RapidKnowHow > The Due Diligence Simulation Model for Industrial Gases

Business Leader > Develop a Due Diligence Simulation Model for the Industrial Gas Sector > in Excel > Step-by-Step > 3 Scenarios > Conclusion

Creating a Due Diligence Simulation Model for the Industrial Gas Sector involves several steps, from understanding the sector to creating a robust Excel model that simulates different scenarios.

I’ll guide you through the process step-by-step, addressing key considerations and outlining how to structure the Excel model.

Step 1: Understand the Industrial Gas Sector

Before diving into the simulation model, it’s important to understand the fundamentals of the industrial gas sector, including:

- Main products (e.g., oxygen, nitrogen, hydrogen, argon)

- Key market players

- Regulatory environment

- Trends (e.g., decarbonization, technological advancements)

- Cost structures and profitability drivers

Step 2: Define Objectives of the Due Diligence Model

- Assess Value: Estimate the potential value of acquisition targets or investments based on various scenarios.

- Risk Analysis: Identify key risks impacting the market and the companies involved.

- Decision Support: Provide insights to support investment decisions.

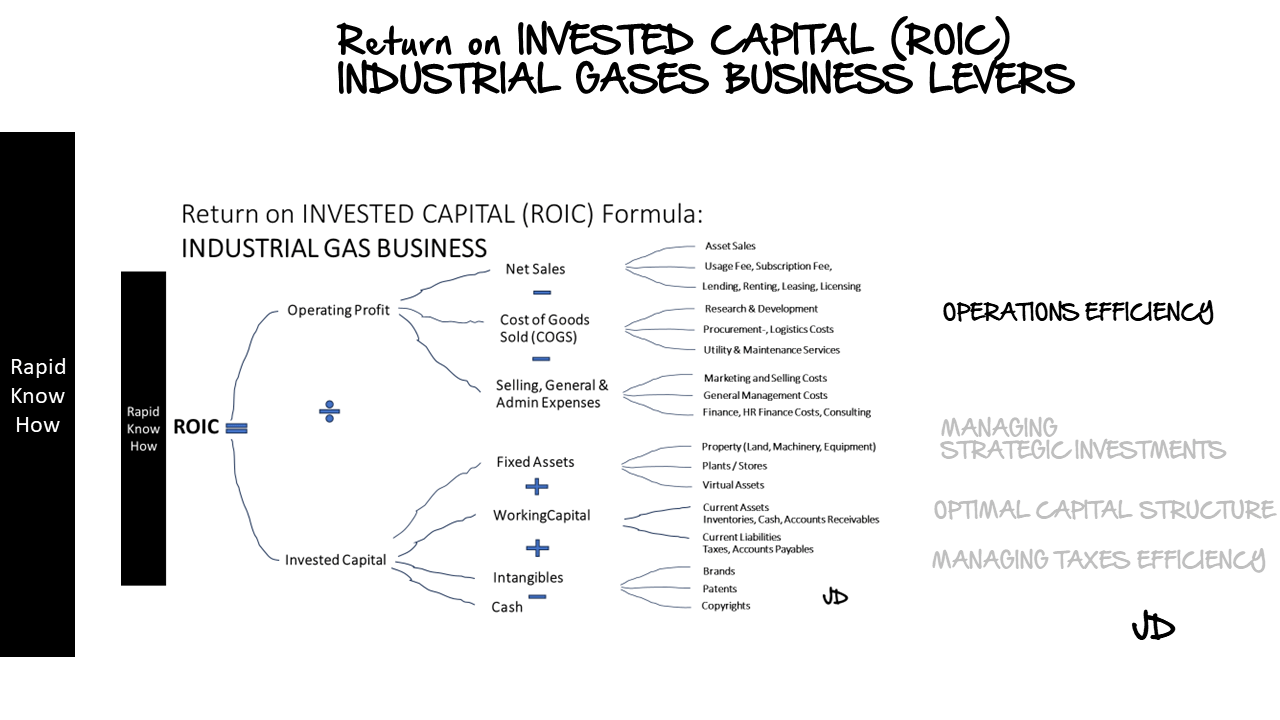

Step 3: Identify Key Variables for Simulation

List out the key variables influencing the industrial gas sector, such as:

- Market demand growth rate

- Pricing fluctuations

- Operating costs (fixed and variable)

- Capital expenditures

- Competitor activities

- Regulatory costs

- Economic factors (e.g., inflation, interest rates)

Step 4: Develop Three Scenarios

You can create scenarios based on different market conditions:

- Optimistic Scenario: High growth in demand, stable prices, and low operating costs.

- Base Scenario: Moderate growth, stable prices with some operational risks.

- Pessimistic Scenario: Low or negative demand, price reductions, and high costs.

Step5: Create the Excel Model

Structure of the Excel Model:

- Input Sheet:

- Define key assumptions for each scenario (e.g., growth rates, cost assumptions).

- Example layout:

Copy Code| Variable | Optimistic | Base | Pessimistic |

|----------------------------|------------|---------|-------------|

| Demand Growth Rate (%) | 7 | 4 | 0 |

| Average Selling Price ($) | 1500 | 1400 |1300 |

| Variable Cost ($) | 600 | 650 | 700 |

| Fixed Cost ($) | 50000 |52000 | 55000 |

- Calculation Sheet:

- Calculate revenues, costs, and net income based on the inputs.

- Example formulas might include:

- Revenue = Demand x Selling Price

- Operating Costs = Fixed Cost + (Variable Cost x Demand)

- Net Income = Revenue – Operating Costs

- Output Summary:

- Create a summary dashboard to display key results for each scenario.

- Include charts to visualize net income, revenues, and costs under each scenario.

Example layout:

Copy Code| Scenario | Revenue ($) | Costs ($) | Net Income ($) |

|---------------|-------------|-----------|----------------|

| Optimistic | 2,100,000 | 920,000 | 1,180,000 |

| Base | 1,400,000 | 1,020,000 |380,000 |

| Pessimistic | 1,000,000 | 1,250,000 | -250,000 |

Step6: Conduct Sensitivity Analysis

- Assess how changes in key inputs impact the outputs. Use Excel’s Data Tables or Scenario Manager.

- For example, vary the demand growth rate between -5% and +10% to see its effects.

Step7: Run the Scenarios

- Utilize the defined inputs from each scenario and calculate results in your model.

- Document insights from each simulation, noting which assumptions had the most significant impact.

Step 8: Conclusion

Summarize findings:

- Highlight critical sensitivities to market conditions.

- Document potential risks and rewards for investing in the industrial gas sector.

- Provide summarized actionable insights that a business leader can utilize for strategic planning or investment decisions.

Example Conclusion

“In conclusion, our due diligence simulation model indicates that the industrial gas sector offers significant potential under optimistic market conditions, with the possibility of generating high net income and robust cash flows.

However, a thorough assessment of operational risks, pricing pressures, and regulatory changes is essential. Investors should prepare for a range of outcomes, as the pessimistic scenario suggests a challenging market landscape that could lead to losses. Therefore, strategic planning should prioritize flexibility and responsiveness to market dynamics.”

Additional Notes

- Ensure to perform regular reviews of the model for accuracy.

- Continuously update market data to reflect real-time changes in the industrial gas sector.

This step-by-step guide provides a comprehensive overview of building a due diligence simulation model tailored to the unique dynamics of the industrial gas sector.