The 5 HOW Technique is a step-by-step method to break down a complex goal into actionable solutions by asking “HOW?” five times in a row. It’s ideal for moving from strategy to execution quickly and clearly.

✅ STRUCTURE OF THE 5 HOW TECHNIQUE:

- Define the Strategic Goal

- HOW #1 – Strategic How: What’s the strategic action to reach the goal?

- HOW #2 – Tactical How: What tactical step makes that strategic action possible?

- HOW #3 – Operational How: What specific operational action delivers the tactical step?

- HOW #4 – Executional How: What task must be executed to complete the operational step?

- HOW #5 – Daily Action: What can be done today to start?

Let’s apply the 5 HOW Technique step-by-step to break it down into actionable moves.

🎯 STRATEGIC GOAL:

Transform traditional Industrial Gas Business into an AI-powered, asset-light Business-as-a-Service model scaling globally through licensee-driven ecosystems.

🔍 HOW #1 – Strategic HOW:

How can we transform into an AI-powered, asset-light, global BaaS model?

👉 By redesigning the value chain into a digital platform model and enabling licensees to operate it.

🔧 HOW #2 – Tactical HOW:

How do we redesign the value chain and enable licensees?

👉 By digitizing core processes (production, delivery, maintenance) and creating a license-ready AI platform.

🏗️ HOW #3 – Operational HOW:

How do we digitize processes and build a license-ready platform?

👉 By identifying digital transformation opportunities and partnering with AI developers to build modular services (e.g., predictive maintenance, demand forecasting).

🧰 HOW #4 – Executional HOW:

How do we identify transformation opportunities and build AI services?

👉 Run a digital audit across operations, prioritize high-impact areas (like logistics), and assign product managers to develop AI modules with tech partners.

✅ HOW #5 – Daily Action:

What can we do today?

👉 Set up a cross-functional team to run the digital audit and shortlist AI technology partners.

📊 COMPLETE ROADMAP SNAPSHOT:

| Level | Action |

|---|---|

| Strategic Goal | Transform into AI-powered, asset-light BaaS with licensee ecosystems |

| Strategic HOW | Redesign value chain into digital platform + enable licensees |

| Tactical HOW | Digitize processes + create AI-based license platform |

| Operational HOW | Identify digital gaps + develop modular AI services |

| Executional HOW | Audit operations + assign teams to develop AI modules |

| Daily Action (Today) | Launch audit team + contact AI tech partners |

BaaS Transformation Quiz

1. What is the primary strategic goal of the transformation?

2. What does the tactical step focus on?

3. What is one of the key executional actions?

Investor Insight: AI-Powered, Asset-Light Industrial Gas Business-as-a-Service (BaaS) Model

Vision

Revolutionizing the Industrial Gas sector by transforming it into a scalable, AI-powered, asset-light Business-as-a-Service model, enabling rapid global market expansion and superior value creation through licensee-driven ecosystems.

Core Strategic Pillars

- Asset-Light Business Model

- Minimizes capital expenditure

- Scales via licensing rather than ownership

- Enables faster market penetration with reduced operational risk

- AI-Powered Digital Platform

- Drives efficiency across logistics, maintenance, and customer experience

- Enables predictive analytics, real-time monitoring, and smart dispatch

- Modular plug-and-play services tailored to licensee needs

- Licensee-Driven Ecosystem

- Empowers local operators to deploy the platform quickly

- Ensures cultural, regulatory, and operational localization

- Grows revenue through license fees, data services, and platform usage

Investment Highlights

- High-Margin Recurring Revenue via platform licensing and services

- Positive Cash Flow Generation from Day 1 of license activation

- Global Scalability without infrastructure ownership

- De-risked Operations with licensees bearing local execution

- IP and Data Value Accumulation through centralized AI insights

Go-to-Market Execution

- Phase 1 (0–6 Months): Platform prototype, first pilot markets

- Phase 2 (6–12 Months): First wave of licensee onboarding in key growth regions

- Phase 3 (12–24 Months): Ecosystem expansion, cross-border scale-up

Financial Projections Snapshot (Illustrative)

- Revenue CAGR: 40–60% over 3 years

- EBITDA Margins: 35–50% with platform maturity

- Payback Period per Licensee: <12 months

- Global TAM (Total Addressable Market): $50B+

Strategic Partnerships Sought

- AI Technology Providers (modular platform builders)

- Strategic Investors with ecosystem access

- Local market licensees with industrial networks

Conclusion

This AI-powered, asset-light BaaS model offers an investable, scalable, and defensible business strategy, with high-margin recurring revenues, global growth potential, and IP accumulation. Ideal for investors seeking growth with operational leverage.

Financial Model Template: ROCE Evolution from Traditional Industrial Gas to AI-Driven BaaS Ecosystem

Objective:

Demonstrate Return on Capital Employed (ROCE) improvement as the business transitions from a capital-intensive traditional model to a scalable, AI-driven, asset-light BaaS ecosystem.

