The only stock strategy that survives generations

A) The uncomfortable truth

Most investors don’t fail because they pick bad stocks.

They fail because they interrupt compounding.

Selling, timing, reacting, optimizing taxes “later”, panicking early—

all flatten the curve before it ever becomes powerful.

B) The winning idea

Compounded wealth is not built by intelligence.

It is built by time, reinvestment, and rules.

Stocks work across generations because they are:

- Ownership in productive systems

- Inflation-adaptive

- Scalable without effort

- Transferable with governance

C) The one-line strategy

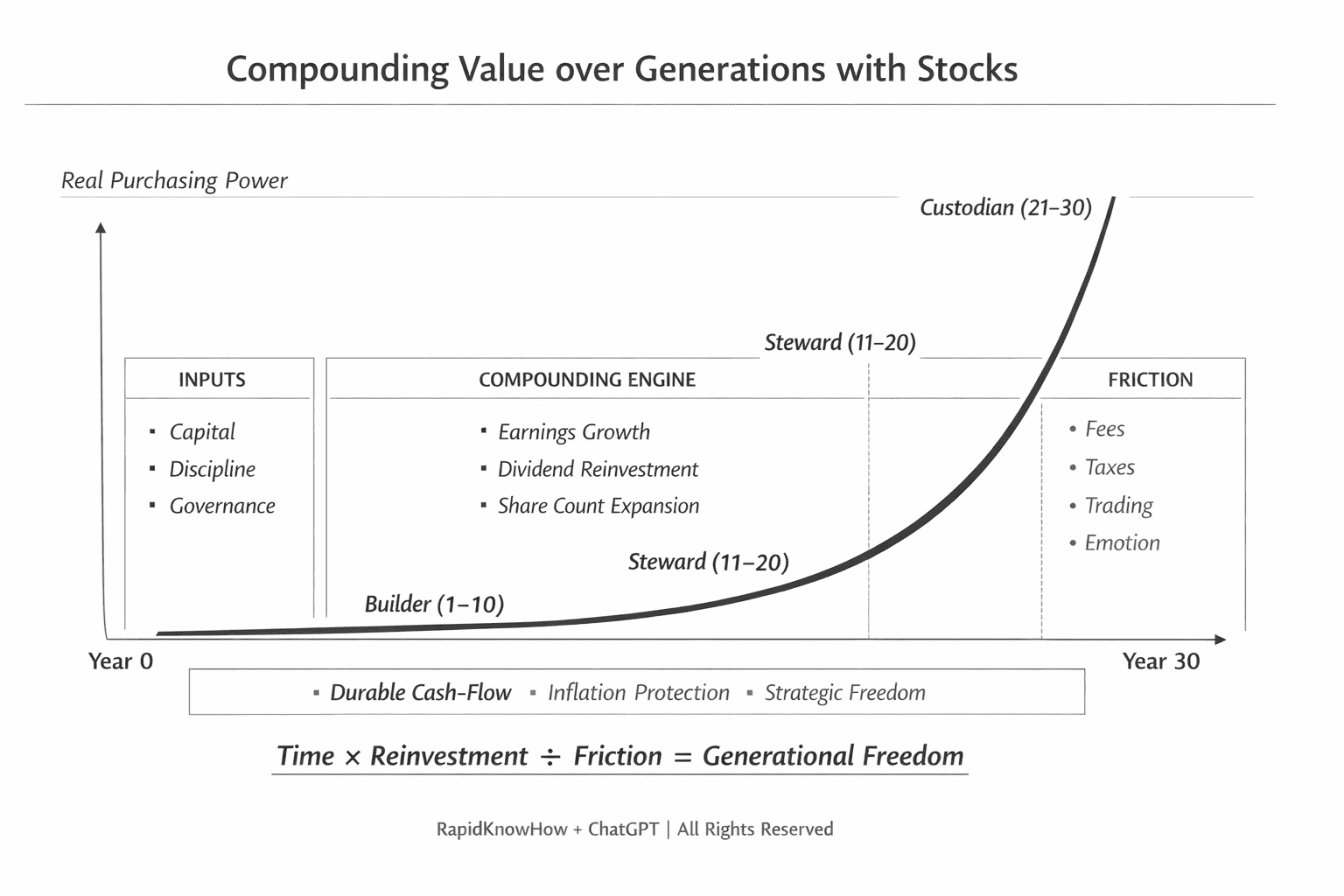

Time × Reinvestment ÷ Friction = Generational Freedom

If your family protects this equation, wealth compounds automatically.

If it breaks one element, compounding dies silently.

1) Strategic Objective

Create durable, inflation-adjusted cash-flow that survives:

- market cycles

- political regimes

- individual decision errors

- generational transitions

This is not a “return-maximization” strategy.

It is a freedom-preservation strategy.

2) The Compounding System (not a portfolio)

A) Inputs (controllable)

- Initial capital + periodic contributions

- Discipline (automatic investing)

- Governance (written rules)

B) Compounding Engine (self-reinforcing)

- Earnings growth of quality businesses

- Dividend reinvestment

- Share count expansion

- Time-driven convexity (late acceleration)

C) Friction (systemic enemies)

- Fees

- Taxes

- Trading

- Emotional decisions

Strategy focus: maximize engine uptime, minimize friction leakage

3) 30-Year / 3-Generation Stock Strategy

Generation 1 – Builder (Years 1–10)

Mission: Accumulate ownership

- Broad global equities + quality compounders

- 100% dividend reinvestment

- No market timing

- Measure shares owned, not portfolio value

Risk managed by diversification and time, not activity.

Generation 2 – Steward (Years 11–20)

Mission: Protect the curve

- Maintain core holdings

- Mechanical rebalancing (annual, rules-based)

- No selling for lifestyle

- Document decisions and rationale

Key KPI: real cash-flow growth, not nominal returns.

Generation 3 – Custodian (Years 21–30)

Mission: Preserve freedom

- Capital remains intact

- Dividends partially fund education, purpose, resilience

- Spending limited to returns, never principal

Capital becomes a tool, not a reward.

4) Governance: the real alpha

Families lose wealth when:

- rules are implicit

- decisions are emotional

- ownership is confused with consumption

Families keep wealth when they codify:

- who decides

- when selling is allowed

- how successors are educated

- what capital is for

Governance compounds faster than money.

5) Failure Modes (why compounding breaks)

- Early selling

- Over-optimization

- Lifestyle inflation

- “Just this once” decisions

- Absence of a family charter

All failures share one feature: shortening the time horizon.

6) Strategic Conclusion

Compounded value investing is not about markets.

It is about designing a system that outlives individuals.

Markets reward patience.

Families must engineer it. – Josef David