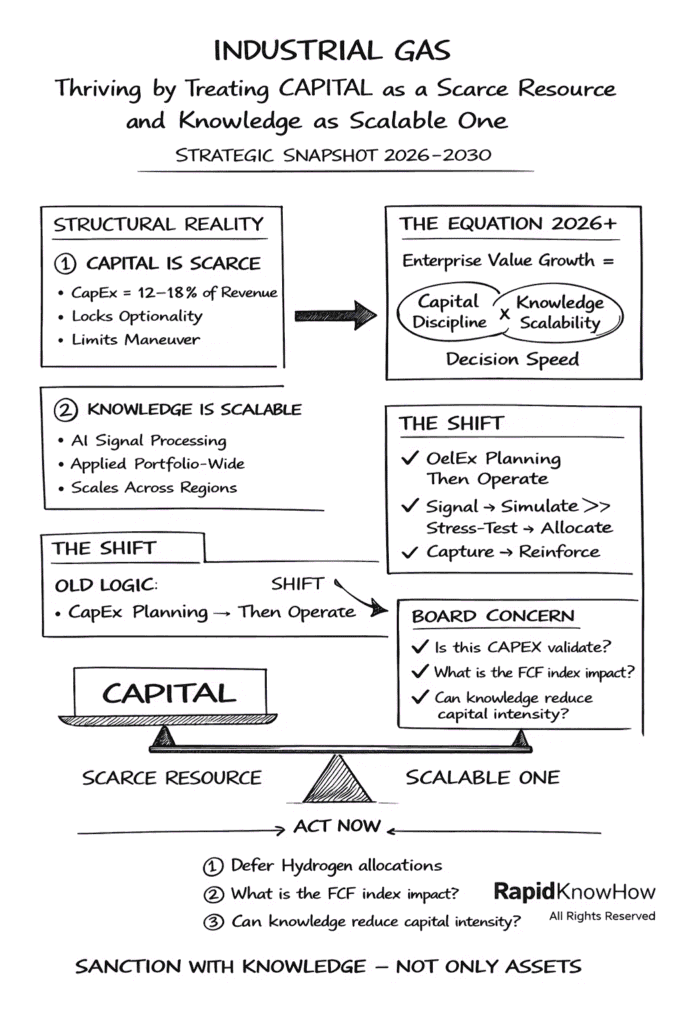

Thriving by Treating CAPITAL as a Scarce Resource

and KNOWLEDGE as a Scalable One

Power Report 2026–2030

A) EXECUTIVE STRATEGIC THESIS

Industrial Gas is one of the most capital-intensive industries in the world.

Players like

Linde plc,

Air Liquide,

Air Products

have mastered:

- Mega-scale ASUs

- Hydrogen infrastructure

- Long-term on-site contracts

- Engineering reliability

But 2026–2030 changes the competitive equation:

Capital remains scarce.

Knowledge becomes exponentially scalable.

The winners will not be those who deploy the most capital —

but those who deploy capital with superior knowledge compression and orchestration.

B) THE STRUCTURAL REALITY OF INDUSTRIAL GASES

1️⃣ CAPITAL IS SCARCE

Industrial Gas characteristics:

- CapEx = 12–18% of revenue

- Long asset lifetimes (20–30 years)

- High energy dependency

- Regulatory exposure

- Slow reallocation cycles

Every wrong investment decision:

→ Locks capital

→ Reduces optionality

→ Limits strategic maneuverability

Capital errors compound negatively.

2️⃣ KNOWLEDGE IS SCALABLE

In contrast, knowledge today:

- AI signal processing

- Exposure modeling

- Pass-through sensitivity

- CapEx scenario simulation

- Customer prioritization analytics

Once built:

→ Can be replicated across regions

→ Applied across portfolios

→ Scaled without proportional capital increase

Knowledge compounds positively.

C) THE NEW LEADERSHIP EQUATION (2026+)

Traditional model:

More assets = more advantage.

AI-Orchestrator model:

Better knowledge × faster decision cycles = more advantage.

The Strategic Formula

Enterprise Value Growth =

Capital Discipline × Knowledge Scalability × Decision Speed

Where:

- Capital Discipline protects downside

- Knowledge Scalability multiplies upside

- Decision Speed captures timing advantage

D) WHY THIS MATTERS NOW

1️⃣ Hydrogen Capital Risk

Billions announced.

But:

- Policy shifts

- Energy pricing

- Subsidy uncertainty

- Demand timing

Knowledge must validate capital before deployment.

2️⃣ AI Data Center Demand

Industrial gases benefit from:

- Nitrogen cooling

- Specialty gases

- Redundancy reliability

But:

The advantage goes to the leader who:

- Identifies high-ROICE accounts first

- Prioritizes capacity intelligently

- Prices dynamically

That is knowledge leverage.

3️⃣ Energy Volatility

ASUs are electricity-intensive.

Knowledge-driven pricing compression

prevents margin erosion.

E) THE STRATEGIC SHIFT

Old Logic

CapEx planning → Then operate.

New Logic

Signal → Simulate → Stress-Test → Allocate → Capture → Reinforce.

Capital becomes the final step.

Knowledge becomes the first step.

F) THE AI-ORCHESTRATOR APPLICATION

The AI-Orchestrator Leader treats:

CAPITAL as limited ammunition

KNOWLEDGE as scalable targeting intelligence

This changes:

- CapEx approval logic

- Portfolio re-ranking

- Contract structure

- Working capital discipline

- Energy pass-through timing

G) FINANCIAL IMPACT ILLUSTRATION

For a €10bn Industrial Gas company:

1% capital misallocation

= €100m strategic drag.

1% FCF improvement through knowledge orchestration

= €100m advantage.

Over 5 years:

The compounding gap becomes structural.

H) COMPETITIVE ADVANTAGE 2026–2030

Those who treat capital as abundant:

→ Overbuild hydrogen

→ Mis-time investments

→ Lock in low IRR projects

Those who treat knowledge as scalable:

→ Optimize CapEx timing

→ Accelerate pricing

→ Reallocate quickly

→ Protect FCF

The difference is not plant size.

It is orchestration intelligence.

I) BOARD-LEVEL IMPLICATIONS

Board questions must evolve:

- Is this capital deployment knowledge-validated?

- What is the exposure index impact?

- What is the FCF sensitivity?

- What happens under 3 stress scenarios?

- Can knowledge reduce capital intensity?

If the answer is unclear —

the decision is premature.

J) STRATEGIC CONCLUSION

Industrial Gas Leaders thrive when they:

- Respect capital scarcity

- Institutionalize knowledge scalability

- Compress decision cycles

- Orchestrate signals into FCF advantage

2026–2030 will reward:

Intelligent allocators — not aggressive spenders.-Josef David