🏡 Household Cash-Flow Formula

Net Cash-Flow = Total Income – Total Expenses

To make it actionable, break it into 4 main building blocks:

1. Income (Cash-In)

- 💼 Active Income: Salaries, wages, freelance, business income

- 💰 Passive Income: Interest, dividends, rental income

- 🎁 Other Income: Transfers, pensions, subsidies, tax refunds

Total Income = Active + Passive + Other

2. Fixed Expenses (Cash-Out – Mandatory)

- 🏠 Housing: Rent/mortgage, utilities

- 🚗 Transportation: Fuel, insurance, public transport

- 🍽️ Essentials: Food, health insurance, medicine

- 🎓 Education & Childcare

3. Variable Expenses (Cash-Out – Flexible)

- 🛍️ Lifestyle: Clothing, entertainment, restaurants

- 🌍 Travel: Holidays, short trips

- 📱 Subscriptions: Streaming, apps, memberships

4. Savings & Investments

- 📈 Emergency Fund (3–6 months of expenses)

- 💵 Debt Repayment (if applicable)

- 🏦 Long-Term Investments: ETFs, bonds, retirement plans

- 🎯 Short-Term Goals: Car, house renovation, studies

📊 Formula in Practice

Net Cash-Flow=(Active + Passive + Other Income) − (Fixed + Variable Expenses) − (Savings + Investments)

- Positive Net Cash-Flow → Wealth builds, financial freedom grows

- Negative Net Cash-Flow → Debt risk, lifestyle needs adjustment

✅ Action Steps

- Track every cash-in and cash-out monthly (Excel, app, or notebook).

- Apply the 50–30–20 rule as a guide:

- 50% Needs (fixed expenses)

- 30% Wants (variable expenses)

- 20% Savings/Investments

- Aim for a positive monthly surplus and direct it to savings & investments.

- Review quarterly: cut waste, increase passive income.

Household Cash-Flow Lifetime Formula Report for Leaders

1. Executive Summary

This report provides leaders with a lifetime framework for managing household cash-flow strategically. The formula ensures financial clarity, resilience, and sustainable wealth-building over decades. Net Cash-Flow=Total Income – Total Expenses\textbf{Net Cash-Flow} = \text{Total Income – Total Expenses}Net Cash-Flow=Total Income – Total Expenses

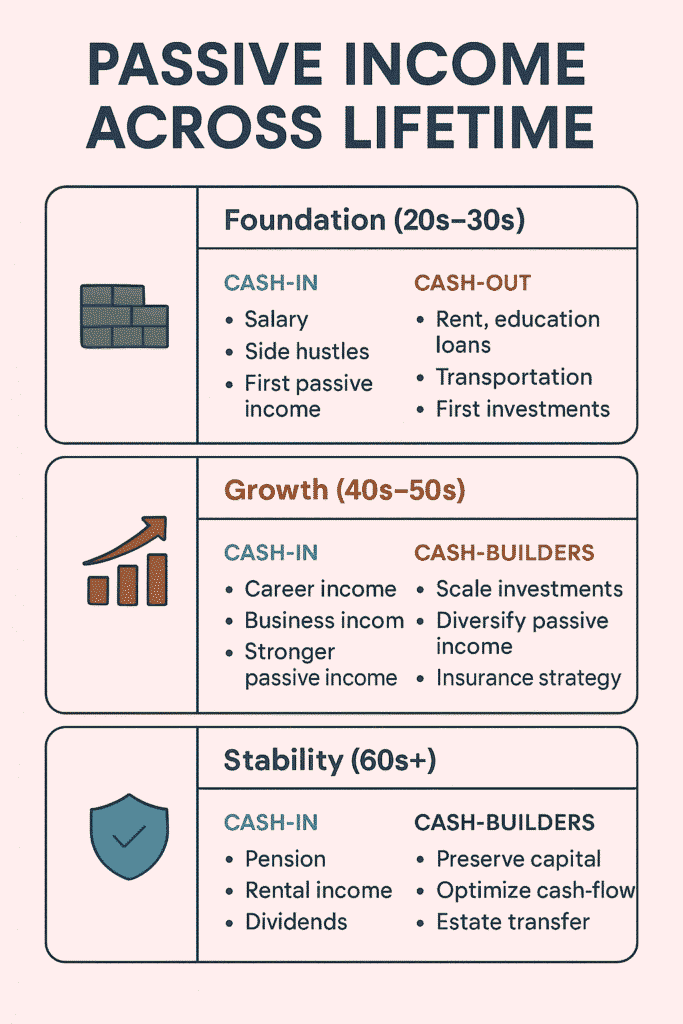

Applied over a lifetime, this formula guides leaders from foundation (20s–30s) through growth (40s–50s) to stability (60s+).

2. The Lifetime Formula Framework

A. Foundation Phase (20s–30s)

Objective: Build financial discipline and security.

- Cash-In: Salary, side hustles, first passive income sources.

- Cash-Out: Rent, education loans, transportation, lifestyle expenses.

- Cash-Builders:

- Emergency fund (3–6 months).

- Debt repayment plan.

- First investments (index funds, ETFs).

B. Growth Phase (40s–50s)

Objective: Expand wealth, reduce risks, secure family future.

- Cash-In: Career income peak, business income, stronger passive income.

- Cash-Out: Mortgage, family expenses, education of children.

- Cash-Builders:

- Scale investments (real estate, stocks, business).

- Diversify passive income.

- Insurance & protection strategies.

C. Stability Phase (60s+)

Objective: Preserve wealth and enjoy financial freedom.

- Cash-In: Pension, rental income, dividends, royalties.

- Cash-Out: Healthcare, simplified lifestyle.

- Cash-Builders:

- Capital preservation (bonds, conservative funds).

- Optimize cash-flow (tax efficiency, low expenses).

- Transfer strategy (estate planning, legacy funds).

3. The Leader’s Household Cash-Flow Formula

Net Wealth Growth=(Active + Passive Income)−(Fixed + Variable Expenses)+(Reinvested Surplus)\textbf{Net Wealth Growth} = (\text{Active + Passive Income}) – (\text{Fixed + Variable Expenses}) + (\text{Reinvested Surplus})Net Wealth Growth=(Active + Passive Income)−(Fixed + Variable Expenses)+(Reinvested Surplus)

- Positive Surplus → Reinvest, accelerate passive income streams.

- Negative Surplus → Lifestyle audit, strategic reset.

4. Strategic Actions for Leaders

- Measure Monthly: Track inflows/outflows consistently.

- Apply the 50–30–20 Rule:

- 50% Needs

- 30% Wants

- 20% Savings/Investments

- Shift to Passive Income: Reinvest surpluses into scalable income.

- Build Legacy: Create structures (trusts, licenses, digital assets) for intergenerational wealth.

5. Lifetime Impact

- Foundation: Financial resilience.

- Growth: Wealth expansion, family security.

- Stability: Financial freedom, legacy building.

The Household Cash-Flow Lifetime Formula ensures leaders thrive across life stages, secure families, and sustain wealth beyond generations. – Josef David