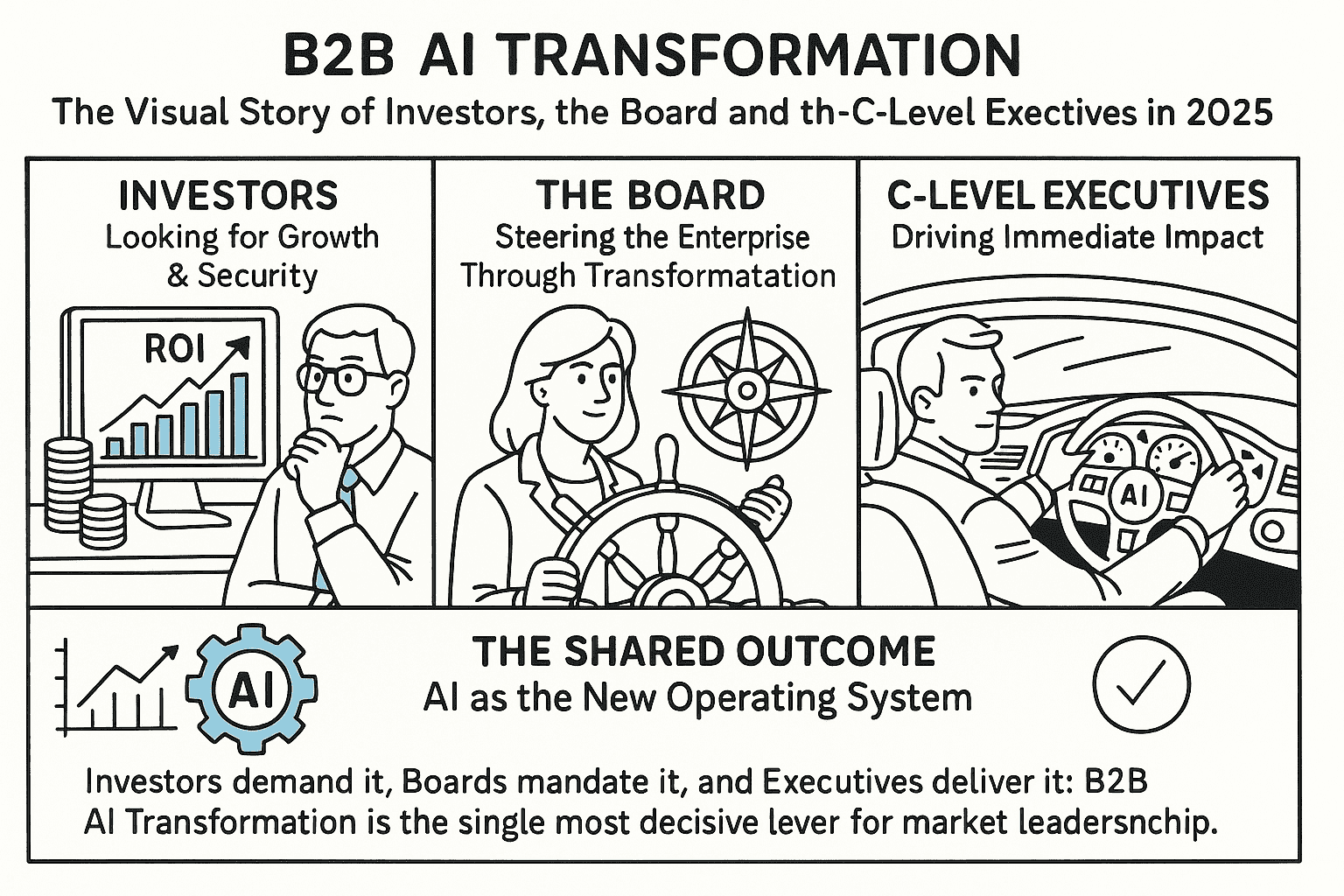

🎥 B2B AI TRANSFORMATION

The Visual Story of Investors, the Board, and the C-Level Executives in 2025

1️⃣ Investors: Looking for Growth & Security

- Expectation: Clear ROI, sustainable cashflows, risk mitigation.

