Answer:

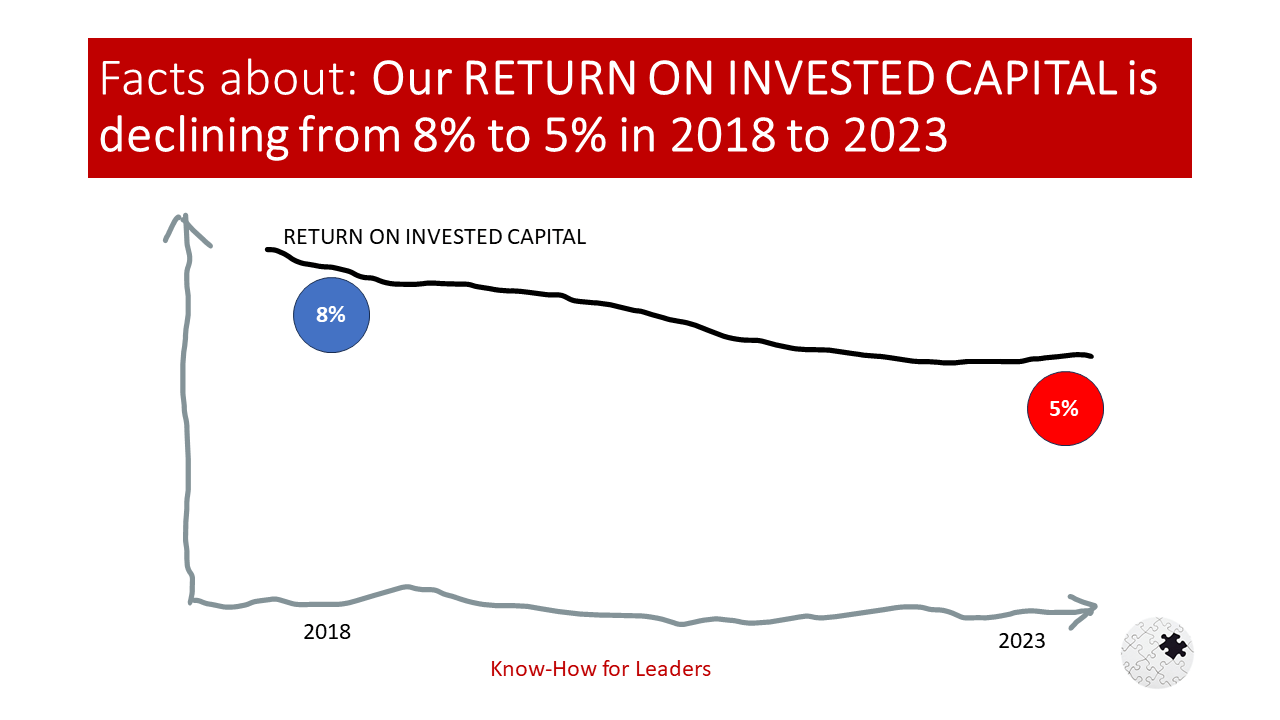

The decline in Return on Invested Capital (ROIC) from 8% to 5% over the period from 2018 to 2023 is a significant concern for any business. ROIC is a profitability ratio that measures how effectively a company uses its capital to generate profits. It’s an important metric because it provides insights into the efficiency of a company’s investment decisions.

**What is the cause of our ROIC decline?**

There could be several reasons for the decline in ROIC.

One possible reason could be that the company’s net operating profit after taxes (NOPAT) has decreased. This could be due to increased competition, higher costs, or lower sales.

Another possible reason could be that the company’s invested capital has increased without a corresponding increase in NOPAT. This could occur if the company has made significant investments in new assets but these investments have not yet generated expected returns.

**What is the effect of our ROIC decline?**

The decline in ROIC can have several negative effects on the business.

Firstly, it can make it more difficult for the company to attract investors, as a lower ROIC indicates that the company is less efficient at using its capital to generate profits.

Secondly, it can also make it more challenging for the company to fund future growth initiatives, as these often require significant capital investment.

Lastly, a declining ROIC can also indicate underlying issues with the company’s business model or strategy that need to be addressed.

**What would be the best strategies to turn the situation around?**

There are several strategies that a company can use to improve its ROIC:

1. **Improve Operational Efficiency:** The company can look for ways to reduce costs and increase sales, which would increase NOPAT and thus improve ROIC.

2. **Optimize Capital Structure:** The company can review its capital structure and look for ways to reduce its invested capital without negatively impacting NOPAT. This could involve selling off non-core assets or improving working capital management.

3. **Invest in High Return Projects:** The company can focus on investing in projects that are expected to generate high returns, which would increase NOPAT and improve ROIC.

**What are the 3 actions to improve the ROIC fast?**

1. **Cost Reduction:** Implement cost reduction measures across all areas of the business. This could involve renegotiating contracts with suppliers, reducing overhead costs, or improving operational efficiency.

2. **Increase Sales:** Look for ways to increase sales, such as entering new markets, launching new products, or improving marketing efforts.

3. **Improve Asset Utilization:** Review the company’s asset utilization and look for ways to get more value from existing assets. This could involve selling off underutilized assets or finding ways to use existing assets more efficiently.

**Conclusion**

In conclusion, a declining ROIC is a serious concern that needs to be addressed promptly. By understanding the causes of the decline and implementing strategies to improve operational efficiency, optimize capital structure, and invest in high return projects, it is possible to turn the situation around and improve ROIC. However, it’s important to remember that these strategies need to be tailored to the specific circumstances of the company and implemented in a thoughtful and strategic manner.