The 2026–2030 Strategic Whitepaper

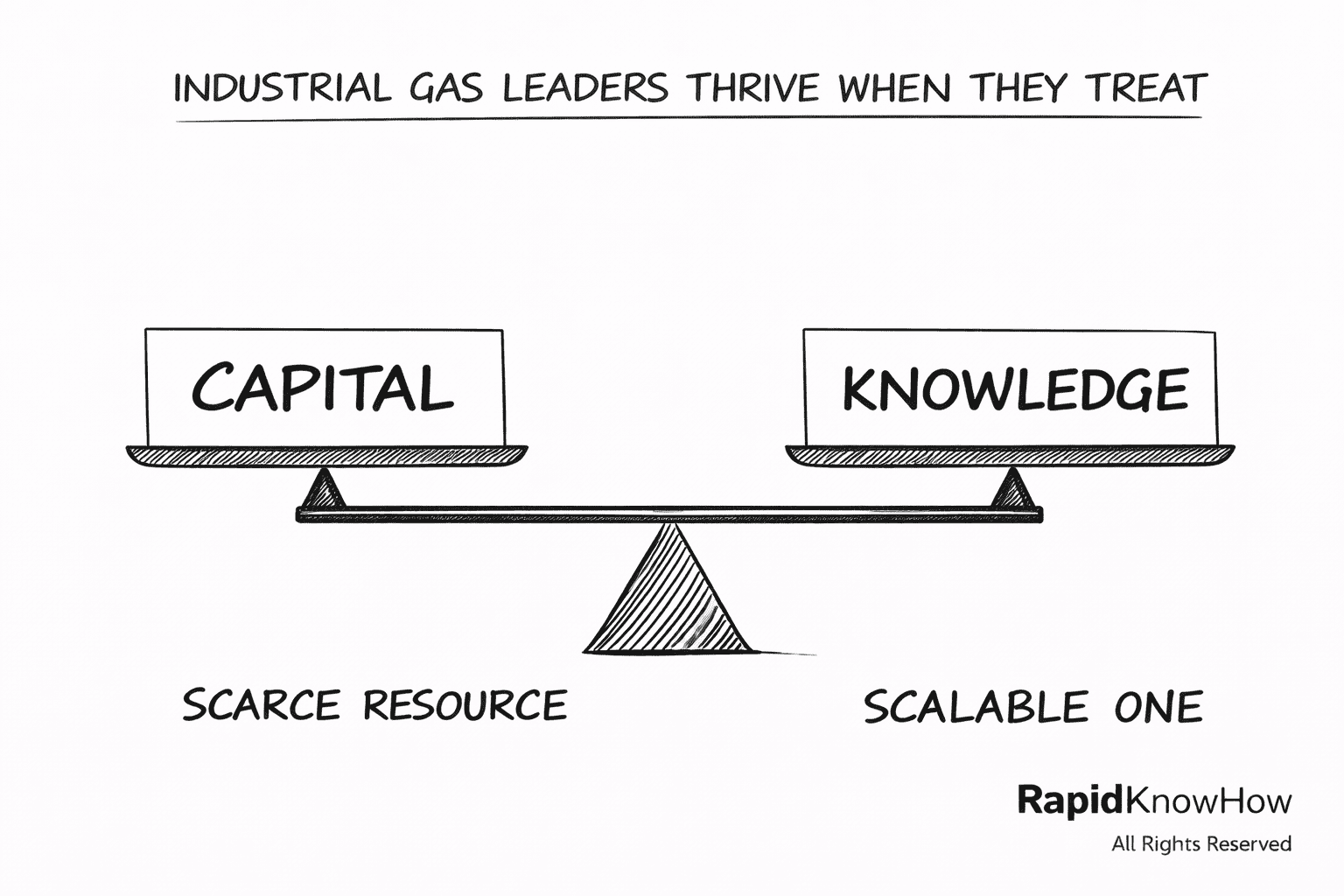

RapidKnowHow + Industrial Gas Leaders

A) EXECUTIVE SUMMARY (CEO 3-Minute Read)

Industrial Gas leaders (e.g., Linde plc, Air Liquide, Air Products) operate in a capital-intensive, margin-sensitive environment shaped by:

- Energy volatility

- Hydrogen hype vs ROI reality

- AI data center cooling demand

- CO₂ policy acceleration

- Long asset cycles

- Slow decision hierarchies

2026 reality:

Operational excellence is no longer sufficient.

The decisive advantage shifts to:

Decision Speed × Capital Allocation Intelligence × AI-Orchestrated System Thinking.

This Whitepaper introduces the AI-Orchestrator Leadership Model for Industrial Gases — a system that converts signal noise into measurable Free Cash-Flow impact.