- AI Promise:

- 20–30% revenue growth via new business models.

- 50–70% cost savings through automation.

- Stable recurring income streams (BaaS).

- Visual Metaphor: ROI Dashboard – showing AI as a growth engine.

2️⃣ The Board: Steering the Enterprise Through Transformation

- Expectation: Strategic clarity, risk management, governance.

- AI Promise:

- Data-driven insights for better oversight.

- Faster adaptation to disruption.

- Transparent KPIs to track AI progress.

- Visual Metaphor: Steering Wheel / Compass – AI as navigation system for corporate governance.

3️⃣ C-Level Executives: Driving Immediate Impact

- Expectation: Fast results, operational excellence, customer centricity.

- AI Promise:

- Predictive customer insights for stronger loyalty.

- Automated processes reducing time-to-market.

- Empowered workforce with AI-augmented decisions.

- Visual Metaphor: Race Car Dashboard – executives steering AI to win the market.

4️⃣ The Shared Outcome: AI as the New Operating System

- Investor View: ROI secured.

- Board View: Risk managed, growth governed.

- Executive View: Results delivered, markets won.

- Overall: AI is not a tool – it is the strategic backbone of B2B in 2025–2030.

🧭 Call to Action

👉 In 2025, Investors demand it, Boards mandate it, and Executives deliver it:

B2B AI Transformation is the single most decisive lever for market leadership.– Josef David

B2B AI Leaders vs Laggards (2025 → 2030)

1) Side-by-side comparison (clear, simple)

| Dimension | AI Leaders (Trajectory 2025→2030) | AI Laggards (Trajectory 2025→2030) |

|---|---|---|

| Strategy | AI tied to top-3 P&L goals; portfolio of pilots with scale gates each quarter. | Tool-driven experiments without economic targets; sporadic pilots. |

| Business Model | Shift to BaaS/recurring: 40–70% revenue recurring by 2030. | <15% recurring; product-only pricing. |

| Data & Platforms | Governed data products; shared AI platform; reusable components. | Siloed datasets; bespoke builds per use case. |

| Operations | >60% of priority processes automated; decisions in minutes. | <20% automated; decisions in days/weeks. |

| Customers | Predictive CX; hyper-personalization; churn −20–40%. | Batch marketing; churn flat or rising. |

| People & Skills | >70% knowledge workers AI-augmented; role redesign & incentives. | <25% adoption; training optional, no role redesign. |

| Risk & Governance | Model risk, security, and compliance built-in; audit trails by design. | Ad-hoc approvals; periodic clean-ups after incidents. |

| Capital Allocation | Stage-gated funding; scale after proven ROI in 90 days. | Big-bang programs; sunk-cost bias. |

3) 5-minute self-diagnostic (score 0–2 each; 0=no, 1=partial, 2=yes)

- AI tied to 3 explicit P&L goals

- Recurring/BaaS revenue >20% today or plan to reach 40%+

- Reusable AI platform with governed data products

- ≥3 high-value processes live with measurable ROI

- 70%+ of knowledge workers trained/using AI weekly

- Predictive CX in sales/service; churn trending down

- Model risk & security framework operating

- Stage-gated funding with 90-day proof points

Interpretation: 14–16 = Leader; 10–13 = Transition; ≤9 = Laggard.

4) 12-month catch-up play (for laggards)

- Q4 ’25: Pick one P&L goal; stand up an AI platform pilot; appoint product owners.

- Q1 ’26: Launch 3 pilots (sales, supply chain, service) with weekly ROI tracking.

- Q2 ’26: Scale the 2 best pilots; introduce recurring pricing on one offer.

- Q3 ’26: Formalize model risk & data products; train 50% workforce in AI use.

- By Q3 ’26 outcomes: ≥15% recurring revenue, 30% cycle-time cut in 2 processes, executive dashboard live.