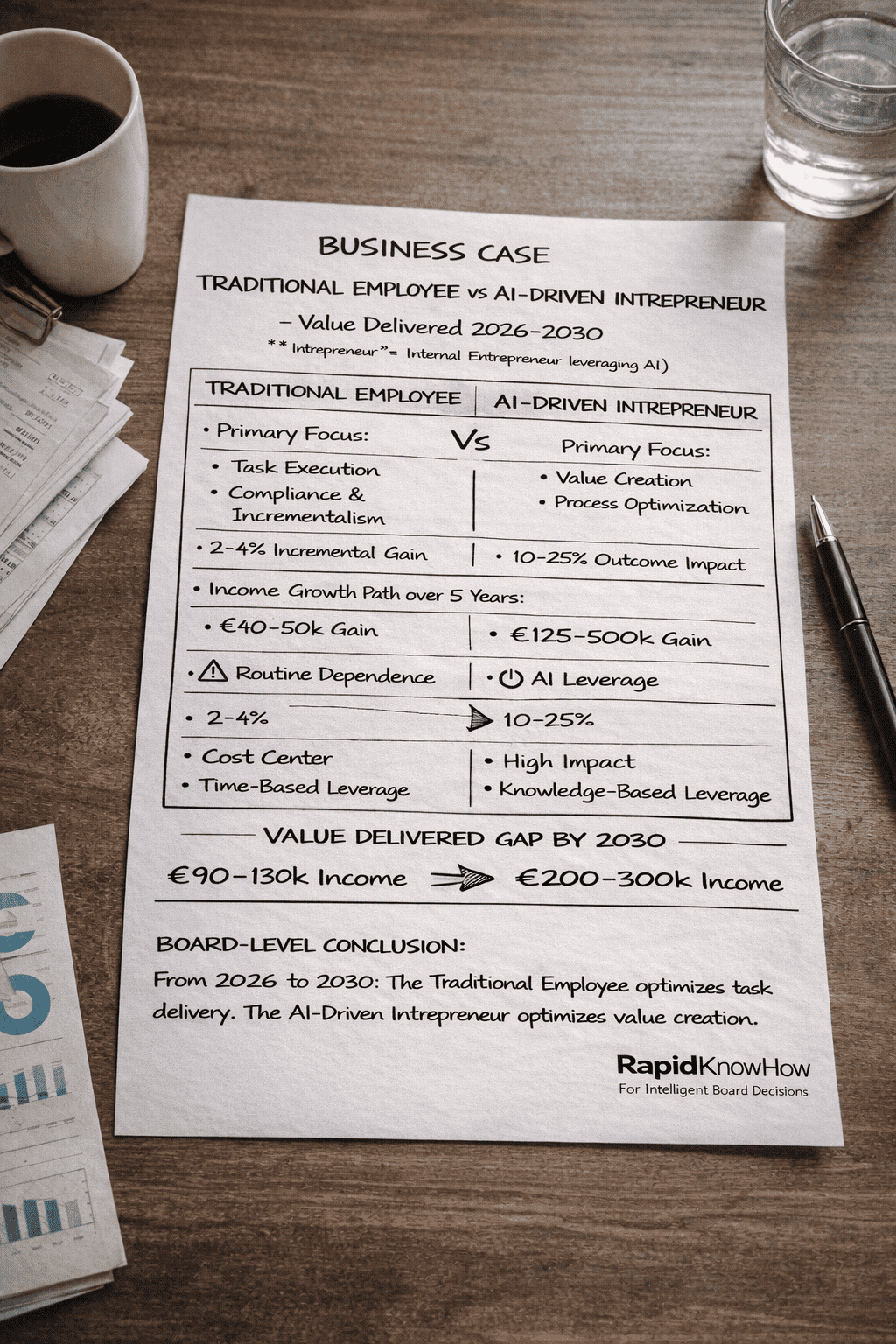

Value Delivered 2026–2030

(“Intrepreneur” = Internal Entrepreneur leveraging AI)

A) STRATEGIC ARCHETYPES

1️⃣ Traditional Employee

Primary Focus:

- Task execution

- Job description compliance

- Hours worked

- Performance review targets

Value Logic:

Input-based compensation.

