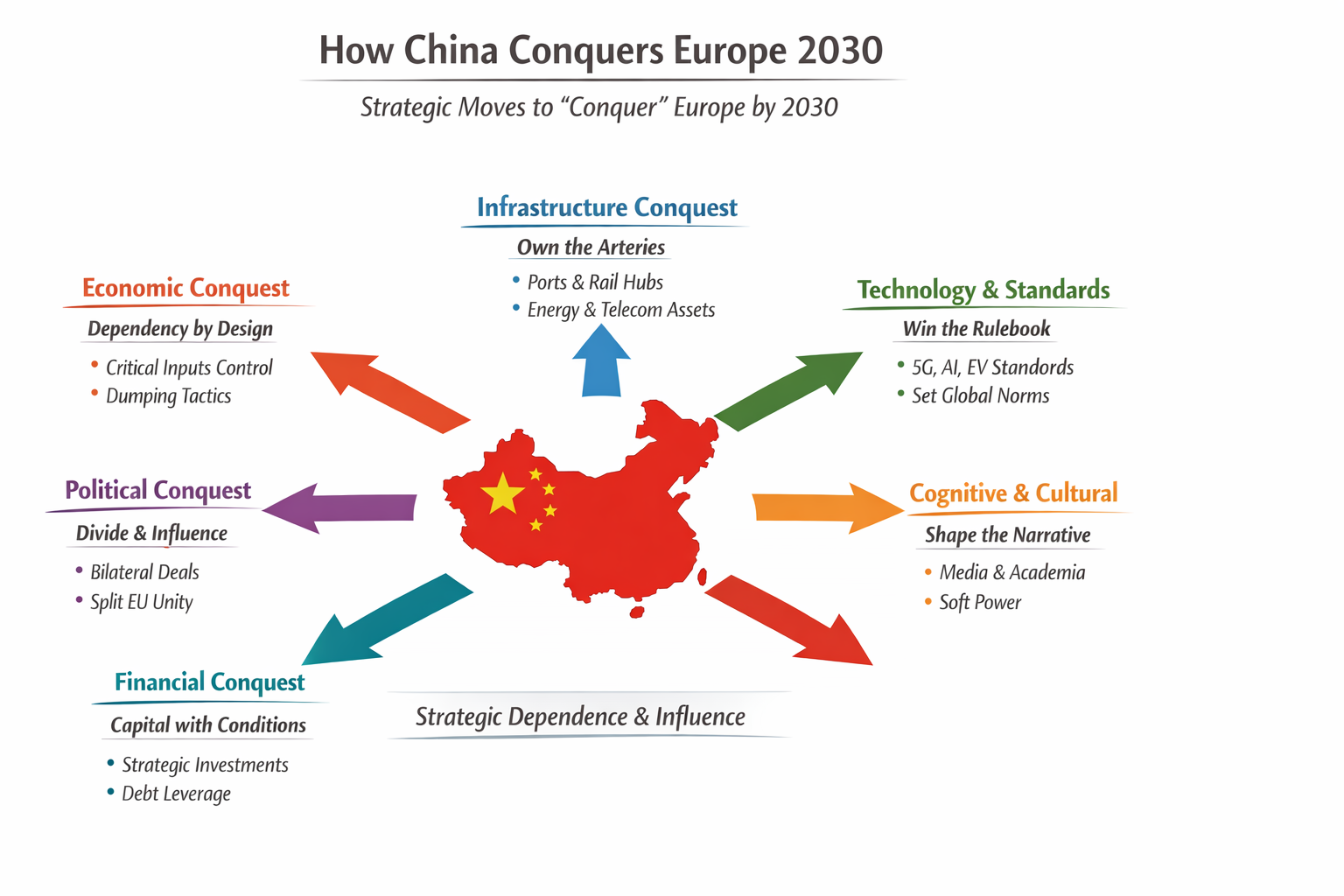

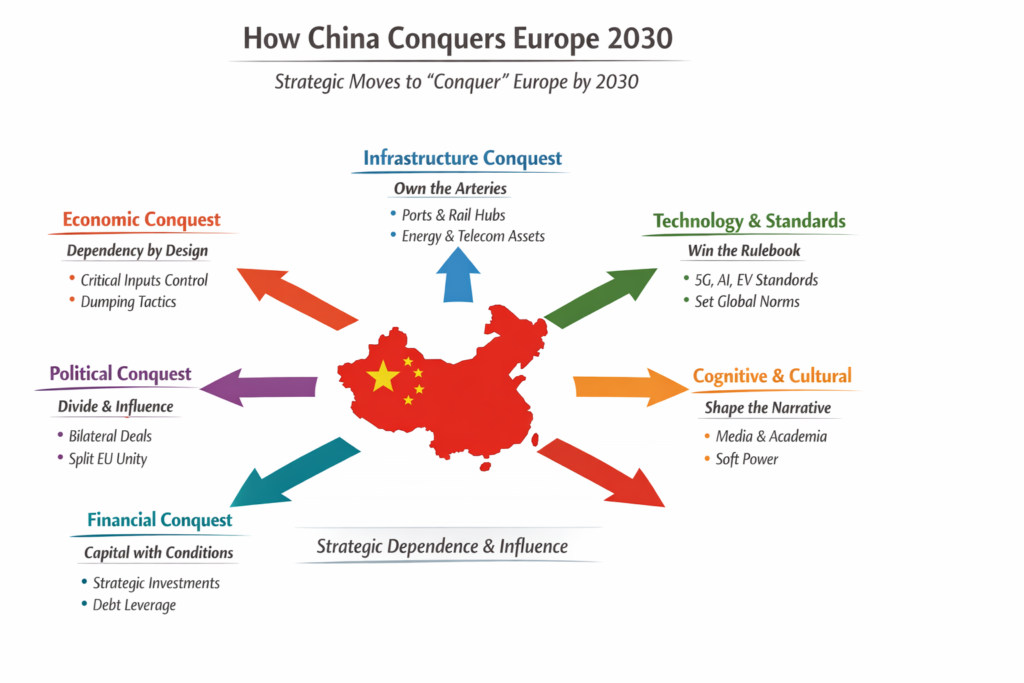

Strategies China Uses to Conquer (Read: Dominate & Shape) Europe

Conquest here is not military. It’s about standards, dependencies, leverage, and decision power. China’s playbook is patient, asymmetric, and systemic.

🎯 Strategic Objective (2030)

China’s aim isn’t to “defeat” Europe—but to lock in long-term influence so that Europe:

- depends on Chinese inputs,

- aligns with Chinese standards,

- hesitates to oppose Chinese interests,

- fragments internally instead of acting as one bloc.

