🗞️ RapidThrive NEWS Dashboard

Edition: April 24, 2025

Concise Daily Geopolitical Insight — Strategic. Structured. Actionable.

Presented by Josef David – Geopolitical Analyst

Powered by ChatGPT | RapidKnowHow.com

🎯 Strategic Tagline

From disruption to insulation. From competition to coalition.

🌍 Geopolitical Breaking News – Rapid Assessments

🇺🇸 USA: Tariff Escalation Intensifies

Headline: U.S. confirms 145% tariffs on key Chinese goods.

Assessment: U.S. economic nationalism accelerates supply chain shifts.

Label: 🔺 Escalation

🇨🇳 China: Retaliatory Tariffs & ASEAN Influence

Headline: China imposes 125% retaliatory tariffs, expands outreach to ASEAN bloc.

Assessment: China consolidates regional strength to offset Western exposure.

Label: 🟢 Coalition Building

🇷🇺 Russia: Dual-Track Pressure Strategy

Headline: Russian military intensifies offensive in Ukraine, energy deals with Asia deepen.

Assessment: Russia uses hard and soft power in parallel to shape conflict zones.

Label: 🔺 Hybrid Warfare

🇪🇺 EU: Fractures Emerge Amid Global Tension

Headline: EU debates retaliatory tariffs, divergent stances weaken unity.

Assessment: The bloc struggles to maintain cohesion amid external pressure.

Label: 🟠 Fragmentation Risk

🇮🇳 India: Asserting Strategic Middle Ground

Headline: India widens trade options, balances U.S.-China pressure via Indo-Pacific ties.

Assessment: Emerging as a swing-state superpower in multipolar world.

Label: 🟢 Stabilizer

🔁 Weekly Dynamics (April 18–24, 2025)

- U.S.–China: Trade war escalates → Tariffs deepen global inflation pressure

- China–ASEAN: Diplomatic push boosts Southeast Asia’s strategic value

- Russia–Ukraine: Escalation renews NATO urgency, affects eastern energy security

- EU Cohesion: Disunity in policy response → Delays collective action

- Market Response: Investors hedge, volatility becomes the new normal

🔍 30-Day Global Trendline (March 25 – April 24, 2025)

| Trend | Direction | Global Impact |

|---|---|---|

| Trade Protectionism | 🔺 Accelerating | Global supply diversification underway |

| Military Conflict Zones | 🔺 Escalating | Pressure on global peace institutions |

| Regional Bloc Building | 🟢 Increasing | Asia-led coalitions rising |

| Tech & Cyber Sovereignty | 🔺 Intensifying | Fragmented innovation systems |

| Resource Nationalism | 🟠 Expanding | Strategic chokepoints emerge |

📡 Strategic Monitoring Indicators

| Indicator | Region | Trend |

| Oil Prices | Middle East | 🔺 Rising |

| Global Stock Markets | Global | 🔻 Volatile |

| USD/CNY Currency Spread | U.S.–China | 🔺 Spreading |

| Cybersecurity Threats | Global | 🔺 Elevated |

| Refugee Outflows | Conflict Zones | 🔺 Rising |

🔮 Strategic Scenarios – April Outlook

| Scenario | Probability | Implication |

| U.S.–China Trade Negotiation Resumes | 30% | Temporary pause, no structural resolution |

| ASEAN-Led Regional Trade Bloc Emerges | 50% | Decentralized trading systems rise |

| Middle East Conflict Worsens | 60% | Global energy insecurity and refugee surges |

| U.S.–EU Tech Decoupling Accelerates | 40% | Fragmentation in AI, chips, and data rules |

| Global Recession Ripple Starts | 70% | Protectionism, asset volatility, capital flight |

