Here’s a clear, battle-tested framework for

Converting Real Estate Equity into a Sustainable Cash-Flow Compounding Portfolio

This is written for owners who already did the hard part (building equity) and now want to make money work every month without selling the crown jewels.

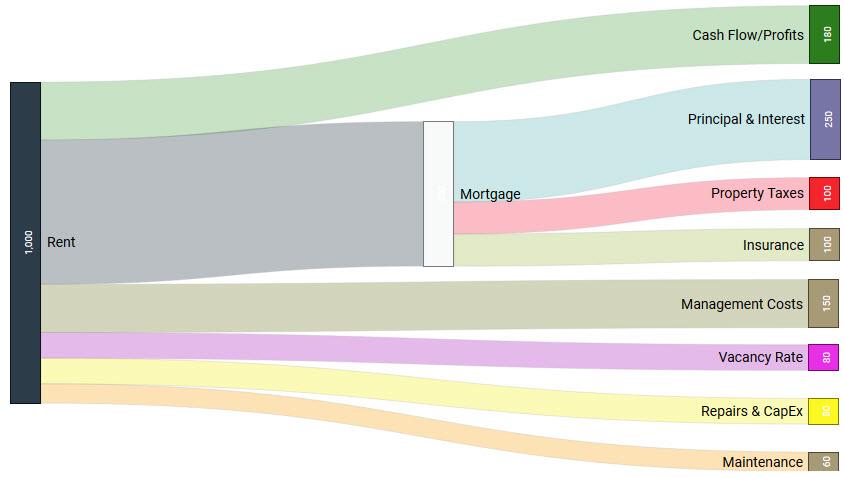

1. The Core Idea

Freeze your real estate, liquefy the equity, redeploy into diversified cash-flow engines, and reinvest systematically.

Real estate becomes the engine, not the destination.

2. Step 1 — Lock the Equity (Do Not Sell)

Your property has three values:

- Market value

- Debt

- Extractable equity (the sleeping asset)

Rule of thumb

- Max 60–65% Loan-to-Value (LTV) across the portfolio

- Fixed or long-term capped rates

- Non-recourse where possible

👉 Goal: Cash extraction without fragility

3. Step 2 — Convert Equity into Liquidity (Smart Leverage)

Instruments

- Cash-out refinancing

- Portfolio credit line

- Structured property loans

Golden Rule

The new debt service must be covered by existing rental income, not by the new investments.

If equity extraction weakens your base cash flow → stop.

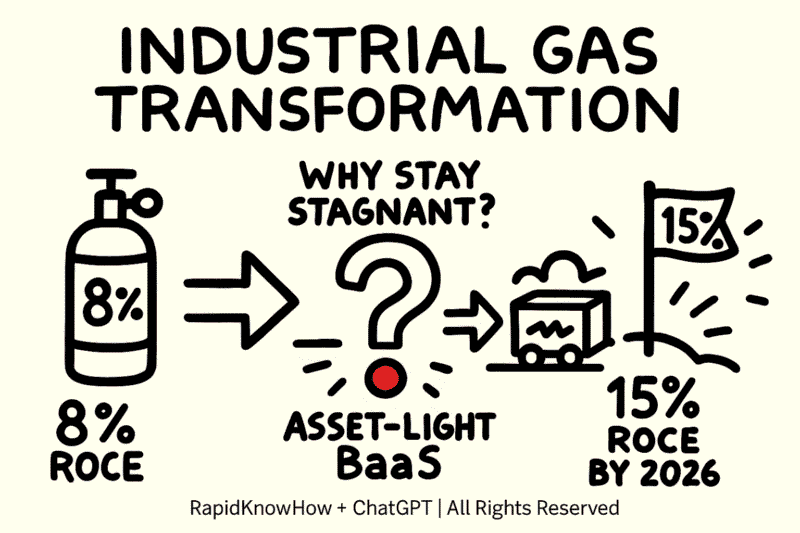

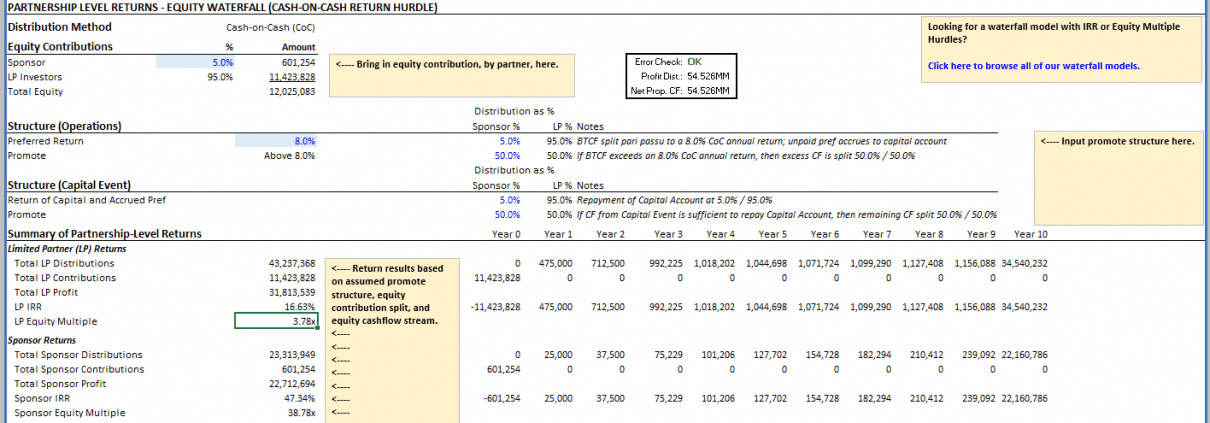

4. Step 3 — Build the Cash-Flow Compounding Portfolio

This is where most investors fail: they chase yield instead of systems.

