Thriving AI-Powered Leadership 2026–2030

1. Executive Summary (Board-Level)

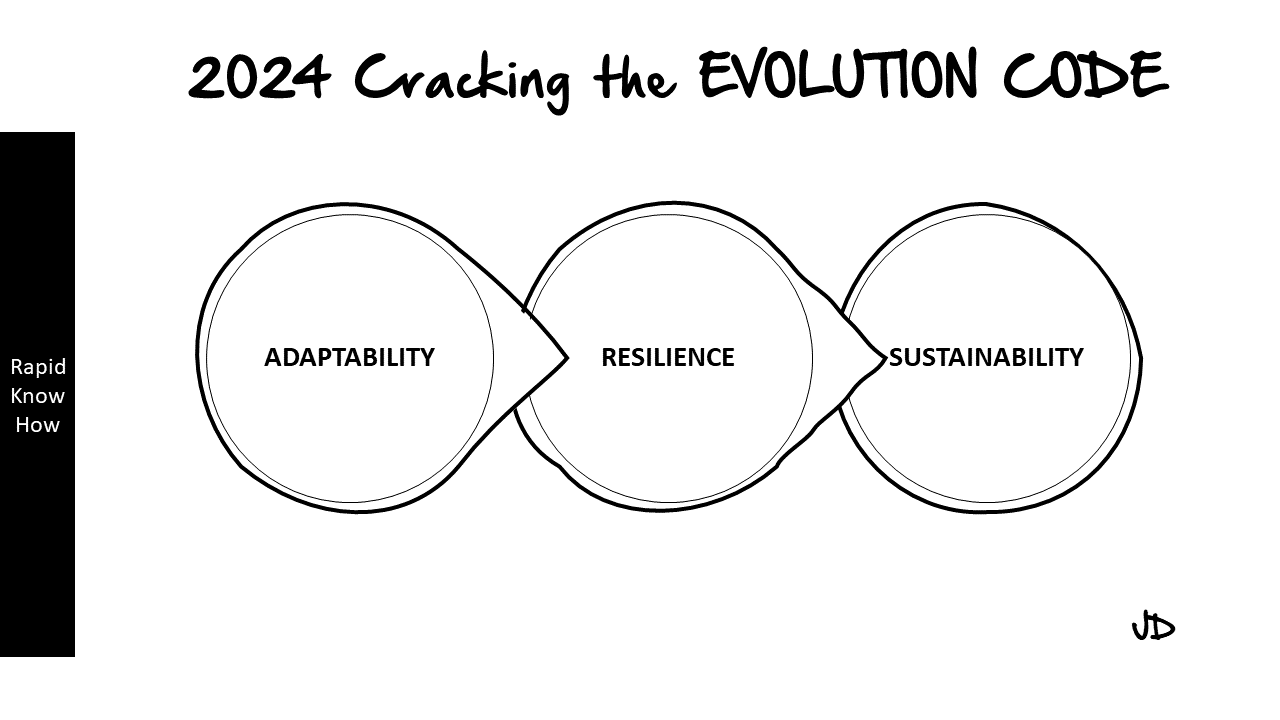

Between 2026 and 2030, organizations will be reshaped by AI as a Leadership Force-Multiplier — not as a cost-cutting tool, but as a capability amplifier across decision-making, governance, strategic agility, and productivity.

Leaders who thrive in this period will use AI to create speed, clarity, asymmetry, and compounding advantage across three dimensions:

- Decision Excellence — faster, fact-based, scenario-driven decisions

- Value Multipliers — accelerated cashflow, margin, and capital allocation

- People & Ecosystem Elevation — augmented workforces, partner ecosystems, and knowledge networks

Organizations that fail to reorganize leadership models around AI will remain linear, while their competitors become exponential.

Conclusion: 2026–2030 will not be about replacing leaders with AI, but about replacing non-AI-powered leaders with AI-powered leaders.

