Why Organisational Design Is Now a Valuation Decision

Executive Power Report 2026–2030

Industrial Gas Focus | Cross-Industry Transferable

1️⃣ Executive Summary

Architecture Determines Enterprise Value

From 2026–2030, enterprise valuation in capital-intensive industries will be determined less by asset scale and more by organisational architecture.

In Industrial Gas, two companies with identical assets can produce radically different valuation outcomes based solely on governance structure.

Architecture → Volatility → FCF Stability → Market Multiple → Enterprise Value

The financial gap is structural — not cyclical.

2️⃣ Why Traditional Functional Architecture Underperforms

Industrial Gas operates under:

• High capital intensity

• Energy exposure

• Long asset lifecycles

• Hydrogen investment waves

• Regulatory pressure

Traditional functional organisations optimise departments:

Production

Sales

Finance

Procurement

But markets value systems, not silos.

Lag between functions creates volatility.

Volatility reduces predictability.

Predictability drives valuation multiples.

3️⃣ The AI-Orchestrator Architecture

The solution is not digital transformation.

It is governance redesign.

Three structural layers:

Layer 1 – Signal Intelligence

Energy exposure, hydrogen IRR stress, working capital velocity.

Layer 2 – Orchestration Hub

Cross-functional compression of decision cycles.

Layer 3 – Dynamic Capital Allocation

Rolling 90-day re-ranking of capital priorities.

This architecture reduces lag at the system level.

4️⃣ Financial Transmission Mechanics

The financial logic is linear and defensible.

Reduced lag

→ Reduced volatility

→ Stable FCF trajectory

→ Lower perceived risk

→ Higher valuation multiple

For a €10bn enterprise:

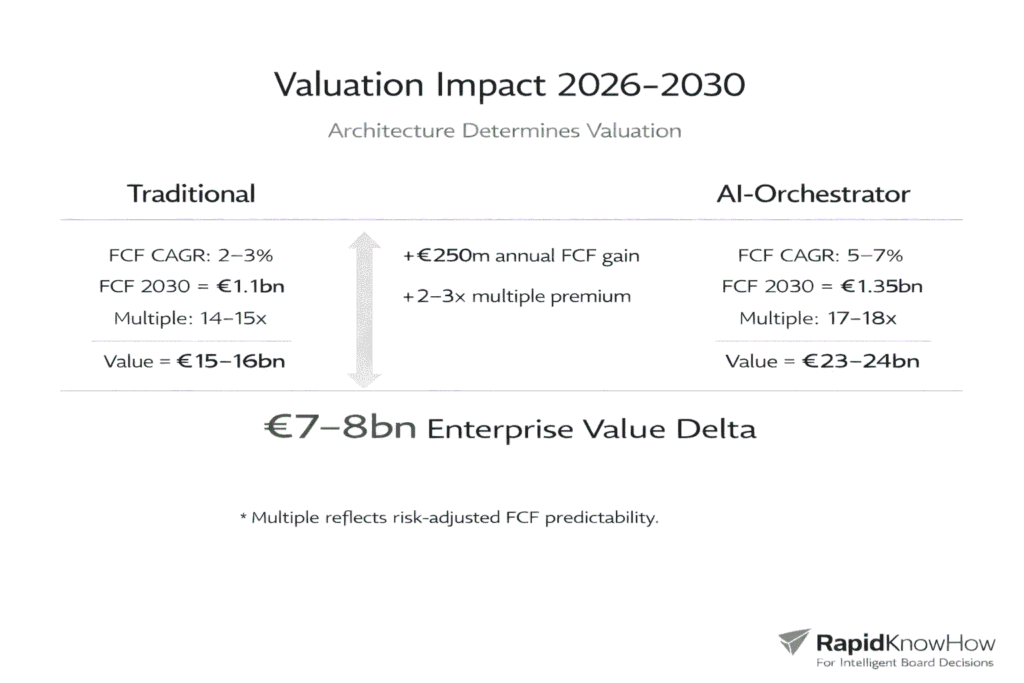

Traditional

FCF CAGR: 2–3%

Multiple: 14–15×

AI-Orchestrator

FCF CAGR: 5–7%

Multiple: 17–18×

The combined effect produces a €7–8bn valuation delta.

5️⃣ Governance Evolution

Boards must move from reporting oversight to orchestration oversight.

Traditional governance reviews past performance.

AI-Orchestrator governance monitors forward stability.

Five governance indicators define the model:

- Exposure Index Trend

- FCF Volatility Range

- CapEx Re-Ranking Ratio

- Pricing Response Time

- Working Capital Velocity

If three indicators deteriorate simultaneously, structural intervention is required.

6️⃣ Industrial Gas as the Blueprint Industry

Industrial Gas makes the architecture visible because:

• CapEx mistakes compound over decades

• Energy shocks are immediate

• Hydrogen waves test capital discipline

• Pricing discipline determines margin durability

But this model applies equally to:

Energy

Infrastructure

Manufacturing

Healthcare

Logistics

Any capital-intensive system exposed to volatility benefits from orchestration.

7️⃣ Strategic Conclusion

This is not an AI discussion.

It is a capital markets discussion.

The board question becomes:

Are we structured to optimise functions

or structured to protect enterprise value?

From 2026–2030:

Organisational design is a valuation decision. – Josef David