SOCM GLOBAL SNAPSHOT — WEEK 7 / 2026 (WHAT IS FORMING?)

SOCM Lens Used

SOCM does not ask:

“What is happening in the world?”

SOCM asks:

“Where is value forming faster than organizations can decide?”

Week 7 / 2026 shows compression of time across geopolitics, markets, and governance.

1️⃣ Global Signals Detected (SOCM – Signal Layer)

Geopolitics

- Escalating multipolar friction (US–China–Russia alignment shifts)

- Regional conflicts remain unresolved → permanent volatility

- Sanctions, trade controls, and strategic resources increasingly politicized

Economy & Markets

- Capital reallocates faster than regulation can follow

- Inflation is no longer the core risk — timing and liquidity are

- Supply chains shift regionally, not globally

Governance & Institutions

- Decision cycles in governments and large corporations lag reality

- Emergency powers normalize → long-term rule changes by stealth

- Trust in official narratives continues to erode

📌 SOCM Insight:

The dominant global pattern is decision latency under accelerating change.

2️⃣ SOCM Opportunity Hypothesis (Pre-Ranking)

In Week 7 / 26, value is forming where:

- Speed matters more than scale

- Delay destroys optionality

- Authority is fragmented

This immediately filters out:

- Long-cycle infrastructure plays

- Consensus-heavy political initiatives

- “Wait-and-see” investment strategies

SOCM OPPORTUNITY RANKING — WEEK 7 / 2026 (WHAT TO CAPTURE FIRST)

SOCM Ranking Criteria (Applied)