The Sustainable Allocation Model

| Layer | Role | Target Yield | Risk |

|---|---|---|---|

| Core Income | Stability | 4–6% | Low |

| Cash-Flow Growth | Inflation hedge | 6–10% | Medium |

| Optional Upside | Accelerators | 10–15% | Controlled |

| Liquidity Buffer | Shock absorber | 0–3% | Very low |

Never let more than 30% sit in high-risk instruments.

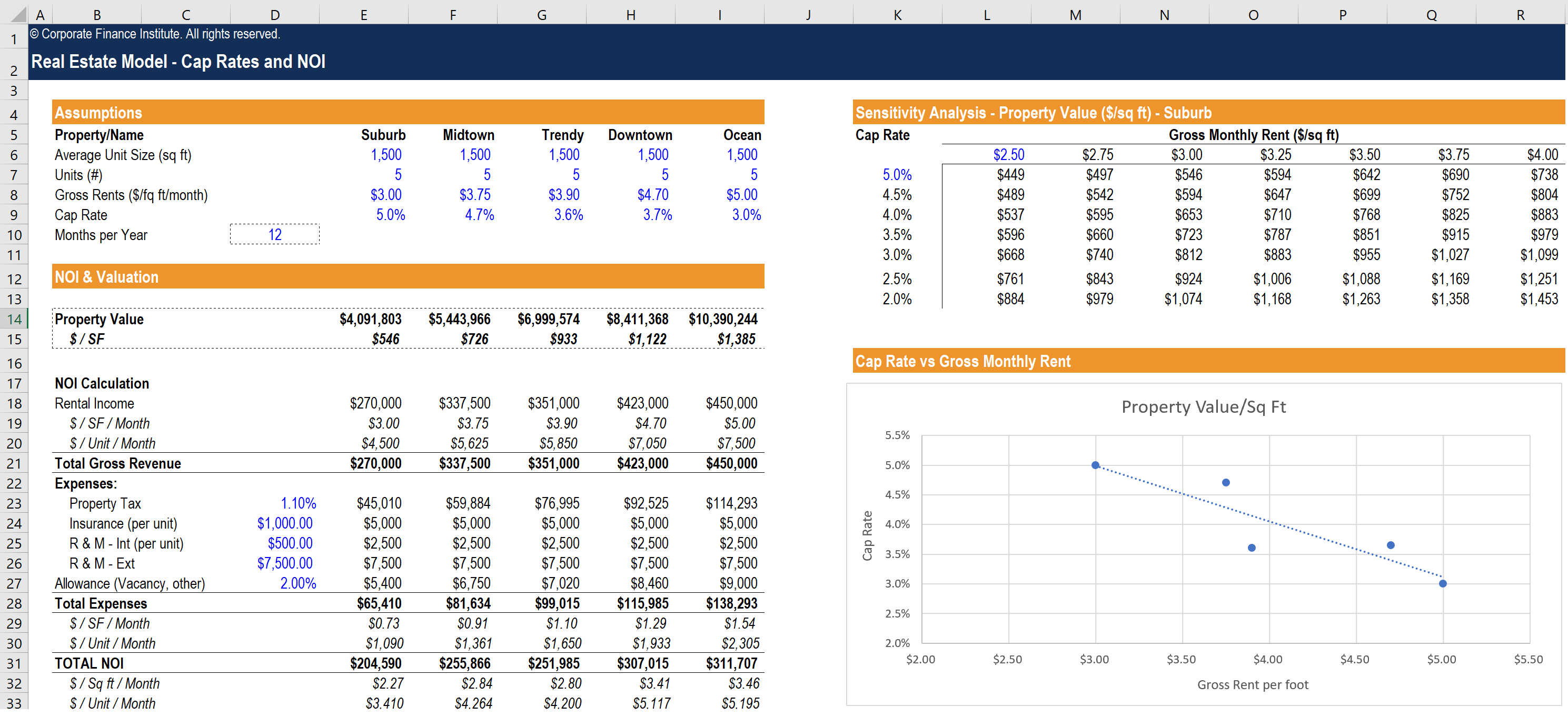

5. Step 4 — Match Cash Flow to Debt (The Safety Lock)

Your system must satisfy this equation:

Net Cash Flow ≥ Debt Service × 1.3

That buffer is what keeps you solvent during:

- Rate hikes

- Vacancy spikes

- Market freezes

If the buffer drops → pause reinvestment, rebuild liquidity.

6. Step 5 — Automate Compounding (The Real Wealth Engine)

Cash flow is not for lifestyle upgrades first.

Monthly Automation

- Cash flow received

- Split:

- 50–70% reinvested

- 20–30% liquidity buffer

- 10–20% discretionary use

- Quarterly rebalance

- Annual risk reset

This turns income into self-expanding capital.

7. The Compounding Flywheel (Mental Model)

Property Equity → Liquidity → Cash Flow → Reinvestment → Stronger Equity Base

Over time:

- Dependence on real estate decreases

- Cash-flow optionality increases

- Risk becomes distributed, not concentrated

8. Common Fatal Errors (Avoid These)

❌ Selling prime assets too early

❌ Over-leveraging above 70% LTV

❌ Yield chasing without correlation control

❌ Mixing speculation with income capital

❌ Lifestyle inflation before system maturity

9. What “Success” Looks Like After 5–10 Years

- Real estate still owned

- Debt shrinking in real terms

- Independent monthly cash flow

- Ability to pause, pivot, or redeploy capital at will

- Wealth survives you (this is the real test)

10. Simple Executive Version

Real estate builds equity.

Cash-flow portfolios build freedom.

Systems build legacy.

“If your cash-flow system passes this test,

you will never be forced to sell, panic, or depend.” – Josef David