2. Strategic Context 2026–2030

2.1 Key Macro Forces

- AI commoditizes knowledge → strategic differentiation shifts to execution speed

- Global de-risking & supply chain rewiring (US–China tech split, semiconductors, energy)

- Capital scarcity & higher interest rates → ROI discipline & capital velocity matter more

- Talent shortages in STEM & leadership functions

- New hybrid workforce model (AI + human teams)

- Industry convergence (Tech + Energy + Healthcare + Finance)

2.2 Implications for Leadership

Traditional leadership models optimized for:

- hierarchy

- control

- reporting

- incremental optimization

No longer sufficient.

Future models demand:

- continuous intelligence

- rapid scenario navigation

- resource orchestration

- cross-domain synthesis

- AI-augmented cognition

3. Strategic Problem Definition

The Leadership Gap

Most organizations face a triple gap:

- Decision Gap

- Decisions too slow for external volatility

- Data → not synthesized → not scenario tested

- Execution Gap

- Strategies not operationalized fast enough

- Bottlenecks in bureaucracy & coordination

- Capability Gap

- Leaders not trained for augmented work

- Knowledge siloed & not compounding

Without AI augmentation, these gaps widen.

4. Solution: Thriving AI-Powered Leadership Model

Definition

AI-Powered Leadership = Human Leadership + Machine Intelligence + Strategic Orchestration

Not “automation” — but augmentation along a defined capability stack:

5. The AI Leadership Capability Stack

Layer 1: Cognitive Augmentation

Leaders gain access to:

- instant briefings

- competitive intelligence

- scenario generation

- root cause analysis

- strategic analogies

- forecasting signals

Outcome: Leaders operate with strategic clarity at speed.

Layer 2: Decision Intelligence

AI enhances:

- decision frameworks

- scenario mapping

- risk-weighted options

- adversarial simulation

Outcome: Better decisions, made faster, with lower regret.

Layer 3: Operational AI

AI plugged into:

- planning

- logistics

- finance

- productivity tools

Outcome: Execution without drag.

Layer 4: Learning & Knowledge Compounding

AI turns organizations into:

- real-time learning ecosystems

- perpetual upskilling machines

- institutional memory systems

Outcome: Knowledge becomes assets, not attrition risks.

Layer 5: Leadership Behavior Transformation

AI enables leaders to:

- communicate better

- coach teams

- align stakeholders

- reduce cognitive overload

- amplify strengths & mitigate biases

Outcome: High leverage leaders, not high-burnout leaders.

6. Business Case: Value Creation 2026–2030

6.1 Value Drivers

Organizations that adopt AI-powered leadership models achieve gains in:

| Value Lever | Expected Impact |

|---|---|

| Decision Speed | 3–10x faster cycle times |

| Strategy → Execution Conversion | 15–25% better throughput |

| Capital Allocation | +3–7% ROIC uplift |

| Cost Structure | −10–25% SG&A & overhead reduction |

| Innovation Output | +30–50% more validated bets |

| Talent Productivity | 2–4x individual throughput |

6.2 Financial Modeling (Indicative)

Typical mid-cap industrial or tech company (5,000–20,000 employees):

- Productivity savings: €40–€120M / year

- Working capital optimization: €20–€60M / year

- Cashflow acceleration: €50–€150M / year

- Talent leverage: avoid €10–€30M annual hiring pressure

ROI breakeven window: 9–18 months, compounding thereafter.

7. Risks & Countermeasures

Risk 1: Technological Over-Reliance

Countermeasure: Human-in-command architecture

Risk 2: AI Illiteracy in Leadership

Countermeasure: AI Leadership Academy & Simulation

Risk 3: Ethical & Safety Issues

Countermeasure: AI Governance & Red Teaming

Risk 4: Disruption of Workforce

Countermeasure: Augmentation > Replacement Framework

Risk 5: Vendor Lock-In

Countermeasure: Modular, multi-cloud AI architecture

8. Implementation Blueprint (2026–2030)

Phase 1 (2026): Cognitive Augmentation

- Executive AI copilots

- Strategic intelligence systems

- Scenario engines

Phase 2 (2027–2028): Enterprise Decision Intelligence

- AI-enabled OKRs

- AI capital allocation tools

- AI scenario planning

- AI budget/portfolio steering

Phase 3 (2028–2029): AI-Driven Execution

- Autonomous workflows

- Industrial copilots

- Digital twins

- Simulation-driven supply chain

- Smart cashflow management

Phase 4 (2029–2030): Leadership Ecosystem

- Institutional memory systems

- AI mentorship networks

- AI-governed decision governance

9. Competitive Advantage & Differentiation

AI-powered leadership produces four asymmetric advantages:

- Time Advantage → faster cognition & action

- Information Advantage → better signals & scenarios

- Capital Advantage → higher capital velocity

- Talent Advantage → augmented workforce productivity

These are the new competitive moats in 2026–2030.

