Powered by People, Enabled by AI

Industrial Gas companies are strong operators.

Revenue is stable.

EBITDA margins are solid.

Capex programs are ambitious.

Yet one structural variable often remains under-optimized:

Free Cash Flow conversion.

Growth is visible.

Cash compounding is not always.

The Hidden Capital Opportunity

In many mid-tier Industrial Gas companies:

Working capital equals 15–20% of revenue.

Even a modest 5–10% improvement in capital velocity can release:

$50–100M annually.

Without revenue growth.

Without additional leverage.

Without expanding fixed assets.

This is not cost cutting.

It is capital discipline.

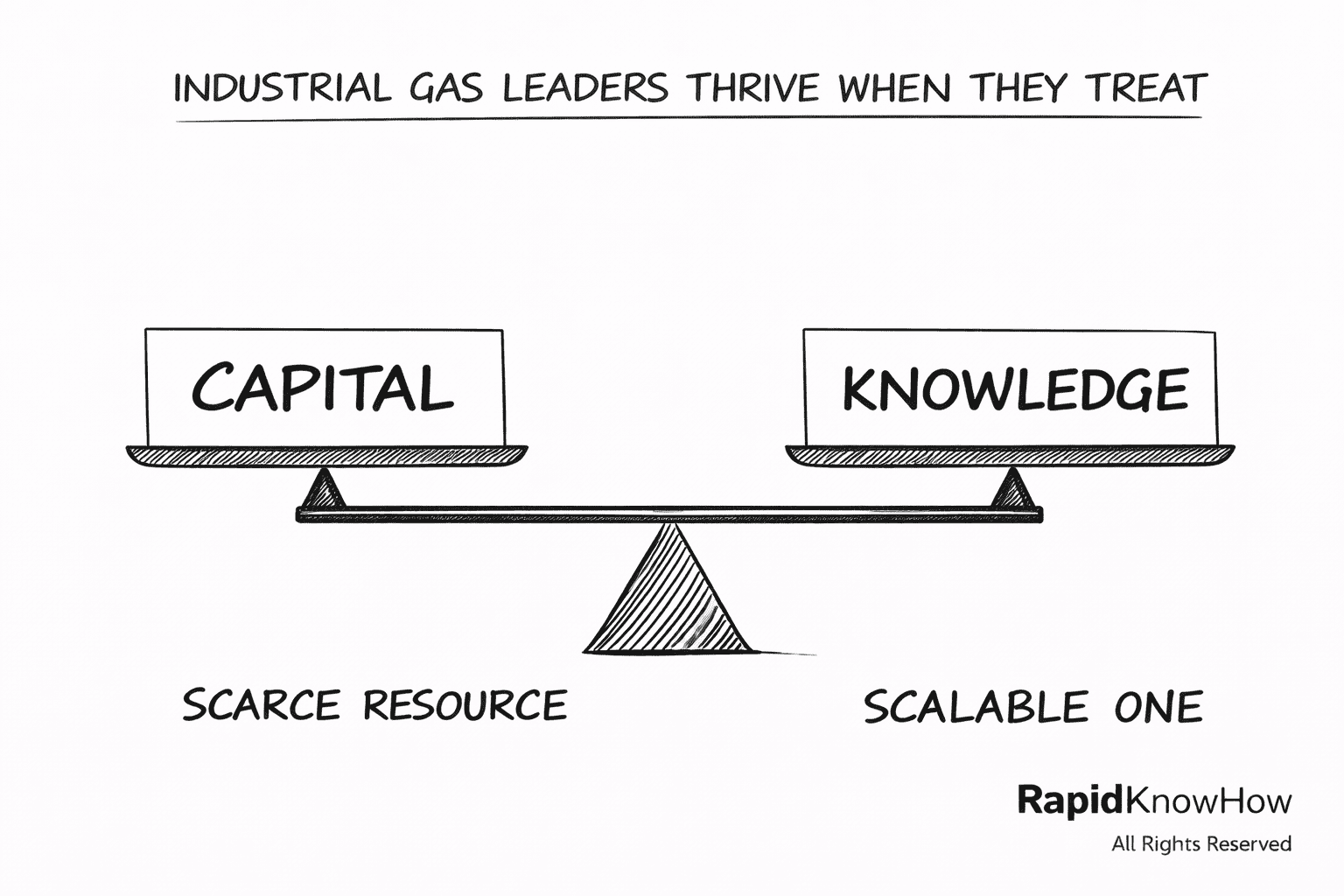

The Strategic Shift

Industrial Gas will always remain asset-intensive.

But competitive advantage no longer comes only from owning more fixed assets.

It increasingly comes from:

Better capital allocation.

Faster decision cycles.

Reduced volatility.

Stronger Free Cash Flow conversion.

This is where people power matters.

AI does not replace leadership.

AI improves signal clarity.

People interpret.

People prioritize.

People act.

When decision quality improves, capital velocity improves.

The Compounding Effect

Improved Free Cash Flow

→ Strengthens ROICE

→ Widens ROICE–WACC spread

→ Enhances valuation resilience

→ Expands strategic optionality

Excess cash funds innovation internally.

Innovation strengthens differentiation.

Differentiation reinforces ROICE.

This is a compounding ecosystem — financed by disciplined Free Cash Flow.

A Calm Observation

The next competitive frontier in Industrial Gases is not plant size.

It is capital intelligence.

Companies that combine:

People-driven capital discipline

with

AI-enabled signal clarity

will quietly outperform those who rely solely on asset expansion.

Free Cash Flow Driven Growth™

is not about doing more.

It is about doing better with what already exists. – Josef David