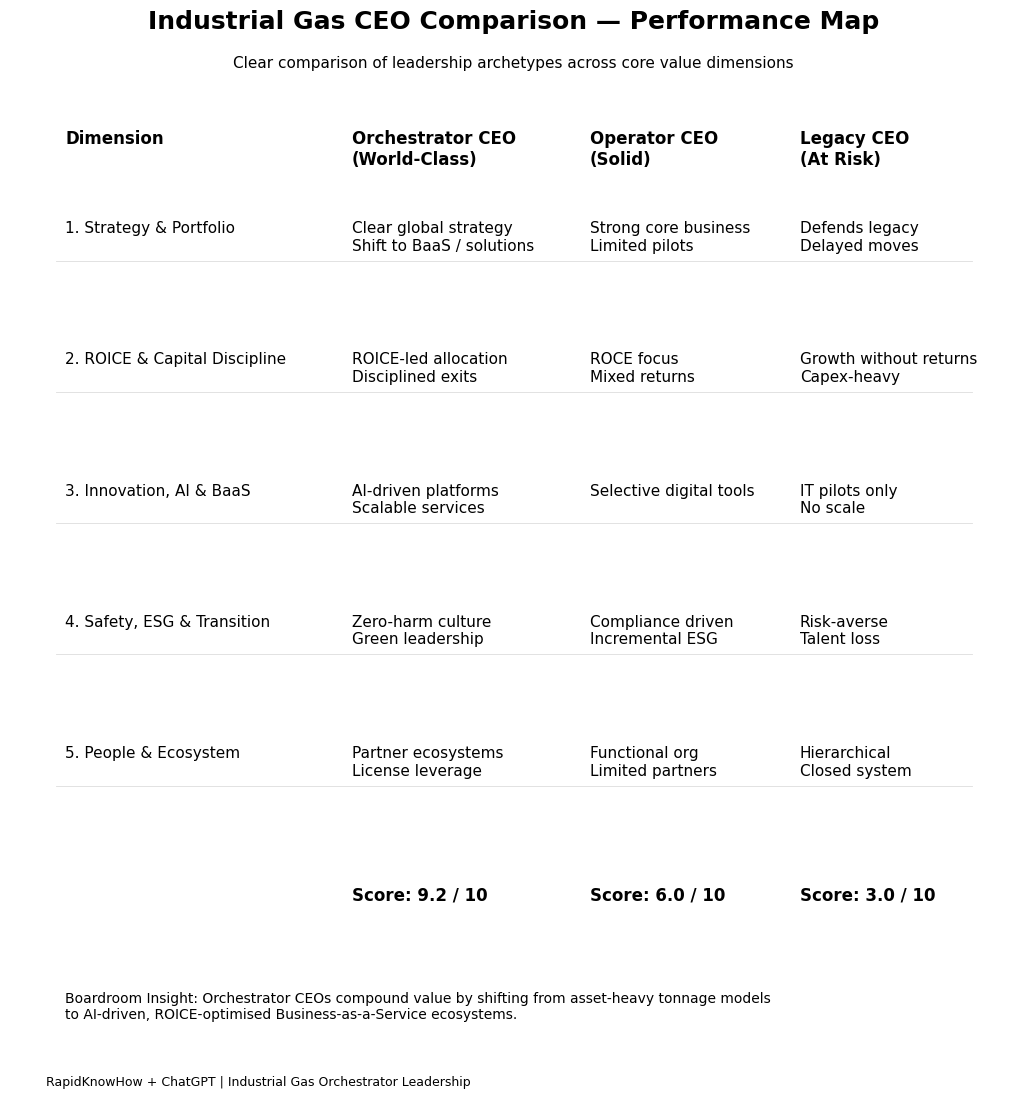

1️⃣ Concept: Three CEO Archetypes

We compare three typical Industrial Gas CEOs:

- Orchestrator CEO – World-Class

- Builds BaaS / Asset-Light ecosystems, ROICE-driven, AI + digital, strong safety & sustainability, alliance builder.

- Operator CEO – Mediocre / Solid

- Runs a classic product + tonnage portfolio, incremental improvement, some digital, limited ecosystem thinking.

- Legacy CEO – Poor

- Protects old asset-heavy model, slow on AI & decarbonisation, weak capital discipline, reactive to disruption.

Dimensions:

- Strategy & Portfolio

- ROICE & Capital Discipline

- Innovation & AI / BaaS

- Safety, ESG & Energy Transition

- People, Culture & Ecosystem

Scores: 1–10, with colour coded performance.

Industrial Gas CEO Comparison – Performance Map

Benchmark three Industrial Gas CEO archetypes across strategy, ROICE, innovation, ESG and culture.

| Dimension |

Orchestrator CEO World-Class |

Operator CEO Mediocre / Solid |

Legacy CEO Poor / At Risk |

|---|---|---|---|

| 1. Strategy & Portfolio Mix of bulk, onsite, specialty, services; clarity on Asset-Light / BaaS shift. |

Clear global strategy, shifts from product tons to BaaS / solutions ROICE; disciplined exits from low-return segments; strong CEE / growth-market playbook. | Solid core business focus; keeps traditional tonnage and cylinder portfolio competitive, but only pilots BaaS and new segments. | Protects legacy footprint, defends old contracts, weak portfolio pruning, waits for “market clarity” before moving. |

| 2. ROICE & Capital Discipline Return on Innovation, Convenience & Efficiency / ROCE, cash-flow, balance sheet. |

Uses ROICE and ROCE as steering wheel; invests in high-return projects, de-risks capex via alliances, transparent capital allocation to investors. | Classic ROCE focus; acceptable returns, but innovation projects measured weakly; some stranded assets remain. | Growth for growth’s sake; overbuilds plants, poor pricing discipline, weak divestment of underperforming assets. |

| 3. Innovation, AI & BaaS Digital, predictive, platform & service models. |

Builds AI-driven service platforms (remote monitoring, predictive maintenance, customer portals); creates Industrial Gas-as-a-Service and licenses playbooks. | Selective digital projects (route optimisation, basic remote monitoring); innovation not integrated into core P&L. | Sees AI as “IT topic”; innovation theatre without scale; misses platform and data opportunities. |

| 4. Safety, ESG & Energy Transition Safety culture, decarbonisation, green gases, hydrogen, circular models. |

Zero-harm culture, transparent KPIs; bold CO₂-reduction path; credible green hydrogen and CCUS portfolio; partners with customers on ESG. | Meets regulatory minimums, incremental energy efficiency, pilot projects in green hydrogen; ESG treated as cost, not growth driver. | Safety reactive not proactive; ESG limited to glossy reports; late mover on energy transition. |

| 5. People, Culture & Ecosystem Leadership bench, partner networks, licensees. |

Develops orchestrator leaders in regions; encourages intrapreneurs; builds ecosystems with OEMs, distributors, digital partners and licensees. | Solid engineering culture, but siloed organisations; partnerships mainly transactional. | Top-down, risk-averse culture; talent leaves; partners see company as slow and difficult. |

| Total Score (1–10 average) | 9.2 / 10 | 6.0 / 10 | 3.0 / 10 |

Boardroom Insight: An Orchestrator CEO compounds value by shifting from tons sold to BaaS- and ROICE-driven ecosystems. Legacy CEOs destroy value by defending asset-heavy models and delaying AI & ESG transformation.

RapidKnowHow + ChatGPT · Industrial Gas Orchestrator Leadership · All Rights Reserved