Issue #1 | February 2026

IGAS AI-Orchestrator™ by RapidKnowHow

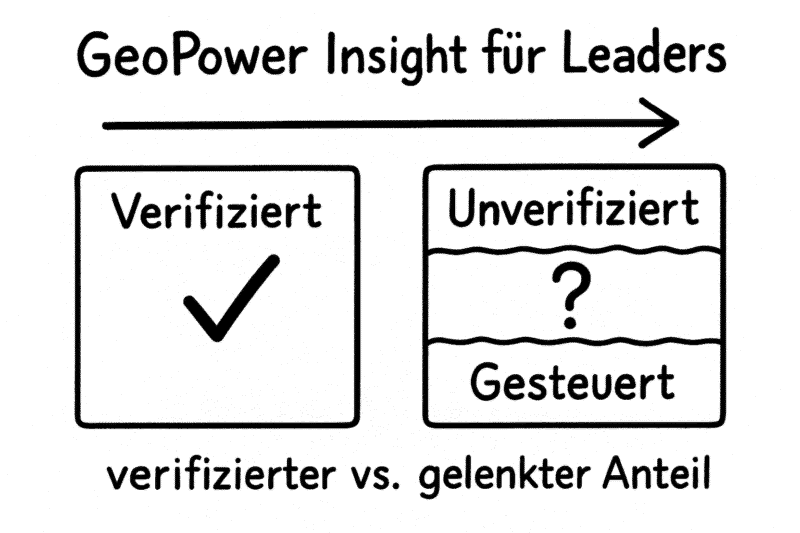

Independent Board Intelligence Layer

Sharp.

Neutral.

Signal-dense.

No marketing tone.

Executive Signal Summary

⚠️ Current Volatility Posture

Energy markets in Europe remain structurally unstable.

Merchant exposure across mid-tier operators remains underpriced.

Portfolio-weighted PTE (pass-through-economics) appears below resilience threshold in several regional players.

Board-Level Trigger:

If portfolio PTE < 0.78 and merchant share > 25%,

next +15% energy shock reduces ROCE below 16% within two quarters.

Energy & CO₂ Shock Monitor

February 2026 Snapshot

- Electricity volatility elevated

- CO₂ pricing structurally embedded

- Freight insurance premiums remain elevated

Shock Simulation

Energy +15%

Logistics +10%

Cost shock impact for typical EU IGAS portfolio:

€90–120m annualized exposure per €4bn revenue base.

Recovery depends entirely on PTE discipline.

Portfolio PTE Risk Heatmap

Resilience Threshold: 0.78

| Supply Mode | Typical PTE | Risk Level |

|---|---|---|

| On-Site | 0.88–0.92 | Stable |

| Merchant | 0.65–0.75 | High |

| Packaged | 0.80–0.85 | Moderate |

| Healthcare | 0.75–0.82 | Moderate |

| Specialty | 0.90+ | Protective |

Board Observation:

Merchant volatility is primary structural ROCE destabilizer.

Merchant Volatility Indicator

Merchant risk escalates when:

- Utilization < 80%

- Energy repricing lag > 90 days

- Contract caps limit α < 0.7

- Inventory days > 55

If 2+ indicators triggered → Margin erosion underway.

Current regional player exposure suggests elevated risk across EU mid-tier operators.

ROCE Early Warning & Consolidation Radar

ROCE Sensitivity

Energy +15%, PTE 0.70 → ROCE compression 2–4pp.

Capital employed inflation compounds effect.

Consolidation Signal

Regional operators with:

- Merchant share > 30%

- PTE < 0.75

- Liquidity buffers < 6 months OPEX (operations expenses)

likely enter structural vulnerability window 2026–2027.

Strategic buyers positioned to widen gap.

Closing Note to Boards

Industrial Gas 2026 is not a volume stress cycle.

It is a capital discipline stress cycle.

Pass-through governance determines competitive positioning.

Boards should request:

- Portfolio-weighted PTE visibility

- Merchant exposure mapping

- ROCE stress simulation under +20% energy shock

- Capex re-evaluation under volatility regime

RapidKnowHow is: The independent intelligence layer that protects Industrial Gas margins and accelerates ROCE under volatility. Clear.Focused.Powerful.-Josef David