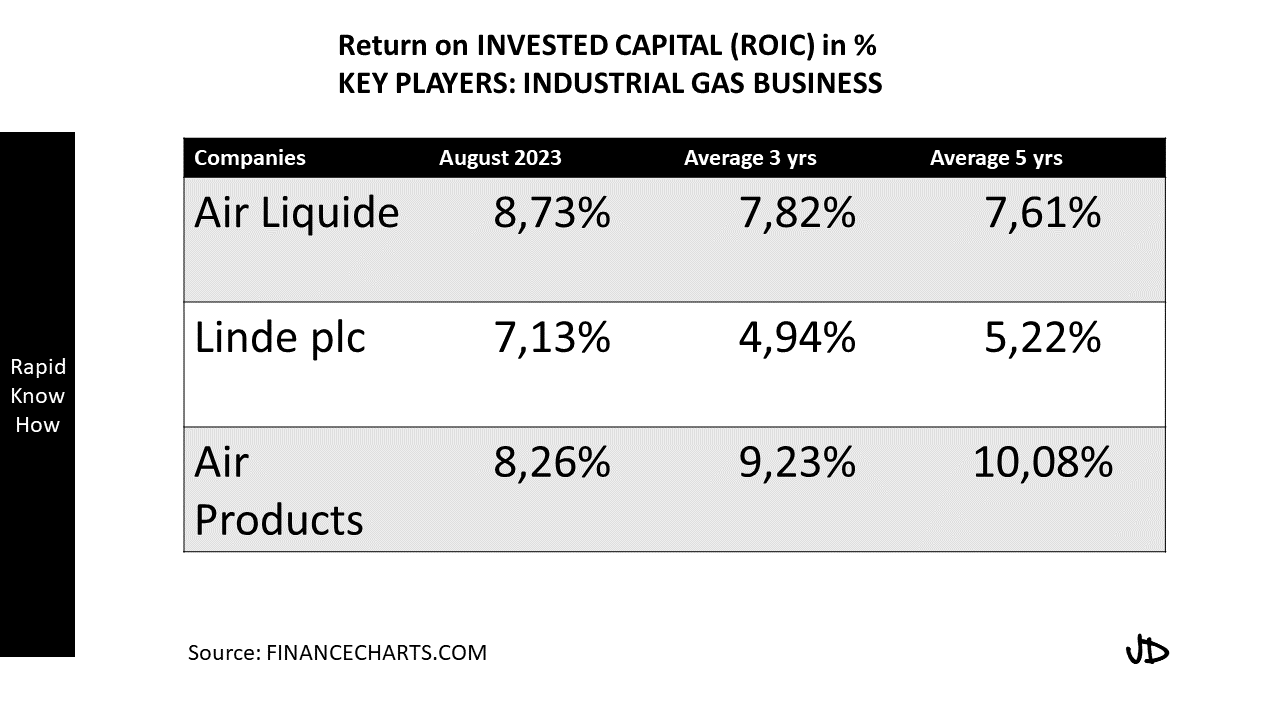

RapidKnowHow > Industrial Gas Leader : Strategic Fit of Key Market Players : Linde plc, Air Liquide, Air Products, Messer Group, SIAD > Comparing Key Strategic KPIs > Rank from Best to Worst Strategic Fit , Conclusion

To evaluate the strategic fit of key market players in the industrial gas sector—specifically Linde plc, Air Liquide, Air Products, Messer Group, and SIAD—we can consider various key performance indicators (KPIs) that reflect their strategic positioning, market influence, operational efficiency, and innovation capabilities.

Key Strategic KPIs for Comparison

- Market Share and Revenue Growth: Indicates the company’s position in the market and its ability to capture a larger customer base.

- Geographic Reach: Reflects the company’s global presence and accessibility to markets, including emerging economies.

- Product and Service Diversification: Assesses the range of products and services offered, highlighting innovation, responsiveness to market changes, and customer satisfaction.

- Operational Efficiency: Includes metrics like cost structure, supply chain efficiency, and production capabilities, which impact profitability.

- Sustainability Initiatives: Evaluates the commitment to sustainable practices and technologies, including investments in green hydrogen and carbon capture.