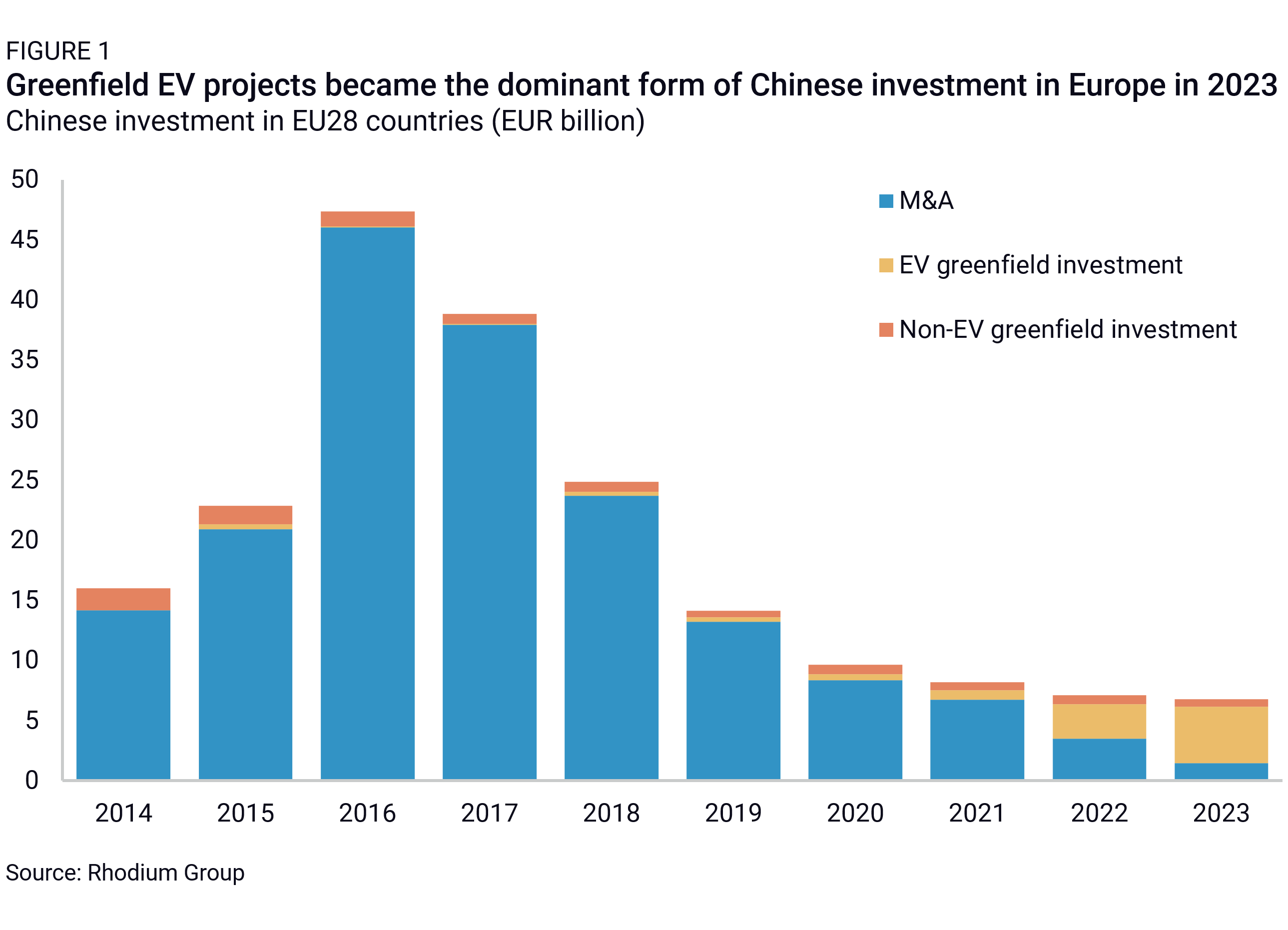

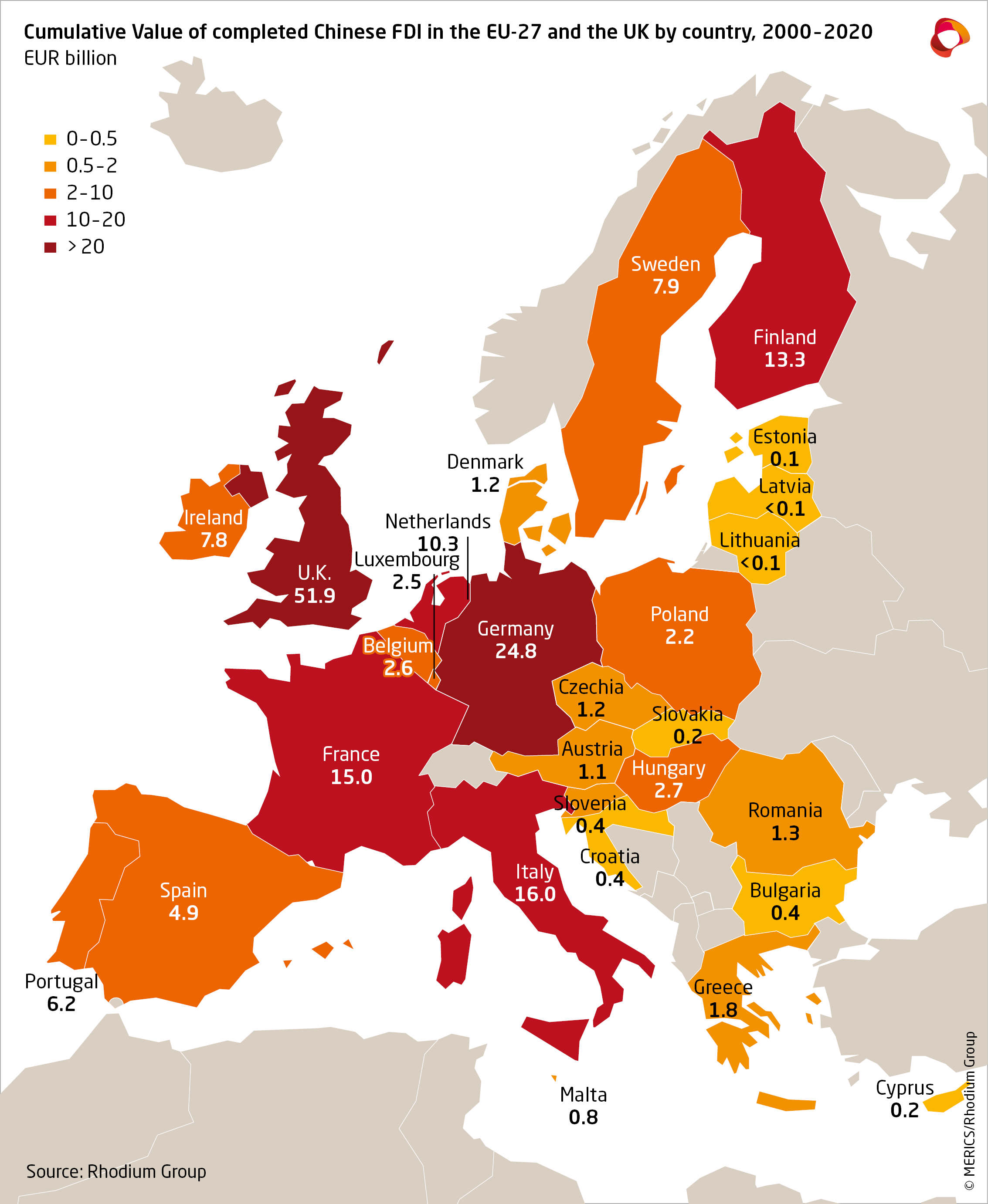

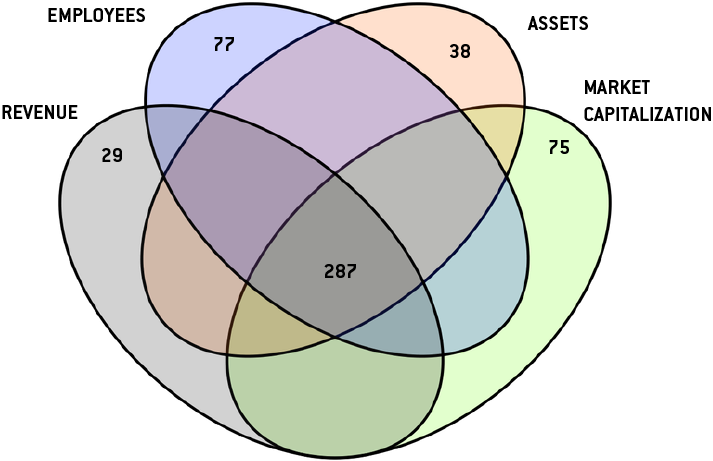

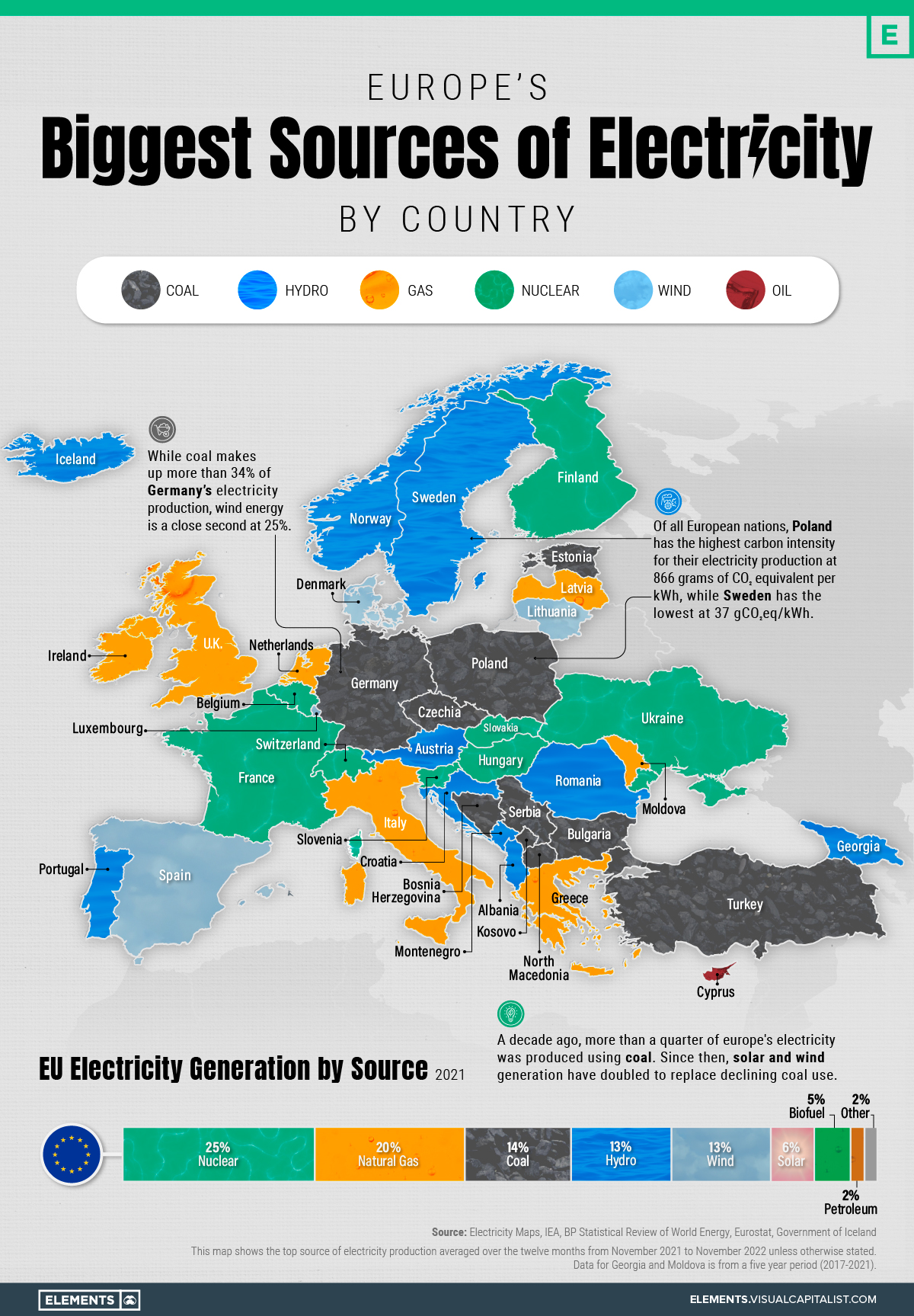

1️⃣ Economic Conquest: Dependency by Design

China systematically embeds itself in Europe’s value chains.

Key Moves

- Control of critical inputs: batteries, rare earths, solar panels, EV components

- Dumping + scale economics to kill European competitors

- Long-term supply contracts → switching costs become prohibitive

Effect on Europe

- Industrial hollowing

