Power Report 2026–2030 | AI-Orchestrator Leadership Model

A) EXECUTIVE STRATEGIC SUMMARY

Core Thesis

The next global competitive advantage will not be money or technology alone —

it will be the ability to orchestrate Health + Wealth systems simultaneously across generations.

Most individuals and institutions treat health and wealth separately.

AI-Orchestrator Leaders integrate them into one compounding system.

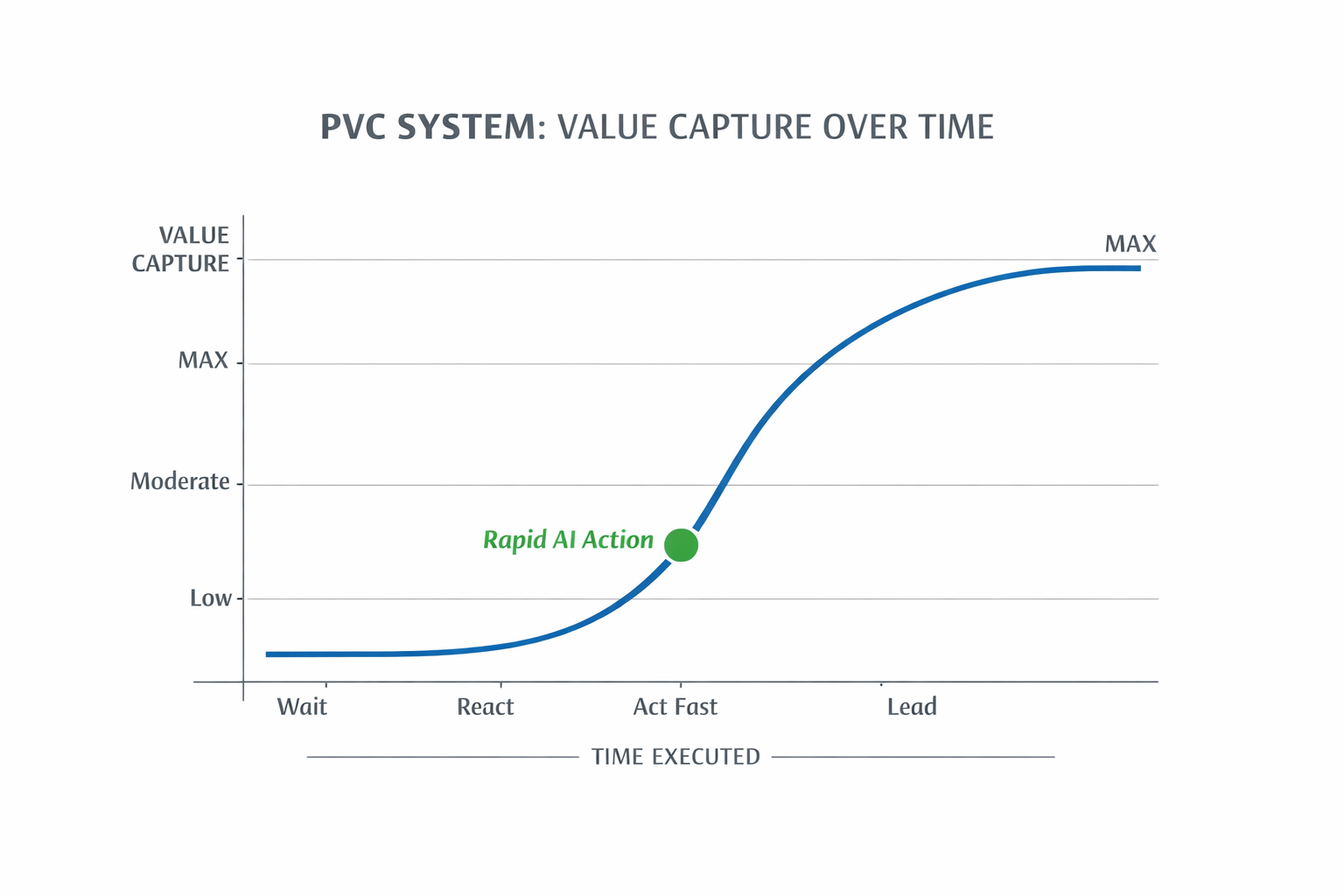

The Compounding Law

Health × Wealth × Time × AI = Generational Advantage

If one factor collapses → system collapses.

