RapidKnowHow Situational Snapshot V2 — Week 4 / 26

Detect GeoPolitical Drivers (High-Impact Global Signals)

U.S.–EU Trade Escalation & Retaliation Dynamics —

President Trump’s threat of tariffs on multiple European countries unless Greenland access is granted has jolted markets and sparked EU retaliation planning, including possible €93 billion tariffs on U.S. goods. This sharp escalation is stressing transatlantic political and economic ties and is likely to affect global trade policy.

Economic Confrontation as Top Global Risk —

World Economic Forum Global Risks data underscore geoeconomic confrontation (sanctions, tariffs) as the foremost near-term risk to global stability, ahead of state-based conflict and climate risks.

Davos Power Shift & Global Policy Framing —

As the World Economic Forum convenes with record participation of government leaders, CEOs, and policymakers, geopolitical and trade risks are influencing discourse more than traditional cooperation agendas.

Greenland Strategic Significance —

Greenland’s Arctic position, rare earth potential, and shipping routes link climate-induced geographic change with intensifying geopolitical competition involving the U.S., Russia, and China.

Market Volatility & Safe-Haven Flows —

Gold and other safe-haven assets have seen heightened interest amid geopolitical uncertainty and policy stress, while oil markets remain reactive to geopolitical shifts in sanctioned supply and broader trade risks.

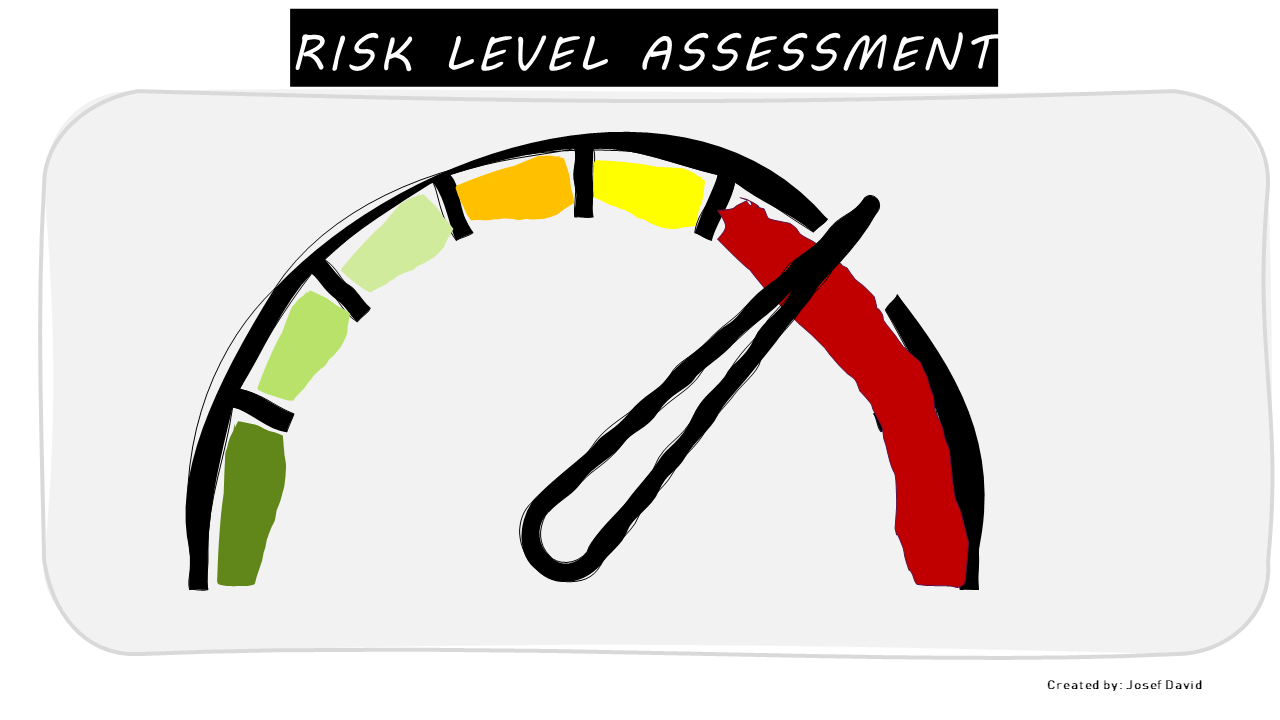

Assess Urgent & Important Drivers (Eisenhower Prioritization)

Q1 — ACT (Urgent + Important)

Transatlantic Trade Dispute Escalation

The threat of tariffs and EU retaliation are immediate market and policy shocks.

Priority: Prepare scenarios and alerts for tariff triggers and supply-chain impacts.

Q2 — DESIGN (Important, Not Urgent)

Geoeconomic Risk Framework Integration

Economic confrontation is ranked top global risk; integrate this into mid-term strategy and risk models.

Priority: Build 30–90-day playbooks incorporating global risk projections and trade fragmentation scenarios.

Q3 — DELEGATE (Urgent, Not Important)

Safe-Haven Asset Noise

Short-term commodity price moves (e.g., gold or silver spikes) can be noise if not tied to fundamental shifts.

Priority: Automate filtering to focus on root causes rather than price swings.

Q4 — ELIMINATE (Not Urgent, Not Important)

General Market Outlook Clutter

Broad, long-term financial forecasts without actionable signals should be deprioritized.

Priority: Remove thematic noise not linked to geopolitically driven decisions.

Convert Urgent & Important into Actions

Business Actions

• Tariff Scenario Modeling: Define threshold triggers for tariff escalations and responses across major markets.

• Trade & Supply-Chain Resilience: Reassess supply routes and diversification strategies in light of escalating trade measures.

• Geopolitical Risk Monitoring: Enhance real-time dashboards for news and policy shifts (EU summits, Davos communiqués, Arctic developments).

Life Actions

• Financial Positioning: Reinforce liquidity buffers; consider safe-haven allocations where appropriate.

• Information Hygiene: Streamline trusted intelligence sources; eliminate speculative media signals.

• Mobility & Personal Planning: Evaluate travel, relocation, or operational plans against evolving geopolitical flashpoints.

Rapid Snapshot: Week 4/26 — Priority Summary

| Priority | Strategic Focus | Required Action |

|---|---|---|

| Q1 — ACT | U.S.–EU trade dispute & market volatility | Define tariff trigger scenarios & supply-chain actions |

| Q2 — DESIGN | Economic confrontation risk framework | Build mid-term geopolitical risk playbooks |

| Q3 — DELEGATE | Safe-haven price noise | Automate noise filtering |

| Q4 — ELIMINATE | General broad market forecasts | Discard signals not tied to geopolitical drivers |