✅ Daily Strategic Recommendations

Business Executives

- Urgent: Rebuild procurement from politically neutral zones

- Important: Monitor trade zone policy shifts weekly

Policy Leaders

- Urgent: Fortify diplomatic relations in Indo-Pacific buffer states

- Important: Prioritize digital sovereignty in regulatory agenda

Investors / Strategic Citizens

- Urgent: Diversify commodity/energy assets and currency baskets

- Important: Stay ahead of regulatory pivots in critical tech sectors

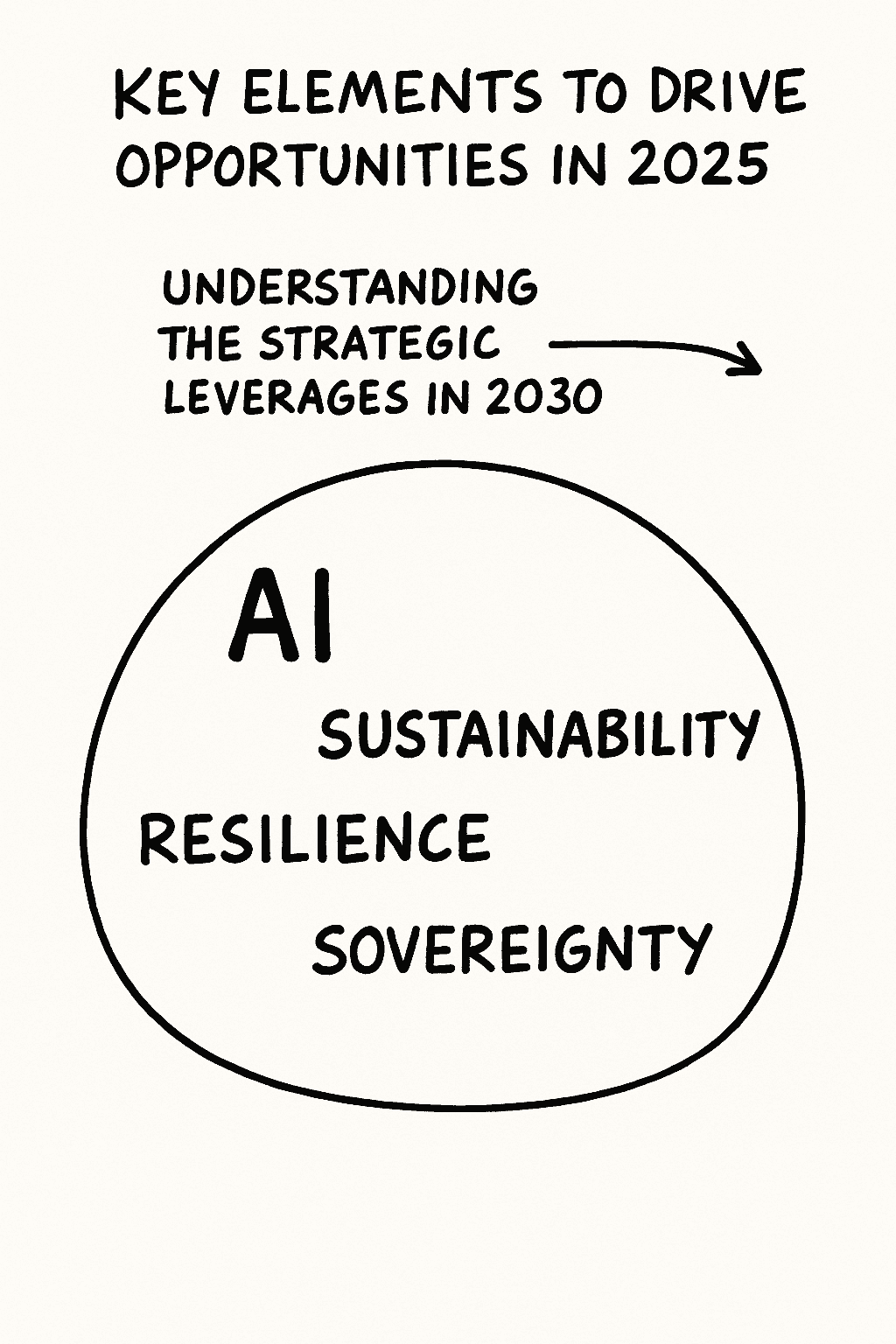

📷 Visual Brief of the Day – Strategic Dialogue in Motion

“An effective diplomat demonstrates the dialogue framework.”

Use this image as a mindset marker:

Diplomacy is structure. Not softness.

🧠 Sources & Verification

- Reuters – Trump Tariffs

- Tom’s Hardware – China Retaliation

- Reuters – Xi in Southeast Asia

- The Guardian – EU Tensions

- ISW – Ukraine Conflict

- Bloomberg – India Trade Gap

- Bharat Shakti – India’s Role

RapidThrive NEWS Dashboard delivers live clarity — short, actionable, credible.

