⚡ Power Executive Summary

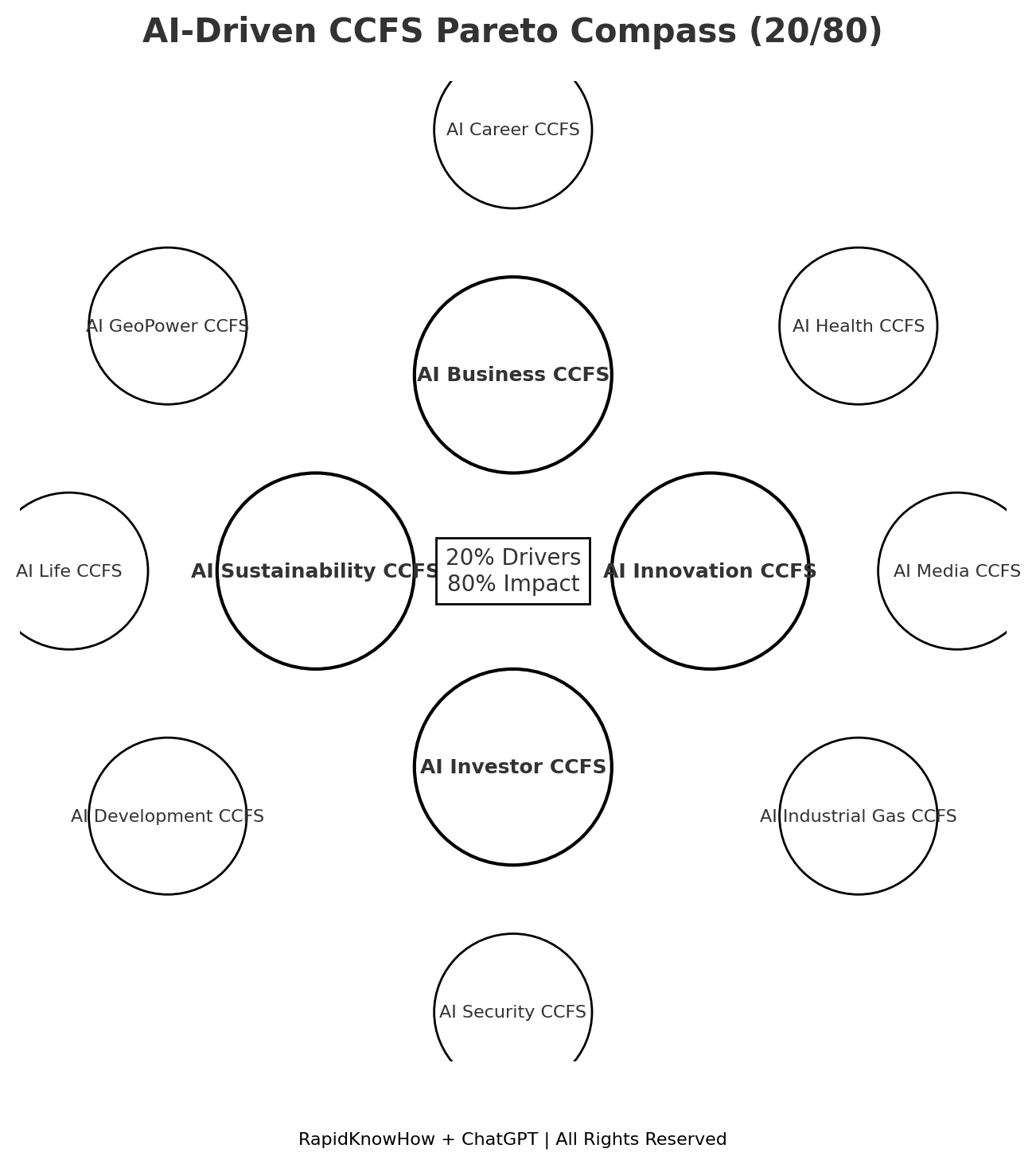

The AI-Driven CCFS 20/80 Pareto Model identifies the 20% of AI-powered Compounded Cash-Flow Systems (CCFS) that generate 80% of sustainable LIFE results.

These Core Drivers — AI Business, AI Innovation, AI Investor, and AI Sustainability — form the compounding engine for growth, wealth, and global impact.

The other 8 CCFS models act as strategic enablers: building resilience, sectoral dominance, and long-term scalability (Career, Health, Media, Industrial Gas, Security, Development, Life, GeoPower).

By focusing resources on the Pareto Core Drivers while gradually integrating the enablers, leaders build a self-reinforcing wealth and impact ecosystem that thrives across business cycles and global disruptions.

Let’s rank your AI-Driven CCFS models using the 20/80 Pareto principle:

👉 20% of systems deliver ~80% of the compounding impact (cash-flow + scale).

📊 Ranking the AI-Driven CCFS (20/80 Pareto)

🏆 Tier 1 – 20% Drivers (Deliver ~80% of results)

These are the breakthrough engines that compound fastest across categories / industries:

- AI Business CCFS – Core system: creates immediate cash-flow (services, licenses).

- AI Innovation CCFS – Multiplier: turns ideas into scalable IP & ecosystems.

- AI Investor CCFS – Capital engine: compounds wealth via smart allocation.

- AI Sustainability CCFS – Long-term global demand driver (ESG, climate, impact).

💡 Together: these 4 create the foundation for wealth + sustainability.

⚙️ Tier 2 – 60% Enablers (Deliver ~20% of results, but essential for balance)

These reinforce Tier 1, securing resilience + sectoral cash-flow:

- AI Career CCFS – Converts personal skills → services & assets.

- AI Health CCFS – Reduces costs, builds preventive service cash-flows.

- AI Media CCFS – Scales narratives, ecosystems, and trust.

- AI Industrial Gas CCFS – Flagship B2B model for asset-light industries.

- AI Security CCFS – Builds resilience, trust, and stable cash-flows.

- AI Development CCFS – Aligns capital, citizens, and infrastructure.

- AI Life CCFS – Personal integration model (career, health, wealth).

- AI GeoPower CCFS – Strategic edge: monetizes geopolitical insights.

💡 These 8 act as sectoral + resilience layers to expand the compounding base.

🧭 Strategic Insight

- Focus Q4 2025–Q2 2026 on Tier 1 (Business, Innovation, Investor, Sustainability) → fastest compounding cash-flow engines.

- Gradually integrate Tier 2 to reinforce resilience and sector dominance.

- This creates a Compounded Wealth Ecosystem: Wealth (Investor), Growth (Business + Innovation), Impact (Sustainability), backed by sector-specific CCFS.

💡 Power Statement

“The AI-Driven CCFS 20/80 Pareto Model is the ultimate wealth and impact compass — transforming 20% of focused AI engines into 80% of compounding results, scaling businesses, investments, and ecosystems into sustainable legacy cash-flow.” – Josef David