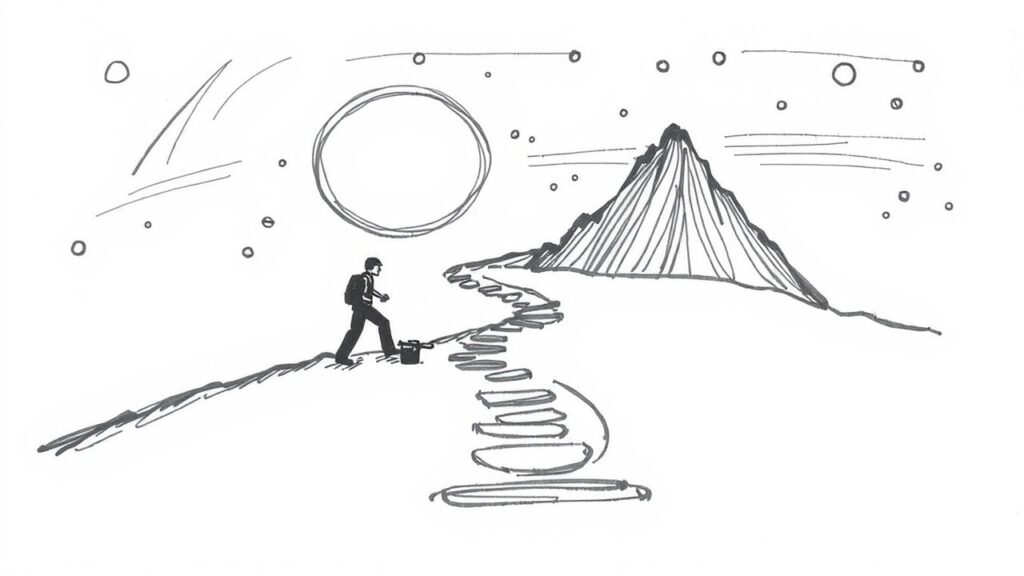

The AI-Age shifts wealth creation from mere effort to leveraging systems that multiply efficiency. Building lifetime wealth requires a multi-faceted approach focusing on skill adaptation, entrepreneurial ventures, and strategic investing in the AI ecosystem.

🚀 Skills for the AI-Augmented Workforce

AI will automate many routine and cognitive tasks, making uniquely human skills and the ability to work with AI the most valuable assets.

- Prompt Engineering and AI Tool Mastery: This is the foundational skill. Learn to communicate effectively with AI tools (like large language models and generative AI) to get high-quality, relevant results. This includes using AI for data analysis, content creation, and workflow automation.

- Human-Centric Skills (The New “Power” Skills): As AI handles technical calculations, roles will shift toward interpretation, communication, and management. Focus on:

- Creative Thinking and problem-solving beyond routine patterns.

- Empathy and Relationship Management for enriched client and team interactions.

- Adaptability and continuous learning, as the pace of technological change accelerates.

- AI Specialization: High-paying opportunities exist for those who can design, build, and deploy AI models, especially in high-demand areas like Machine Learning, Data Science, and building AI agents.

💡 Entrepreneurship and Business Leverage

The greatest wealth is being created by those who leverage AI as the ultimate multiplier for their business systems.

- Build AI-Powered Platforms: Start a Software as a Service (SaaS) business that integrates AI as a core feature. This could include specialized AI writing assistants, data visualization tools for niche industries, or personalized educational applications. The goal is to create a system that multiplies output without needing proportional human effort.

- Identify and Solve Niche Problems: Look for problems in large markets where AI can provide massive savings in time or cost. Focus on creating solutions with excellent user experience, as clients care more about the result than the underlying complexity.

- Adopt “Agentic-First” Workflows: For existing businesses, fully redesign workflows to integrate AI agents, moving beyond simply automating isolated tasks. This means a flatter organizational structure where human roles evolve to orchestrate hybrid human-AI teams.

💰 Strategic Investing in the AI Ecosystem

Investing is crucial for long-term wealth, and the AI sector presents significant growth potential, but also volatility.

- Invest in AI Enablers: Focus on companies that provide the foundational infrastructure for the AI revolution. This includes firms specializing in:

- AI Chip Manufacturing (GPUs and custom silicon).

- Cloud Computing and Data Centers (powering the training and deployment of AI models).

- Unique Data Providers (as proprietary data becomes a key differentiator for competitive AI models).

- Prioritize Fundamentals Over Hype: Evaluate AI stocks using a disciplined checklist that assesses:

- The company’s financial strength to afford the capital-intensive AI race.

