– Let’s design The Top 10 Ecosystem Builder Formulas 2025–2030.

Here we focus on how leaders create, scale, and sustain ecosystems (business, civic, or digital) that generate compounding value.

🌐 The RapidKnowHow – Top 10 Ecosystem Builder Formulas 2025–2030

1️⃣ Anchor Platform Formula

= Core Service × Open APIs × Partner Access

👉 Build the “digital town square” others connect to (example: Microsoft Azure, Shopify).

2️⃣ Network Effect Formula

= More Users × More Value ÷ Switching Costs

👉 Each new participant makes the ecosystem more attractive (example: Airbnb, LinkedIn).

3️⃣ Trust & Transparency Formula

= Verified Data × Governance × Security

👉 Trust accelerates adoption → ecosystem becomes indispensable (example: blockchain consortia, Gaia-X).

4️⃣ Co-Creation Formula

= Innovators × Customers × Communities

👉 Ecosystems thrive when users are co-designers (example: open-source, developer ecosystems).

5️⃣ Circular Value Formula

= One’s Waste → Another’s Resource

👉 Industrial ecosystems that reduce cost + emissions by design (example: Kalundborg Symbiosis, Umicore).

6️⃣ Licensing & Replication Formula

= Proven Model × Scalable Playbook × Local Partners

👉 Spread fast via franchise/licensing ecosystems (example: RapidKnowHow, McDonald’s, Montessori).

7️⃣ Citizen Participation Formula

= Digital Platforms × Direct Involvement

👉 Democracy and civic ecosystems get stronger with active citizen input (example: Swiss e-democracy pilots).

8️⃣ Financing Ecosystem Formula

= Capital Pools × Shared Risk × Collective ROI

👉 Sustainable ecosystems require blended finance (example: green bonds, venture networks).

9️⃣ Cross-Sector Alliance Formula

= Industry A + Industry B + Tech

👉 Build hybrid ecosystems where boundaries blur (example: EV + Energy + IT in Tesla/Enel/ChargePoint networks).

🔟 Legacy & Purpose Formula

= Shared Vision × Intergenerational Value

👉 The strongest ecosystems thrive because they serve a higher purpose beyond profit (example: Patagonia networks, family wealth alliances).

⚡ Power Insight

Ecosystem Builders 2025–2030 don’t just run companies – they design environments where businesses, citizens, and institutions mutually reinforce value.

- Leaders who apply these formulas own the gameboard, not just a piece of it.

- Followers play on others’ platforms.

- Laggards remain isolated and decline.

