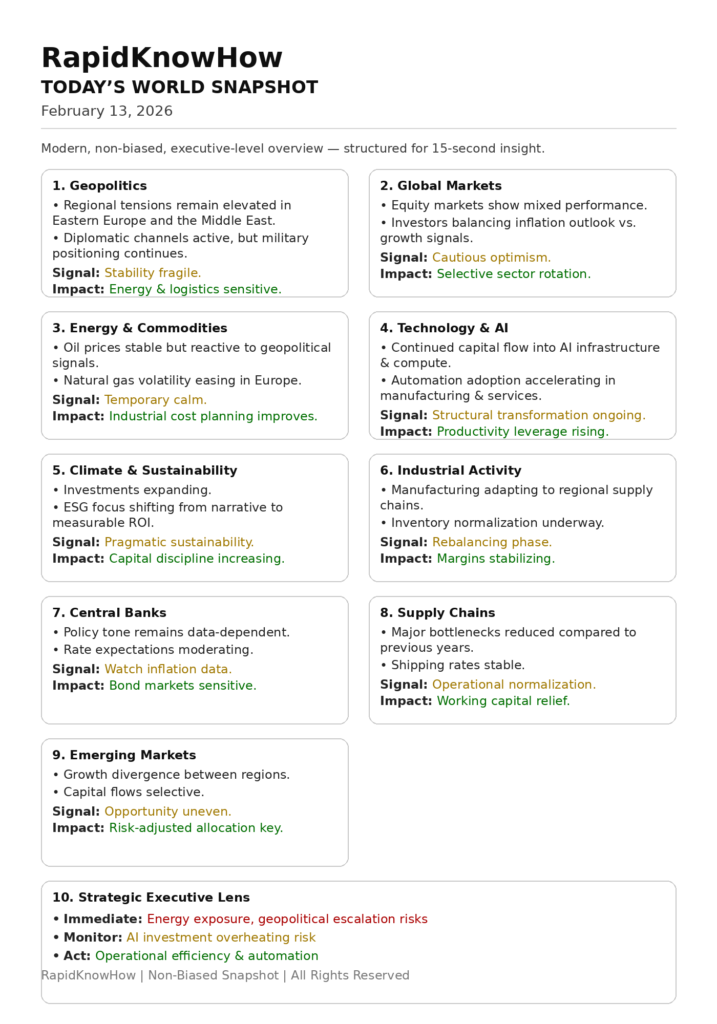

TODAY’S WORLD SNAPSHOT

February 13, 2026

Modern, non-biased, executive-level overview — structured for 15-second insight.

1. Geopolitics

Regional tensions remain elevated in Eastern Europe and the Middle East.

Diplomatic channels active, but military positioning continues.

Signal: Stability fragile.

Impact: Energy & logistics sensitive.

2. Global Markets

Equity markets show mixed performance.

Investors balancing inflation outlook vs. growth signals.

Signal: Cautious optimism.

Impact: Selective sector rotation.

3. Energy & Commodities

Oil prices stable but reactive to geopolitical signals.

Natural gas volatility easing in Europe.

Signal: Temporary calm.

Impact: Industrial cost planning improves.

4. Technology & AI

Continued capital flow into AI infrastructure & compute.

Automation adoption accelerating in manufacturing & services.

Signal: Structural transformation ongoing.

Impact: Productivity leverage rising.

5. Climate & Sustainability

Investments expanding.

ESG focus shifting from narrative to measurable ROI.

Signal: Pragmatic sustainability.

Impact: Capital discipline increasing.

6. Industrial Activity

Manufacturing adapting to regional supply chains.

Inventory normalization underway.

Signal: Rebalancing phase.

Impact: Margins stabilizing.

7. Central Banks

Policy tone remains data-dependent.

Rate expectations moderating.

Signal: Watch inflation data.

Impact: Bond markets sensitive.

8. Supply Chains

Major bottlenecks reduced compared to previous years.

Shipping rates stable.

Signal: Operational normalization.

Impact: Working capital relief.

9. Emerging Markets

Growth divergence between regions.

Capital flows selective.

Signal: Opportunity uneven.

Impact: Risk-adjusted allocation key.

10. Strategic Executive Lens

🔴 Immediate: Energy exposure, geopolitical escalation risks

🟡 Monitor: AI investment overheating risk

🟢 Act: Operational efficiency & automation