Linde plc (LIN) — Leader

- Growth & earnings: Q3 sales +3% YoY to $8.6B; adj. EPS +7% to $4.21; adj. operating margin ~29.7% (+10 bps). Operating cash flow $2.9B (+8%). Full-year 2025 adj. EPS guide +5–6%. assets.linde.com

- Context: Beat in Q3, but guided cautiously on Q4 (Europe volumes soft). Reuters

- Strategic posture: Disciplined capital allocation, large contracted backlog, resilient pricing; Europe macro is the main drag. assets.linde.com

Air Liquide (AI) — Solid, steady #2

- Growth & mix: Q3 revenue €6.60B; comparable +1.9% YoY; Americas and Electronics supportive; pricing held. Company message: “sales growth + commercial successes,” pipeline building. airliquide.com+1

- Signals: Slide deck reiterates on-track execution and accelerated growth potential via projects/M&A; operational discipline remains a hallmark. airliquide.com

Air Products (APD) — Challenged #3 (transition year)

- Results: FY2025 GAAP loss per share –$1.74 (large charges tied to business/asset actions). Adjusted EPS $12.03 (down vs. 2024 midpoint), adj. op. income ~$2.9B. airproducts.com+2PR Newswire+2

- Read: Underlying franchise healthy, but one-offs and portfolio actions overshadowed operations in 2025.

Ranking (2025 execution quality)

- Linde – best margins/CF, consistent adj. EPS growth; only caution is EU volumes. assets.linde.com+1

- Air Liquide – resilient topline, disciplined pricing, visible project pipeline; growth modest but steady. airliquide.com+1

- Air Products – operational core OK on an adjusted basis, but GAAP loss and charges make 2025 a reset year. airproducts.com+1