- De-risking becomes expensive, slow, politically painful

China’s Advantage

- State-backed capital

- Willingness to absorb losses for strategic gain

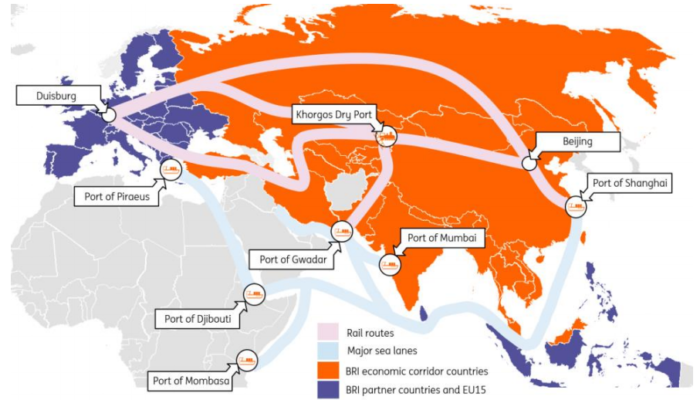

2️⃣ Infrastructure Conquest: Own the Arteries

Key Moves

- Ports (e.g. Piraeus), rail hubs, logistics centers

- Energy grids, telecom backbones (directly or via vendors)

Why It Matters

Infrastructure = optionality + leverage

- Preferential access

- Data visibility

- Crisis influence

Europe keeps sovereignty on paper—China gains it in practice.

