Here is our RapidKnowHow Prompt Value Capture (PVC) System 2026 structured in our preferred format and aligned with our RapidKnowHow + AI-Orchestrator philosophy.

Top 20 Rapid Free-Cash-Flow Opportunities for AI-Orchestrator Leaders

A) PVC SYSTEM — EXECUTIVE LOGIC

Definition

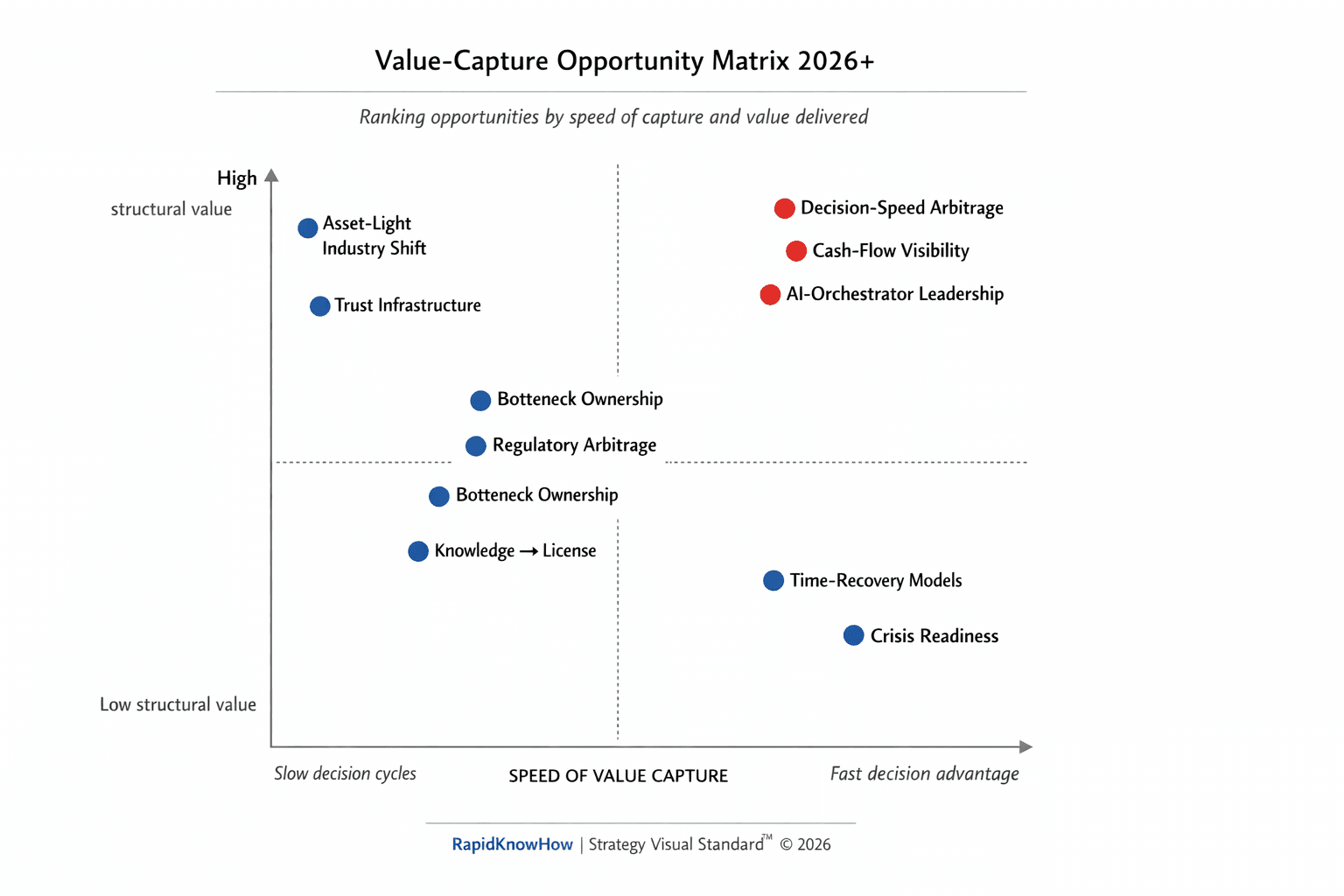

PVC = A decision framework that identifies opportunities where:

Speed × AI Leverage × Market Friction = Immediate Cash-Flow Gain

PVC Formula

PVC Score = (Time Advantage × Margin Expansion × AI Automation Level) ÷ Complexity

High PVC Score = act immediately.

