

“The winners of Q4 2025 will not be the biggest, but the most adaptive, informed, and prepared.”- Josef David