10. Conclusion & Strategic Mandate for Boards

Boards should issue a Leadership Transformation Mandate:

“Transform leadership effectiveness using AI augmentation to drive speed, clarity, and capital efficiency — not as IT transformation, but as organizational capability transformation.”

Boards that fail to do this by 2028 risk:

- competitive irrelevance

- capital erosion

- talent attrition

- slower innovation cycles

- hostile takeover vulnerability

📢 Final Statement

The decisive divide in 2030 will not be digital transformation itself, but the presence or absence of AI-powered leaders.

Those who master AI-augmented leadership will build compounding organizations.

Those who don’t will get acquired by those who do. – Josef David

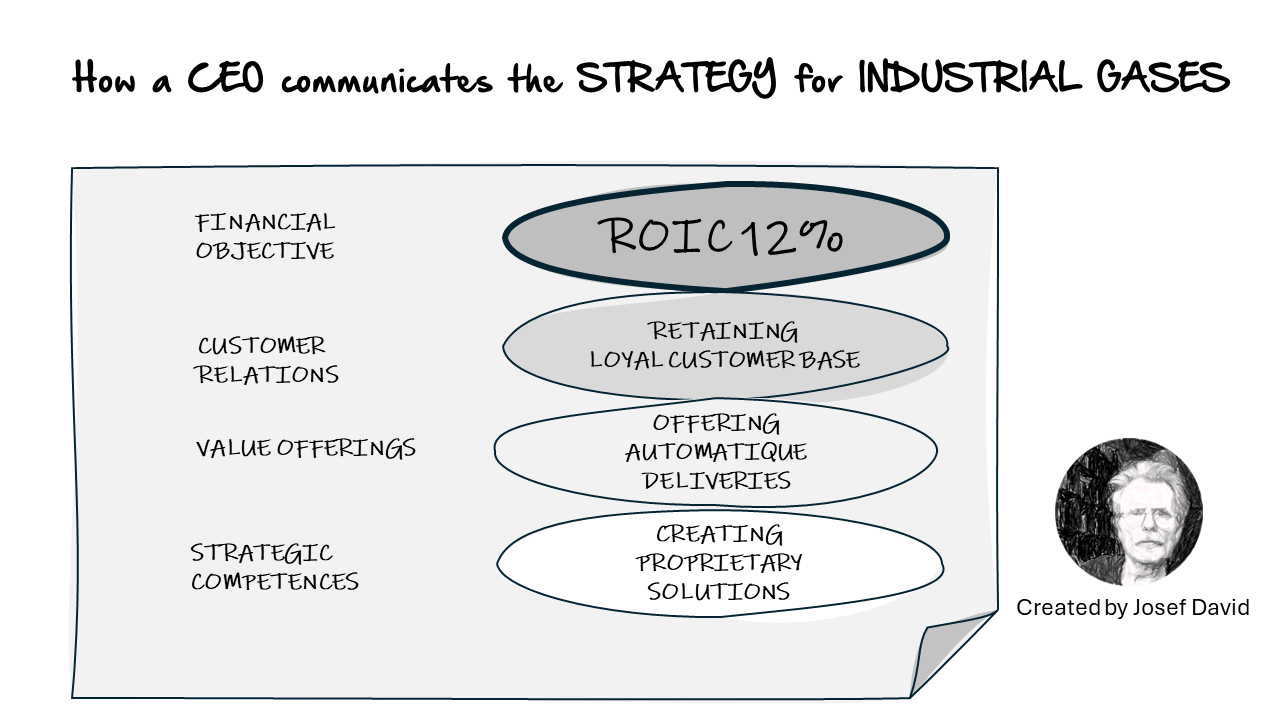

📌 STRATEGIC BUSINESS CASE (INDUSTRIAL GAS)