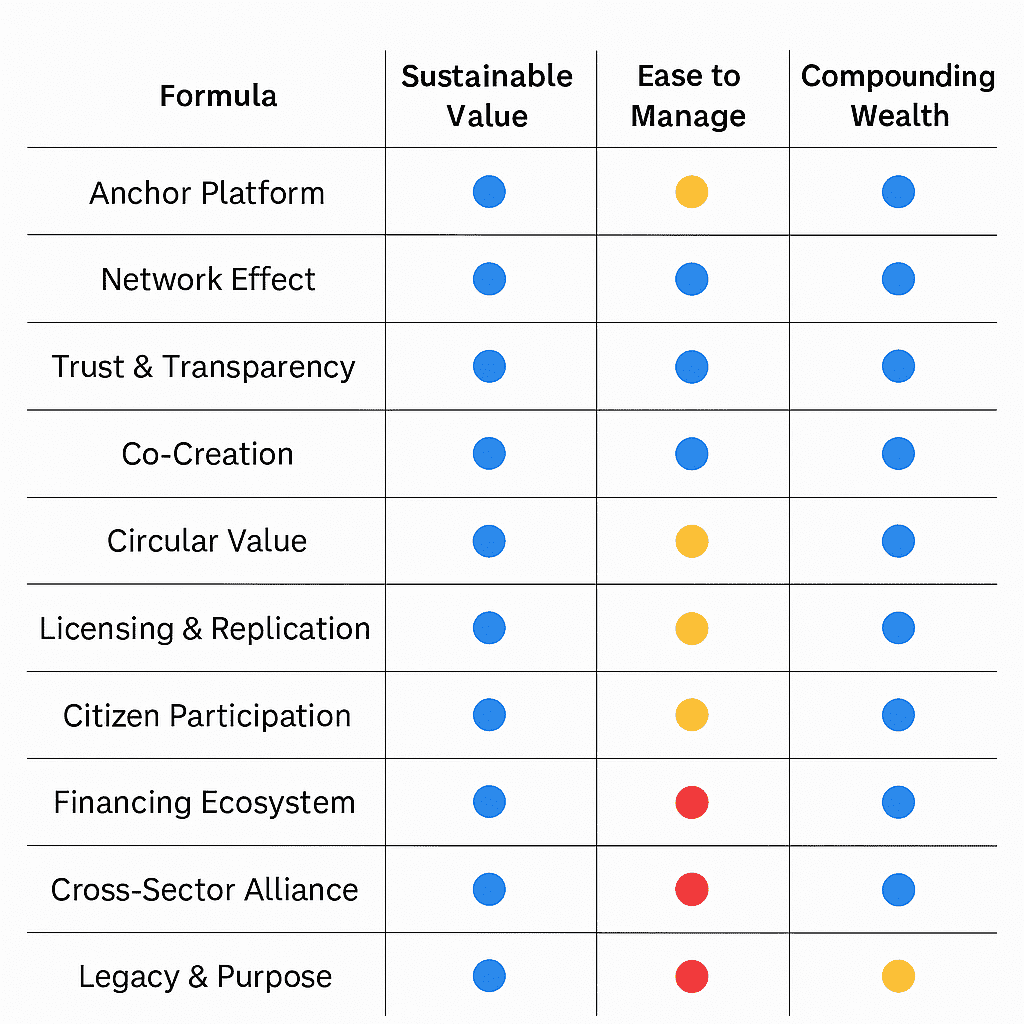

Assessing the 10 Ecosystem Builder Formulas

– Let’s assess the 10 Ecosystem Builder Formulas using three criteria:

- Sustainable Value → Long-term resilience, environmental & social fit.

- Ease to Manage → Complexity, governance, and control effort.

- Compounding Wealth Creation → Ability to scale and multiply returns.

I’ll use a High / Medium / Low assessment format so you can quickly compare.

🌐 Assessment of the 10 Ecosystem Builder Formulas (2025–2030)

| # | Ecosystem Formula | Sustainable Value | Ease to Manage | Compounding Wealth Creation | Comment |

|---|---|---|---|---|---|

| 1️⃣ | Anchor Platform | High | Medium (platform governance critical) | High | Creates digital infrastructure, attracts partners long-term. |

| 2️⃣ | Network Effect | High | Medium | Very High | Flywheel model – strongest compounding once critical mass is reached. |

| 3️⃣ | Trust & Transparency | Very High | Medium | High | Essential for adoption; slower to scale but enduring. |

| 4️⃣ | Co-Creation | High | Medium-High (requires openness) | High | Engaged communities drive innovation continuously. |

| 5️⃣ | Circular Value | Very High | Low-Medium (industrial integration complex) | High | Structural cost + sustainability advantage, but complex governance. |

| 6️⃣ | Licensing & Replication | High | High (clear playbook = easier) | Medium-High | Scales fast across geographies, compounding depends on local execution. |

| 7️⃣ | Citizen Participation | High | Medium-Low (political complexity) | Medium | Builds legitimacy + social capital, wealth indirect but long-term. |

| 8️⃣ | Financing Ecosystem | Very High | Medium | High | Capital attracts capital, ESG finance compounds wealth with impact. |

| 9️⃣ | Cross-Sector Alliance | High | Medium-Low (coordination challenges) | High | Unlocks new markets, but fragile if interests diverge. |

| 🔟 | Legacy & Purpose | Very High | High | Medium | Builds resilience & loyalty over decades, compounding slower but stable. |

⚡ Insights

- Top Compounding Wealth Engines: Network Effect (2), Anchor Platform (1), Financing Ecosystem (8).

- Most Sustainable Long-Term: Circular Value (5), Trust & Transparency (3), Legacy & Purpose (10).

- Easiest to Manage & Scale: Licensing & Replication (6), Anchor Platform (1).

👉 The sweet spot for 2025–2030 is Anchor Platform + Network Effect + Licensing & Replication → together, they scale fast, sustain value, and compound wealth.