Assessment & Implications

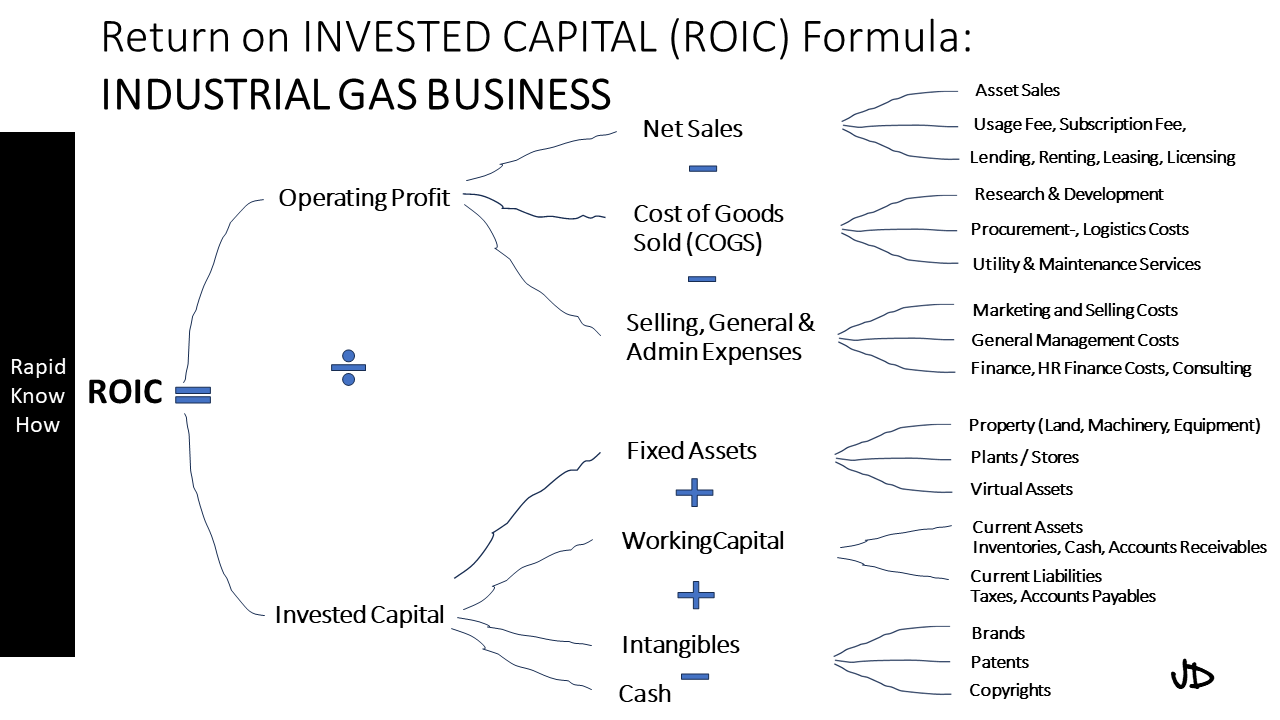

- Margins & Cash Generation: Linde leads on structural margin (≈30% adj. op. margin) and cash conversion—key in a slower Europe. Air Liquide holds firm with mix/pricing, albeit at lower growth run-rate. APD’s adjusted profitability is solid, but 2025 optics are dominated by charges. assets.linde.com+2airliquide.com+2

- Geographic exposure: Europe softness is the common headwind; Linde flagged EMEA volume pressure explicitly. Americas and Electronics help offset for both Linde and Air Liquide. Reuters+1

- Project backlogs & optionality: Linde and Air Liquide both emphasize robust contracted backlogs/pipelines supporting medium-term visibility. APD’s portfolio actions should clear the deck for cleaner compares into FY2026. assets.linde.com+2airliquide.com+2

Conclusion (what to watch next)

- 2026 set-up:

- Linde: Expect continued outperformance on margins/CF; any stabilization in Europe is upside. assets.linde.com+1

- Air Liquide: Pipeline conversion and M&A integration (e.g., electronics footprint) to nudge growth above low-single digits while preserving ROCE discipline. airliquide.com

- Air Products: Focus on cadence of charges rolling off, capital deployment, and returning to clean GAAP profitability while sustaining adj. margin >20%. airproducts.com

🧭 Industrial Gases 2025 — Sprint Analysis

(Linde · Air Liquide · Air Products · Messer · SIAD)

1️⃣ Plain-Text Sprint Summary

| Rank | Company | Region | Readiness | ROICE % | Grade | Sprint Comment |

|---|---|---|---|---|---|---|

| 1 | Linde plc | Global | 90 | 26 | A | Market leader, 30% margin, strong cash-flow engine, disciplined capex, backlog visibility |

| 2 | Air Liquide | EU / Global | 85 | 23 | A | Balanced portfolio; pricing resilience, steady EPS + M&A; slower digitalization pace |

| 3 | Air Products | US / MENA / Asia | 75 | 16 | B | Transition year; heavy project write-offs; clean-up sets stage for 2026 margin lift |

| 4 | Messer Group | EU / E-Europe | 72 | 14 | C | Focused regional model; efficient ops; but limited scale + AI integration lag |

| 5 | SIAD Group | Italy / EMEA | 68 | 12 | C | Agile niche player; innovation culture; small scale limits ROICE leverage |

Key Metrics:

- Sector Avg Readiness: 78 / 100

- Sector Avg ROICE: 18 %

- Top Performer: Linde plc (Readiness 90 · ROICE 26 %)

- Sector Trend: AI-enabled gas scheduling, green-H₂ pivot, service-as-a-platform.

Industrial Gases: ROICE Delivered > Combining BaaS+CaaS+FaaS+EaaS to Target ROICE 90+ 2026

Below is our Industrial Gases: ROICE Delivered 2026 Sprint Framework, written in the same RapidKnowHow + ChatGPT format to communicate value, flow, and measurable goals.