Thriving AI-Powered Leadership 2026–2030

Tailored for the Global Industrial Gas Sector

1. Executive Summary

The global industrial gas sector (Linde, Air Liquide, Air Products, NSHD, Messer) faces the most strategically disruptive period in decades:

- Hydrogen hype → Hydrogen reality

- Electronics reshoring (U.S./EU/Taiwan)

- Steel & chemical downcycles

- CO₂ shortages & logistics constraints

- Homecare reimbursement changes

- Anti-trust barriers to consolidation

- Aging plant portfolios & safety pressures

In this environment, AI-powered leadership becomes the only model capable of thriving between 2026 and 2030.

Industrial gas leaders must operate with:

speed, foresight, safety, operational precision, and capital discipline — all boosted by AI copilots, scenario engines, and real-time plant/customer intelligence.

Strategic Mandate for CEOs (2026–2030):

Use AI to accelerate decision-making, enhance plant reliability, improve capital allocation, increase customer contract quality, and build a safer, more adaptive global industrial gas organization.

2. Sector Context: The 2026–2030 Challenge Landscape

2.1 Structural Forces Shaping Industrial Gas

1) Hydrogen (H₂) Correction Cycle

- Subsidies weaken by 2027

- Unit economics under scrutiny

- On-site hydrogen projects face delays

- Stock markets punish “PR hydrogen” portfolios

2) Electronics Reshoring

- Semiconductor fabs in U.S., EU, and Japan

- Ultra-pure gases (UHP) surge

- Helium supply fragility intensifies

- Highest margin segment becomes supply-risk driven

3) Steel & Metallurgy Downcycles

- China steel output flattening

- Oxygen demand volatility

- On-site O₂ plants at risk of idle capacity

- Contract renegotiations accelerate

4) Healthcare Homecare Squeeze

- Insurance reimbursement pressures

- High last-mile logistics cost

- Safety & liability risks

- Only specialized models remain viable

5) Cylinder & ISO Bottlenecks

- Steel constraints

- Lost cylinders = cashflow erosion

- Turn-rate optimization becomes core profitability driver

6) Anti-Trust & M&A Constraints

- Linde/Praxair limits

- Air Liquide/Airgas learning

- Large M&A unlikely → JVs & swaps the new model

3. The Leadership Gap in Industrial Gas

Most industrial gas companies struggle with:

Gap 1 — Slow strategic decision cycles

Capex committees are cautious, slow, and politically overloaded.

Gap 2 — Fragmented knowledge

Key insights sit in:

- plant operators

- applications engineers

- regional managers

- SCADA logs

- contract archives

- safety incident databases

But they are not integrated.

Gap 3 — Operational drag

- Safety investigations slow

- Contracts are static instead of dynamic

- Logistics planning is manual

- Hydrogen projects not scenario-tested

- Cylinder/ISO tracking fragmented

Gap 4 — Declining customer intimacy

Sales is often disconnected from:

- plant data

- supply chain limitations

- application opportunities

4. Solution: AI-Powered Leadership Tailored to Industrial Gas

AI is not for replacing operators or engineers.

AI is for augmenting leaders & decision-making.

The Thriving AI-Powered Leadership Model increases strength in five areas:

5. The AI Capability Stack for Industrial Gas

Layer 1 — Cognitive Augmentation

AI gives executives instant clarity on:

- plant uptime

- safety status

- contract margin health

- capex ROIC projections

- customer churn signals

- application opportunities

- hydrogen feasibility

- logistics bottlenecks

Outcome: Leaders see the real situation instantly, not quarterly.

Layer 2 — Decision Intelligence

AI supports:

- capex prioritization

- contract renewal simulation

- “idle plant risk” calculation

- multi-scenario H₂ modelling

- electronics fab supply-risk scenarios

Outcome:

Risk-weighted strategic choices instead of gut feel or politics.

