Week of August 25, 2025

🚀 Strategic Opportunities 2025–2030

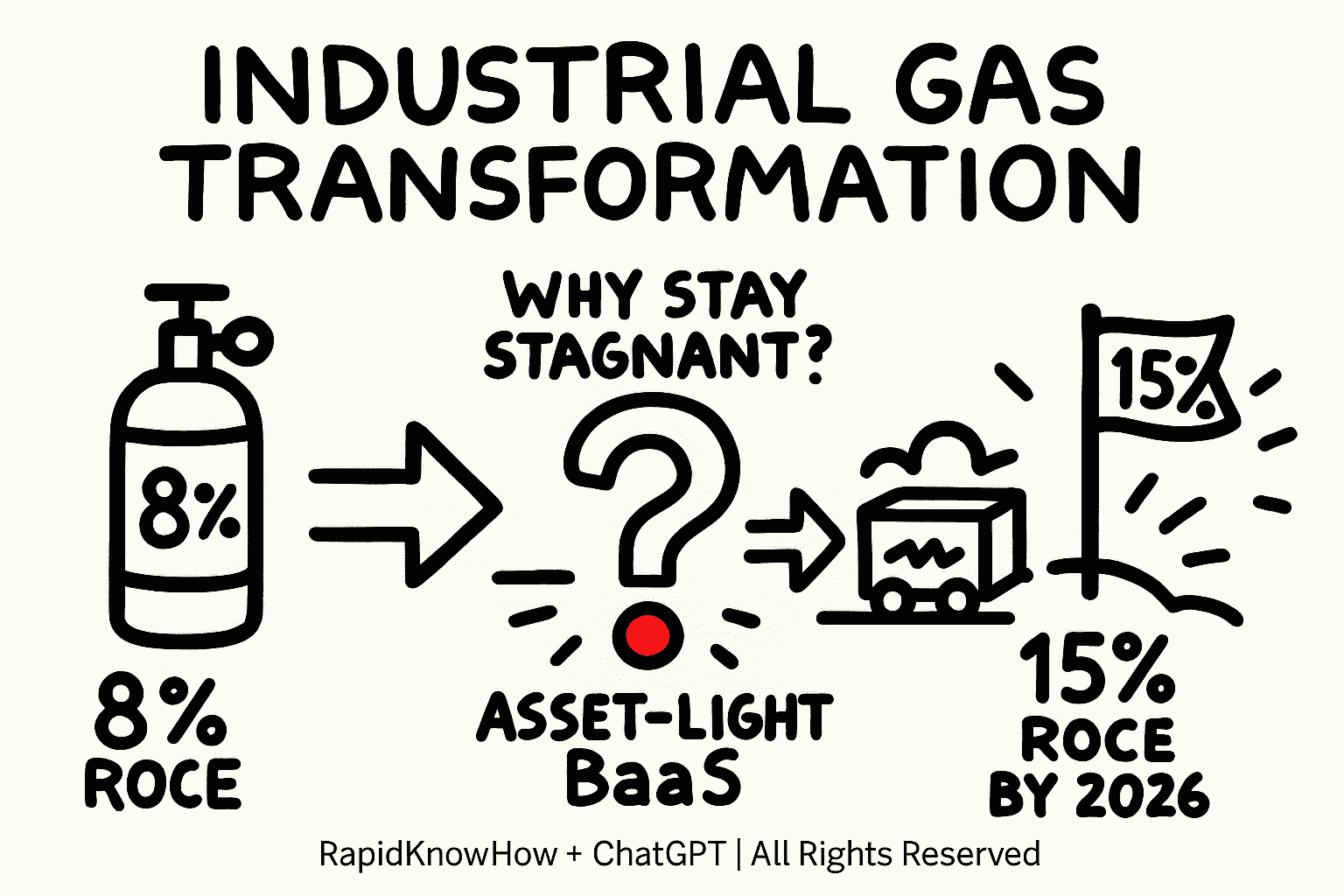

- Asset-Light Supply Chains

- Replace capex-heavy plants with flexible partner-driven networks.

- Investor Gain: Higher ROCE (15–20%), faster market penetration in CEE, Africa, MENA.

- Green Hydrogen Expansion

- Growth in refining, steel, mobility, and export corridors.

- Investor Gain: Long-term contracts with premium margins under EU/Asia decarbonization mandates.

- Healthcare Oxygen-as-a-Service

- Hospitals & homecare shift to subscription models.

- Investor Gain: Predictable cashflows + ESG-positive positioning.

- Specialty Gases for High-Tech

- Semiconductor, pharma, and electronics industries expanding.

- Investor Gain: High-value margins, resilient to commodity swings.

- CO₂ Capture & Circular Use

- Industrial emitters seeking capture + re-use.

- Investor Gain: Early-mover stakes in carbon markets and food/beverage applications.

✅ Recommended Strategic Actions (Q3–Q4 2025)

- Form alliances with midsize distributors to accelerate asset-light models.

- Pre-commit capital to green hydrogen hubs in Iberia, North Sea, and MENA.

- Acquire niche players in medical O₂ logistics for rapid scaling.

- Secure long-term contracts in specialty gases for semiconductor/pharma hubs.

- Invest in CO₂ tech startups with scalable capture + utilization solutions.

🏆 Key Player Strategic Analysis (2025–2030)

| Player | Current Strategy | Opportunity Capture | Investor Benefit 2025–2030 |

|---|---|---|---|

| Air Liquide | Heavy focus on green H₂ (Normandy, Saudi JV). | Strongest in hydrogen scaling; cautious in asset-light. | Long-term stable cashflows from H₂; steady dividends. |

| Linde | Broad portfolio, tech leadership in H₂ & CO₂ capture. | Captures high-tech/specialty gases well; disciplined capex. | Margin stability + innovation premium; reliable ROCE. |

| Air Products | Betting big on mega H₂ projects (NEOM, U.S. Gulf). | High risk/high reward; limited asset-light flexibility. | Potential outsized returns if mega projects succeed; volatility risk. |

| Messer Group | Family-owned, nimble in CEE & niche healthcare O₂. | Strong in asset-light alliances; agile in homecare. | High ROI regional growth; attractive JV/licensing partner. |

| Taiyo Nippon Sanso | Asia-centric, strong in semiconductors. | Best positioned for specialty gases. | Investors gain tech-driven margin resilience; moderate growth outside Asia. |

| Tier-2 Players (e.g. SIAD, SOL, regional gascos) | Regional partnerships, asset-light by necessity. | Natural fit for RapidThrive-style alliances. | Fast ROI for investors backing local expansions; acquisition targets. |

📌 Investor Outlook

- Winners 2025–2030:

- Air Liquide & Linde → hydrogen + specialty gas scale with solid returns.

- Messer & Tier-2s → agile, asset-light, high-ROI regional disruptors.

- High-risk/high-reward:

- Air Products with mega H₂ projects — breakthrough or bust.

- Strategic Play:

Investors should balance blue-chip stability (Air Liquide, Linde) with asset-light growth bets (Messer, Tier-2 alliances).