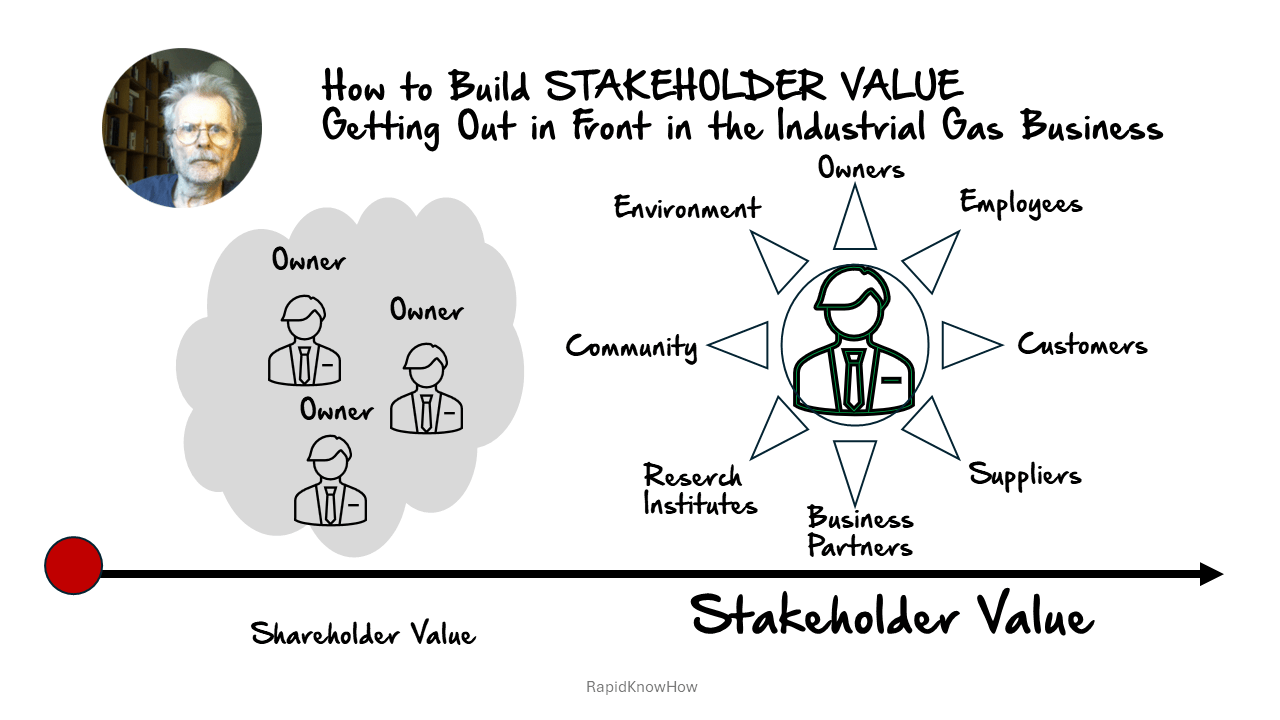

Result Delivered: A strategy that grows stock value, strengthens ecosystems, and delivers long-term sustainability — without the traditional trade-off between profit vs. people.

HABIT 1 — Driving Profit Through Operational Excellence

Why this pushes Shareholder Value:

Top-line growth is important — but margin expansion is what lifts valuation.

Operational excellence creates predictable earnings, and predictable earnings increase shareholder confidence.

Where companies fail:

- High cost friction

- Unclear process ownership

- Slow cycle times

- Manual work → inconsistent output

- Low productivity per headcount

THE STRATEGY THAT THRIVES STAKEHOLDER VALUE:

The Lean + AI Performance Engine (LAPE-26)

1. Lean First

Eliminate 30–40% of non-value-adding activities.

Stabilize flow → fewer errors → higher customer satisfaction.

2. AI Second

Automate repetitive tasks, scheduling, planning, forecasting.

Increase productivity without overworking people.

3. Human Empowerment Third

Give teams autonomy + clarity + decision rights.

A motivated workforce = better service & better output.

Result Delivered:

Higher margins + lower variability + happier employees.

HABIT 2 — Investing in High-Value Innovation, Not Trend Chasing

Why this pushes Shareholder Value:

Innovation must produce cashflow, not PowerPoint slides.

Markets reward companies that innovate where ROI is measurable.

Where companies fail:

- Chasing technology fads

- Investing in non-core ventures

- Missing customer pain points

- Innovation not tied to revenue

THE STRATEGY THAT THRIVES STAKEHOLDER VALUE:

The ROICE Innovation Portfolio (RIP-30)

1. Solve Real Problems

Focus on innovations that reduce cost, time, complexity, or emissions.

2. Scale Repeatable Solutions

Turn know-how into:

- Toolkits

- Subscriptions

- Services

- Licenses

3. Retire Dead Projects Fast

Free resources for high-return innovations.

Increase velocity of learning & delivering.

Result Delivered:

Shareholders gain growth → Stakeholders gain real, practical value.

HABIT 3 — Building Predictable Recurring Revenue Streams

Why this pushes Shareholder Value:

Companies with recurring revenue:

- Are valued higher

- Have more stable cashflow

- Have lower risk

- Grow faster

- Build long-term investor trust

Where companies fail:

- Still selling one-off transactions

- Missing service revenue

- Weak customer lifetime value

- No usage-based monetization

THE STRATEGY THAT THRIVES STAKEHOLDER VALUE:

The Recurring Value Ecosystem (RVE-28)

1. Monetize Predictively

Examples:

- Maintenance-as-a-Service

- Analytics-as-a-Service

- Supply-as-a-Service

2. Create Stakeholder Participation

Suppliers, employees, customers benefit from value:

- Lower costs

- Better results

- More reliability

3. Build a Lifetime Value Engine

Use AI to:

- Predict churn

- Personalize retention

- Optimize upselling

- Reduce customer cost-to-serve

Result Delivered:

A resilient, long-term business ecosystem where:

- Shareholders get appreciation

- Stakeholders get continuous value

THE EXECUTIVE 15-SECOND VERSION

- Operational Excellence → Margin expansion

- ROICE Innovation → Growth acceleration

- Recurring Revenue → Stability & higher valuations

Result Delivered:

Shareholder Value ↑

Stakeholder Value ↑

Sustainability ↑

Trust ↑

A complete Value Ecosystem.