Result Delivered: A precise, actionable model to stop cash burn, stabilize operations, and generate positive cashflow within 30–90 days.

HABIT 1 — Growing Revenue Without Managing Working Capital

Why this reduces cashflow:

Most companies chase revenue but ignore the operational heartbeat:

- Inventory grows faster than sales

- Receivables stretch beyond 45–60 days

- Payables are paid too early

- Production runs ahead of orders

- No cash conversion discipline

The Leadership Mistake:

Confusing profit with cash.

THE STRATEGY FOR TURNAROUND:

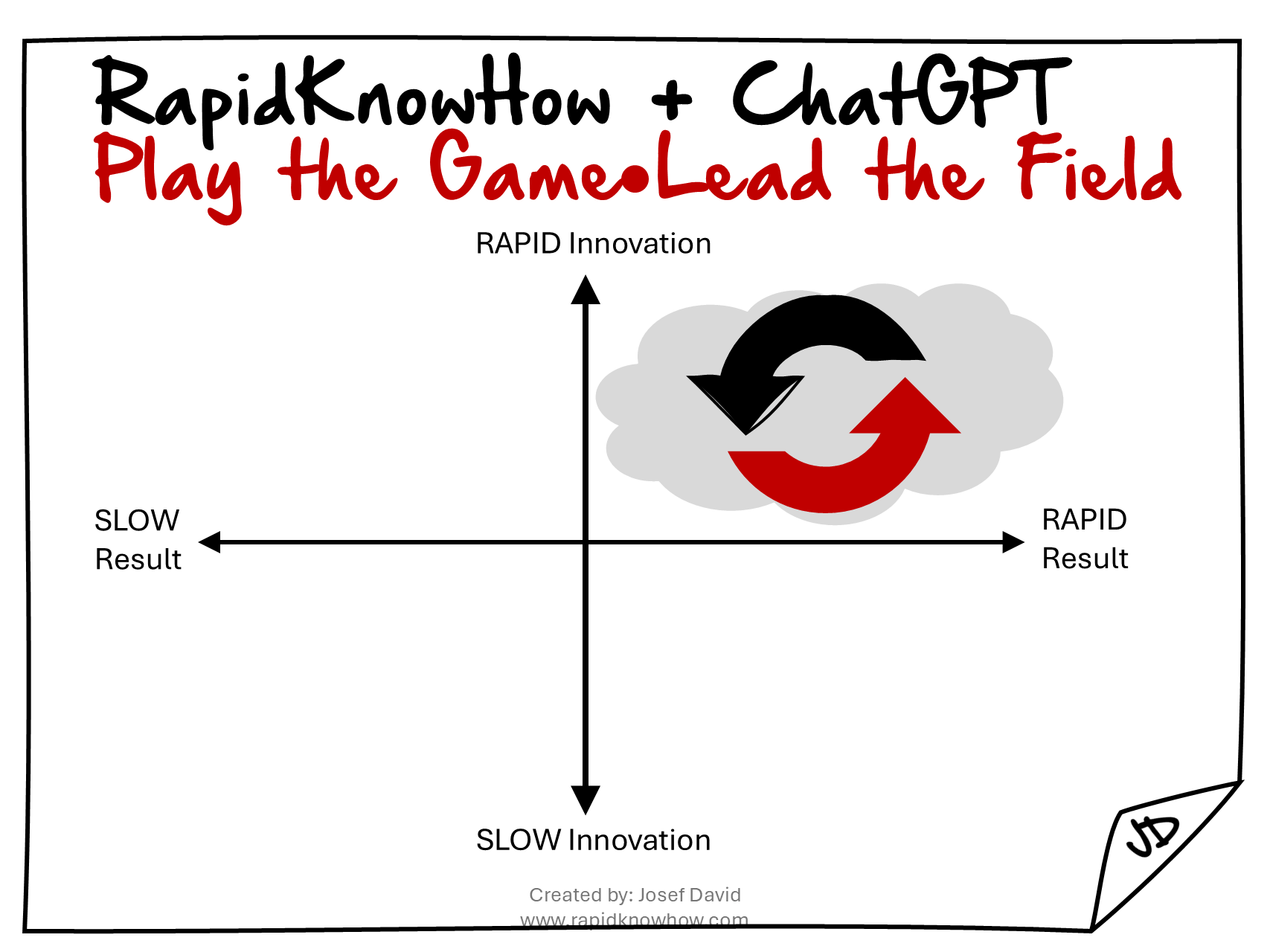

The Cash Conversion Accelerator (CCA-30)

1. Receivables Compression (Get cash in)

- DSO target: 30–35 days

- AI risk scoring for customers

- Pre-invoice transparency

2. Inventory Release (Free trapped cash)

- Eliminate slow movers

- Apply 80/20 SKU prioritization

- Predictive reorder points

3. Payables Optimization (Control cash out)

- Negotiate net-45/60 terms

- Group suppliers for volume leverage

- Introduce approval workflows

Result Delivered:

+15–30% cashflow improvement in 30–60 days.

HABIT 2 — Expanding Costs Faster Than Value

Why this destroys cashflow:

- Hiring without productivity gains

- Growing SG&A with no ROI

- Overbuilt infrastructure

- Shadow IT systems

- Spending justified by “growth” instead of value

The Leadership Mistake:

Pegging budget to last year instead of need.

THE STRATEGY FOR TURNAROUND:

The 3-Level Smart Cost Reset (SCR-3)

Level 1 — Cut Waste (immediately)

- Remove non-core subscriptions

- Eliminate duplicated work

- Collapse unnecessary meetings & roles

Level 2 — Rebuild Value (30 days)

- Assign KPIs to every cost center

- Identify value gaps

- Automate repetitive tasks

Level 3 — Scale Efficiency (90 days)

- AI-enabled workflows

- Outsourcing non-core activities

- Cloud-first operations

Result Delivered:

SG&A -10 to -20% while increasing performance.

HABIT 3 — Selling Products Instead of Outcomes

Why this reduces cashflow:

Product-based selling has:

- Low margins

- High churn

- High acquisition cost

- No recurring revenue

- Weak customer lifetime value

The Leadership Mistake:

Focusing on price, not value.

THE STRATEGY FOR TURNAROUND:

The Recurring Revenue Shift (RRS-24)

1. Move from Transaction → Subscription

Examples:

- Maintenance-as-a-Service

- Calibration-as-a-Service

- Analytics-as-a-Service

2. Introduce Performance Guarantees

Customers pay for uptime, speed, reliability — not units.

3. Build a Retention Engine

- Predict churn signals

- Personalize value delivery

- Review quarterly performance KPIs

Result Delivered:

Stable monthly income → predictable cashflow → long-term customer lock-in.

THE EXECUTIVE 15-SECOND VERSION

- Manage working capital → unlock cash

- Reset costs → increase operating efficiency

- Build recurring revenue → stabilize the system

Result Delivered:

A sustainable, measurable, 90-day cashflow turnaround.