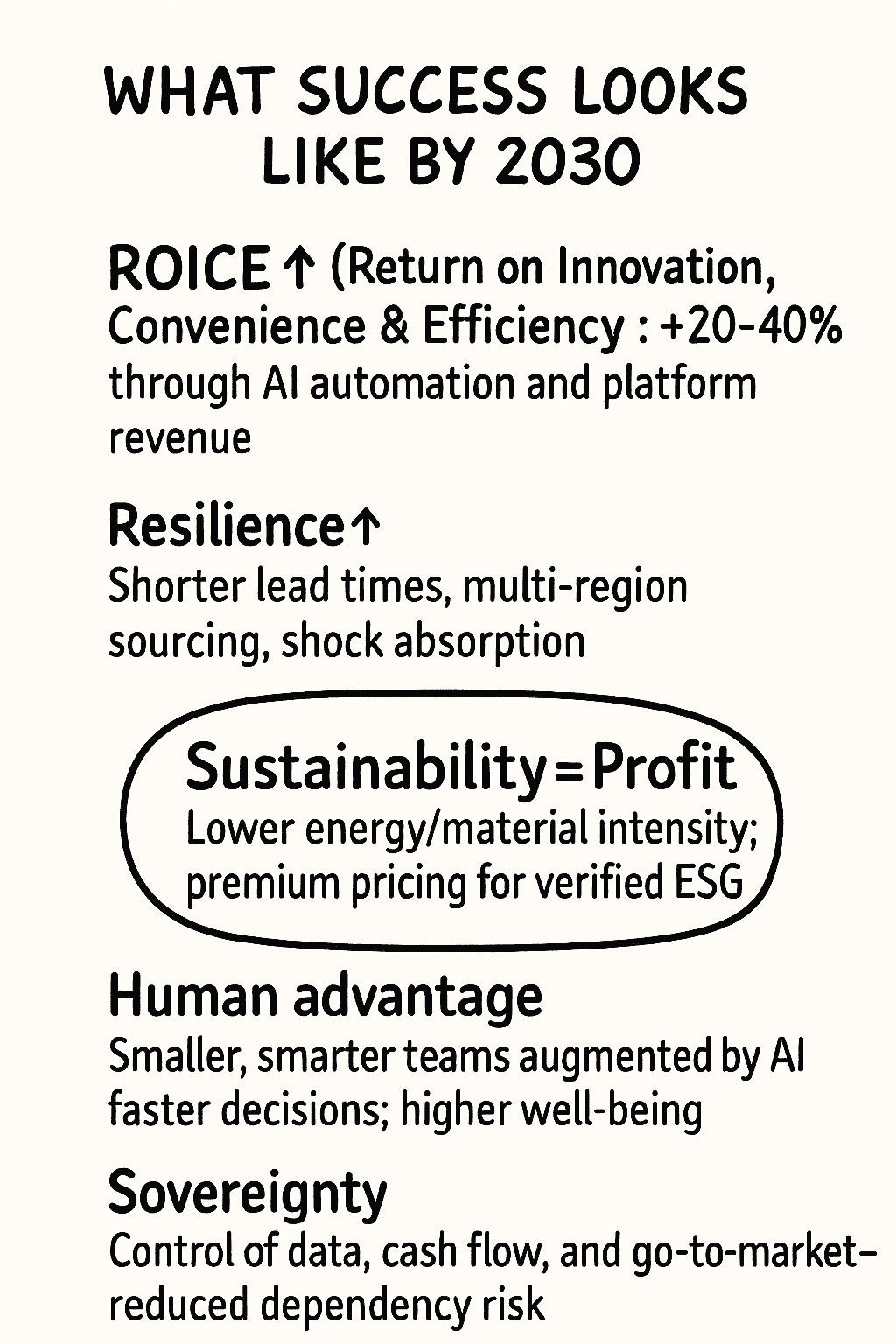

AI-Powered ASSET-LIGHT Conversion — Asset Reduction Potential

Industrial Gases • Capital Employed ↓ • ROCE ↑ • Capex Avoided

Power Executive Summary

- Capital Release: € 210m CE reduction (Sale&Leaseback, Outsource/aaS, NWC optimization, decommission).

- ROCE uplift: 10.3% → 14.7% (constant EBIT); conservative (adjusted EBIT) 14.1%.

- Asset Turnover: 0.86× → 1.22× (Revenue / CE).

- Capex Avoided: ~€ 21m/yr (35% of €60m baseline) → new capex ~€ 39m (6.5% of revenue).

Capital Employed (CE)

€ 700m → € 490m

Release € 210m

ROCE (constant EBIT)

14.7%

from 10.3% baseline

ROCE (adjusted EBIT)

14.1%

EBIT € 72m → € 69m

Capex (annual)

€ 60m → € 39m

Avoided € 21m/yr

Asset Reduction Waterfall (Capital Employed)

| Lever | CE Impact (€m) | Notes |

|---|---|---|

| Sale & Leaseback (non-core sites/equipment) | -€ 80 | Frees cash; converts to opex (lease) |

| Outsource / as-a-Service (fleet, non-critical plants) | -€ 60 | aaS contracts with uptime SLAs |

| NWC Optimization (inventory & AR) | -€ 30 | Pooling, forecasting, risk-scoring |

| Decommission / JV Shared Capacity | -€ 40 | Exit low-utilization assets; JV peak capacity |

| Total Reduction | -€ 210 | CE €700m → €490m |

Scenario

Baseline

CE € 700m

ROCE 10.3% • Turnover 0.86×

Scenario

Asset-Light Lite

CE ~€ 560m (-20%)

ROCE ≈ 12.9% • Turnover ≈ 1.07×

Scenario

Full Asset-Light

CE € 490m (-30%)

ROCE 14.7% (const) / 14.1% (adj) • Turnover 1.22×

Power Decision Request (Board)

- Approve Asset-Light Program (12 months): target CE reduction € 210m with value tracking.

- Launch 3 pilots (100 days): Sale&Leaseback tranche, aaS fleet outsourcing, NWC pooling in 2 clusters.

- Governance: ROCE/Cash PMO, monthly CE & capex dashboards, risk & compliance checkpoints.