Built for leaders. Backed by facts.

🗞️ RapidThrive NEWS Dashboard – DACH Region

Edition: April 24, 2025

Strategic Geopolitical Briefing for Germany, Austria & Switzerland

Presented by Josef David – Geopolitical Analyst

Powered by ChatGPT | RapidKnowHow.com

🎯 Strategic Tagline

From disruption to insulation. From competition to coalition.

🇩🇪🇦🇹🇨🇭 Geopolitical Breaking News – DACH Region Assessment

🇩🇪 Germany: Economic Fragility and Industrial Adaptation

Headline: German exports drop 5% amid tariff pressures and energy shifts.

Assessment: Germany’s export-led economy is under stress, prompting calls for a green industrial pact and increased EU cohesion.

Label: 🟠 Economic Pressure

🇦🇹 Austria: Neutral Diplomacy & Energy Pivot

Headline: Austria reinforces neutrality stance and secures long-term LNG deal.

Assessment: Vienna leverages neutrality and energy stability as geoeconomic shields amid broader EU fragmentation.

Label: 🟢 Strategic Positioning

🇨🇭 Switzerland: Safe Haven Under Scrutiny

Headline: Swiss franc surges as investors flee global volatility; crypto regulation tightened.

Assessment: Switzerland maintains economic resilience but faces increased scrutiny from global regulatory alliances.

Label: 🔺 Financial Magnetism

🔁 Weekly Dynamics (April 18–24, 2025)

- Germany: Industry groups urge Berlin to accelerate energy independence

- Austria: Maintains neutrality as EU security rhetoric intensifies

- Switzerland: Balances financial openness with G7 regulatory pressure

🔍 30-Day Regional Trendline (March 25 – April 24, 2025)

| Trend | Direction | DACH Region Impact |

|---|---|---|

| Export Market Pressure | 🔻 Declining | Core industries reduce forecasts |

| Energy Diversification | 🟢 Increasing | LNG, renewables gain ground |

| Political Cohesion in EU | 🟠 Eroding | Pressure on coordination |

| Neutral Diplomatic Roles | 🔺 Strengthening | Global mediator positioning |

| Financial Stability Shift | 🔺 Magnetizing | CHF and digital assets rise |

📡 Monitoring Indicators – DACH Specific

| Indicator | Region | Trend |

| Export Volume Index | Germany | 🔻 Dropping |

| LNG Import Commitments | Austria | 🟢 Expanding |

| CHF Safe-Haven Flows | Switzerland | 🔺 Increasing |

| Cross-Border Investment | DACH Total | 🔻 Selective slowdown |

| Energy Dependence Ratio | DACH Total | 🔻 Falling |

🔮 Strategic Scenarios – DACH Outlook

| Scenario | Probability | Implication |

| Germany Reindustrialization Pact | 40% | Acceleration of EU clean tech cooperation |

| Austria Mediates Balkan-EU Energy Talks | 35% | Strengthens diplomatic relevance |

| Switzerland Expands Crypto Restrictions | 60% | Preserves international standing |

| DACH-Led EU Sovereignty Coalition Forms | 25% | Leadership bloc within EU policy shifts |

✅ Recommended Actions – DACH Stakeholders

For Business Leaders

- Urgent: Shift production resilience planning toward domestic & EU-sourced inputs

- Important: Leverage EU green industry funding mechanisms

For Policymakers

- Urgent: Reinforce neutral diplomatic identity amid EU polarization

- Important: Coordinate DACH regulatory positions in finance and AI

For Citizens & Investors

- Urgent: Hedge against export risk and currency fluctuation

- Important: Explore strategic industries (renewables, defense tech)