B) THE TOP 20 PVC OPPORTUNITIES (Ranked by Cash-Flow Velocity)

TIER 1 — ACT NOW (0–90 DAYS PAYBACK)

- AI Sales Automation for B2B high-ticket deals

- Contract renegotiation using AI price benchmarking

- Inventory liquidation via AI demand repricing

- Supplier consolidation optimization

- AI invoice auditing (recover overpayments)

- Pricing optimization engine deployment

- Subscription conversion of one-time services

- Eliminating manual reporting tasks

- Cash collection acceleration system

- Workforce productivity AI copilots

TIER 2 — FAST SCALE (3–9 MONTH PAYBACK)

- Asset-Light outsourcing of non-core operations

- Predictive maintenance replacing reactive repair

- Dynamic procurement bidding platform

- AI-optimized marketing spend allocation

- Data monetization from existing customer base

- Process cycle-time compression projects

TIER 3 — STRATEGIC LEAP (9–18 MONTH PAYBACK)

- Platformizing your core product as BaaS

- Licensing proprietary know-how

- AI-driven new market entry simulation

- Digital twin of operations for decision testing

C) PVC DECISION MATRIX FOR LEADERS

Use this 4-Quadrant Execution Filter

| Priority | Criteria | Action |

|---|---|---|

| Immediate | High cash + low complexity | Execute now |

| Fast Track | High cash + medium complexity | Assign SWAT team |

| Strategic | High cash + high complexity | Pilot first |

| Ignore | Low cash | Discard |

D) HOW AI-ORCHESTRATOR LEADERS CAPTURE PVC FIRST

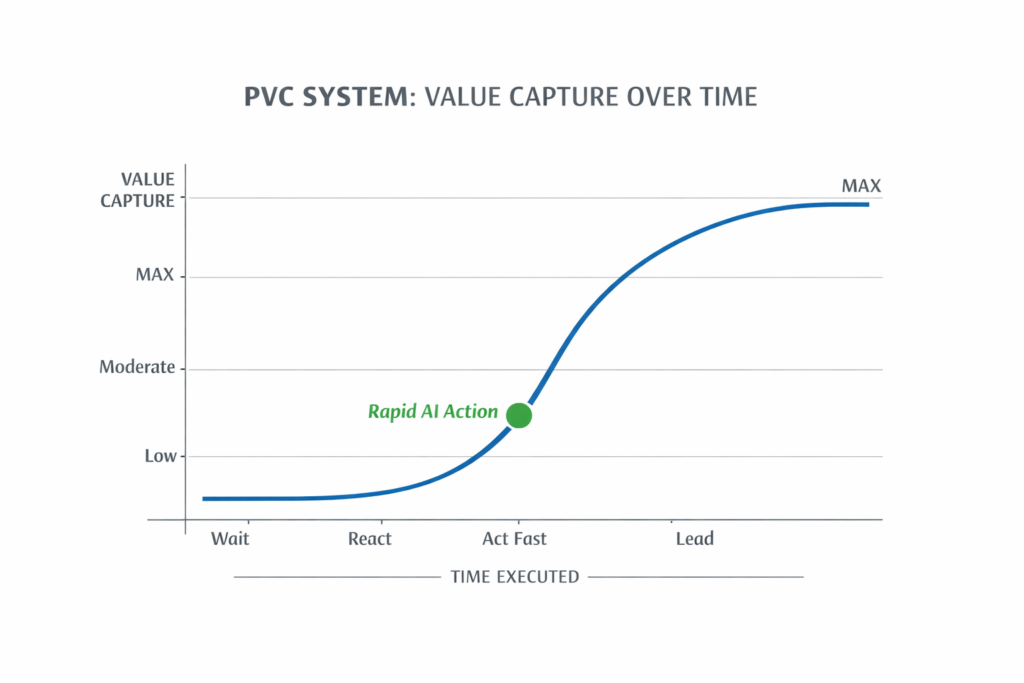

Traditional leaders wait for certainty.

AI-Orchestrator leaders act on probability.

They operate with 5 execution rules:

- Decide before competitors see opportunity

- Automate before hiring

- Monetize before optimizing

- Capture cash before scaling

- Scale before competitors copy

E) EXECUTIVE SIGNALS THAT A PVC OPPORTUNITY EXISTS

If you see any of these — act immediately:

- Manual processes still exist

- Pricing unchanged for 12+ months

- Data unused

- Teams overloaded

- Customer waiting time >24h

- Supplier dependency >40%

- Reports created manually

These are hidden cash-flow leaks.

F) PVC PLAYBOOK — 48-HOUR ACTION SPRINT

Day 1 — Scan

- Identify 10 friction points

- Score PVC for each

Day 2 — Capture

- Select top 3

- Assign owner

- Automate or renegotiate

Day 7 — Cash Impact Review

- Measure delta

- Scale winner

G) STRATEGIC INSIGHT FOR 2026

The fastest companies will not be the biggest —

they will be the fastest at capturing value.

AI doesn’t create value.

Speed does.

AI only multiplies speed.- Josef David

H) FINAL CEO TAKEAWAY

The PVC Rule

If an opportunity increases cash-flow within 90 days, it is not optional.

It is a leadership obligation.

✅ Recommended Next Step (Strategic)

Build a PVC Dashboard inside your RapidKnowHow ecosystem showing:

- Opportunity

- PVC Score

- Owner

- Cash-Flow Delta

- Status

This becomes your real-time value radar.

