Traditional Industrial Functional Organisation

vs

AI-Orchestrator Leadership Model

(Industrial Gas / Capital-Intensive Industry Context)

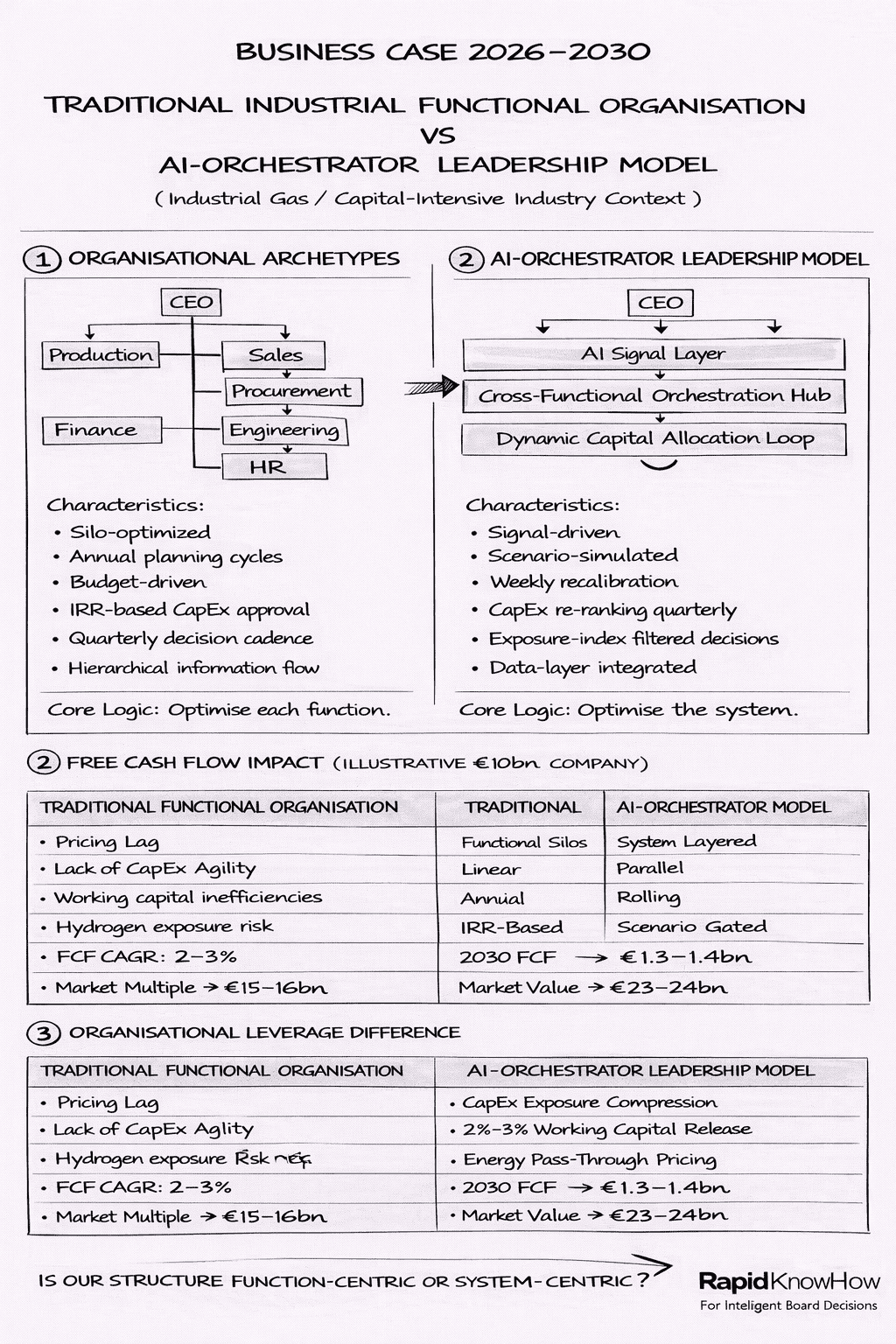

A) ORGANISATIONAL ARCHETYPES

1️⃣ Traditional Industrial Functional Organisation

Structure:

CEO

→ Production

→ Sales

→ Procurement

→ Finance

→ Engineering

→ HR

Characteristics:

- Silo-optimized

- Annual planning cycles

- Budget-driven

- IRR-based CapEx approval

- Quarterly decision cadence

- Hierarchical information flow

Core Logic:

Optimise each function.

Blind Spot:

System volatility across functions.

2️⃣ AI-Orchestrator Leadership Model

Structure:

CEO

→ AI Signal Layer

→ Cross-Functional Orchestration Hub

→ Dynamic Capital Allocation Loop

Characteristics:

- Signal-driven

- Scenario-simulated

- Weekly recalibration

- CapEx re-ranking quarterly

- Exposure-index filtered decisions

- Data-layer integrated

Core Logic:

Optimise the system.

B) DECISION SPEED & CAPITAL FLOW

Traditional Model

Energy shock occurs.