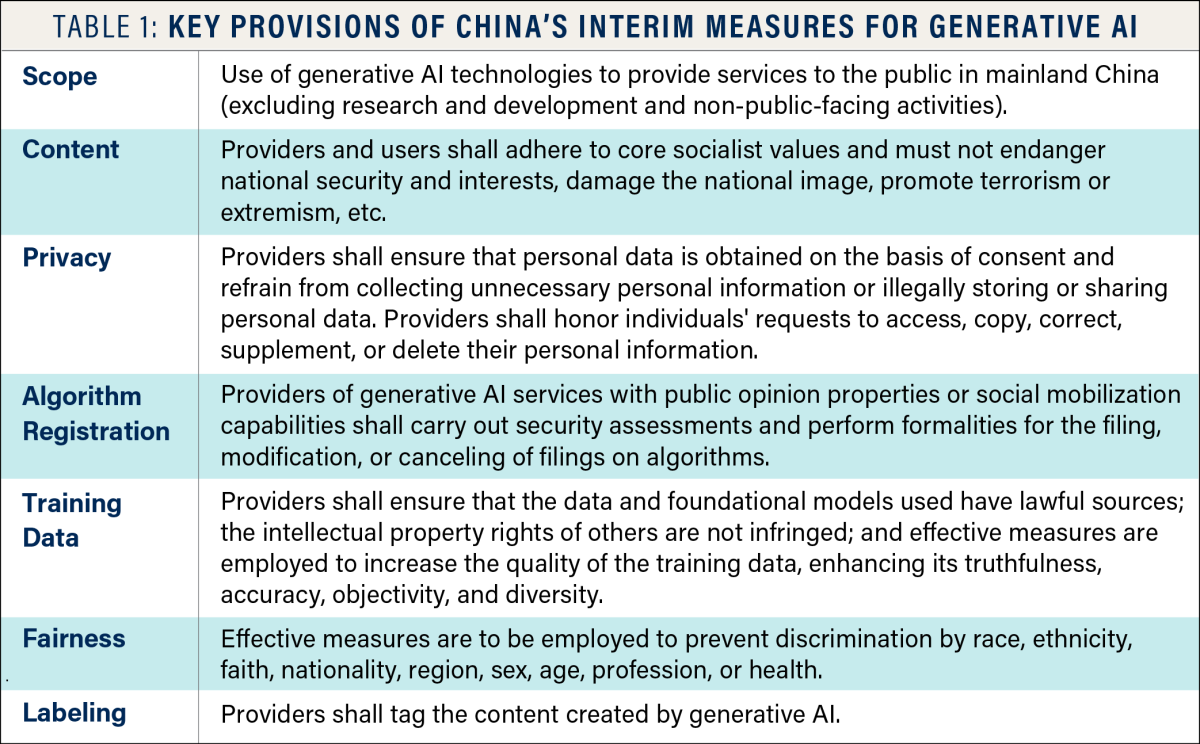

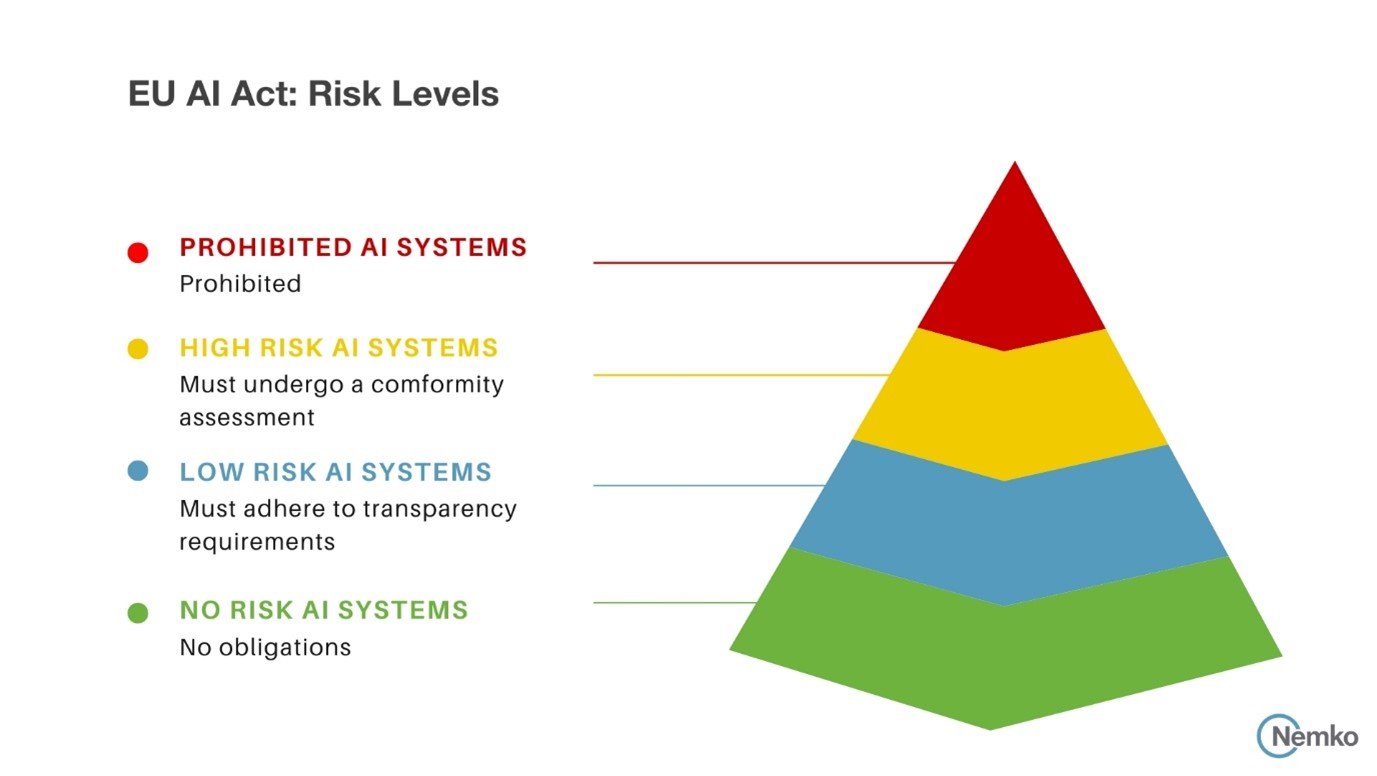

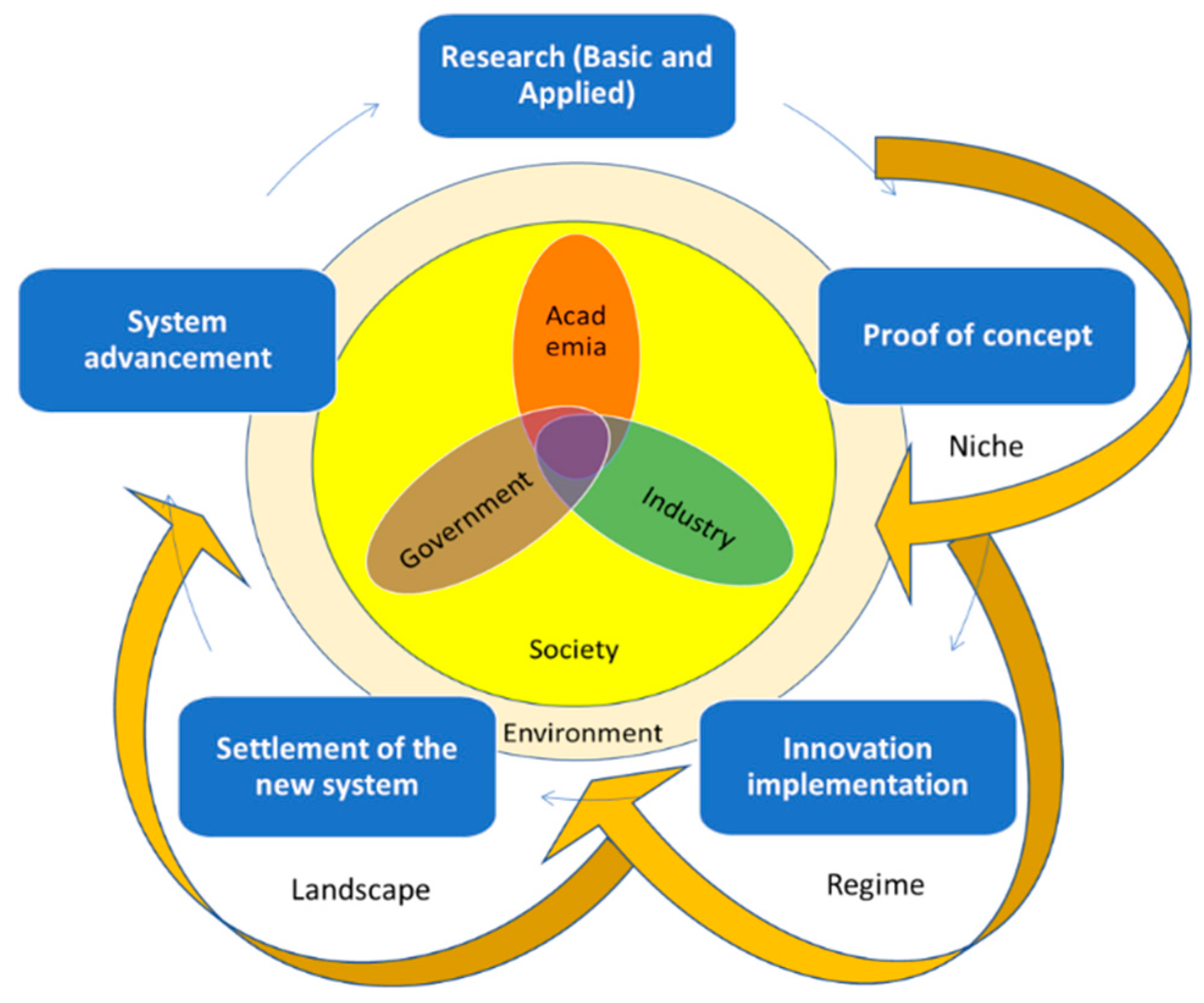

3️⃣ Technology & Standards Conquest: Win the Rulebook

Key Moves

- Push Chinese standards in:

- 5G/6G

- AI governance

- Smart cities

- EV charging & batteries

- Dominate international standards bodies

Outcome

- European firms must adapt to Chinese norms

- China captures IP rents & platform power

The real war is fought before products exist.

4️⃣ Political Conquest: Divide, Don’t Confront

China avoids Brussels-first strategies.

Instead

- Bilateral deals with weaker or cash-strapped states

- “17+1 logic” → fragment EU unity

- Strategic courting of business elites, regions, cities

Result

- Europe speaks with 27 voices, China with one.

