Result Delivered: A decisive roadmap for leaders to grow margins, accelerate innovation, and build AI-driven asset-light ecosystems in the global gases market.

HABIT 1 — Running Lean Asset-Light Operations, Not Asset-Heavy Bureaucracies

Why this habit drives success:

Industrial gas markets are increasingly low-margin, capital-intensive, and regulated. Winners in 2026–2030 will be those who reduce assets, increase digital automation, and scale services.

Why most companies still fail:

- Overbuilt distribution networks

- Manual scheduling → lost efficiency

- Fragmented telemetry data

- Gas shortages + truck underutilization

- High CAPEX culture

THE LEADERSHIP STRATEGY:

The AI-Driven Asset-Light Operations Model (ALO-26)

1. Predictive Supply & Demand Matching

Use AI to optimize:

- LOX/LIN/LAR production

- Routing and truck scheduling

- Cylinder balances

→ 15–25% logistics cost reduction.

2. Telemetry-First Execution

Every tank, evaporator, and bundle becomes a predictive signal → no emergency deliveries → no stockouts.

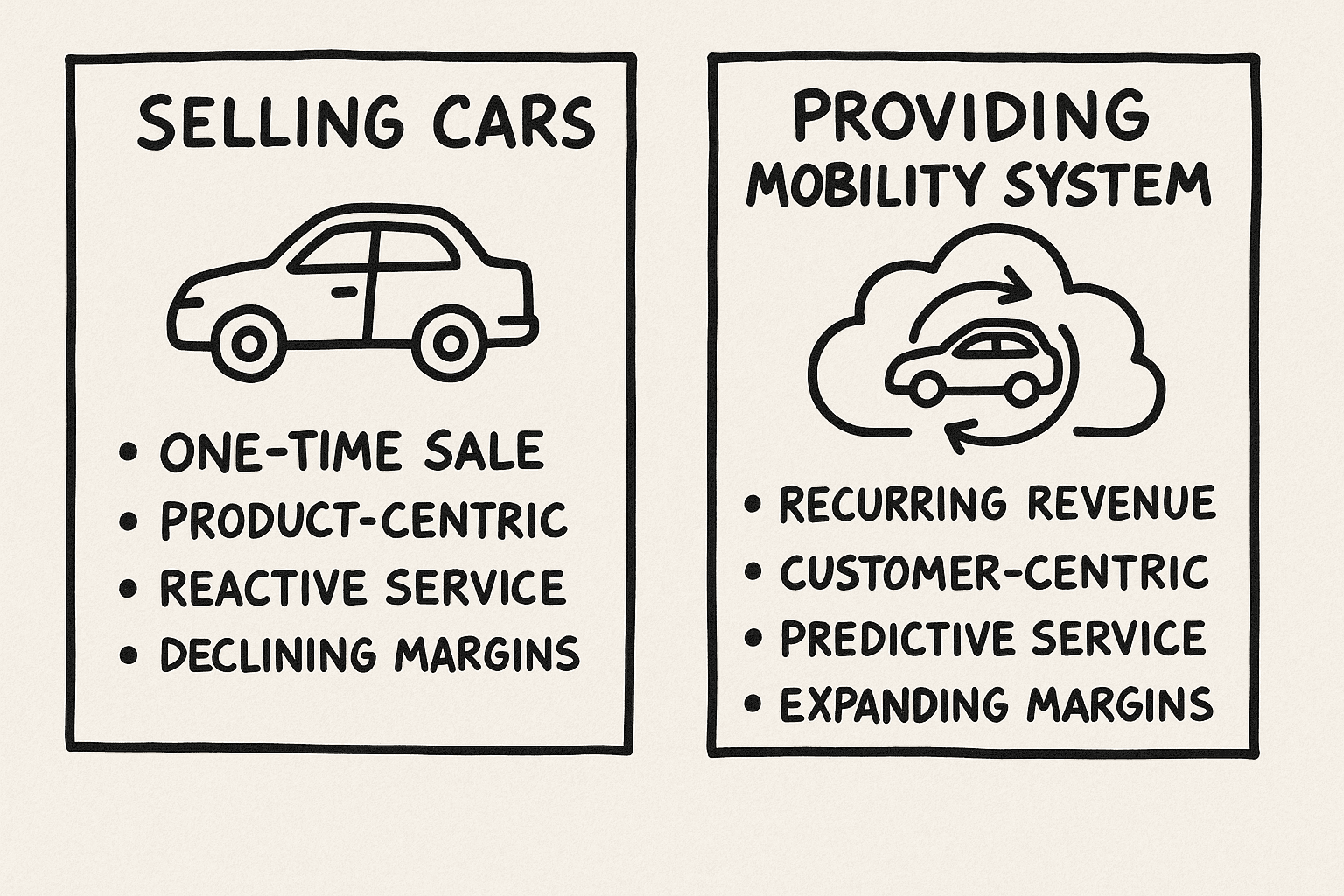

3. O₂/N₂/LNG-as-a-Service Contracts

Shift from selling tons to selling:

- Availability

- Uptime

- Predictive reliability

Result Delivered:

Higher margins + lower CAPEX + faster ROI → scalable growth through 2030.

HABIT 2 — Scaling Specialty Gases & High-Value Segments First

Why this habit thrives performance:

Specialty gases drive the highest ROICE in the industry and account for the largest growth drivers:

- Semiconductors

- Electronics

- Pharma & biotech

- Food safety

- Renewable technologies

Why most leaders lose the opportunity:

- Too much focus on volume gases

- Underdeveloped purification capacity

- Weak applications engineering

- Slow customer onboarding

THE LEADERSHIP STRATEGY:

The High-Value Segment Strategy (HVSS-27)

1. Electronics & Semiconductor Priority Clusters

Co-locate supply hubs next to fabs → guaranteed long-term cashflows.

2. Applications Engineering Units

Move from “gas seller” → to solution partner in:

- Cryogenics

- Laser cutting

- MAP food packaging

- Additive manufacturing

3. Productization of Know-How

Turn internal expertise into:

- Paid audits

- Subscription-based monitoring

- RapidThrive specialty-gas toolkits

Result Delivered:

A shift from commodity pricing → to premium value creation → to sticky long-term contracts.

HABIT 3 — Building Predictive B2B Ecosystems, Not Transactional Relationships

Why this habit defines 2026–2030 leaders:

Industrial gas customers want zero downtime, predictive supply, and transparent pricing. Whoever builds the ecosystem wins the market.

Why most fail:

- Sales is still transaction-oriented

- No digital customer interface

- Data sits in silos

- No lifetime-value strategy

THE LEADERSHIP STRATEGY:

The Predictive Customer Ecosystem Model (PCE-30)

1. Predictive Customer Portals

Self-service dashboards:

- Consumption graph

- Alarm limits

- AI-based reorder points

- KPI reports

2. Subscription Maintenance & Safety

Offer:

- ATEX inspections

- Training schedules

- Leak detection audits

- Refilling optimization

3. AI-Driven Retention Architecture

Predict customer churn via:

- Declining deliveries

- Cost spikes

- Operational changes

→ Apply proactive retention interventions.

Result Delivered:

Higher lifetime value, reduced churn, strong recurring revenue base.

THE EXECUTIVE 15-SECOND VERSION (C-Suite Clarity)

- Lean Asset-Light Ops → lower CAPEX, higher margins

- Specialty Gas Priority → premium growth, sticky clients

- Predictive B2B Ecosystems → recurring revenue & customer lock-in

Result Delivered:

A profitable, AI-driven Industrial Gas Enterprise ready for 2026–2030.

“No Hanky Panky – Just Pure Value Added” – Josef David