Answer:

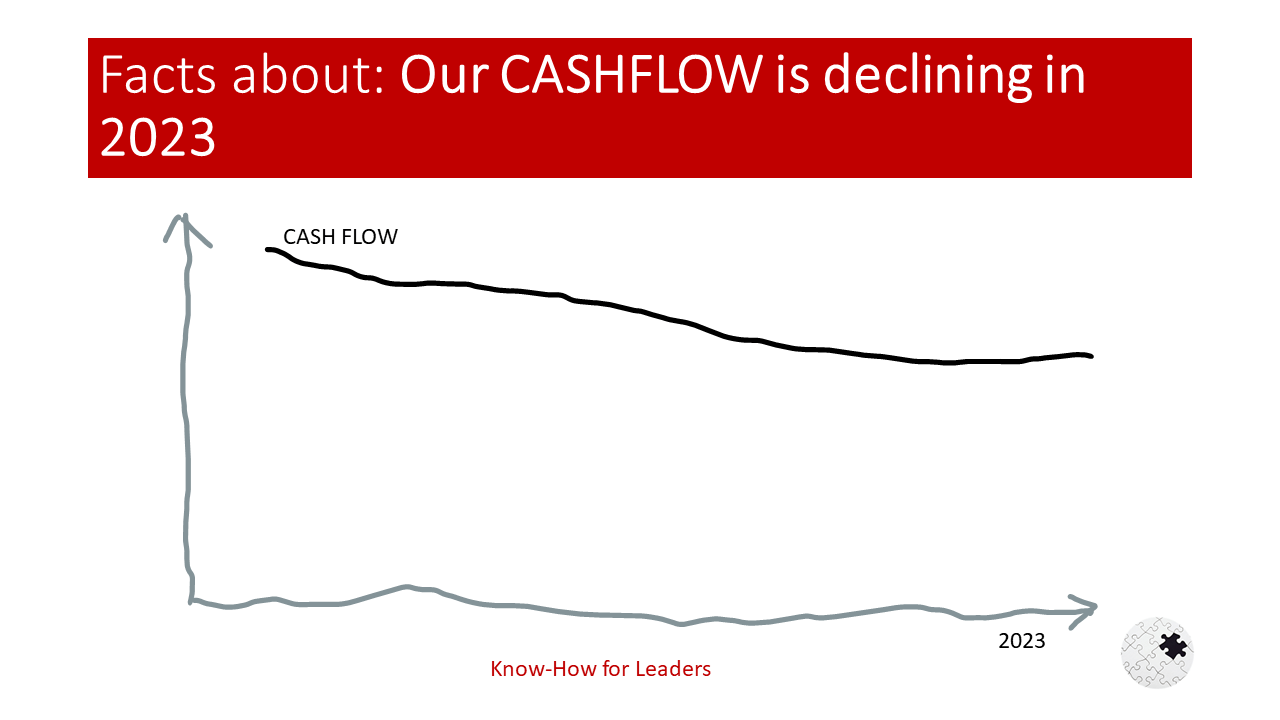

The business situation you’re facing, a decline in cash flow in 2023, is a common challenge for many businesses. It’s important to understand that cash flow is the lifeblood of any business and its decline can have serious implications. Let’s delve into the possible causes, effects, strategies to turn the situation around, and quick actions to improve your cash flow.

**What is the cause of our cash-flow decline?**

There could be several reasons for a decline in cash flow.

One of the most common causes is a decrease in sales or revenue. This could be due to market conditions, increased competition, or a decrease in demand for your product or service.

Another cause could be an increase in expenses. This could be due to rising costs of raw materials, labor costs, or other operational expenses.

Additionally, poor accounts receivable management can also lead to cash flow problems. If customers are not paying their invoices on time, it can create a cash crunch for your business.

**What is the effect of our cash-flow decline?**

The effects of a declining cash flow can be severe and far-reaching.

Firstly, it can limit your ability to invest in growth opportunities. Without sufficient cash flow, you may not be able to invest in new products, services, or markets.

Secondly, it can affect your ability to meet your financial obligations such as paying suppliers, employees, or lenders. This can damage your business reputation and relationships.

Lastly, prolonged cash flow problems can lead to insolvency or bankruptcy.

**What would be the best strategies to turn the situation around?**

Turning around a declining cash flow requires strategic planning and execution.

Here are some strategies:

1. **Increase Sales:** This is the most straightforward strategy but often the hardest to achieve. You could consider expanding into new markets, launching new products or services, or improving your marketing efforts.

2. **Reduce Expenses:** Look at all your business expenses and identify areas where you can cut costs without affecting the quality of your product or service.

3. **Improve Accounts Receivable Management:** Implement stricter credit policies and follow up on overdue invoices more aggressively.

**What are the 3 actions to improve the cash-flow fast?**

1. **Invoice Promptly:** The sooner you invoice, the sooner you get paid. Make sure you’re invoicing as soon as work is completed or a product is delivered.

2. **Negotiate with Suppliers:** Try to negotiate longer payment terms with your suppliers to delay outflows of cash.

3. **Offer Discounts for Early Payment:** Encourage your customers to pay their invoices early by offering a small discount.

**Conclusion**

In conclusion, a decline in cash flow is a serious issue that needs immediate attention. By understanding the causes and effects, implementing strategic changes, and taking quick actions, you can turn around your cash flow situation. Remember, managing cash flow is not a one-time task but an ongoing process that requires constant monitoring and adjustments.