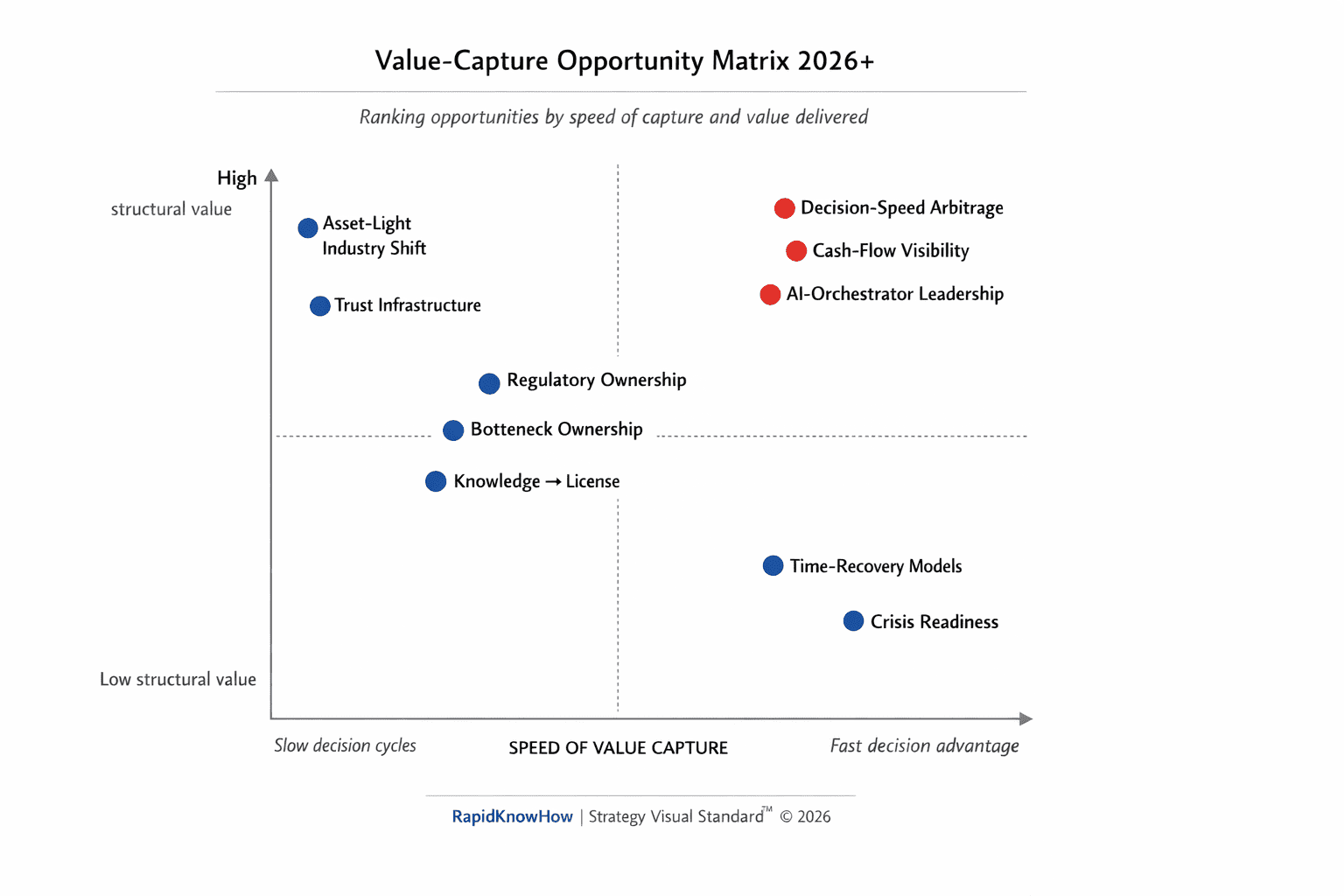

Each opportunity is assessed on:

- Speed of Capture

- Value Delivered

- Opportunity Half-Life (OHL)

- Decision Latency Risk

GEO SIGNAL DETECTION — WEEK 7 / 2026 (SOC SIGNAL LAYER)

SOC starts before headlines.

It focuses on signals that form value asymmetries due to slow decision-making.

A1) Primary Geo Signals Identified

1️⃣ Escalation Without Resolution (Chronic Conflict Zones)

- Ukraine, Middle East, Red Sea remain unresolved

- Conflicts normalized → volatility becomes structural

- No diplomatic closure visible

SOC Interpretation:

➡️ Opportunity lies not in resolution, but in preparedness and speed.

2️⃣ Fragmentation of Global Trade Rules

- Sanctions, export controls, “friend-shoring” accelerate

- Rules change faster than companies adapt

- Compliance becomes unpredictable

SOC Interpretation:

➡️ Regulation itself becomes a competitive weapon.

3️⃣ Weakening of Central Authority (States & Institutions)

- Governments act slower than markets

- Emergency measures replace long-term governance

- Trust in institutions continues to erode

SOC Interpretation:

➡️ Decision authority migrates from institutions to private actors who move faster.

4️⃣ Capital Mobility Outpaces Policy Control

- Capital reallocates faster than regulation

- Liquidity shocks > inflation shocks

- Time-to-cash becomes decisive

SOC Interpretation:

➡️ Cash-flow visibility and speed trump long-term forecasts.

5️⃣ Narrative Instability & Information Overload

- Competing narratives replace shared reality

- Media amplification without clarity

- Decision paralysis increases

SOC Interpretation:

➡️ Trust + clarity become scarce, monetizable assets.

B) SOC ALIGNMENT & RANKING — GEO SIGNALS WEEK 7 / 2026

SOC now asks one question only:

Where does decision latency destroy the most value fastest?

SOC Ranking Criteria Applied

Each signal ranked by:

- Speed Sensitivity (how fast value decays)

- Value Impact (economic, strategic, security)

- Decision Latency Gap (institutions vs actors)

- Opportunity Half-Life (OHL) Explanation below

🥇 RANK 1 — Chronic Conflict as a Permanent Condition

Why #1

- Institutions still treat conflicts as temporary

- Reality: conflicts are persistent

- Value lies in acting as if they will last

SOC Metrics

- Speed Sensitivity: 🔥🔥🔥🔥🔥

- Value Impact: 🔥🔥🔥🔥🔥

- OHL: Very short

SOC Opportunity

➡️ Crisis readiness, logistics, energy security, decision-speed infrastructure

🥈 RANK 2 — Regulatory & Sanction Volatility

Why #2

- Rules change faster than governance cycles

- Fear freezes slower competitors

SOC Metrics

- Speed Sensitivity: 🔥🔥🔥🔥

- Value Impact: 🔥🔥🔥🔥

- OHL: Short–Medium

SOC Opportunity

➡️ Regulatory arbitrage, compliance-as-strategy, early-mover advantage

🥉 RANK 3 — Capital Flight & Liquidity Shocks

Why #3

- Capital moves instantly

- Boards react quarterly

SOC Metrics

- Speed Sensitivity: 🔥🔥🔥🔥

- Value Impact: 🔥🔥🔥🔥

- OHL: Short

SOC Opportunity

➡️ Cash-flow visibility, fast reallocation, downside protection

4️⃣ RANK 4 — Institutional Trust Erosion

Why #4

- Slow-burning but compounding

- High long-term value, lower immediacy

SOC Metrics

- Speed Sensitivity: 🔥🔥

- Value Impact: 🔥🔥🔥🔥

- OHL: Medium–Long

SOC Opportunity

➡️ Trust infrastructure, decision-grade intelligence

5️⃣ RANK 5 — Narrative Warfare & Info Chaos

Why #5

- High noise, indirect value

- Needs filtering, not reaction

SOC Metrics

- Speed Sensitivity: 🔥

- Value Impact: 🔥🔥🔥

- OHL: Longer

SOC Opportunity

➡️ Signal filtering, clarity systems, leadership framing

C) SOC DECISION PLAYBOOK — WEEK 7 / 2026 (WHAT TO DO NOW)

