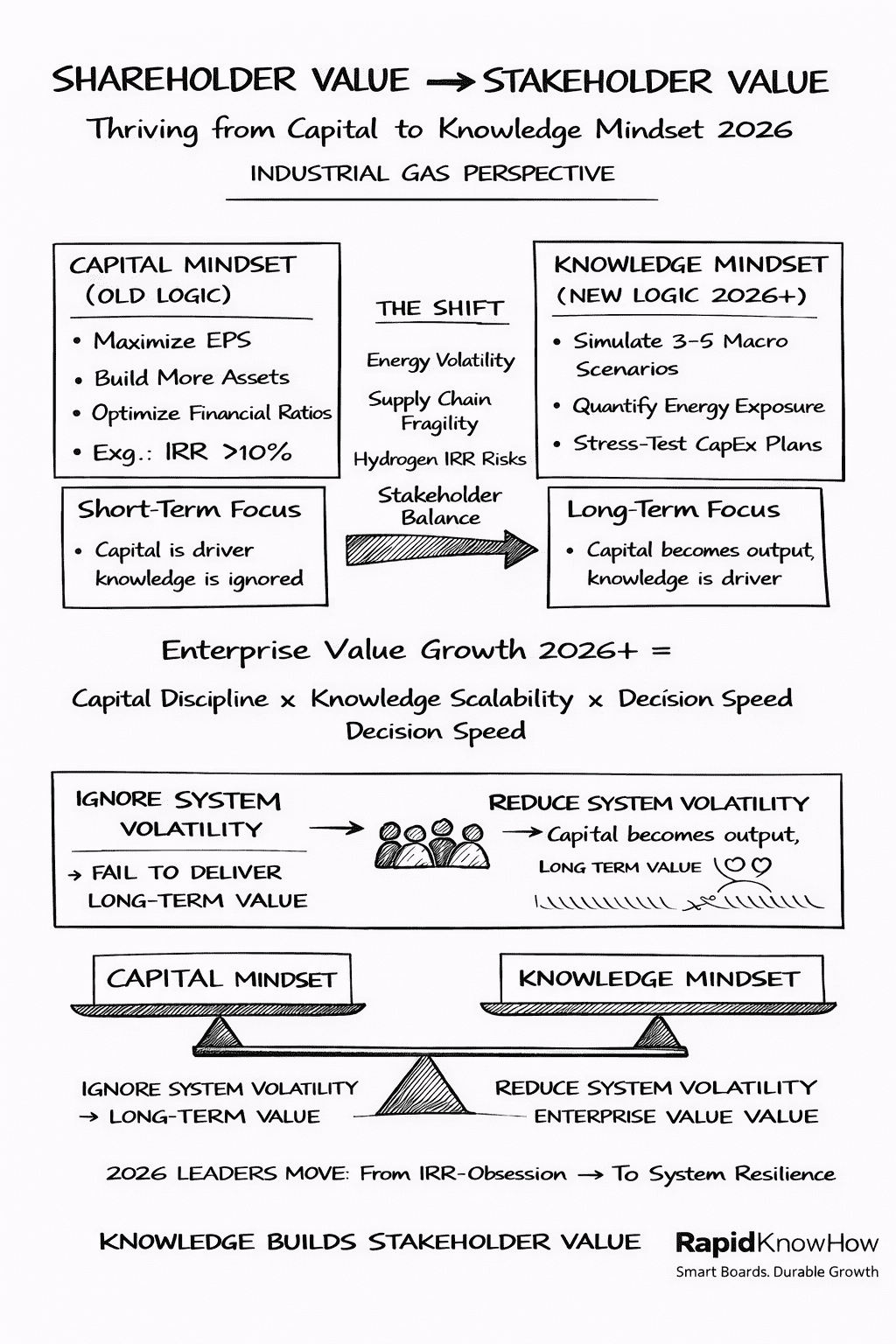

Between 2026 and 2030, industrial capital will operate under structural volatility.

Energy dispersion, merchant exposure sensitivity, capital intensity shifts, financing normalization, and geopolitical fragmentation are reshaping return stability across industrial systems.

RapidKnowHow focuses on one core question:

How do Boards, Investors, CxOs and Owners preserve capital sovereignty under volatility?

The IGAS AI-Orchestrator™ framework — developed through the Industrial Gases case — provides a governance blueprint to:

• Stabilize Stress ROCE

• Discipline capital allocation

• Manage merchant exposure

• Install pass-through effectiveness controls

• Map energy sensitivity risk

• Prevent silent capital drift

This is not growth advisory.

It is governance architecture.

RapidKnowHow supports:

• Medium-sized industrial owners seeking independence durability

• Boards installing volatility discipline

• Investors evaluating capital resilience

• CxOs aligning incentives to long-term ROCE stability

Volatility governance is not defensive.

It is structural capital leadership.

Industrial Gases serve as the laboratory.

The broader industrial ecosystem is the application field. – Josef David