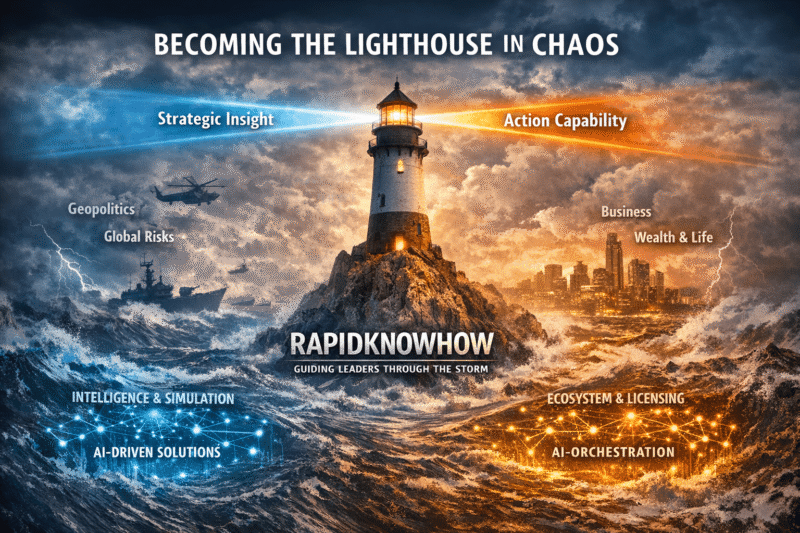

Thriving WEALTH Capital — From Fragile to Leadership

A RapidKnowHow + ChatGPT Power Guide to compound Financial, Knowledge, Relational, and Legacy Capitals with a single Growth Multiplier. Minimal. Action-first. Results-driven.

Contents

1) Model & Formula

2) Diagnostic Rubric (0–10 per capital)

3) 12-Month Roadmap (2026)

4) 90-Day Sprint Playbook

5) Operating System (weekly cadence)

6) Metrics That Matter

7) Scripts & Templates

8) Interactive Tools

9) Risks & Anti-Patterns

10) Next Steps & CTA

1) Model & Formula

Total WEALTH = (F + K + R + L) × G

- F = Financial Capital (assets, surplus, liquidity, debt quality)

- K = Knowledge Capital (codified IP, tools, playbooks, systems)

- R = Relational Capital (partners, trust, distribution, referrals)

- L = Legacy Capital (brand trust, continuity, repeatability, impact)

- G = Growth Multiplier (applied once): Asset-Light × AI × Licensing Discipline

Tip: Improve your weakest capital by +2 in 30 days, then lift G via SOPs + automation + partners.

2) Diagnostic Rubric (score 0–10)

F — Financial

- 0–2: Runway <1 mo; savings <5%; high-interest debt; 1 stream

- 3–4: Runway 1–3 mo; 5–10% savings; 1–2 streams

- 5–6: Runway 3–6 mo; 10–20%; 2 streams

- 7–8: Runway 6–12 mo; 20–30%; 3+ streams; autopay allocations

- 9–10: Runway 12+ mo; 30%+; 4+ streams; drawdown play

K — Knowledge

- 0–2: In head only; no repeatable method

- 3–4: Fragmented notes; no packaging

- 5–6: 1 MVP playbook/tool; first results

- 7–8: 2–3 assets; cases; monthly updates; AI ops

- 9–10: 4+ assets; SOPs; QA; fast cloning

R — Relationship

- 0–2: No partners; ad-hoc intros; no CRM

- 3–4: Few warm contacts; no terms

- 5–6: 3 active; rev-share; monthly touches

- 7–8: 5–10 active; ≥30% revenue via partners; weekly co-marketing

- 9–10: 10–15 active; ≥50%; SLAs; dashboards; waitlist

L — Legacy

- 0–2: Person-dependent; no docs; no continuity

- 3–4: Basic docs; sporadic repeat

- 5–6: Clear promise; 20–40% repeat; IP registry

- 7–8: 40–60% repeat; brand proof; handover pack

- 9–10: 60%+ repeat; survives leadership change; legal/IP strong

3) 12-Month Roadmap (2026)

Q1 — Build

- Ship 1 licenseable asset (PDF/HTML + mini-tool)

- Sign 3 partners; 1 campaign live

- Automate surplus allocations

- Set SOP for weekly release

Q2 — Run

- 8 active partners; weekly co-marketing

- 30–40% partner-sourced revenue

- 2nd asset live; case proofs

- Automation to 40–60%

Q3 — Scale

- 12 active partners; tiering (Gold/Platinum)

- 45–50% partner-sourced revenue

- Launch BaaS billing

- QBRs & dashboards

Q4 — Lead

- 15 active partners; waitlist

- ≥50% partner-sourced revenue

- Portfolio of 4 assets; handover pack

- Spin-up new SKU in days

4) 90-Day Sprint Playbook

Days 1–30

- Define offer 1-pager + economics

- Co-marketing kit (emails/posts/webinar)

- Outreach 30–30–10 → 3 signed

Days 31–60

- Weekly launch with partners

- Tracker: clicks → leads → revenue

- CRM hygiene & stage discipline

Days 61–90

- QBR with top 3 partners

- Tier incentives; ask 2 intros

- Target: 8–10 active partners

5) Operating System (weekly cadence)

- Mon: 30m partner pipeline review (stages, blockers, next step)

- Wed: ship one co-marketing asset with a partner

- Fri: numbers + learnings message to partners

Stages: Identified → Contacted → Qualified → Agreed → Live → Producing → Scaling

6) Metrics That Matter

- Partner-sourced revenue % (aim ≥50%)

- Active partners (produced revenue in last 30d)

- Launch velocity (new partner go-lives / month)

- Pipeline coverage (90d expected ÷ monthly target ≥3×)

- Conversion funnel by stage

7) Scripts & Templates

Partner opener (email/LinkedIn)

Hi {{Name}} — your audience of {{niche}} struggles with {{pain}}.

We have a 1-pager that produced {{result}} in {{time}}.

Simple {{rev-share%}} rev-share, full co-marketing kit. Worth 15 min next week?

Post-meeting summary

Thanks, {{Name}}. Summary: audience {{…}}, asset {{…}}, go-live {{date}}.

Attached: 1-pager, agreement draft, UTMs.

Next step: approve creative by {{date}}; launch {{date}}. Tracker coming.

8) Interactive Tools

Asset-Light

AI-Powered

Licensing

SOPs

Capitals Sum26

Growth Multiplier G (applied once) 1.5

Set values and click “Compute”.

Safety

Emergency Fund

Growth

Index/Equity

Cashflow

BaaS / IP

Impact

Donations

Run the Compass to see runway, surplus and actions; then allocate your surplus.

Aim for ≥5/6 before scaling licensing.

Definition of Done: first revenue / signed license + documented playbook.

9) Risks & Anti-Patterns

- Single “whale” partner >30% of revenue

- No written economics / SLA / UTMs

- Quarterly-only communication (relationships decay)

- Over-customization (kills scale and G)

- Not shipping weekly (momentum loss)

10) Next Steps & CTA

Now: Run the 4 tools above (F,K,R,L,G → score; Compass; Readiness; Sprint).

Then: Pick one 30-day booster for your weakest capital and schedule weekly ship cadence.

Privacy: This demo runs locally in your browser.

RapidKnowHow + ChatGPT | WEALTH Leadership Delivered

© 2025 RapidKnowHow — All Rights Reserved