C1) SOC “ACT NOW” ZONE (Weeks 7–9)

Immediate SOC Focus

- Chronic conflict preparedness

- Regulatory volatility positioning

- Cash-flow shock readiness

Rule

If a geo signal affects cash-flow or security within 60 days, it is SOC-critical.

C2) SOC “PREPARE” ZONE

- Trust infrastructure

- AI-supported geopolitical clarity

- Scenario-based leadership positioning

Rule

Prepare authority and tools — delay execution.

C3) SOC “DO NOT CHASE” ZONE

- Diplomatic optimism narratives

- Long-cycle geopolitical reforms

- Consensus-heavy global initiatives

Rule

Hope is not a strategy. Speed is.

C4) SOC Board-Level Questions (Mandatory, Week 7)

Use verbatim:

- Which geopolitical signal will destroy value fastest if we delay?

- Where is our decision cycle longer than the signal’s half-life?

- Which assumption are we treating as temporary that is actually permanent?

Unanswered → SOC escalation required.

C5) SOC WEEK 7 OUTCOME (REQUIRED)

By end of Week 7:

- ≥1 geo opportunity authorized

- ≥1 geo assumption killed

- Decision latency made explicit

No kill → SOC not applied.

SOC FINAL WEEK 7 / 26 TRUTH

Geopolitics no longer shocks markets.

Slow decisions do.

SOC converts:

- Geo chaos → ranked opportunity

- Risk → timing advantage

- Delay → measurable loss

SOC Anchor Sentence (Applied)

In Week 7 / 2026, geopolitical advantage belongs to those who decide faster than institutions can react.

Here is the clear, authoritative explanation of OHL, exactly as used in the RapidKnowHow SOC system

OHL — Opportunity Half-Life (SOC Core Concept)

A) What OHL Means (Plain and Precise)

OHL = Opportunity Half-Life

The time it takes for an opportunity to lose 50% of its potential value due to delay.

In SOC, an opportunity is not lost suddenly.

It decays continuously while decisions are delayed.

OHL answers one brutal question:

“How long can we wait before half of the value is gone — even if we later decide correctly?”

B) Why OHL Is Central to SOC (Not Optional)

Most organizations ask:

- Is this the right opportunity?

- Is the analysis complete?

SOC asks first:

“Will value still exist when we decide?”

SOC Law

If Decision Cycle > OHL → Value Destruction Is Guaranteed

This is why SOC treats speed as a strategic asset.

Typical OHL Ranges (SOC Benchmarks)

| Opportunity Type | Typical OHL |

|---|---|

| Decision-Speed Arbitrage | 2–6 weeks |

| Regulatory / Sanction Arbitrage | 1–3 months |

| Cash-Flow Visibility Plays | 1–2 months |

| Geopolitical Readiness | Weeks to months |

| Trust Infrastructure | 6–24 months |

Short OHL = speed-critical

Long OHL = strategic but not urgent

C) How OHL Is Used in SOC (Operationally)

C1) OHL vs Decision Latency (DLI)

SOC always compares:

OHL vs DLI (Decision Latency Index)

- If DLI < OHL → value can still be captured

- If DLI ≈ OHL → fragile opportunity

- If DLI > OHL → opportunity already half-dead

This removes debate instantly.

C2) OHL Drives Ranking (Not Opinions)

In SOC ranking:

- Two opportunities with equal value

- The one with shorter OHL ranks higher

Because:

Speed beats magnitude when decay is fast

C3) OHL in Geo Context (Week 7 / 26 Examples)

| Geo Signal | OHL | Why |

|---|---|---|

| Chronic conflict preparedness | Short | Windows close fast |

| Regulatory volatility | Short–Medium | Rules shift suddenly |

| Capital flight | Very short | Liquidity moves instantly |

| Trust erosion | Long | Compounds over time |

| Narrative chaos | Longer | Needs filtering, not haste |

C4) Board-Level OHL Question (Mandatory)

Use this exact wording:

“What is the opportunity half-life — and is our decision cycle shorter than that?”