Layer 3 — Operations AI

AI copilots enhance:

- SCADA insights

- safety compliance analytics

- cylinder/ISO route optimization

- predictive maintenance

- energy efficiency

- downtime prediction

Outcome:

Higher uptime + lower cost + safer plants.

Layer 4 — Knowledge Compounding

AI turns:

- applications engineering libraries

- safety reports

- operator know-how

- customer cases

- capex learnings

- root-cause analysis archives

into real-time intelligence.

Outcome: The organization becomes smarter each day.

Layer 5 — Leadership Behavior Transformation

AI makes leaders:

- faster

- clearer

- more data-driven

- more customer-connected

- more safety-intense

- more capital-disciplined

- less political

This is the most valuable transformation.

6. Business Case for AI Leadership in Industrial Gas

Value Creation Levers 2026–2030

| Lever | Sector Impact |

|---|---|

| Increased Uptime | +1–3% EBITDA uplift |

| Predictive Maintenance | −10–20% maintenance cost |

| Capex Prioritization | +3–7% ROIC |

| Supply Chain Optimization | +5–12% delivery efficiency |

| Contract Margin Optimization | +2–5% margin improvement |

| Cylinder/ISO Turn-Rate Improvement | +10–25% cashflow gain |

| Helium Optimization | +5–8% margin defense |

| Hydrogen Portfolio Rationalization | Avoid stranded capex |

Indicative ROI

AI-powered leadership →

9–18 months breakeven, then compounding gains.

7. Risk Map & Mitigations (Industrial Gas Specific)

Risk 1 — Safety Miscalibration

Mitigation:

AI safety system with red-flag escalation to CEO.

Risk 2 — Hydrogen Overpromise

Mitigation:

Hydrogen Simulation Engine (HSE) verifying payback, risk, and customer anchor conditions.

Risk 3 — Cylinder Loss → Cashflow Erosion

Mitigation:

AI-powered cylinder GPS + turn-rate optimizer.

Risk 4 — Over-Centralization

Mitigation:

AI supports regional autonomy with shared intelligence.

Risk 5 — Talent Resistance

Mitigation:

AI-as-copilot model: empower operators, don’t replace them.

8. Implementation Roadmap (Industrial Gas Version)

Phase 1 — Foundation (2026)

- AI copilots for executives

- Safety intelligence platform

- Uptime analytics

- Contract margin engine

- H₂ scenario modeling

Phase 2 — Operational Intelligence (2027–2028)

- Predictive maintenance

- Energy optimization

- Cylinder/ISO digital twin

- Regional supply-chain copilots

- Customer contract renewal prediction

Phase 3 — Enterprise Leadership Engine (2029–2030)

- Real-time P&L simulators

- Plant-to-customer decision dashboards

- AI-assisted capex governance committee

- AI-driven M&A scanning

- Applications intelligence aggregator

9. Competitive Advantage in Industrial Gas

AI-powered leadership creates five structural moats:

- Safety Moat

- AI flags incidents and patterns early

- Safety becomes predictive, not reactive

- Reliability Moat

- Plants run with higher uptime

- Customers gain confidence and renew longer contracts

- Capital Moat

- Capex deployed only where payback is proven

- Idle plants avoided

- Customer Moat

- Sales becomes intelligence-driven

- Applications know-how scaled across regions

- Speed Moat

- Decisions made 5–20x faster than competitors

- Faster contract cycles → faster locking of margins

10. Strategic Mandate for Industrial Gas Boards

Boards should instruct leadership:

“Use AI to accelerate reliability, safety, capital efficiency, contract quality, and application know-how — turning the company into an adaptive, learning, compounding industrial gas ecosystem.”

Organizations that do so will:

- gain margin superiority

- secure long-term contracts

- outperform peers in hydrogen, electronics, and steel

- run safer, more reliable plants

- attract AI-fluent talent

Organizations that don’t:

- lose margin to more agile competitors

- experience contract leakage

- absorb stranded H₂ capex

- suffer logistics inefficiency

- fall behind in safety & uptime metrics

Final Power Statement

Industrial Gas Leadership 2026–2030 will be decided by the companies who master AI-powered safety, AI-powered reliability, and AI-powered capital allocation.

This is the new competitive moat — and it compounds. – Josef David