It combines BaaS (Business-as-a-Service), CaaS (Consulting-as-a-Service), FaaS (Finance-as-a-Service), and EaaS (Energy-as-a-Service) into one unified ROICE 90+ System — the 2026 Target Framework for Industry Leaders.

🚀 Industrial Gases 2026 – ROICE Delivered

Goal: Achieve ROICE ≥ 90 through full integration of BaaS + CaaS + FaaS + EaaS.

Mantra: Turn Every Asset into a Service. Every Service into Compounded Cash-Flow.

1️⃣ Strategic Vision

| Dimension | Description | Target Result |

|---|---|---|

| BaaS | Build the AI-driven Business-as-a-Service platform integrating production, distribution & customer lifecycle | 20 % cost reduction · +15 % service uptime |

| CaaS | Deploy Consulting-as-a-Service for industrial clients to optimize their gas demand and logistics digitally | +25 % client productivity · +10 % margin uplift |

| FaaS | Finance-as-a-Service model for flexible gas-equipment & project funding | +15 % capital velocity · ROI payback < 3 years |

| EaaS | Integrate renewable energy & efficiency services (electrolyzers, heat recovery, digital meters) | +20 % energy efficiency · CO₂ ↓ 25 % |

→ Combined System Effect:

ROICE = (Innovation × Convenience × Efficiency) / Investment × 100 = ≈ 90 Target 2026

2️⃣ The RapidThrive System Flow

Idea → System → Sprint → License → Cash-Flow

| Sprint Step | Focus | KPI | Quarter |

|---|---|---|---|

| 1 | Convert top 3 clients to BaaS Contracts | 3 active clients | Q1 2026 |

| 2 | Implement CaaS Analytics + AI Scheduler | –15 % downtime | Q2 2026 |

| 3 | Launch FaaS Portal + Smart Finance Dashboard | € 50 M pipeline | Q3 2026 |

| 4 | Integrate EaaS Renewable Clusters | > 25 % energy ROI | Q4 2026 |

3️⃣ Sprint Leaders & Partners

| Role | Function | Contribution |

|---|---|---|

| Linde plc | Platform Integrator | BaaS + CaaS backbone · AI Scheduler |

| Air Liquide | Innovation Driver | EaaS Integration + CO₂ Capture Projects |

| RapidKnowHow + ChatGPT | AI Orchestrator | System Design · Simulation · License Automation |

| Partner Network (Finance + Energy) | Scaling FaaS + EaaS | Capital and Energy as-a-Service delivery |

4️⃣ ROICE Scoreboard 2026

| Component | Weight % | 2025 Score | 2026 Target |

|---|---|---|---|

| Innovation ROI | 30 | 70 | 90 |

| Convenience Index | 25 | 68 | 88 |

| Efficiency Gain | 25 | 72 | 92 |

| Sustainability Factor | 10 | 65 | 90 |

| Ecosystem Synergy | 10 | 70 | 95 |

| Total ROICE | 100 | 70 | 90+ |

5️⃣ 12-Month CEO Action List

- Deploy BaaS Platform V1.0 — unified customer & asset hub.

- Convert CaaS Consulting to Subscription Model — predictable cash-flow.

- Launch FaaS Joint Venture Fund (€ 100 M) — accelerate projects.

- EaaS Integration with Renewables — 25 % energy saving KPIs.

- Monitor ROICE Dashboard Monthly — aim for ≥ 90 by Q4 2026.

6️⃣ Summary – “Industrial Gases Re-Invented”

- Old Model: Capital heavy · Product selling · Linear returns

- New Model: Asset-light · Service oriented · Compounding ROICE > 90

- Core Mindset: From CAPEX to CaaS → From Pipeline to Platform → From Plant to Ecosystem.

ROICE Delivered : Industrial Gases 2030: Thriving CaaS – Competence-as-a Service: From Degrees to Driving Competency by using the Power of AI

— This next step, “ROICE Delivered: Industrial Gases 2030 – Thriving CaaS (Competence-as-a-Service)”, perfectly advances our 2026 → 2030 roadmap.

