Rebuilding National Competitiveness Through Orchestrated Execution

Applying the RapidKnowHow Model:

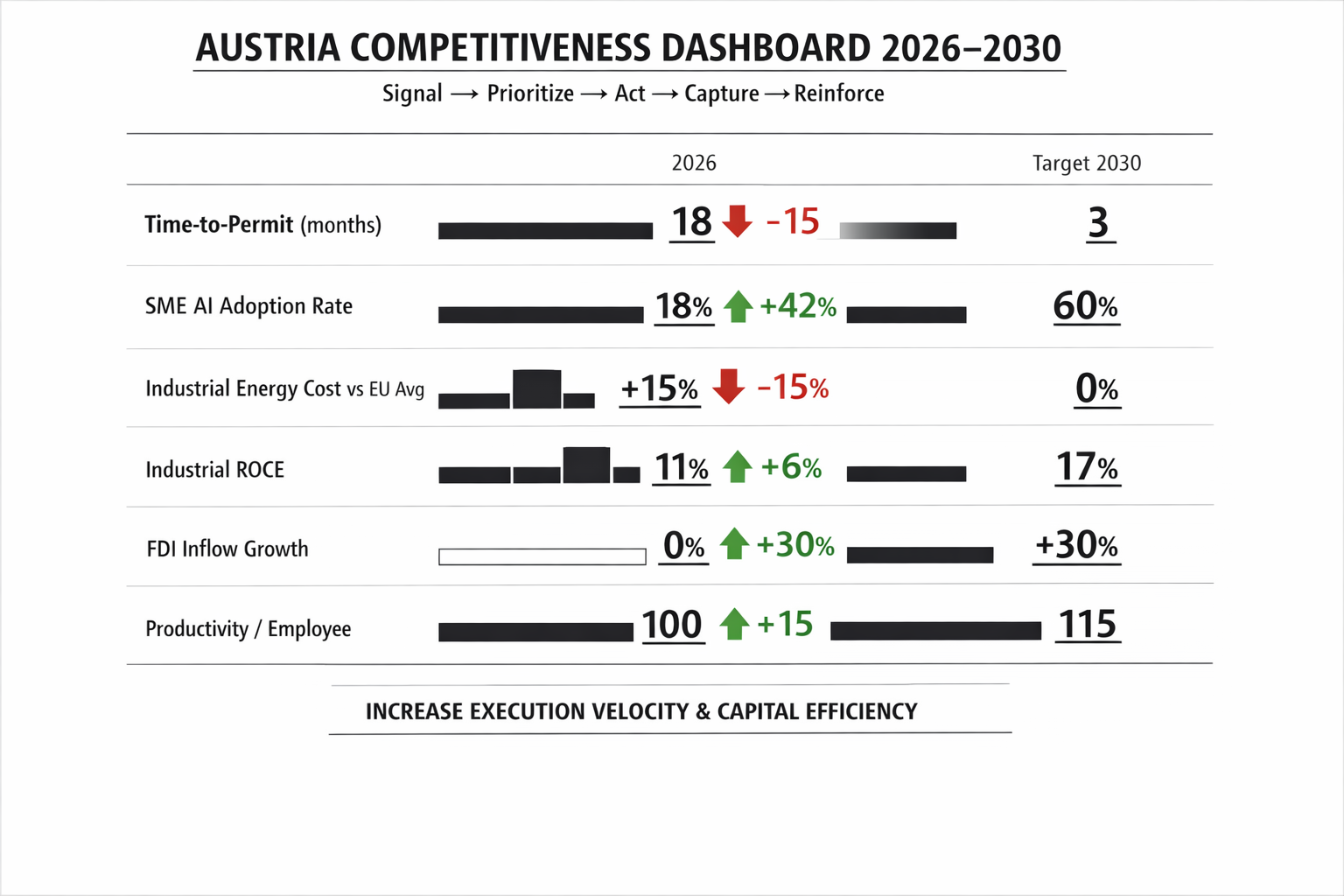

Signal → Prioritize → Act → Capture → Reinforce

Executive Summary (5-Minute Board Read)

Austria is not in crisis — but it is losing competitive velocity.