- Whether AI is already contributing to measurable revenue.

- The company’s control over unique data and infrastructure advantage.

- Diversification and Long-Term Horizon: A long-term investment strategy is generally best suited for a transformative technology like AI. Diversify your portfolio to avoid over-concentration in a single sector, mitigating risk while capitalizing on the sector’s growth.

Business Case: www.rapidknowhow.com

The business case for RapidKnowHow is built on leveraging Artificial Intelligence (specifically implied Generative AI like ChatGPT) and proprietary consulting frameworks to provide instant, strategic solutions and drive wealth creation for business and sector leaders. The core value lies in converting complex, fragmented business knowledge into actionable, on-demand advice.

1. Executive Summary: AI-Powered Knowledge-as-a-Service (KaaS)

| Element | Description |

| Core Offering | A proprietary platform that combines human-led consulting with AI-driven knowledge synthesis to deliver rapid, strategic solutions. |

| Mission | “Empowering Leaders to Create Sustainable Wealth.” |

| Target Audience | “Leaders” across specialized domains (e.g., Business, Career, Wealth, Innovation, Sustainability, GeoPower). |

| Problem Solved | Overcoming the time and cost barrier of traditional consulting by offering instant knowledge retrieval and high-level strategic guidance. |

| Key Differentiator | The “Proprietary RapidKnowHow Systems” and the “ROICE Smart Search” combined with the power of large language models AI + IP. |

2. Value Proposition and Strategic Fit

RapidKnowHow addresses the demand for speed and precision in an era of information overload and rapid change (the “AI-Age”).

Value for the Customer (The Leader):

- Instant Solutions: The platform promises to allow users to “Describe your challenge — get the solution instantly.” This eliminates the typical delay and high expense associated with hiring human consultants for initial analysis or frequent, smaller queries.

- Specialized Expertise: The different “Leader” programs (e.g., Wealth Leader, Sustainability Leader, Industrial Gas Leader) indicate a focused knowledge base, offering specialized, vertical intelligence that generalist AI tools cannot provide.

- Total User Experience Focus: This suggests a commitment to making the interface and interaction seamless, reducing the cognitive load on the user.

Strategic Advantage (The Moat):

The power of the business case rests on the blending of Proprietary Systems with Generative AI:

- Proprietary Knowledge: The value is not the AI itself, but the curated, structured, and confidential data used to train or inform the AI output. This “know-how” is the company’s intellectual property (IP).

- System Thinking: Features like “ROICE Smart Search” and the focus on “Mastering ECOSYSTEM Leadership” suggest a structured framework for analyzing challenges, which provides better, more reliable output than raw AI prompts.

3. Business Model and Revenue Streams

RapidKnowHow likely employs a hybrid revenue model that captures value from both automated systems and high-touch human interaction.

| Revenue Stream | Description |

| Subscription (Platform Access) | Monthly or annual fees for access to the core AI-powered knowledge base, “ROICE Smart Search,” and interactive Q&A. Tiered pricing could be offered for specific “Leader” verticals (e.g., a higher fee for the “Investor Leader” program). |

| Consulting (Premium Services) | High-margin human consulting services for complex challenges that require bespoke solutions, deep dives, or implementation support. This serves as the high-touch extension of the initial AI analysis. |

| Programs/Training | Revenue from structured educational programs, workshops, or “Bootcamps” tied to the “PowerLeader” or other leader-specific offerings. |

| Partnerships/Alliances | Revenue from co-developing solutions or licensing the “Proprietary RapidKnowHow Systems” to other large organizations, software vendors, or data providers. |

4. Key Metrics and Investment Rationale

Operational Metrics (KPIs):

- Knowledge-to-Action Rate: The speed at which a user’s query is resolved and translated into a decision or action.

- System Usage/Stickiness: High frequency of log-ins and repeat usage of the AI Q&A feature, indicating the system is replacing traditional research methods.

- Consulting Conversion Rate: The percentage of platform users who upgrade to high-touch consulting services.

Investment Rationale:

Investing in RapidKnowHow is an investment in a scalable, defensible consulting model.

- Scalability: The AI layer provides high-margin scalability. The company can serve 1000s of users instantly without a proportional increase in human consultant headcount.

- Defensibility: The value is protected by the proprietary knowledge and data, making it difficult for pure AI competitors or traditional consulting firms to replicate quickly.

- Low Barrier to Entry (User Side): By offering instant, specialized knowledge, the company significantly lowers the barrier for leaders to seek strategic advice, expanding the total addressable market beyond what traditional, expensive consulting can reach.