- R&D Investment: Considers the level of investment in research and development to drive innovation and future growth.

- Customer Base and Key Industries Served: Highlights the industries powered by the company’s gases (e.g., healthcare, energy, manufacturing) and the diversity of the customer base.

Strategic Fit Analysis of Key Players

Based on the evaluated KPIs, here’s a comparative assessment:

- Linde plc

- Market Share and Revenue Growth: Strong global leader with the largest market share in the industrial gas sector.

- Geographic Reach: Extensive global network, particularly strong in North America and Europe.

- Product and Service Diversification: Offers comprehensive product lines, including specialty gases and advanced technologies.

- Operational Efficiency: High operational efficiency and strong cost management.

- Sustainability Initiatives: Leader in sustainability with substantial investment in green technologies.

- R&D Investment: Significant commitment to R&D with a focus on innovation.

- Customer Base: Diverse across various sectors including healthcare, electronics, and manufacturing.

Conclusion: Linde has the strongest overall strategic fit based on comprehensive KPIs.

- Air Liquide

- Market Share and Revenue Growth: Substantial market share and consistent revenue growth.

- Geographic Reach: Strong presence in Europe and significant operations in Asia and North America.

- Product and Service Diversification: Broad portfolio including healthcare and industrial applications.

- Operational Efficiency: Very efficient operations with good margins.

- Sustainability Initiatives: Committed to the energy transition, investing in clean hydrogen and circular economy initiatives.

- R&D Investment: Strong focus on innovation particularly in new technologies.

- Customer Base: Extensive, serving a wide array of sectors.

Conclusion: Air Liquide ranks close second due to its strong strategic fit and commitment to sustainability.

- Air Products

- Market Share and Revenue Growth: Significant market presence with solid growth, especially in industrial gases for energy.

- Geographic Reach: Primarily strong in North America with growing international presence.

- Product and Service Diversification: Comprehensive range, notably in hydrogen for energy applications.

- Operational Efficiency: Highly efficient operations but slightly lagging compared to Linde and Air Liquide.

- Sustainability Initiatives: Strong emphasis on energy transition and sustainability.

- R&D Investment: Significant but not as strong as Linde and Air Liquide.

- Customer Base: Diverse, with key industries including energy and electronics.

Conclusion: Air Products is a solid player with good strategic fit, particularly in the energy sector.

- Messer Group

- Market Share and Revenue Growth: Stable, localized growth mainly in Europe and parts of Asia.

- Geographic Reach: Regional focus but is expanding into new markets.

- Product and Service Diversification: Offers a good range of products but less diversified than larger players.

- Operational Efficiency: Reasonably efficient but more localized compared to larger firms.

- Sustainability Initiatives: Committed but less visibility compared to the top players.

- R&D Investment: Moderate investment in innovation.

- Customer Base: Concentration in specific industries, which can limit growth.

Conclusion: Messer Group has a decent strategic fit, particularly in Europe, but can improve in diversification and sustainability.

- SIAD

- Market Share and Revenue Growth: Smaller player with modest growth prospects.

- Geographic Reach: Mainly present in Europe with limited global reach.

- Product and Service Diversification: A narrow range of products relative to larger competitors.

- Operational Efficiency: Less efficient operations; needs improvement.

- Sustainability Initiatives: Limited investment relative to industry leaders.

- R&D Investment: Low in comparison to peers.

- Customer Base: Much smaller and less diversified customer base.

Conclusion: SIAD has the weakest strategic fit due to limited scale, geography, and innovation capacity.

Rankings from Best to Worst Strategic Fit

- Linde plc – Best strategic fit

- Air Liquide – Strong strategic fit

- Air Products – Good strategic fit

- Messer Group – Decent strategic fit

- SIAD – Worst strategic fit

Final Conclusion

Linde plc and Air Liquide stand out as leaders in the industrial gas sector, demonstrating the best strategic fit based on critical KPIs.

Their comprehensive market strategies, operational efficiencies, and sustainability commitments position them as industry frontrunners.

Air Products also performs well, particularly in the energy segment, while Messer Group and SIAD, although stable, have significant room for improvement in operational scale and service diversification to enhance their competitive positioning.