We combine our RapidKnowHow AI-Driven Orchestrator Leadership Model with a Big-3 Industrial Gas Composite (Linde, Air Liquide, Air Products) and translate numbers into a strategic control cockpit.

A) INDUSTRY BIG-3 COMPOSITE (2020–2025)

(Weighted by Market Cap, converted conceptually to USD for comparability)

1️⃣ Market Value (Big-3 Combined)

| Year | Approx. Combined Market Cap |

|---|---|

| 2020 | ~$262B |

| 2021 | ~$317B |

| 2022 | ~$298B |

| 2023 | ~$353B |

| 2024 | ~$360B |

| 2025 | ~$347B |

Observation:

• Structural expansion despite volatility

• Linde + Air Liquide compounding

• APD capital-cycle drag since 2023

2️⃣ Free Cash Flow Composite (Directional)

| Year | Composite FCF |

|---|---|

| 2020 | ~$7.4B |

| 2021 | ~$10.2B |

| 2022 | ~$8.5B |

| 2023 | ~$6.9B |

| 2024 | ~$4.6B |

| 2025 | ~$3.8–4.0B |

Signal:

• Peak 2021

• Decline due to APD heavy capex

• Core model still structurally cash generative

3️⃣ Composite ROCE (Weighted Trend)

| Year | ROCE Trend |

|---|---|

| 2020 | ~9–10% |

| 2021 | ~9–10% |

| 2022 | ~10–11% |

| 2023 | ~11–12% |

| 2024 | ~11–12% |

| 2025 | ~10–11% |

Interpretation:

The sector structurally operates in a double-digit ROCE corridor, but capital allocation discipline is decisive.

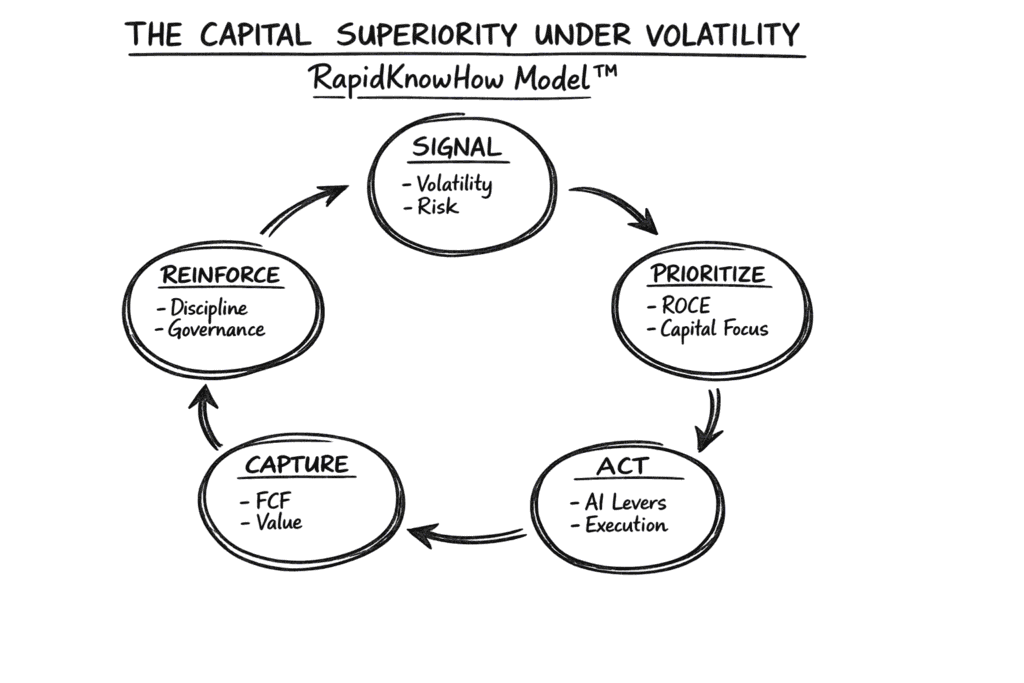

B) RAPIDKNOWHOW AI-ORCHESTRATOR MODEL APPLIED TO BIG-3

Now we switch from reporting mode → to leadership orchestration mode.