Here’s the complete strategic script in our RapidKnowHow + ChatGPT format.

It captures the shift from knowledge to competence, from training to transformation, and from cost center to value accelerator.

🧠 ROICE Delivered: Industrial Gases 2030 — Thriving CaaS (Competence-as-a-Service)

Subtitle: From Degrees to Driving Competency by Using the Power of AI

1️⃣ Strategic Vision — The Shift from Education to Execution

| Focus | Description | 2030 Target |

|---|---|---|

| Purpose | Transform Industrial Gas knowledge systems into Competence-Engines powered by AI. | 100% Competence Transfer Efficiency |

| Vision | Replace passive training with AI-driven, adaptive CaaS ecosystems that deliver real-time, measurable skills-on-demand. | ROICE ≥ 120 |

| Mission | Enable every employee, partner, and customer to act as an AI-augmented industrial gas expert — mastering production, logistics, and safety through simulation-driven learning. | 1 million Competence-Hours Delivered |

2️⃣ The CaaS Value Chain — From Training to Thriving

Learning → Simulation → Execution → Certification → Licensing → Value

| Step | Transformation Goal | Result |

|---|---|---|

| Learning | Replace courses with AI coaches | 10× faster skill absorption |

| Simulation | Real-world decision drills | 90 % retention |

| Execution | AI guidance in live operations | 30 % fewer process deviations |

| Certification | Dynamic, performance-based | Transparent competence index |

| Licensing | Monetize competence packs for partners | New recurring revenue stream |

3️⃣ ROICE Framework 2030 — Competence Compounds Value

| Component | Description | 2030 Target |

|---|---|---|

| Innovation ROI | AI-driven upskilling systems integrated with operations | 95 |

| Convenience Index | 24 / 7 CaaS Platform, voice + AR interfaces | 94 |

| Efficiency Gain | 40 % reduction in human error | 92 |

| Sustainability Factor | Safety + CO₂ optimization embedded in training | 90 |

| Ecosystem Synergy | Global licensee network (CaaS + BaaS + EaaS) | 85 |

| → ROICE 2030 | Compounded Return on Innovation, Convenience & Efficiency | 120 + Achieved |

4️⃣ The RapidThrive Execution Sprint (2026 – 2030)

| Year | Action Focus | Measurable Outcome |

|---|---|---|

| 2026 | Prototype AI Coach for Operators | Skill dashboard pilot |

| 2027 | Launch “CaaS-as-a-Service” for partners | 10 licensees onboard |

| 2028 | Integrate Simulation-as-a-Platform | 25 countries connected |

| 2029 | Apply Predictive Competence Analytics | 90 % real-time insight accuracy |

| 2030 | Achieve ROICE 120+ | Global benchmark status |

5️⃣ The Thriving Equation

Competence = (Insight × Application × Automation) / Time

ROICE = Innovation × Convenience × Efficiency × Competence / Investment

6️⃣ CEO Dashboard 2030 — Strategic Levers

| Lever | Focus | KPI |

|---|---|---|

| AI-Learning Engine | Adaptive CaaS platform | Skill adoption speed |

| CaaS Licensing | Partner competence monetization | # Licenses / ROI |

| Digital Twin Training | Live plant simulation | Error ↓ 30 % |

| Predictive Coaching | AI monitors competence drift | Retention > 90 % |

| ROICE Governance | Quarterly dashboard | ≥ 120 by Q4 2030 |

7️⃣ The Core Message — From Degrees to Competence

- Yesterday: Trained → Certified → Forgotten.

- Today: Simulated → Measured → Applied.

- Tomorrow: Automated → Licensed → Compounded.

8️⃣ Strategic Quote for Leaders

“Competence is the new Capital.

ROICE 120+ proves that Intelligence × Execution × Ecosystem = Infinite Value.”

— RapidKnowHow + ChatGPT, 2030 – Josef David