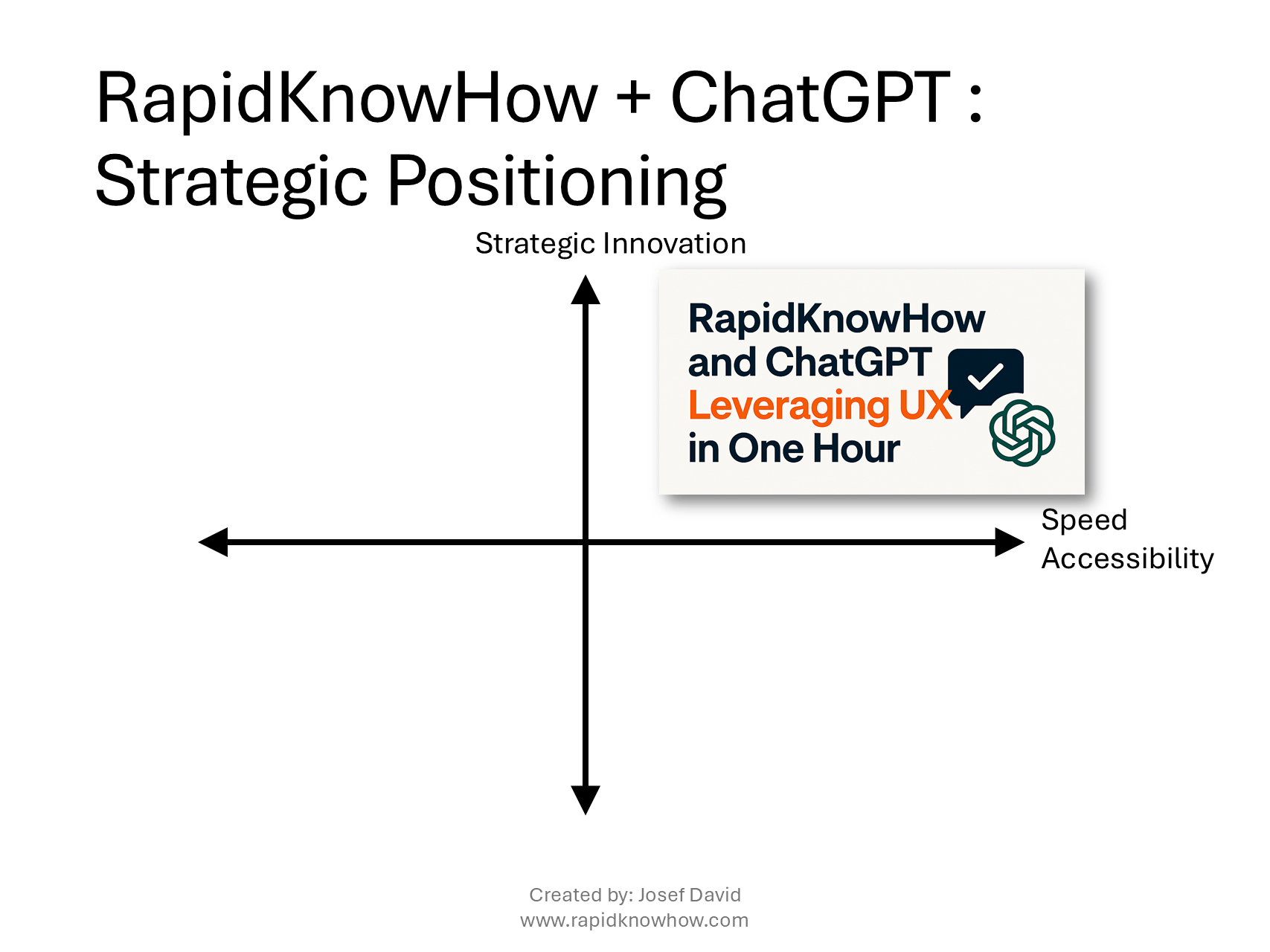

📷 Regional Visual of the Day – Neutrality & Leverage

“In the heart of fragmentation, neutrality becomes influence.”

🖼️ Visual: Three dominos — Germany industrial, Austria diplomatic, Switzerland financial — each stabilizing a collapsing row.

🧠 Sources & Verification – DACH Region

- Handelsblatt – German Export Pressures

- Der Standard – Austria LNG Strategy

- SRF – Swiss Franc and Crypto Regulation

- ORF – Austrian Diplomacy and EU Talks

- EU Commission – Green Industry Plans

RapidThrive NEWS Dashboard – DACH Edition

Strategic clarity across Germany, Austria, and Switzerland — for those who shape the future.