Our model:

Signal → Prioritize → Act → Capture → Reinforce

1️⃣ SIGNAL (2026–2030)

Key structural signals:

• Hydrogen build-out cycle

• Semiconductor gas demand

• Energy transition volatility

• High interest rates → capital discipline required

• AI infrastructure build → specialty gas boost

Big-3 Composite Insight:

The sector is strong — but entering a capital-intensive reinvestment cycle.

2️⃣ PRIORITIZE

Orchestrator Priorities for Industrial Gas Leaders:

- Protect ROCE corridor > 12%

- Convert hydrogen CAPEX into contracted FCF

- Optimize asset utilization (digital twins + AI scheduling)

- Avoid political CAPEX without secured return

- Tight working capital AI control

3️⃣ ACT (AI-Driven Levers)

Where our AI-Orchestrator Model adds structural advantage:

| Traditional | AI-Orchestrator Advantage |

|---|---|

| Static pricing reviews | Real-time margin optimization |

| Reactive plant maintenance | Predictive AI asset control |

| Capex approval committees | AI scenario ROCE simulations |

| Lagging KPI dashboards | Live volatility exposure index |

| Annual planning | Weekly Signal-to-Capital loop |

4️⃣ CAPTURE (FCF Acceleration Logic)

Composite potential 2030:

If Big-3 restore:

• ROCE corridor → 13–15%

• FCF conversion → 90%+

• Capex discipline improved

Then Big-3 composite FCF 2030 could return to:

👉 $12B–$15B annually

Which implies:

👉 Combined Market Cap 2030: $420B–$500B

(if capital markets price compounding stability)

5️⃣ REINFORCE (Compounding Engine)

The Orchestrator must institutionalize:

• Weekly volatility governance

• AI-based contract repricing

• Dynamic energy pass-through

• Capital kill-switch discipline

• Portfolio pruning discipline

This is where 99% of companies fail.

C) 2030 SCENARIO SNAPSHOT (BIG-3)

| Scenario | Market Cap | FCF | ROCE |

|---|---|---|---|

| Bear | $350B | $7–8B | 9–10% |

| Base | $420B | $12B | 13% |

| Bull | $500B+ | $15B+ | 15% |

D) STRATEGIC CEO SNAPSHOT

Industrial Gases is:

• Not a growth hype sector

• Not a commodity sector

• A compounding infrastructure cash engine

But only if capital discipline + AI orchestration exist.

E) Strategic Conclusion for the Industrial Gas Sector

AI-Driven Orchestrator Leadership Model fits this sector perfectly because:

- It is capital-intensive.

- It requires volatility governance.

- It lives from long-term contracts.

- Small margin differences → huge FCF impact.

RapidKnowHow is not selling AI.

RapidKnowHow provides:

Capital Allocation Superiority Under Volatility.

And nobody frames it this way yet in Industrial Gases.- Josef David

Industrial Gases 2026–2030

The Sector Will Not Fail from Demand.

It May Fail from Capital Misallocation.

Industrial Gases remains one of the most structurally resilient infrastructure sectors in the world.

Demand drivers remain intact:

- Semiconductor expansion

- Healthcare growth

- Energy transition

- Hydrogen build-out

- AI infrastructure support

Yet between 2026–2030, the decisive variable is not growth.

It is Capital Discipline under Volatility.

The Quiet Risk

- Free Cash Flow compression

- Hydrogen CAPEX acceleration

- Energy volatility

- Interest-rate sensitivity

The sector is stable.

But the margin for capital error is shrinking.

The Leadership Question

Will Industrial Gas companies:

A) Continue traditional capital cycles

B) Install a Capital Allocation Intelligence System?

The difference between these paths by 2030 is structural — not incremental.

The Missing Layer

Most companies manage operations well.

Few institutionalize:

- Capital velocity control

- ROCE protection corridors

- Volatility governance

- Weekly signal-to-capital conversion

This missing layer is AI-Orchestrated Capital Intelligence.

Not AI hype.

Not dashboards.

Not digital slogans.

Capital allocation discipline — institutionalized.

Who This Is For

Owners.

Board members.

Capital stewards.

Not buzzword seekers.

Confidential Executive Brief

Selective access available for leaders exploring:

AI-Orchestrator Leadership in Industrial Gases 2026–2030.

RapidKnowHow | Capital Superiority Under Volatility

Requests are reviewed individually.