If leadership cannot answer:

- The opportunity is not decision-ready

- SOC escalation is required

SOC FINAL TRUTH ABOUT OHL

Opportunities do not fail because leaders are wrong.

They fail because leaders decide after the half-life expires.

OHL makes time visible — and delay expensive.

SOC GEO SNAPSHOT — WEEK 7 / 2026

What is forming globally, filtered through Speed Opportunity Capture

SOC Purpose

This snapshot answers one question only:

Where is geopolitical value forming faster than institutions can decide?

Everything shown must be time-critical, rankable, and action-relevant.

A1) SOC Signal Clusters Detected

Cluster 1 — Permanent Conflict Reality

- Ukraine, Middle East, Red Sea remain unresolved

- Conflicts normalized → volatility becomes structural

- Governments still treat them as temporary

SOC Insight:

➡️ Value lies in acting as if conflicts will persist, not in waiting for peace.

Cluster 2 — Regulatory & Sanction Volatility

- Export controls, sanctions, and trade rules change abruptly

- Compliance cycles slower than rule changes

- Fear freezes competitors

SOC Insight:

➡️ Regulation is no longer a constraint — it is a speed-based competitive weapon.

Cluster 3 — Capital Mobility & Liquidity Shocks

- Capital reallocates faster than policy reactions

- Liquidity risk outweighs inflation risk

- Time-to-cash becomes decisive

SOC Insight:

➡️ Cash-flow visibility before commitment is now geopolitical defense.

Cluster 4 — Institutional Authority Erosion

- States and institutions react slower than markets

- Emergency governance becomes normal

- Decision authority shifts to private actors

SOC Insight:

➡️ Power migrates to those who can decide without consensus delay.

Cluster 5 — Narrative & Information Instability

- Competing narratives replace shared reality

- Information overload increases paralysis

SOC Insight:

➡️ Clarity and trust become scarce, monetizable assets — but with longer OHL.

A2) SOC GEO SNAPSHOT — IMPLIED RANKING (Speed × Value)

| Geo Signal | Speed Sensitivity | Value Impact | OHL |

|---|---|---|---|

| Chronic conflict preparedness | Very High | Very High | Short |

| Regulatory volatility | High | High | Short–Medium |

| Capital flight / liquidity | Very High | High | Very Short |

| Institutional erosion | Medium | High | Medium |

| Narrative instability | Low | Medium | Long |

➡️ SOC Conclusion (Snapshot):

Week 7 / 26 is dominated by short OHL geo signals.

Delay destroys value rapidly.

B) SOC ACT-NOW GEO LIST — WEEK 7 / 2026

What must be decided, not discussed

B1) ACT-NOW #1 — Chronic Conflict Preparedness

Why now

- Conflicts are persistent, not episodic

- Institutions still wait for resolution

OHL

- Weeks

SOC Decision Required

Authorize permanent-volatility operating assumptions

(energy, logistics, security, sourcing)

If delayed

- Higher costs

- Loss of optionality

- Reactive posture locked in

B2) ACT-NOW #2 — Regulatory & Sanction Speed Positioning

Why now

- Rules shift faster than governance adapts

- Early movers lock advantages while others freeze

OHL

- 1–3 months

SOC Decision Required

Decide where to pre-position compliance, exits, or pivots

before rule changes force reaction

If delayed

- Forced compliance

- Missed arbitrage

- Strategic immobility

B3) ACT-NOW #3 — Cash-Flow Shock Readiness

Why now

- Capital moves instantly

- Boards still decide quarterly

OHL

- Days–Weeks

SOC Decision Required

Implement cash-flow visibility before commitments

(stress-test liquidity under geo shock scenarios)

If delayed

- Liquidity traps

- Irreversible commitments

- Value destruction without error

B4) SOC “PREPARE” (Not Execute Yet)

- Trust infrastructure

- Narrative clarity systems

- AI-supported geopolitical filtering

Rule

Prepare authority and tools — do not rush execution.

B5) SOC “DO NOT CHASE”

- Diplomatic optimism narratives

- Long-cycle geopolitical reforms

- Consensus-heavy global initiatives

Rule

Hope without speed is value destruction.

SOC WEEK 7 / 26 — FINAL DECISION RULE

By the end of Week 7:

- ≥ 1 geo decision authorized

- ≥ 1 geo assumption killed

- Decision latency explicitly acknowledged

If nothing is killed → SOC is not applied.

SOC Anchor (Applied)

In Week 7 / 2026, geopolitical advantage belongs to those who decide faster than institutions can react.