Step 1: Production impact analysis

Step 2: Finance review

Step 3: Sales pricing adjustment

Step 4: Board update

Time: 6–12 weeks.

Margin compression happens before reaction.

AI-Orchestrator Model

Energy signal detected.

AI Signal Engine →

Scenario simulation (24–48h) →

Cross-functional war-room →

Pricing adjustment within 5–7 days.

Result:

Margin protected.

Decision compression = FCF protection.

C) FREE CASH FLOW IMPACT (ILLUSTRATIVE €10bn COMPANY)

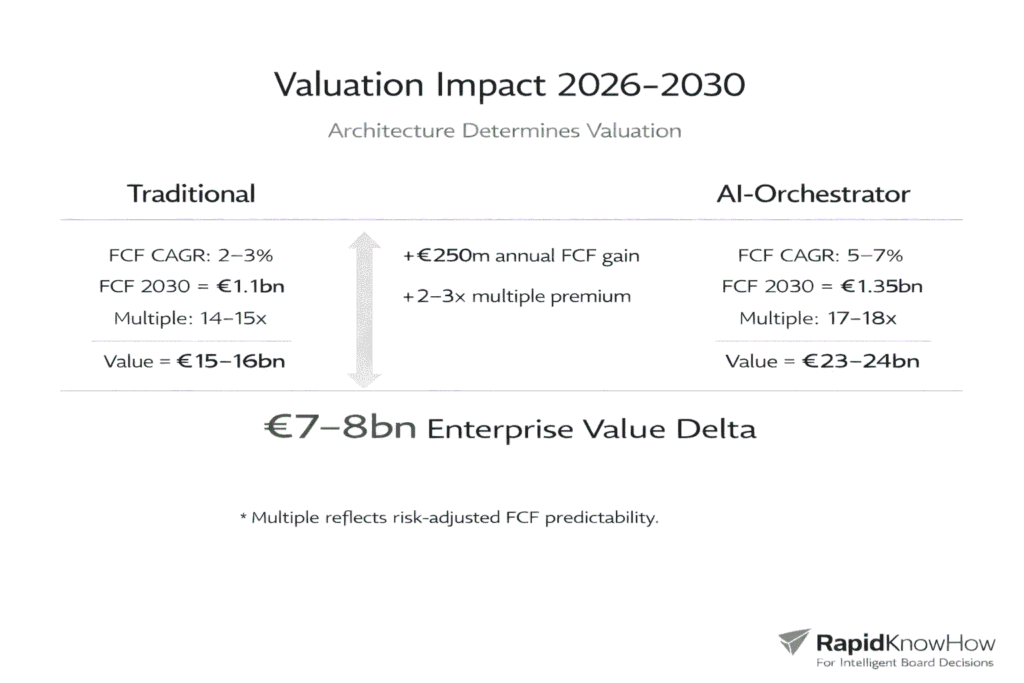

Baseline FCF: €1bn

Traditional Functional Organisation

- Pricing lag

- CapEx rigidity

- Working capital inefficiencies

- Hydrogen exposure risk

FCF CAGR: 2–3%

2030 FCF ≈ €1.1bn

Market Multiple: 14–15×

Market Value ≈ €15–16bn

AI-Orchestrator Leadership Model

- Exposure-index filtered CapEx

- Working capital release 2–3%

- Energy pass-through compression

- AI-prioritized revenue focus

FCF CAGR: 5–7%

2030 FCF ≈ €1.3–1.4bn

Multiple expansion: 17–18×

Market Value ≈ €23–24bn

D) ORGANISATIONAL LEVERAGE DIFFERENCE

| Dimension | Traditional | AI-Orchestrator |

|---|---|---|

| Structure | Functional Silos | System Layered |

| Decision Flow | Linear | Parallel |

| Planning | Annual | Rolling |

| CapEx Logic | IRR-based | Scenario-gated |

| Pricing | Reactive | Predictive |

| Risk Management | Post-event | Pre-signal |

| FCF Volatility | High | Reduced |

| Enterprise Value 2030 | ~€16bn | ~€23–24bn |

E) STRATEGIC GAP

The difference is not technology.

It is architecture.

Functional organisations optimise departments.

AI-Orchestrator organisations optimise cash-flow systems.

From 2026–2030:

The market will reward system-level intelligence.

F) BOARD-LEVEL QUESTION

The real governance question becomes:

Are we structured to optimise functions?

Or are we structured to orchestrate value?

Because:

Silos create lag.

Lag creates volatility.

Volatility compresses valuation.

G) CONCLUSION

The Traditional Industrial Organisation is efficient in stable environments.

The AI-Orchestrator Model is resilient in volatile environments.

2026–2030 will be volatile.

Therefore:

The organisational design decision

is a valuation decision. – Josef David

What an effective Board-Level Presentation Must Deliver

In 10 seconds Board Members must understand:

- FCF increases structurally.

- Risk declines.

- Multiple expands.

- Valuation gap compounds.

Everything else is secondary. – Josef David