Comparing Traditional Managers and AI-Orchestrator Leaders

Applying RapidKnowHow’s Cash-Flow Allocation Lens

Case: Industrial Gas CEE

Timeframe: Situation Week 5/26 · Forecast Q1/26

1. Executive Purpose

This snapshot explains why leadership approach — not market conditions — determines net cash-flow outcomes under geopolitical stress.

Using the Industrial Gas market in Central & Eastern Europe (CEE) as a real-world case, we compare:

- Traditional Management

- AI-Orchestrator Leadership

Both face the same external conditions.

The difference lies in how cash-flow is allocated under pressure.

2. External Situation Overview (CEE · Week 5/26)

The Industrial Gas sector in CEE is exposed to multiple simultaneous pressures:

- Ongoing geopolitical instability linked to Eastern supply corridors

- Increased logistics volatility and longer lead times

- Energy price uncertainty and LNG spot exposure

- Higher interest rates and tighter liquidity conditions

- Customers demanding reliability despite volatility

These factors are external and uncontrollable.

They directly affect cost structures, delivery reliability, and cash-flow timing.

3. Traditional Management Response

Leadership Pattern

Traditional managers respond reactively once disruption becomes visible.

Typical actions include:

- Last-minute logistics decisions

- Emergency LNG or cylinder sourcing at premium prices

- Short-term firefighting to protect delivery commitments

- Delayed structural decisions due to uncertainty

- Focus on urgent operational issues over systemic fixes

Cash-Flow Allocation Behavior

Cash is primarily allocated to:

- Emergency freight

- Spot purchases

- Overtime and escalation costs

- Short-term credit facilities

Resulting Cash-Flow Impact

- Higher operating costs

- Margin erosion

- Increased financing costs

- Liquidity buffers consumed

- Management attention absorbed by noise

Outcome:

Cash-flow is defended too late and leaks through urgency.

4. AI-Orchestrator Leadership Response

Leadership Pattern

AI-Orchestrator Leaders act before urgency peaks.

They use:

- Early geopolitical and logistics signal monitoring

- Scenario modeling (cost, supply, liquidity, margin)

- Structured supplier diversification

- Customer segmentation and pricing logic

- Cash-flow treated as a strategic constraint, not an accounting outcome

Cash-Flow Allocation Behavior

Cash is allocated intentionally to:

- Buffer capacity

- Optional logistics routes

- Supplier portfolio redesign

- Scenario readiness instead of firefighting

- Selective automation and delegation

Resulting Cash-Flow Impact

- Lower volatility costs

- Reduced emergency spending

- Preserved liquidity

- Stable margins despite disruption

- Management focus remains on value-creating decisions

Outcome:

Cash-flow is orchestrated, not consumed.

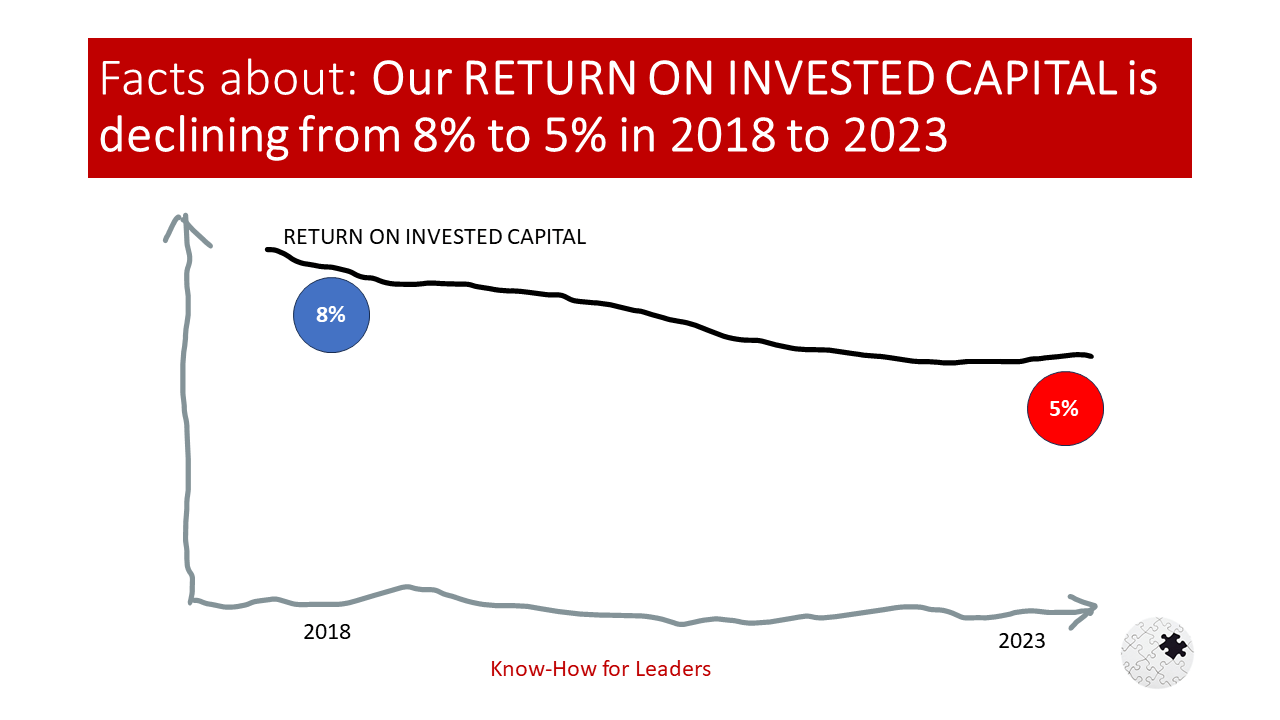

5. Comparative Net Cash-Flow Effect

Under identical market conditions:

- Traditional Management

- Experiences cash-flow erosion due to reactive urgency

- Loses value through hidden operational leakage

- AI-Orchestrator Leadership

- Redirects cash from urgency to importance

- Converts volatility into structured advantage

Observed Delta:

≈ +16% net positive cash-flow impact

created solely by better allocation decisions, not higher sales.

6. The Cash-Flow Allocation Insight

The decisive shift is not technology itself.

It is this leadership move:

From allocating cash to urgent reactions

to allocating cash to important, orchestrated decisions before shocks materialise.

This shift:

- Reduces downside risk

- Preserves optionality

- Stabilises cash-flow under uncertainty

7. Board-Level Takeaway

- Geopolitical volatility is unavoidable.

- Cash-flow losses are not.

- The real differentiator is how leadership allocates cash under pressure.

Traditional managers manage urgency.

AI-Orchestrator Leaders manage importance.

8. Final Statement

The Delta is the net cash-flow gained by shifting leadership attention from urgent reactions to important, orchestrated decisions before shocks materialise.

RapidKnowHow®

AI-Orchestrating Leadership · Cash-Flow Allocation under Uncertainty