What are Virtual Assets?

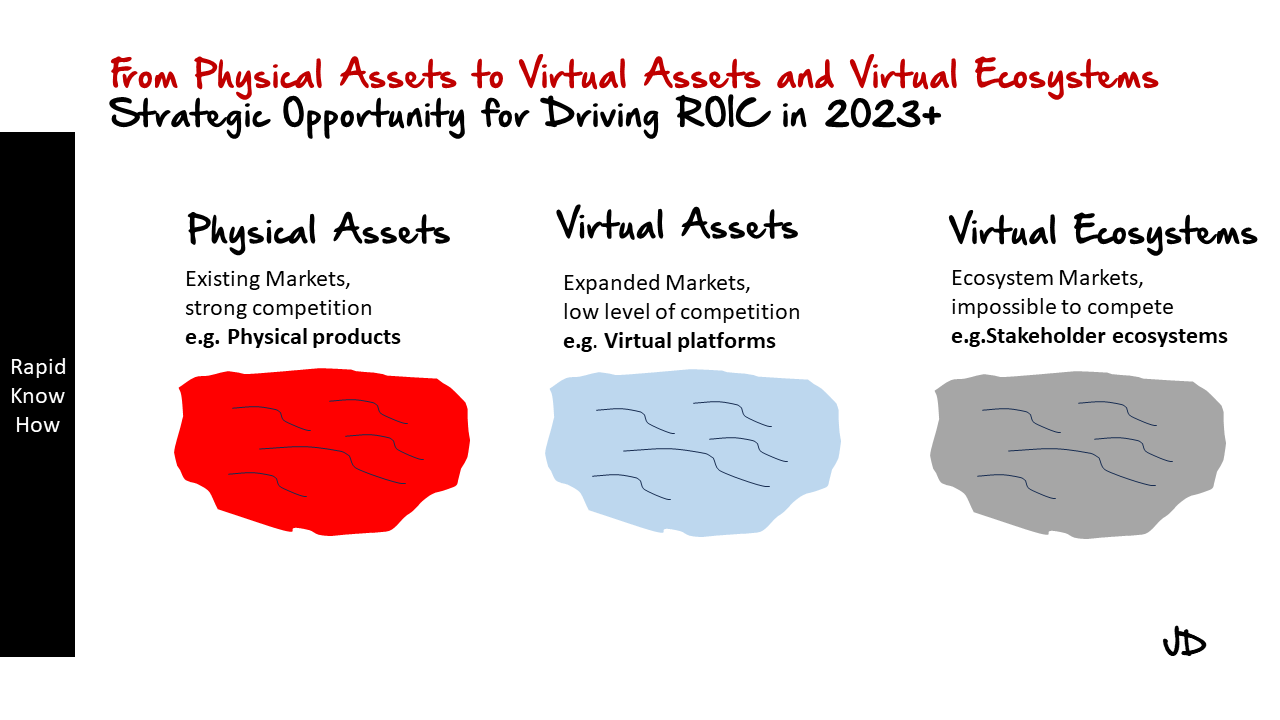

Virtual assets, in the simplest terms, are digital resources that have value in a particular context. They can range from digital currencies like Bitcoin to intellectual property rights, domain names, social media accounts, and even virtual real estate in online games or platforms. In the B2B context, virtual assets often refer to digital properties that can generate revenue or provide strategic advantages to businesses.

Advantages / Disadvantages of Buying Virtual Assets

[emaillocker id=”62166″]Buying virtual assets can offer several advantages. Firstly, it’s a quick way to acquire valuable resources without the need for development time or expertise. For instance, purchasing an established website can provide immediate access to its existing traffic and revenue. Secondly, buying virtual assets can also be a strategic move to eliminate competition or gain control over key digital properties.

However, there are also disadvantages to consider. The value of virtual assets can be volatile and unpredictable, making it a risky investment. Additionally, due diligence is crucial as there may be hidden liabilities or issues with the asset that aren’t immediately apparent. For example, a website might have used black-hat SEO techniques that could lead to penalties from search engines.

Advantages / Disadvantages of Building Virtual Assets

Building your own virtual assets allows for complete control over the asset’s development and direction. This means you can tailor it to your specific needs and goals. It also provides an opportunity for innovation and creating unique value that sets your business apart.

On the downside, building virtual assets requires significant time and resources. It also involves risks such as project failures or delays. Furthermore, there’s no guarantee of success or return on investment – your newly built asset might not attract the desired audience or generate the expected revenue.

Case Study: Leading Companies Buying Virtual Assets

Facebook’s acquisition of Instagram is a prime example of a company buying a virtual asset to expand its reach and eliminate competition. By purchasing Instagram for $1 billion in 2012, Facebook gained access to a younger demographic and a platform that was rapidly growing in popularity.

Leading Companies Building Virtual Assets

On the other hand, Amazon has consistently focused on building its own virtual assets. Its development of Amazon Web Services (AWS) is a notable example. AWS started as an internal infrastructure project but has since grown into the world’s most comprehensive and broadly adopted cloud platform.

[/emaillocker]Take Away and Call to Action

In conclusion, both buying and building virtual assets come with their own sets of advantages and disadvantages. The best approach depends on various factors including your business goals, resources, risk tolerance, and market dynamics.

If you’re considering investing in virtual assets, it’s crucial to conduct thorough research and due diligence. Consider seeking advice from professionals who specialize in this field.

Remember that whether you choose to buy or build virtual assets, they should align with your overall business strategy and contribute towards achieving your objectives.

As we move further into the digital age, understanding and leveraging virtual assets will become increasingly important for businesses across all sectors. So start exploring this exciting realm today!