1. Traditional Industrial Gas Business (Baseline Model)

| Metric | Value |

|---|---|

| Capital Employed (CE) | $500M |

| EBIT | $50M |

| ROCE | 10% |

| Growth Rate (Annual) | 3% |

| CapEx Intensity | High |

| Revenue Model | Asset ownership + product sales |

2. Transition Phase (Hybrid Platform + Operations Model)

| Metric | Year 1 | Year 2 |

| Capital Employed (CE) | $350M | $300M |

| EBIT | $70M | $95M |

| ROCE | 20% | 31.7% |

| Platform Revenue Share | 20% | 35% |

| CapEx Intensity | Moderate | Low |

| Key Focus | Digitization, early licensees, ops integration |

3. Fully Scaled AI-Powered BaaS Model

| Metric | Year 3 | Year 4 |

| Capital Employed (CE) | $150M | $120M |

| EBIT | $90M | $110M |

| ROCE | 60% | 91.7% |

| Platform Revenue Share | 60% | 80% |

| Licensee Count | 15 | 30 |

| CapEx Intensity | Very Low | Minimal |

| Revenue Model | Recurring license + data services |

Key ROCE Drivers in AI-Driven BaaS Model

- Capital efficiency through licensee-led operations

- High-margin digital services (AI modules, data analytics)

- Reduced asset ownership and maintenance costs

- Centralized platform with growing user base

Scenario Sensitivity Levers:

- Licensee expansion rate

- AI service monetization per licensee

- Platform maintenance and upgrade costs

- Market adoption velocity in key regions

Conclusion:

This template illustrates how transitioning to an AI-powered BaaS model unlocks exponential ROCE growth, operational leverage, and recurring revenue, turning the Industrial Gas business into a scalable digital ecosystem.

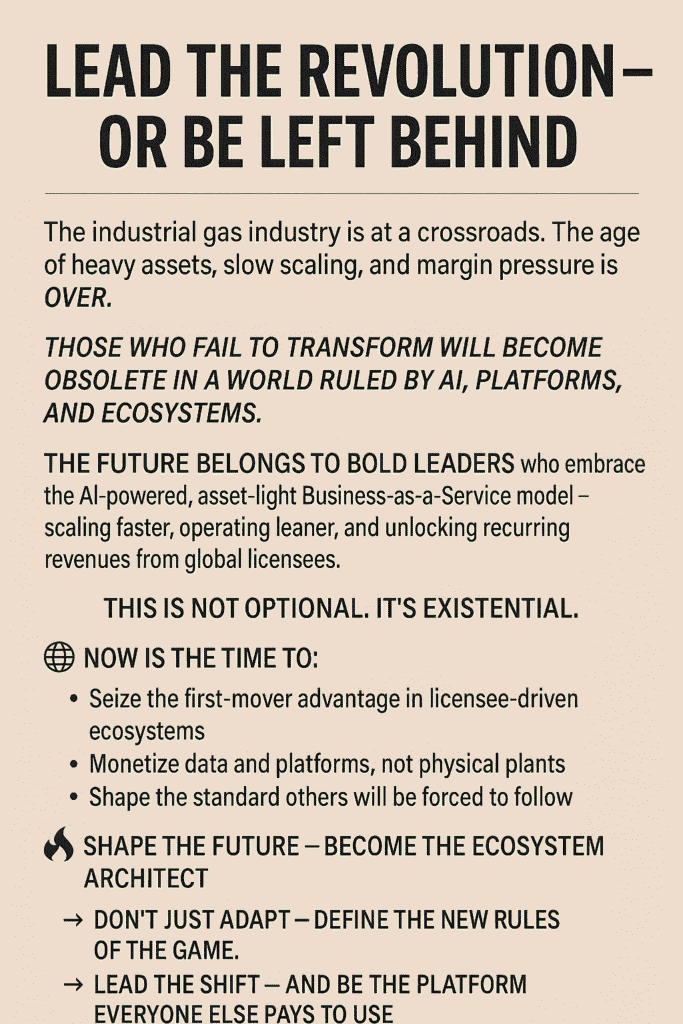

🚀 Lead the Revolution – or Be Left Behind

The industrial gas industry is at a crossroads. The age of heavy assets, slow scaling, and margin pressure is over.

Those who fail to transform will become obsolete in a world ruled by AI, platforms, and ecosystems.

The future belongs to bold leaders who embrace the AI-powered, asset-light Business-as-a-Service model—scaling faster, operating leaner, and unlocking recurring revenues from global licensees.

This is not optional. It’s existential.

🌐 Now is the time to:

- Seize the first-mover advantage in license-driven ecosystems

- Monetize data and platforms, not physical plants

- Shape the standard others will be forced to follow

🔥 Shape the Future – Become the Industrial Gas Ecosystem Architect

👉 Don’t just adapt—define the new rules of the game.

👉 Lead the shift—and be the platform everyone else pays to use.

RapidKnowHow + ChatGPT scale AI-Powered, Asset-Light Business-as-a-Service (BaaS) solutions through Licensee-Driven Ecosystems, enabling high-margin, recurring revenues, sustained cash+flows and increasing market value by global market and ecosystem expansion

If you’re still tied to the heavy, traditional industrial gas model, then you can leap ahead by transforming into an AI-powered, asset-light Business-as-a-Service ecosystem that drives higher margins and global scalability. 👉 Book your free 30-Minute Strategy with Josef David.