Why 2026–2030 Is the Decisive Window

This period represents a rare convergence:

| Driver | Impact |

|---|---|

| AI automation | 10× productivity leverage |

| Longevity tech | Longer productive lifespan |

| Financial AI | Autonomous capital allocation |

| Data platforms | Real-time decision advantage |

| Preventive medicine | Cost collapse vs treatment |

Leaders who build integrated systems now will dominate for decades.- Josef David

B) THE AI-ORCHESTRATOR GENERATIONAL SYSTEM MODEL

SYSTEM ARCHITECTURE

Layer 1 — Foundation Engines

- Health Intelligence Engine

- Wealth Compounding Engine

- Decision Intelligence Engine

- Risk Detection Engine

Layer 2 — Orchestration Layer

The AI-Orchestrator acts as:

- strategist

- optimizer

- early-warning system

- allocation engine

Traditional leaders manage.

Orchestrator leaders allocate.

Layer 3 — Compounding Loops

Loop 1 — Health → Wealth

Healthy individuals:

- make better decisions

- work longer

- compound capital longer

Loop 2 — Wealth → Health

Financial strength enables:

- preventive care

- stress reduction

- optimized lifestyle

Loop 3 — AI → Both

AI provides:

- predictive diagnostics

- optimal portfolio allocation

- behavioral nudges

- risk alerts

The Flywheel Effect

Health ↑ → Energy ↑ → Decisions ↑ → Income ↑ → Wealth ↑ → Care ↑ → Health ↑

Compounding becomes exponential.

C) THE 10 STRATEGIC PILLARS (2026–2030)

1. Preventive Health First

Shift spending from treatment → prevention.

2. AI Decision Copilot

Every strategic decision supported by AI scenario simulation.

3. Cash-Flow Dominance

Focus on free cash flow, not revenue.

4. Asset-Light Models

Ownership ↓

Control ↑

5. Longevity Productivity

Plan careers for 60-year productivity cycles.

6. Data Ownership

Those who own their data own their future.

7. Risk Radar Systems

Detect threats before they appear.

8. Automated Wealth Compounding

Invest automatically, remove emotion.

9. Cognitive Optimization

Mental performance becomes economic leverage.

10. Legacy Architecture

Design systems that work without you.

D) THE 5 GENERATIONAL LEADERSHIP RULES

- Build systems, not income streams

- Design for 50 years, not 5

- Optimize energy before time

- Automate decisions before scaling

- Create assets that outlive you

E) STRATEGIC RISK MAP (WHY MOST FAIL)

Most health-wealth systems collapse because of:

- reactive healthcare

- emotional investing

- fragmented data

- short-term thinking

- manual decision-making

AI-Orchestrator leadership eliminates these weaknesses.

F) IMPLEMENTATION ROADMAP 2026–2030

Phase 1 — Build (2026)

Create your dual system infrastructure.

Phase 2 — Automate (2027)

Deploy AI decision layers.

Phase 3 — Compound (2028)

Reinvest surplus automatically.

Phase 4 — Scale (2029)

Replicate system across entities.

Phase 5 — Legacy (2030)

System runs without your presence.

G) CEO DASHBOARD METRICS

Track only these 6 indicators:

- Energy Score

- Decision Speed

- Free Cash Flow

- Asset Ratio

- Risk Exposure

- Compounding Rate

Everything else is noise.

H) FINAL STRATEGIC INSIGHT

The richest and healthiest leaders of 2035 will not be the smartest —

they will be the best orchestrators. – Josef David

I) BOARDROOM CONCLUSION

The real strategic question is no longer:

How do we grow?

It is:

How do we build a self-compounding system that grows without us?