5️⃣ Financial Conquest: Capital with Conditions

Key Moves

- Patient capital via SOEs, policy banks, shadow vehicles

- Strategic equity stakes (below political radar)

- Refinancing during stress phases

Effect

- Quiet veto power

- Political reluctance to “upset the investor”

6️⃣ Cognitive & Cultural Conquest: Shape the Narrative

Tools

- Academic partnerships

- Think tanks & Confucius Institutes

- Media cooperation, sponsorships

- “Win-win” framing, depoliticized language

Goal

Normalize:

- Chinese governance logic

- Technocratic authoritarian efficiency

- “Stability > messy democracy” narrative

🧠 The Meta-Strategy: Asymmetric Patience

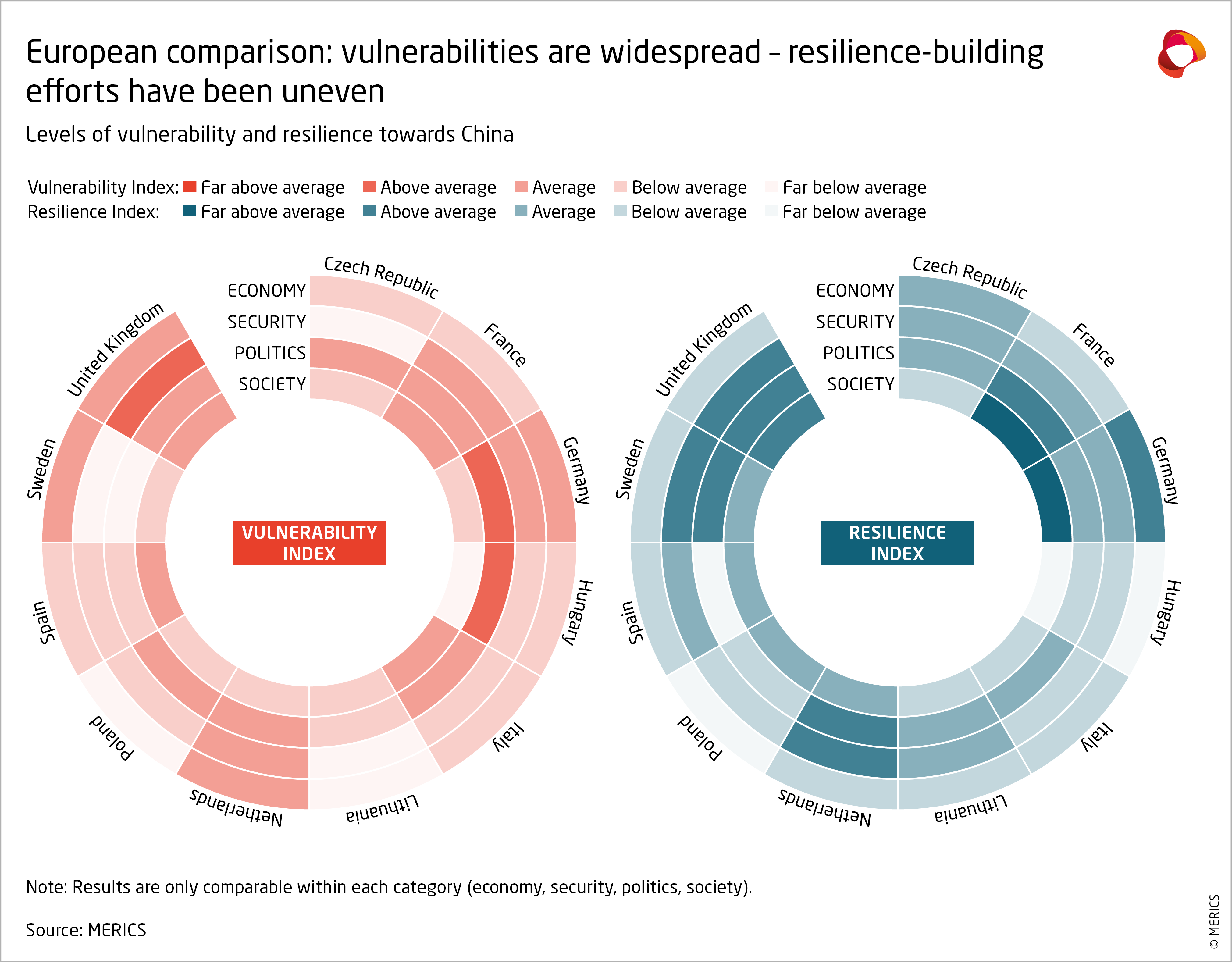

China exploits Europe’s structural weaknesses:

- Short political cycles

- Regulatory overhang

- Fragmented sovereignty

- Moral hesitation to use power

China plays 20-year games. Europe debates 4-year budgets.

⚠️ What Europe Underestimates Most

- Speed of lock-in (dependencies form faster than expected)

- Standards power > military power

- Economic coercion without sanctions

- Internal division as the primary vulnerability

🔮 2030 Scenarios (Condensed)

| Scenario | Description | Likelihood |

|---|---|---|

| Soft Sinicization | Economic & tech dependence, political ambiguity | High |

| Strategic Drift | Europe reacts too late, fragments further | Medium-High |

| Selective Decoupling | Partial pushback, high cost | Medium |

| European Strategic Awakening | Unified industrial & tech sovereignty | Low (but decisive) |

🧭 Strategic Bottom Line

China does not conquer Europe with tanks.

It conquers with:

- contracts,

- standards,

- ports,

- capital,

- patience.

When Europe finally decides, the options are already gone.

Stress-Test: Europe’s Counter-Strategies vs China (to 2030)

What holds under pressure—and what collapses when China pushes the levers?

Test Setup (the “China Push”)

Assume China simultaneously applies four pressures:

- export restrictions on critical inputs, 2) price undercutting via scale, 3) standards acceleration, 4) political divide-and-deal tactics.

Counter-Strategy 1: “Strategic Autonomy / De-Risking”

Claim: Reshore essentials; diversify suppliers.

Reality under stress:

- ⛔ Too slow: permitting, labor, capital cycles lag China’s moves.

- ⛔ Too narrow: autonomy framed as risk, not competitiveness.

China’s break move: temporary price wars + selective export throttles.

Verdict: Weak unless speed and scale change.

Counter-Strategy 2: Industrial Policy & Subsidies

Claim: Build EU champions (chips, batteries, green tech).

Reality under stress:

- ⛔ Fragmentation: national programs dilute impact.

- ⛔ ROCE problem: subsidies without demand discipline burn cash.

China’s break move: overcapacity dumping to kill EU ROI.

Verdict: Medium-Weak without a demand anchor and consolidation.

Counter-Strategy 3: Trade Defense (Tariffs, CBAM, Anti-Dumping)

Claim: Level the playing field.

Reality under stress:

- ⛔ Retaliation-prone: hits EU exporters first.

- ⛔ Political fatigue: member states peel off.

China’s break move: targeted retaliation by sector/country.

Verdict: Medium tactically useful, strategically insufficient.

Counter-Strategy 4: Alliances (US, Japan, India)

Claim: Strength in numbers.

Reality under stress:

- ⛔ Asymmetric priorities: partners hedge their own interests.

- ⛔ Execution gaps: coordination is slow.

China’s break move: bilateral incentives to split the coalition.

Verdict: Medium—helpful but unreliable in crunch moments.

Counter-Strategy 5: Standards Leadership

Claim: Win the rulebook (AI, green, digital).

Reality under stress:

- ⛔ Late starts: committees move slower than markets.

- ⛔ Compliance cost: EU firms bear higher burden first.

China’s break move: rapid market adoption of Chinese standards.

Verdict: Medium-Strong if Europe moves first and funds adoption.

Counter-Strategy 6: Investment Screening & Security

Claim: Protect critical assets.

Reality under stress:

- ⛔ Capital gaps: fewer investors step in.

- ⛔ Creative routing: influence via minority stakes, suppliers.

China’s break move: indirect control through ecosystems.

Verdict: Medium—necessary guardrail, not a moat.

Counter-Strategy 7: Values & Normative Power

Claim: Democracy, rule of law attract allies.

Reality under stress:

- ⛔ Not a market lever: values don’t ship components.

- ⛔ Credibility gap: internal divisions blunt force.

China’s break move: “efficiency vs debate” narrative.

Verdict: Weak as a standalone defense.

🧪 Failure Modes (What breaks first)

- Speed mismatch (policy vs market time)

- Unity erosion (bilateral carve-outs)

- ROCE blindness (subsidies without returns)

- Standards lag (rules after lock-in)

🟢 What Actually Survives Stress

- Demand-side power (public procurement at scale)

- First-mover standards + adoption funding

- Pan-EU consolidation (fewer, larger champions)

- Hard industrial timelines (permits in months, not years)

📊 Stress-Test Scorecard

| Counter-Strategy | Holds Under China Pressure? | Fix Required |

|---|---|---|

| De-Risking | ❌ | Speed + scope |

| Subsidies | ⚠️ | Demand anchor + ROCE |

| Trade Defense | ⚠️ | Targeted, time-bound |

| Alliances | ⚠️ | Binding commitments |

| Standards | ✅* | Early adoption funding |

| Screening | ⚠️ | Ecosystem coverage |

| Values | ❌ | Pair with economics |

*Conditional on fast execution.