B) THE STRATEGIC CONTEXT 2026–2030

1️⃣ Hydrogen Investment Wave

Massive announcements.

Uncertain IRR.

Policy-driven demand distortions.

2️⃣ AI Infrastructure Acceleration

Data centers require:

- Liquid nitrogen

- Specialty gases

- Precision supply reliability

AI growth = opportunity — if priced correctly.

3️⃣ Energy Volatility

Electricity cost directly impacts ASUs.

Pass-through timing is decisive.

4️⃣ Carbon Pricing & ESG

CO₂ capture and green positioning affect access to capital.

C) THE CORE PROBLEM

Traditional Leadership Model:

- Production optimized

- Sales optimized

- Procurement optimized

- Finance optimized

→ But not orchestrated.

Result:

- Slow reaction to energy spikes

- Late pricing adjustments

- Suboptimal CapEx sequencing

- FCF leakage

- Hydrogen misallocation risk

D) THE AI-ORCHESTRATOR LEADER MODEL

THE OPERATING LOOP

Signal → Prioritize → Act → Capture → Reinforce

1️⃣ SIGNAL

Inputs:

- Energy cost delta

- Policy shifts

- AI data center pipeline

- Customer credit risk

- Capacity utilization

Filtered via:

Industrial Gas Exposure Index

2️⃣ PRIORITIZE

Ranking based on:

- FCF sensitivity

- Decision speed leverage

- ROICE potential

- Risk compression effect

3️⃣ ACT

Examples:

- Accelerated price pass-through recalibration

- Merchant contract renegotiation

- Hydrogen project re-staging

- AI infrastructure account prioritization

- CapEx deferral or acceleration

4️⃣ CAPTURE

Measure:

- Free Cash-Flow Delta

- Margin delta

- Working capital release

- ROICE %

5️⃣ REINFORCE

Institutionalize:

- Weekly signal dashboard

- Monthly orchestration meeting

- Quarterly capital re-ranking

- AI decision compression

E) THE DIFFERENCE VS TRADITIONAL LEADERSHIP

| Traditional | AI-Orchestrator |

|---|---|

| Budget cycle driven | Signal driven |

| Annual CapEx planning | Rolling capital re-ranking |

| Operational focus | Cash-Flow focus |

| Departmental decisions | System orchestration |

| Reactive pricing | Predictive adjustment |

F) INDUSTRIAL GAS USE CASES

Use Case 1 — Energy Shock

Traditional:

Quarterly adjustment.

Orchestrator:

48-hour scenario stress → 7-day pricing reset → FCF preservation.

Use Case 2 — Hydrogen Hype Risk

Traditional:

CapEx driven by political pressure.

Orchestrator:

IRR stress-tested with exposure model before final investment.

Use Case 3 — AI Data Center Surge

Traditional:

Standard sales cycle.

Orchestrator:

Strategic prioritization of high-ROICE accounts + supply assurance.

G) MEASURABLE IMPACT POTENTIAL (ILLUSTRATIVE)

Industrial Gas Player:

Revenue: €5–15bn

EBITDA Margin: 20–30%

CapEx: 12–18% of revenue

Orchestrator Model Potential:

- 1–3% FCF improvement via decision speed compression

- 2–4% working capital release

- 1–2% CapEx re-ranking improvement

- Risk reduction in hydrogen exposure

Net Impact:

Strategic resilience + compounding capital discipline.

H) WHY THIS MATTERS NOW

Between 2026–2030:

- AI energy demand rises

- Hydrogen reality check occurs

- Carbon costs increase

- Capital becomes more selective

Leaders who orchestrate win.

Leaders who optimize silos lag.

I) IMPLEMENTATION ROADMAP

Phase 1 – Diagnostic (30 Days)

Deploy:

- Industrial Gas Exposure Index

- Pass-Through Sensitivity Model

- CapEx Heatmap

- AI Demand Radar

Phase 2 – 90-Day Sprint

Deliver:

- FCF opportunity map

- Decision speed compression plan

- Portfolio stress test

- CapEx re-ranking

Phase 3 – Institutionalization

Embed:

- Weekly Signal Dashboard

- Monthly Orchestration Forum

- Board-Level ROICE Review

J) POSITIONING STATEMENT

RapidKnowHow + Industrial Gas Leader

= Industrial Gas Strategic Orchestration as a Service

Not consulting.

Not digital transformation.

But:

Cash-Flow Centric AI-Orchestrated Leadership.

K) STRATEGIC CONCLUSION

The next competitive advantage in industrial gases will not come from:

- Bigger plants

- More hydrogen announcements

- ESG slogans

It will come from:

Decision Speed + Capital Allocation Intelligence + AI Signal Compression.

That is the AI-Orchestrator Leader. – Josef David