Compared to high-performance small nations such as Switzerland and Denmark, Austria’s weakness is not innovation capability or institutional stability. It is execution speed, regulatory friction, and slow diffusion of productivity-enhancing technologies.

Between 2026 and 2030, Austria’s competitiveness will depend on:

- Regulatory acceleration

- AI-driven SME productivity

- Energy price predictability

- Capital efficiency improvement

- Skilled workforce modernization

If implemented with sprint-based governance, Austria can shift from a high-cost administrative economy to a high-efficiency innovation economy.

1️⃣ SIGNAL (2026): Structural Diagnosis

Macro Signals

- Sluggish GDP growth vs EU innovation leaders

- Industrial margin compression

- Increasing wage pressure without proportional productivity growth

- Energy volatility impacting manufacturing competitiveness

Competitive Signals

- Switzerland: capital efficiency + innovation depth

- Denmark: digital governance + labor flexibility

- CEE: lower cost base + faster permitting

Core Diagnosis

Austria’s system is stable but slow.

Capital flows to speed.

Without acceleration, Austria risks:

- Gradual FDI stagnation

- Talent outflow

- Declining industrial ROCE

2️⃣ PRIORITIZE: Five National Levers (High ROICE Focus)

Lever 1 – Regulatory Speed Reform

- Legally binding 90-day permit cap

- Digital unified submission platform

- Sunset clauses for outdated regulations

Expected Impact: +10–15% investment velocity

Lever 2 – AI-Driven SME Acceleration

- National AI diagnostic program for SMEs

- 90-day AI implementation sprint subsidy

- Tax incentives for productivity-enhancing automation

Expected Impact: +5–10% productivity per employee

Lever 3 – Energy Predictability

- Long-term industrial energy contracts

- Faster renewable permitting

- Strategic hydrogen corridor expansion

Expected Impact: Stabilized export margins

Lever 4 – Capital Market Deepening

- SME IPO simplification

- Pension fund allocation incentives

- Venture capital co-investment fund

Expected Impact: Higher domestic capital retention

Lever 5 – Talent & Skills 2.0

- AI + data literacy in vocational schools

- Dual education modernization

- Fast-track skilled migration

Expected Impact: Workforce productivity multiplier

3️⃣ ACT: Governance Architecture

Austria must shift from political negotiation cycles to sprint governance cycles.

Proposal: National Competitiveness Orchestrator Board

Composition:

- Industry CEOs

- SME representatives

- AI experts

- Independent fiscal analysts

Mandate:

- 90-day reform sprints

- Public KPI reporting

- Cross-ministry acceleration authority

4️⃣ CAPTURE: Economic Impact Projection (2028–2030)

If reforms succeed:

- Industrial ROCE increases from ~11% → 16–18%

- FDI inflow +25–35%

- Productivity index +15%

- Tax base expansion without tax increases

The economic compounding effect:

Higher productivity →

Higher corporate profits →

Higher reinvestment →

Higher innovation →

Higher competitiveness.

5️⃣ REINFORCE: Institutional Lock-In

Most reform programs fail in reinforcement.

Austria must:

- Tie ministerial budgets to KPI performance

- Maintain public transparency dashboards

- Continue AI integration into public services

- Prevent regulatory re-inflation

Reinforcement converts reform into structural advantage.

Geopolitical Lens (2026–2030)

Austria’s role within the EU depends on:

- Maintaining neutrality while enhancing economic strength

- Acting as a CEE gateway innovation hub

- Avoiding dependency on slower reform states

Competitiveness equals sovereignty.

Strategic Conclusion

Austria does not need ideological change.

It needs operational acceleration.

The RapidKnowHow Model applied nationally creates:

Signal clarity

Priority focus

Action velocity

Capital capture

Structural reinforcement

If Austria increases execution speed by 30% and productivity by 15%, it can regain top-tier small-nation competitiveness by 2030. – Josef David