Income growth path:

2–4% annual increment.

Risk:

- Replaceable

- Role automation exposure

- Limited leverage

- Dependent on hierarchy

2️⃣ AI-Driven Intrepreneur

Primary Focus:

- Value creation

- Process optimization

- Revenue acceleration

- Cost compression

- Decision speed improvement

Value Logic:

Outcome-based leverage.

Tools:

- AI signal processing

- Workflow automation

- Scenario simulation

- KPI dashboard orchestration

- Knowledge compounding

Income growth path:

10–25% annual growth potential

(or bonus, equity, profit-share)

B) BASELINE PROFILE (ILLUSTRATIVE)

Assume:

Salary 2026 = €80,000

Company revenue per employee = €400,000

EBITDA contribution per employee = €100,000

C) VALUE CREATION TRAJECTORY (2026–2030)

1️⃣ Traditional Employee

Efficiency stable.

Productivity incremental.

Value impact:

0–2% incremental gain per year.

By 2030:

Contribution increases marginally

Automation risk increases.

Company view:

Cost center or stable contributor.

Income 2030:

~€88–92k.

Total 5-year incremental income:

~€40–50k gain.

2️⃣ AI-Driven Intrepreneur

Leverages AI to:

- Reduce process time 20–40%

- Improve pricing analytics

- Identify cost leakages

- Accelerate decision cycles

- Build internal knowledge assets

Value delivered:

5–15% EBITDA impact on specific unit.

If managing €5m cost base:

5% efficiency gain = €250k/year impact.

Even if 10% credited to individual influence:

€25k–50k annual value attribution.

D) FINANCIAL IMPACT COMPARISON (5-YEAR VIEW)

| Metric | Traditional Employee | AI-Driven Intrepreneur |

|---|---|---|

| Value Impact / Year | €0–10k | €25k–150k |

| Income CAGR | 2–4% | 10–25% |

| Automation Risk | Medium–High | Low |

| Strategic Visibility | Limited | High |

| Replacement Risk | Moderate | Low |

| Leverage | Time-based | Knowledge-based |

E) ROICE COMPARISON

(Return on Innovation, Convenience & Efficiency)

Traditional Employee:

ROICE ≈ 3–6%

AI-Driven Intrepreneur:

ROICE ≈ 15–30%

Because:

Knowledge scales.

Time does not.

F) ENTERPRISE PERSPECTIVE

From employer viewpoint:

Traditional Employee:

Predictable cost.

AI-Driven Intrepreneur:

Internal value accelerator.

Companies that institutionalize AI-intrepreneurship:

- Increase FCF

- Reduce volatility

- Accelerate innovation

- Retain top performers

G) MARKET VALUE LOGIC (MACRO LEVEL)

If 20% of workforce becomes AI-driven Intrepreneurs:

EBITDA margin improves 1–3%.

For a €1bn EBITDA company:

1% margin improvement = €10m.

At 15× multiple:

€150m enterprise value gain.

That is workforce-level orchestration.

H) CAREER CAPITAL COMPOUNDING

Traditional Career:

Linear growth.

AI-Driven Intrepreneur Career:

Knowledge compounds.

Network compounds.

Authority compounds.

Optionality compounds.

Result:

Higher mobility.

Higher negotiation power.

Higher equity probability.

I) STRATEGIC CONCLUSION

Traditional Employee optimizes task delivery.

AI-Driven Intrepreneur optimizes value creation.

From 2026–2030:

The gap is not job title.

It is leverage architecture.

Capital-intensive industries will reward:

Knowledge leverage.

Decision compression.

Outcome orientation.