🔁 The One Counter-Move That Changes the Game

Europe as a single buyer + single standard-setter.

- Massive EU-wide procurement (energy, grids, mobility, defense tech).

- Adopt standards first, pay firms to implement, then export the rulebook.

- Force consolidation to create scale that matches China.

Without demand power and speed, Europe regulates while China dominates.

Stress-Test: Europe’s Counter-Strategies vs China (to 2030)

What holds under pressure—and what collapses when China pushes the levers?

Test Setup (the “China Push”)

Assume China simultaneously applies four pressures:

- export restrictions on critical inputs, 2) price undercutting via scale, 3) standards acceleration, 4) political divide-and-deal tactics.

Counter-Strategy 1: “Strategic Autonomy / De-Risking”

Claim: Reshore essentials; diversify suppliers.

Reality under stress:

- ⛔ Too slow: permitting, labor, capital cycles lag China’s moves.

- ⛔ Too narrow: autonomy framed as risk, not competitiveness.

China’s break move: temporary price wars + selective export throttles.

Verdict: Weak unless speed and scale change.

Counter-Strategy 2: Industrial Policy & Subsidies

Claim: Build EU champions (chips, batteries, green tech).

Reality under stress:

- ⛔ Fragmentation: national programs dilute impact.

- ⛔ ROCE problem: subsidies without demand discipline burn cash.

China’s break move: overcapacity dumping to kill EU ROI.

Verdict: Medium-Weak without a demand anchor and consolidation.

Counter-Strategy 3: Trade Defense (Tariffs, CBAM, Anti-Dumping)

Claim: Level the playing field.

Reality under stress:

- ⛔ Retaliation-prone: hits EU exporters first.

- ⛔ Political fatigue: member states peel off.

China’s break move: targeted retaliation by sector/country.

Verdict: Medium tactically useful, strategically insufficient.

Counter-Strategy 4: Alliances (US, Japan, India)

Claim: Strength in numbers.

Reality under stress:

- ⛔ Asymmetric priorities: partners hedge their own interests.

- ⛔ Execution gaps: coordination is slow.

China’s break move: bilateral incentives to split the coalition.

Verdict: Medium—helpful but unreliable in crunch moments.

Counter-Strategy 5: Standards Leadership

Claim: Win the rulebook (AI, green, digital).

Reality under stress:

- ⛔ Late starts: committees move slower than markets.

- ⛔ Compliance cost: EU firms bear higher burden first.

China’s break move: rapid market adoption of Chinese standards.

Verdict: Medium-Strong if Europe moves first and funds adoption.

Counter-Strategy 6: Investment Screening & Security

Claim: Protect critical assets.

Reality under stress:

- ⛔ Capital gaps: fewer investors step in.

- ⛔ Creative routing: influence via minority stakes, suppliers.

China’s break move: indirect control through ecosystems.

Verdict: Medium—necessary guardrail, not a moat.

Counter-Strategy 7: Values & Normative Power

Claim: Democracy, rule of law attract allies.

Reality under stress:

- ⛔ Not a market lever: values don’t ship components.

- ⛔ Credibility gap: internal divisions blunt force.

China’s break move: “efficiency vs debate” narrative.

Verdict: Weak as a standalone defense.

🧪 Failure Modes (What breaks first)

- Speed mismatch (policy vs market time)

- Unity erosion (bilateral carve-outs)

- ROCE blindness (subsidies without returns)

- Standards lag (rules after lock-in)

🟢 What Actually Survives Stress

- Demand-side power (public procurement at scale)

- First-mover standards + adoption funding

- Pan-EU consolidation (fewer, larger champions)

- Hard industrial timelines (permits in months, not years)

📊 Stress-Test Scorecard

| Counter-Strategy | Holds Under China Pressure? | Fix Required |

|---|---|---|

| De-Risking | ❌ | Speed + scope |

| Subsidies | ⚠️ | Demand anchor + ROCE |

| Trade Defense | ⚠️ | Targeted, time-bound |

| Alliances | ⚠️ | Binding commitments |

| Standards | ✅* | Early adoption funding |

| Screening | ⚠️ | Ecosystem coverage |

| Values | ❌ | Pair with economics |

*Conditional on fast execution.

🔁 The One Counter-Move That Changes the Game

Europe as a single buyer + single standard-setter.

- Massive EU-wide procurement (energy, grids, mobility, defense tech).

- Adopt standards first, pay firms to implement, then export the rulebook.

- Force consolidation to create scale that matches China.

Without demand power and speed, Europe regulates while China dominates.

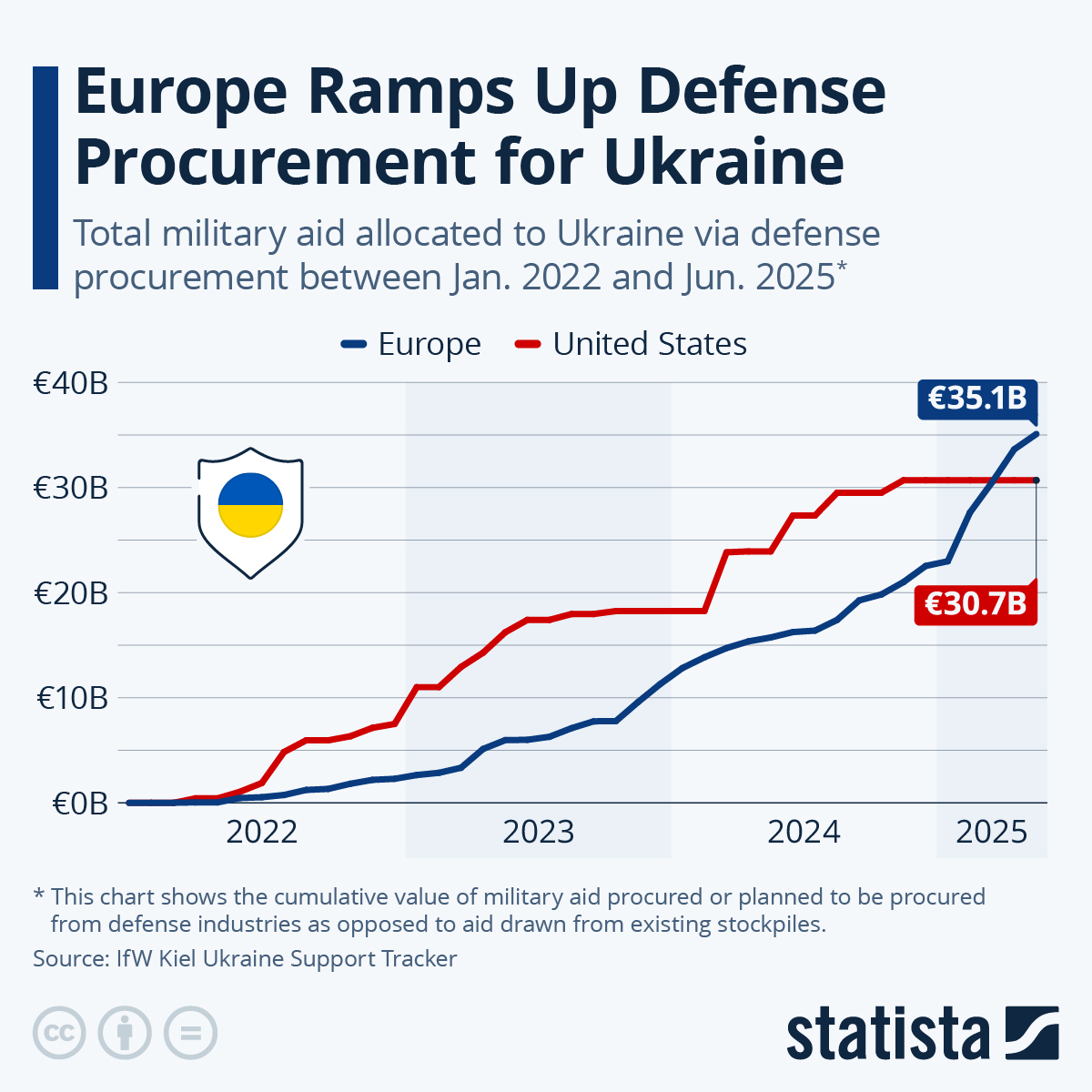

“EUROPE WINS” Counter-Strategy (2026–2035)

A strategy that passes the stress test—because it changes the game instead of reacting to it.