🚀 ACT NOW (0–90 DAYS PAYBACK)

PVC RAPID EXECUTION PLAYBOOK

A) AI SALES AUTOMATION FOR B2B HIGH-TICKET DEALS

Objective

Increase deal velocity and close rate within 30–60 days.

Rapid Deployment

- Automate lead qualification (AI scoring)

- AI-generated personalized proposals

- Follow-up automation sequences

- CRM trigger alerts for deal momentum

Cash-Flow Impact

- Shorter sales cycles (–20–40%)

- Increased close rate (+10–25%)

90-Day Outcome

Higher deal throughput without increasing headcount.

B) CONTRACT RENEGOTIATION USING AI PRICE BENCHMARKING

Objective

Improve margin immediately.

Rapid Deployment

- Upload supplier contracts into AI comparison tool

- Benchmark against market pricing

- Identify 5–10 renegotiation targets

- Renegotiate high-variance contracts first

Cash-Flow Impact

- 3–8% cost reduction typical

- Direct FCF improvement

60-Day Outcome

Structural margin lift.

C) INVENTORY LIQUIDATION VIA AI DEMAND REPRICING

Objective

Unlock trapped capital.

Rapid Deployment

- Identify slow-moving SKUs

- AI-driven price elasticity testing

- Targeted liquidation campaign

- Bundle or dynamic discount

Cash-Flow Impact

- Working capital release

- Reduced storage cost

30–60 Day Outcome

Liquidity boost without external financing.

D) SUPPLIER CONSOLIDATION OPTIMIZATION

Objective

Reduce complexity + increase leverage.

Rapid Deployment

- Identify overlapping vendors

- Consolidate to top-performing suppliers

- Increase volume leverage

Cash-Flow Impact

- Lower unit cost

- Lower admin overhead

90-Day Outcome

Cost structure simplification.

E) AI INVOICE AUDITING (RECOVER OVERPAYMENTS)

Objective

Recover hidden losses.

Rapid Deployment

- Run last 12–24 months invoices through AI anomaly detection

- Identify duplicates, overcharges, pricing mismatches

- Recover credits

Cash-Flow Impact

- 1–3% recovery common

- Immediate cash injection

30-Day Outcome

Recovered capital.

F) PRICING OPTIMIZATION ENGINE DEPLOYMENT

Objective

Increase gross margin fast.

Rapid Deployment

- Analyze price sensitivity

- Segment customers

- Adjust high-elasticity zones first

- Implement test-and-measure model

Cash-Flow Impact

- 2–7% margin increase typical

60-Day Outcome

Permanent structural margin gain.

G) SUBSCRIPTION CONVERSION OF ONE-TIME SERVICES

Objective

Create predictable cash-flow.

Rapid Deployment

- Identify recurring-value services

- Bundle into monthly subscription

- Incentivize early adopters

Cash-Flow Impact

- Recurring revenue stability

- Increased LTV

90-Day Outcome

Cash-flow predictability improvement.

H) ELIMINATING MANUAL REPORTING TASKS

Objective

Increase executive productivity.

Rapid Deployment

- Identify repetitive reporting tasks

- Automate via AI dashboards

- Eliminate 5–10 manual workflows

Cash-Flow Impact

- Reduce labor cost

- Faster decisions

30-Day Outcome

Higher decision velocity.

I) CASH COLLECTION ACCELERATION SYSTEM

Objective

Improve liquidity.

Rapid Deployment

- AI prioritize overdue accounts

- Automated reminder cadence

- Offer early payment incentives

Cash-Flow Impact

- DSO reduction (5–20 days possible)

60-Day Outcome

Stronger cash position.

J) WORKFORCE PRODUCTIVITY AI COPILOTS

Objective

Multiply output without hiring.

Rapid Deployment

- Deploy AI assistants in sales, operations, finance

- Train teams for targeted use cases

- Focus on time-consuming tasks

Cash-Flow Impact

- Productivity +15–30%

- Reduced burnout

90-Day Outcome

Structural efficiency gain.

📊 STRATEGIC PVC PRIORITY ORDER (IMMEDIATE IMPACT)

- Cash Collection Acceleration

- Invoice Auditing

- Contract Renegotiation

- Pricing Optimization

- Inventory Repricing

- AI Sales Automation

- Manual Reporting Elimination

- Supplier Consolidation

- Workforce AI Copilots

- Subscription Conversion

🔥 PVC SPEED RULE

If action does not produce measurable cash-flow impact within 90 days:

- Redesign

- Replace

- Remove

No emotional attachment to initiatives.

🧠 EXECUTIVE TAKEAWAY

This list is not about innovation.

It is about:

Immediate cash liberation + structural acceleration.

Organizations that execute these 10 moves within 90 days:

- strengthen liquidity

- improve margin

- increase velocity

- reduce risk