Core shift: Europe stops playing regulator-of-last-resort and becomes a single buyer, single builder, single standard-setter.

This is not anti-China. It is pro-Europe.

🎯 Strategic Objective (2035)

Europe becomes indispensable, not dependent:

- controls demand in strategic sectors,

- sets standards others must follow,

- owns infrastructure that can’t be bypassed,

- achieves ROCE-positive industrial scale.

China can compete—but on Europe’s terms.

🧠 The Strategic Doctrine (Simple & Hard)

Demand → Scale → Standards → Compounding Power

Europe wins only where these four are locked together.

1️⃣ SINGLE DEMAND ENGINE (The Breakthrough Move)

What Europe does

Create EU-level demand mandates in 5 non-negotiable domains:

- Energy systems (grids, storage, hydrogen)

- Mobility infrastructure (rail, EV charging, batteries)

- Digital backbone (cloud, AI compute, data spaces)

- Defense & security tech

- Critical health & biotech capacity

Rule:

No national procurement above €X bn without EU aggregation.

Why this works

- Demand is faster than supply policy

- Scale kills Chinese dumping economics

- ROCE becomes predictable for European industry

Stress-test result: ✅ Holds

2️⃣ PAN-EU CHAMPIONS (FEWER, BIGGER, FASTER)

What Europe does

- Forces cross-border mergers in strategic sectors

- Ends “27 national champions” illusion

- Allows temporary monopoly in exchange for performance

KPI contract

- Cost curve targets

- Export share targets

- Technology sovereignty thresholds

Fail → license revoked.

Stress-test result: ✅ Holds

3️⃣ STANDARDS FIRST, MARKET SECOND (THE RULEBOOK TRAP)

What Europe does differently

- Writes standards first

- Pays firms to adopt them

- Procures only compliant systems

- Exports standards via trade deals

This flips the usual sequence.

China’s problem:

Adapt or lose access to the world’s largest regulated market.

Stress-test result: ✅ Very strong

4️⃣ HARD INFRASTRUCTURE SOVEREIGNTY

What Europe does

- No foreign control in:

- ports

- grids

- cloud

- rail hubs

- Existing exposure → gradual buy-back with EU bonds

- Infrastructure treated as defense assets

Stress-test result: ✅ Holds

5️⃣ CAPITAL WITH TEETH (EU SOVEREIGN SCALE)

What Europe does

- Creates EU Strategic Scale Fund (€1–2 tn by 2035)

- Capital only flows to:

- EU-controlled IP

- EU production

- EU standards adoption

No passive finance. Only strategic equity.

Stress-test result: ✅ Holds

6️⃣ SELECTIVE DECOUPLING (NOT BLIND SEPARATION)

What Europe does

Decouples only where leverage matters:

- rare earth processing

- chips <10nm

- grid control tech

- military-adjacent AI

Everywhere else: compete hard, trade open.

Stress-test result: ✅ Costly but survivable

7️⃣ UNITY ENFORCEMENT (THE HIDDEN KEY)

What Europe does

- Access to EU funds conditional on compliance

- No side-deals in strategic sectors

- Fast infringement procedures (months, not years)

Fragmentation becomes expensive.

Stress-test result: ✅ Critical

📊 STRESS-TEST SCORECARD (FINAL)

| Dimension | Old Europe | Europe Wins |

|---|---|---|

| Speed | ❌ Slow | ✅ Fast |

| Scale | ❌ Fragmented | ✅ Continental |

| ROCE | ❌ Subsidy burn | ✅ Demand-driven |

| Standards | ⚠️ Late | ✅ First |

| Unity | ❌ Optional | ✅ Enforced |

| China leverage | ❌ High | 🔻 Reduced |

🔮 2035 Outcome

- Europe remains open—but not naïve

- China remains powerful—but not dominant

- Strategic symmetry is restored

Europe stops asking: “How do we protect ourselves?”

Europe starts asking: “How do we make others depend on us?”

Leveraging Europe’s Strengths to Counter-Attack China (2026–2027)

A short, offensive window where Europe can still flip leverage—if it moves fast.

4

Counter-attack ≠ confrontation.

It means turning Europe’s latent strengths into active pressure points—before structural lock-in deepens.

🎯 Strategic Aim (by end-2027)

Europe regains initiative by converting:

- Market size → leverage

- Regulation → standards power

- Fragmentation → enforced unity

- Capital depth → strategic ownership

Result: China adapts to Europe, not the other way around.

🧠 The Core Insight

China’s strength = supply & patience

Europe’s strength = demand & rules

👉 The counter-attack weapon is demand orchestration + standards sequencing.

1️⃣ Weaponize the EU Single Market (Demand Shock)

Europe’s Strength

- World’s largest regulated consumer & industrial market

- €2+ trillion public + quasi-public annual demand

Counter-Attack Move (2026)

- EU-level procurement mandates in:

- energy grids & storage

- EV charging & batteries

- AI / cloud for public sector

- defense-adjacent tech

Rule

No compliance with EU standards → no access to EU demand.

Impact on China

- Forces redesign of products

- Breaks dumping economics

- Slows Chinese scale advantage

✅ Immediate leverage

2️⃣ Standards First, Market Second (Reverse the Game)

Europe’s Strength

- Regulatory legitimacy + global norm credibility

Counter-Attack Move (2026–2027)

- Publish hard standards (not guidelines) for:

- AI governance

- green tech lifecycle

- industrial data spaces

- Subsidize European firms to adopt first

- Lock standards into procurement & trade deals

Impact on China

- Must comply or exit

- Loses first-mover advantage

- Becomes rule-taker in EU space

✅ High asymmetry win

3️⃣ Strategic Capital Re-Nationalization (Quiet but Decisive)

Europe’s Strength

- Deep capital markets

- Credible sovereign balance sheets

Counter-Attack Move

- EU-level fund to:

- buy back stakes in ports, grids, data centers

- dilute non-EU minority control

- Use market mechanisms, not bans

Impact on China

- Influence erodes without headlines

- No retaliation trigger

- Control shifts silently

✅ Low noise, high effect

4️⃣ Enforced Unity via Conditionality (The Hidden Knife)

Europe’s Weakness → Strength

Fragmentation becomes leverage against itself.

Counter-Attack Move

- Access to:

- EU funds

- crisis instruments

- industrial subsidies

conditional on no bilateral strategic deals

Impact on China

- Loses divide-and-deal channel

- Forced back to Brussels-level negotiation

✅ Critical enabler

5️⃣ Trade as a Precision Weapon (Not a Blunt One)

Europe’s Strength

- Regulatory trade architecture

- Legal endurance

Counter-Attack Move

- Narrow, sector-specific trade actions

- batteries

- overcapacity steel/chemicals

- Time-limited, review-based, data-driven

Impact on China

- Predictable pain points

- No full trade war

- Signals resolve

✅ Controlled escalation

6️⃣ Narrative Reversal (From Moral to Strategic)

Europe’s Weakness

Values talk without power delivery.

Counter-Attack Move

- Reframe message:

- “Open markets require fair symmetry”

- “Standards protect citizens & innovation”

- Focus on sovereignty, not ideology

Impact on China

- Soft-power shield weakens

- Europe regains legitimacy in Global South debates

✅ Supportive, not primary

⏱️ 24-Month Execution Timeline

| Phase | Focus | Key Output |

|---|---|---|

| H1 2026 | Demand aggregation | EU mega-procurement |

| H2 2026 | Standards lock-in | Binding EU norms |

| H1 2027 | Capital repositioning | Asset control shifts |

| H2 2027 | Trade pressure | Selective correction |

📊 Counter-Attack Effect Matrix

| Dimension | 2025 Status | End-2027 |

|---|---|---|

| China leverage in EU | High | ↓ Reduced |

| EU strategic autonomy | Rhetorical | Operational |

| Standards control | Weak | Strong |

| Internal unity | Voluntary | Enforced |

🧭 Strategic Bottom Line

Europe does not need to out-produce China.

It needs to out-orchestrate.

The side that controls demand + rules controls the game.

Chinese Propaganda Strategy & Narratives to Weaken Europe

How influence is shaped without tanks—by stories, incentives, and selective truths.

The goal isn’t to “convince everyone.”

It’s to create doubt, delay decisions, and fragment unity—especially inside democracies.

🎯 Strategic Objective

For China, influence operations toward European Union aim to:

- reduce Europe’s will to act,

- normalize dependence,

- split member-state cohesion,

- reframe China as indispensable and criticism as counterproductive.

🧠 The Operating Logic

China doesn’t push one loud message.

It deploys many soft, overlapping narratives, each tailored to a specific European audience.

1️⃣ “Win–Win Cooperation”

Narrative:

“China and Europe rise together. Cooperation has no losers.”

Target: Business leaders, trade ministries, export regions

Method: Investment promises, joint ventures, market-access hints

Effect: Economic elites lobby against “confrontation” or scrutiny.

Hidden Function:

Silences risk discussion; reframes dependency as partnership.

2️⃣ “Europe Is Hypocritical”

Narrative:

“Europe lectures on values but violated them itself (colonialism, wars, surveillance).”

Target: Academics, journalists, progressive audiences

Method: Historical reminders, selective comparisons, moral equivalence

Effect: Paralyzes criticism; shifts debate from China to Europe’s past.

Hidden Function:

Turns ethical debate into self-doubt and guilt.

3️⃣ “Strategic Autonomy Means Neutrality”

Narrative:

“True European sovereignty means staying out of US–China rivalry.”

Target: French, German, Southern EU strategic circles

Method: Think-tank papers, op-eds, conferences

Effect: Weakens transatlantic coordination.

Hidden Function:

Decouples Europe from allies without strengthening Europe itself.

4️⃣ “Efficiency over Chaos”

Narrative:

“China delivers results. Europe debates endlessly.”

Target: Technocrats, crisis-fatigued citizens

Method: Infrastructure showcases, crisis management comparisons

Effect: Subtle admiration for authoritarian efficiency.

Hidden Function:

Erodes confidence in democratic decision-making.

5️⃣ “Economic Pain Is Your Fault”

Narrative:

“Sanctions, de-risking, and regulation hurt Europeans more than China.”

Target: Consumers, SMEs, labor groups

Method: Inflation framing, job-loss warnings, energy-cost narratives

Effect: Public pressure against strategic resilience policies.

Hidden Function:

Turns short-term discomfort into long-term surrender.

6️⃣ “Europe Is Divided Anyway”

Narrative:

“There is no single Europe—why negotiate as one?”

Target: National governments, regional leaders

Method: Bilateral praise, selective deals, symbolic recognition

Effect: Encourages side-deals and veto behavior.

Hidden Function:

Undermines EU-level authority without open confrontation.

7️⃣ “China as the Inevitable Future”

Narrative:

“China’s rise is unstoppable. Adapt early or lose.”

Target: Corporate strategy, youth, universities

Method: Long-term growth charts, tech demos, scholarships

Effect: Psychological bandwagoning.

Hidden Function:

Transforms resistance into resignation.

🧬 Delivery Channels (How It Spreads)

- State & partner media (English, German, French)

- Academic cooperation & institutes

- Business forums and chambers

- Sponsored research & policy papers

- Cultural and city-level exchanges

- Social media amplification (often indirect)

This is influence laundering: messages appear local, neutral, and pragmatic.

⚠️ Why Europe Is Vulnerable

- Open media ecosystems

- Academic & business openness

- Normative reluctance to “counter-propaganda”

- Fragmented communication authority

China exploits freedom asymmetry.

🧭 Strategic Takeaway

China’s propaganda doesn’t say:

“Europe should submit.”

It whispers instead:

“Europe should hesitate.”

And in geopolitics, hesitation is defeat by default.

Chinese Propaganda Strategy to Weaken Europe (2025–2030)

Strategic Objective

Create fragmentation, hesitation, dependency, and moral confusion inside Europe—without military confrontation.

Core Narrative Vectors

| Vector | Chinese Narrative | Intended Effect |

|---|---|---|

| Governance | “Western democracy is chaotic & declining” | Reduce trust in EU institutions |

| Economy | “China delivers growth, Europe delivers regulation” | Legitimize dependency |

| Technology | “Chinese tech is neutral & efficient” | Normalize strategic tech reliance |

| Peace | “China is the responsible stabilizer” | Undermine NATO / EU alignment |

| Values | “Human rights are cultural, not universal” | Moral relativism |

| Elites | “Pragmatism over ideology” | Co-opt business & political elites |

Operational Channels

- Academic partnerships & think tanks

- Business forums & city-to-city diplomacy

- Media co-productions & sponsored content

- Social media amplification via proxies

- Bilateral deals bypassing EU cohesion

Europe’s Strategic Weakness (Propaganda Target Surface)

Before counter-narratives, realism matters:

- Fragmented messaging (27 voices)

- Guilt-based moral discourse

- Technocratic, non-emotional language

- Weak strategic storytelling

- Over-reliance on “rules” instead of power logic

China exploits European hesitation, not European weakness.

Counter-Narrative Map: “Europe Wins” (2026–2027)

4

Principle Shift

From defensive values → confident system superiority

1. Governance Counter-Narrative

Chinese claim: “Democracy is inefficient”

Europe responds:

“Democracy corrects itself. Authoritarian systems don’t.”

Action Layer

- Publish decision-correction metrics (policy reversals, court rulings)

- Show failures openly → credibility advantage

- Turn transparency into a power signal

2. Economy Counter-Narrative

Chinese claim: “China delivers growth”

Europe responds:

“Europe delivers durable prosperity, not debt growth.”

Action Layer

- Expose hidden costs of Chinese capital (IP loss, dependency)

- Highlight European resilience during shocks (energy, supply chains)

- Reframe regulation as economic insurance

3. Technology Counter-Narrative

Chinese claim: “Technology is neutral”

Europe responds:

“Technology reflects the system behind it.”

Action Layer

- Tie tech standards to legal accountability

- Make “auditability” a selling point

- Promote Trusted Tech Zones (EU-only certification)

4. Peace & Stability Counter-Narrative

Chinese claim: “China is a neutral stabilizer”

Europe responds:

“Peace without accountability is delayed conflict.”

Action Layer

- Contrast conflict mediation vs conflict freezing

- Document coercive diplomacy cases calmly, factually

- Elevate rule-based deterrence as peace infrastructure

5. Values Counter-Narrative

Chinese claim: “Values are cultural”

Europe responds:

“Human dignity is universal—systems differ, not people.”

Action Layer

- Shift from moral preaching → lived outcomes

- Use real-life citizen impact stories

- Avoid superiority tone; use competence tone

Leveraging Europe’s Real Strengths (2026–2027 Counter-Attack)

Europe’s Underrated Strategic Assets

| Asset | Why China Can’t Copy It |

|---|---|

| Rule of Law | Limits power abuse |

| Independent Courts | Enforced accountability |

| Free Research | Innovation without censorship |

| Citizen Trust | Self-correcting legitimacy |

| Open Markets | Adaptive efficiency |

| Cultural Pluralism | Narrative resilience |

Strategic Counter-Attack Moves (2026–2027)

- Narrative Centralization

One EU strategic narrative hub (not 27 voices) - Expose Dependency Logic

Calm, forensic exposure of coercive economics - Elite Immunization

Mandatory transparency on foreign funding & partnerships - Cognitive Defense Layer

Treat information integrity like cyber-security - Confidence Shift

Stop apologizing for democracy

Start marketing it as the strongest operating system

Strategic Bottom Line

China does not aim to defeat Europe.

China aims to outwait, out-divide, and out-narrate Europe.

Europe wins by:

- Being calm instead of moralizing

- Being transparent instead of defensive

- Being confident instead of fragmented